Table of Contents

- Executive Summary: Key Takeaways for 2025 and Beyond

- Market Size & Growth Forecast: 2025–2030 Projections

- Emerging Technologies in Microvascular Kymography

- Leading Manufacturers and Pioneering Companies

- Applications in Research and Clinical Practice

- Regulatory Landscape and Compliance Updates

- Competitive Analysis: Market Share and Strategic Moves

- Innovation Drivers: AI, Automation, and Digital Integration

- Challenges, Barriers, and Opportunities Ahead

- Future Outlook: Trends Shaping the Next 3–5 Years

- Sources & References

Executive Summary: Key Takeaways for 2025 and Beyond

Microvascular kymography instrumentation continues to evolve rapidly, driven by the growing demand for advanced, high-resolution tools in microcirculatory research and clinical diagnostics. As of 2025, leading manufacturers and research organizations are focusing on real-time imaging capabilities, enhanced data analytics, and integration with other microvascular assessment technologies. These advances are aimed at improving the precision and usability of kymographic systems for applications ranging from basic vascular biology studies to the monitoring of microcirculatory function in critical care settings.

Key instrumentation trends include the miniaturization of probes, increased sensitivity to detect subtle motion changes in microvessels, and the incorporation of artificial intelligence for automated data interpretation. Notably, systems are being tailored for compatibility with digital health platforms, enabling remote monitoring and multi-site clinical trials. Companies such as Leica Microsystems and Olympus Corporation continue to refine their imaging platforms, collaborating with research institutions to push the boundaries of spatial and temporal resolution in microvascular studies.

Recent data from industry stakeholders suggest that demand for microvascular kymography instruments is highest in cardiovascular research, oncology, and diabetes-related microangiopathies. Hospitals and research centers are increasingly seeking systems that provide not only kymographic analysis but also multimodal imaging, including laser Doppler and fluorescence modalities, for comprehensive vascular assessment. Instrumentation is being designed with ease-of-use in mind, reducing training barriers for clinical staff and supporting wider adoption in routine diagnostics.

Looking ahead to the next few years, the outlook for microvascular kymography instrumentation remains robust. Integration with cloud-based data storage, interoperability with electronic health records, and enhanced portability are expected to be major growth drivers. Collaborations between device manufacturers and academic groups, such as those involving Carl Zeiss AG and university medical centers, will likely accelerate innovation and validation of new clinical applications. Regulatory agencies are also anticipated to provide clearer pathways for device approval, particularly as more instruments demonstrate clinical utility in early disease detection and personalized therapy monitoring.

In summary, the microvascular kymography instrumentation sector is poised for significant advancements in 2025 and beyond, characterized by technical innovation, expanded clinical integration, and a strong focus on interoperability and user experience. This trajectory points to a future where microvascular kymography becomes a standard component of vascular health assessment and precision medicine.

Market Size & Growth Forecast: 2025–2030 Projections

The global market for microvascular kymography instrumentation is poised for notable growth between 2025 and 2030, driven by advances in microcirculation research, increased funding in life sciences, and a rising emphasis on translational vascular studies. As of 2025, the market is characterized by both established manufacturers and emerging entrants expanding the technological capabilities of kymography systems, particularly with higher-resolution imaging and enhanced digital analysis.

Current market leaders such as ADInstruments and World Precision Instruments continue to innovate in hardware and software integration, supporting real-time, high-fidelity microvascular motion analysis. These companies are expected to maintain growth trajectories as demand for sophisticated physiological recording tools rises across academic, pharmaceutical, and clinical research segments. Notably, ADInstruments has strengthened its global presence with tailored systems for microvascular flow assessment, while World Precision Instruments is expanding its portfolio to include automated, high-throughput kymograph solutions.

The market’s growth is further bolstered by increased adoption of kymography in preclinical drug testing and regenerative medicine, where precise measurement of microvascular dynamics is essential. The ongoing trend toward miniaturization and automation in biomedical instrumentation is fostering new product launches and upgrades, with several manufacturers focusing on user-friendly platforms that integrate seamlessly with data analytics and laboratory information management systems.

From 2025 to 2030, the compound annual growth rate (CAGR) for microvascular kymography instrumentation is anticipated to be in the mid- to high single digits, supported by rising research output in cardiovascular and metabolic disease, as well as by the proliferation of translational platforms in emerging economies. The Asia-Pacific market, in particular, is projected to experience the fastest expansion, fueled by government investments in life science infrastructure and growing collaborations between academic centers and industry partners.

- Technological advancements in imaging and motion tracking are expected to further differentiate leading suppliers, with companies like ADInstruments and World Precision Instruments investing in R&D for next-generation systems.

- Regulatory compliance and standardization efforts, led by bodies such as the International Organization for Standardization, are anticipated to shape product development and global market access.

- Outlook for 2030 indicates a more competitive landscape, with greater integration of artificial intelligence in data interpretation and expanded application fields including oncology and tissue engineering.

In summary, the microvascular kymography instrumentation market is set for robust growth through 2030, underpinned by technology innovation, broader adoption in biomedical research, and expanding international demand.

Emerging Technologies in Microvascular Kymography

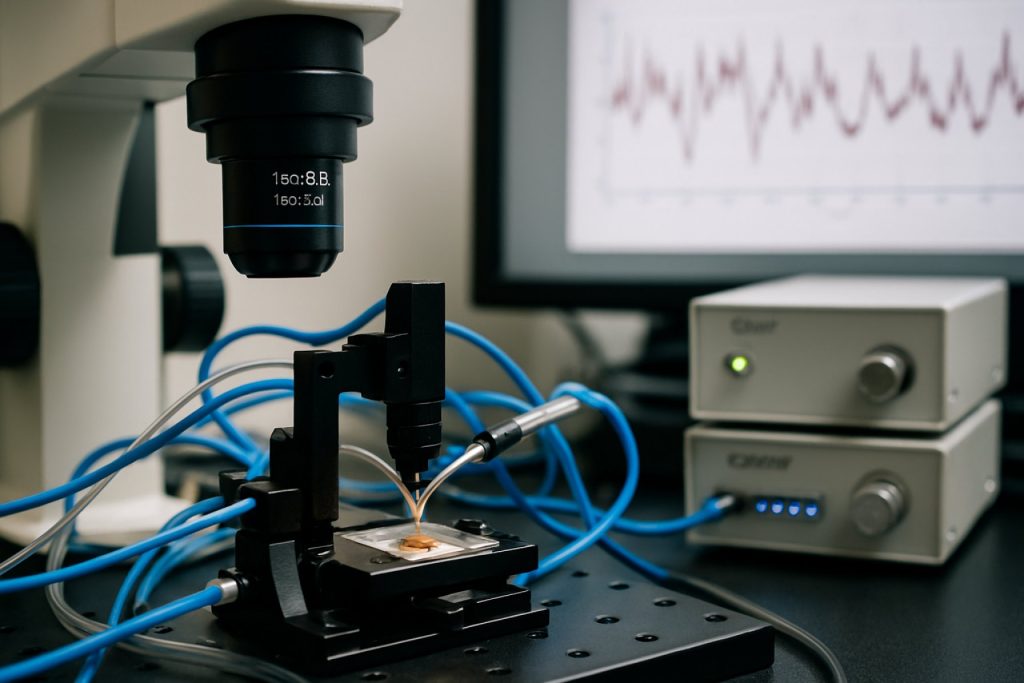

Microvascular kymography—a technique used to assess blood flow dynamics in the microvasculature—has witnessed significant technological innovations in instrumentation as of 2025. The latest wave of emerging technologies centers on improving spatial and temporal resolution, automation, and integration with digital health platforms.

A key trend is the miniaturization and automation of kymography systems. Manufacturers are introducing advanced optical and video-microscopy modules with enhanced sensitivity and real-time processing capabilities. These systems leverage high-speed CMOS sensors and sophisticated light sources, enabling the capture of subtle vascular oscillations at unprecedented frame rates and with minimal phototoxicity. Companies such as Leica Microsystems and Olympus Life Science have launched new generations of upright and inverted microscopes tailored for live microvascular imaging, incorporating built-in kymography analysis tools.

Software advancements are equally pivotal. Integration of artificial intelligence algorithms for automated vessel detection, segmentation, and motion quantification is becoming standard. These solutions reduce operator dependency, facilitate reproducibility, and allow for large-scale data analytics. In 2025, several platforms now offer cloud-based modules for remote analysis and collaboration, a response to the growing need for distributed research and multi-center studies. Carl Zeiss and Nikon Corporation have both expanded their imaging ecosystems with AI-powered analysis suites optimized for microvascular applications.

Furthermore, there is a noticeable shift towards multimodal instrumentation. Modern kymography devices increasingly integrate with laser Doppler flowmetry, optical coherence tomography, and two-photon microscopy, providing complementary data on flow, oxygenation, and vessel architecture. Bruker has advanced hybrid platforms that combine kymography with multiphoton imaging, enabling simultaneous morphological and functional assessment of microvessels in vivo.

Outlook for the next few years suggests sustained momentum in this field, with greater emphasis on portable, point-of-care systems. Efforts are underway to develop wearable microvascular kymography instruments for continuous monitoring in clinical and research settings. As the demand for high-throughput, quantitative microvascular assessments grows—spanning cardiovascular, metabolic, and neurovascular research—the sector is poised for further integration of AI, cloud connectivity, and advanced optics, positioning microvascular kymography as a cornerstone of next-generation vascular diagnostics and research.

Leading Manufacturers and Pioneering Companies

Microvascular kymography instrumentation, which enables the precise measurement and visualization of microvascular dynamics, is a highly specialized field within biomedical engineering. In 2025, the sector is defined by a select group of manufacturers and pioneering companies that have established themselves as leaders through innovation, reliability, and close partnerships with both clinical and preclinical research communities.

Among the most prominent companies is Danish Myo Technology A/S (DMT), which has long been recognized for its range of wire and pressure myograph systems. DMT’s instruments are widely used in laboratories studying vascular reactivity and microcirculation, offering precision kymography capabilities that capture real-time vessel movement and contractility. DMT’s continuous development of software and hardware integrations aligns with the increasing demand for automated data acquisition and advanced analytics in vascular research.

Another key player is Linton Instrumentation, which supplies a variety of physiological recording instruments, including microvascular video kymographs. Their systems are frequently deployed in both academic and pharmaceutical research settings, particularly in Europe and Asia, where the study of microvascular function is integral to cardiovascular and metabolic research pipelines.

ADInstruments is also advancing in this niche, leveraging its expertise in data acquisition and analysis. While more broadly known for its PowerLab systems and LabChart software, ADInstruments has expanded its support for microvascular applications, facilitating integration with kymographic and myograph hardware from other providers. This interoperability is increasingly important as research labs seek modular solutions for multi-parameter vascular studies.

Emerging companies are also shaping the outlook for microvascular kymography. For example, Scientific Instruments, Inc. has recently introduced instrumentation tailored for high-resolution, high-frequency kymography, reflecting growing demand for detailed dynamic imaging of microvessels in preclinical models. Furthermore, collaborations between manufacturers and university laboratories are accelerating product innovation, especially in miniaturization and digital image processing.

Looking ahead, the microvascular kymography instrumentation market is expected to grow steadily through the late 2020s. Key drivers include the global rise in cardiovascular and metabolic diseases, increased investment in translational vascular research, and technological advances in imaging and AI-powered analysis. Leading manufacturers are poised to respond with enhanced automation, better integration with imaging modalities, and user-friendly interfaces, consolidating their roles as critical partners in both basic and applied biomedical research.

Applications in Research and Clinical Practice

Microvascular kymography instrumentation is gaining significant traction in both research and clinical environments as the need for high-resolution, real-time analysis of microvascular function grows. In 2025, the adoption of these systems is being propelled by their capacity to provide quantitative, dynamic measurements of blood flow, vessel diameter changes, and vasomotor responses in microvessels, which are critical for understanding physiological and pathological processes.

In research contexts, these instruments are invaluable for cardiovascular, neurovascular, and metabolic studies. Laboratories are using advanced kymography to analyze endothelial function, investigate microcirculatory dysfunction in diabetes, and monitor the effects of therapeutic interventions on microvessel behavior. The latest platforms integrate high-speed video microscopy with automated image analysis algorithms, enabling precise tracking of microvascular wall motion and flow dynamics in ex vivo and in vivo models. For example, the integration of kymography modules into established perfusion systems by companies like Danish Myo Technology (DMT) is facilitating standardized protocols for vessel reactivity assays and pharmacological testing.

Clinically, microvascular kymography is emerging as a non-invasive or minimally invasive adjunct to traditional diagnostics. Its application in assessing tissue perfusion and microvascular health is of particular interest in critical care, wound healing, and reconstructive surgery. The technology’s ability to visualize and quantify microvascular function in real time is supporting early detection of perfusion deficits and guiding interventions. Companies such as Transonic Systems Inc. are advancing instrument platforms that combine kymography with flowmetry, providing clinicians with actionable hemodynamic data at the bedside.

The outlook for the next few years predicts broader use of microvascular kymography in translational and clinical research, especially as instrument sensitivity, automation, and integration with other imaging modalities improve. Cross-platform compatibility and cloud-based data analysis are also expanding collaborative research opportunities. Regulatory interest in microvascular assessment as a surrogate endpoint in cardiovascular and metabolic disease trials is likely to spur further clinical adoption and refinement of instrumentation standards. As sensor miniaturization and computational power increase, portable and even wearable kymographic tools may become available, expanding point-of-care diagnostics and personalized vascular health monitoring.

In summary, microvascular kymography instrumentation is set to enhance both research and clinical workflows in 2025 and beyond, driven by technical advances and growing recognition of microvascular health as a key determinant in systemic disease management.

Regulatory Landscape and Compliance Updates

The regulatory landscape for microvascular kymography instrumentation is evolving rapidly as these devices gain traction in clinical research and potential diagnostic applications. In 2025, compliance with global standards for medical devices remains central, with manufacturers focusing on adherence to frameworks such as the European Medical Device Regulation (EU MDR 2017/745) and the U.S. Food and Drug Administration (FDA) guidelines for medical devices. These frameworks emphasize rigorous requirements for clinical evaluation, biocompatibility, usability engineering, and cybersecurity.

Within the European Union, the transition period for the EU MDR is in its final stages, compelling microvascular kymography system manufacturers to update technical documentation, risk management files, and clinical data to support CE marking. This has led to a surge in demand for post-market surveillance systems and real-world performance data. Leading industry organizations and notified bodies are offering increased guidance and pre-submission consultations to help companies navigate these requirements.

In the United States, the FDA continues to refine its approach to digital health and medical device software, which directly impacts kymography systems that integrate advanced imaging, signal processing, and AI-based analysis. The FDA’s Digital Health Center of Excellence is expected to release updated guidance in the next few years, specifically targeting connected and software-driven medical devices. This will likely affect premarket notification (510(k)), De Novo, and premarket approval (PMA) pathways for microvascular kymography instrumentation.

Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) and China’s National Medical Products Administration (NMPA) are also advancing their regulatory frameworks, aligning more closely with international standards such as those outlined by the International Medical Device Regulators Forum (IMDRF). This harmonization aims to streamline multi-region approvals, though local clinical data requirements remain a consideration for market entry in Asia.

Recent industry developments indicate that manufacturers such as Leica Microsystems and Carl Zeiss AG, both active in microvascular research instrumentation, are investing in compliance infrastructure and working closely with regulatory bodies to ensure their devices meet the latest safety and performance benchmarks. These companies are also contributing to the development of new standards and best practices through industry consortia and working groups.

Looking ahead, the regulatory outlook for microvascular kymography instrumentation will continue to emphasize data transparency, interoperability, and lifecycle management. Manufacturers must anticipate ongoing updates to software validation, data security, and human factors engineering requirements, as authorities incorporate lessons learned from digital health innovation into device regulations. Proactive engagement with regulators and standards organizations will remain crucial for timely market access and sustained compliance in the coming years.

Competitive Analysis: Market Share and Strategic Moves

The competitive landscape of the microvascular kymography instrumentation market in 2025 is characterized by a small number of highly specialized players, each focusing on technological innovation, clinical integration, and expansion into emerging applications. Microvascular kymography remains a niche segment within the broader microcirculation and vascular imaging market, but heightened interest in microcirculatory assessment for critical care, diabetes, sepsis, and wound healing is driving renewed competition.

A leading position in the market is held by LUXAMED GmbH, whose kymography-enabled microvascular imaging devices are widely adopted in European clinical and research settings. Their systems leverage high-sensitivity optics and advanced motion analysis algorithms, allowing for precise quantification of microvascular flow and vessel wall dynamics. LUXAMED’s strategic partnerships with university hospitals and research institutes have reinforced its dominance, especially in Germany and neighboring countries.

Another key player, Moor Instruments, has expanded its microcirculatory technologies portfolio to include kymography modules compatible with its laser Doppler and imaging devices. The modular approach enables integration of kymographic analysis into existing microvascular research workflows, catering to both academic and translational research markets. Moor Instruments’ global distribution network, particularly in North America and Asia-Pacific, positions it as a formidable competitor.

Emerging entrants from Asia, such as TAIMED Biomedical, are gaining traction by offering cost-effective, portable kymography solutions targeting point-of-care diagnostics. These newer systems have found early adoption in hospital outpatient clinics and by telemedicine providers seeking quantitative microvascular data to inform remote consultations. Strategic moves by these companies include collaborations with digital health platforms and local distributors to accelerate market penetration in rapidly developing healthcare sectors.

Despite robust R&D activity, barriers to entry remain high due to the technical complexity of capturing and analyzing microvascular motion signals, as well as the stringent regulatory requirements for clinical instrumentation. Intellectual property portfolios centered on advanced image processing algorithms and integration with electronic health record systems are increasingly seen as critical differentiators.

Looking ahead, competitive dynamics are expected to intensify as demand for personalized microvascular monitoring grows in cardiovascular and metabolic diseases, and as health systems seek non-invasive, real-time diagnostic tools. Companies are likely to pursue further miniaturization, integration with wearable platforms, and enhanced AI-driven analytics to capture greater market share. Strategic alliances between instrumentation manufacturers and clinical research consortia are anticipated to shape both product innovation and clinical adoption over the next few years.

Innovation Drivers: AI, Automation, and Digital Integration

The field of microvascular kymography instrumentation is experiencing a dynamic transformation in 2025, driven by the integration of artificial intelligence (AI), automation, and digital connectivity. These innovation drivers are reshaping how microvascular function is visualized, measured, and interpreted, with a focus on enhanced precision, reproducibility, and real-time data utilization.

AI-powered image analysis is at the forefront of these advancements. Contemporary microvascular kymography systems are increasingly equipped with deep learning algorithms capable of recognizing and quantifying subtle microvascular patterns that are difficult for human operators to discern. This has resulted in improved detection of pathological changes and more accurate assessments of microcirculatory health. Automated segmentation and flow quantification, enabled through AI, are reducing operator-dependent variability, a long-standing limitation in manual kymographic analyses. Leading manufacturers such as Leica Microsystems and Carl Zeiss AG are actively developing platforms that incorporate AI modules for enhanced image interpretation and workflow efficiency.

Automation is another key innovation driver. Modern microvascular kymography instruments now offer automated stage control, adaptive focusing, and smart sample handling, minimizing manual intervention and streamlining experimental protocols. This is particularly significant in clinical and pre-clinical research settings, where high-throughput and reproducibility are critical. Integration with laboratory automation systems further accelerates data acquisition and processing, supporting large-scale studies and multicenter trials. Companies such as Olympus Life Science are advancing automated imaging platforms that can be tailored for microvascular investigations, allowing for seamless transitions between observation, recording, and analysis.

Digital integration—especially through cloud-based data management and remote connectivity—is also shaping the outlook for microvascular kymography. Instruments are increasingly designed to interface with hospital information systems and research databases, facilitating real-time data sharing, collaborative analysis, and automated reporting. The adoption of standardized digital protocols ensures interoperability with broader digital pathology and telemedicine infrastructures, making microvascular kymography more accessible and scalable. These trends are supported by global initiatives to digitize and network diagnostic instrumentation, as seen in the strategic roadmaps of organizations like Siemens Healthineers.

Looking ahead, the convergence of AI, automation, and digital integration is expected to further democratize access to sophisticated microvascular kymography, enhance clinical decision-making, and drive new research frontiers in vascular health and disease monitoring. These technologies are poised to deliver greater accuracy, scalability, and utility, setting new standards for microvascular assessment in the years to come.

Challenges, Barriers, and Opportunities Ahead

Microvascular kymography, a technique for real-time assessment of microvascular blood flow and vessel motility, is experiencing a pivotal phase of technological and market evolution in 2025. Despite its promise in both clinical and research environments, several challenges and barriers hinder widespread adoption and innovation. At the same time, notable opportunities are emerging, driven by advances in optics, imaging software, and integration with digital health platforms.

One of the most persistent challenges is the limited standardization of instrumentation and protocols across laboratories and clinics. Microvascular kymography systems require precise calibration and highly sensitive optical components, which can vary between manufacturers. This lack of harmonization complicates data comparability and multi-center studies. Furthermore, the high cost of specialized cameras, light sources, and analysis software restricts access, particularly in resource-limited settings. Leading suppliers of sophisticated imaging components, such as Carl Zeiss AG and Leica Microsystems, are working to address calibration and usability issues but price remains a barrier for many potential users.

Another technical barrier involves motion artifacts and the difficulty of capturing consistent, high-quality kymographs in vivo, particularly in conscious or mobile subjects. Researchers and developers are exploring new stabilization algorithms and compact probe designs to mitigate these artifacts. Integration with machine learning for automated data interpretation is in early stages, but holds promise for reducing operator dependency and enhancing accuracy.

Regulatory and reimbursement hurdles also affect the sector. Unlike more established vascular imaging modalities, microvascular kymography lacks clear regulatory pathways and standardized clinical validation, slowing its clinical adoption. As of 2025, industry stakeholders are collaborating with regulatory bodies in Europe and North America to establish performance guidelines and clinical trial frameworks.

Nevertheless, the outlook for microvascular kymography instrumentation is encouraging. The growing demand for microcirculatory assessment in sepsis, diabetes, and cardiovascular disease, as well as in preclinical pharmaceutical research, is catalyzing investment in next-generation platforms. Companies such as Hamelin (specializing in kymograph technology) and Olympus Corporation are expanding their microvascular imaging portfolios, including systems optimized for real-time, high-resolution kymography.

Opportunities ahead include the miniaturization of probes for bedside or field use, integration with telemedicine solutions, and cloud-based data analysis. The adoption of open-source hardware and software models, as well as strategic partnerships between academia and industry, could further accelerate innovation and accessibility in the coming years.

Future Outlook: Trends Shaping the Next 3–5 Years

The future of microvascular kymography instrumentation is poised for significant advancements over the next 3–5 years, driven by the convergence of miniaturized sensor technology, enhanced imaging modalities, and the integration of artificial intelligence (AI) for data analysis. As research into microcirculation gains momentum, particularly in cardiovascular, neurological, and metabolic disease contexts, the demand for precise, real-time assessments of microvascular dynamics is accelerating.

One notable trend is the increasing adoption of high-resolution video microscopy systems with automated kymographic analysis capabilities. Recent product developments by established instrumentation providers signal a move toward more compact, user-friendly platforms with improved optical sensitivity and digital integration. For example, companies such as Leica Microsystems and Carl Zeiss AG are investing in modular microscopy solutions that facilitate live measurement of vessel diameter changes and red blood cell velocity in ex vivo and in vivo models. These systems are expected to offer not only greater spatial and temporal resolution but also seamless connectivity with laboratory automation and data management systems.

Simultaneously, there is a shift toward hybrid instrumentation that combines traditional kymography with advanced optical coherence tomography (OCT) or laser speckle contrast imaging (LSCI), enabling multimodal assessment of microvascular function. This trend is exemplified by collaborations between imaging technology firms and clinical device manufacturers, aiming to create integrated platforms for both research and translational applications. Companies such as Hamamatsu Photonics are at the forefront, leveraging their expertise in photonic sensors and imaging modules to enhance the sensitivity and scalability of microvascular monitoring devices.

- AI and Machine Learning: The integration of AI-driven image analysis and automated pattern recognition is expected to streamline data interpretation, reduce operator variability, and enable large-scale quantitative studies. Algorithms capable of detecting subtle kymographic changes could facilitate early diagnosis and monitoring of microvascular pathologies.

- Portability and Point-of-Care Use: Miniaturization and wireless connectivity are likely to produce portable kymography solutions for bedside or outpatient settings. This democratization of technology could extend microvascular assessments beyond specialized labs, supporting broader clinical adoption.

- Regulatory and Standardization Efforts: As instrumentation matures, industry bodies are expected to develop guidelines for performance benchmarking and data compatibility, fostering interoperability between devices from different manufacturers.

Looking ahead, ongoing investment from leading optical and biomedical device companies, combined with advances in digital health infrastructure, suggests that microvascular kymography instrumentation will become increasingly accessible, reliable, and integral to both preclinical research and patient care by the end of the decade.