Table of Contents

- Executive Summary: Key Trends and Forecasts for 2025–2030

- Market Drivers: Demand, Demographics, and Technological Advancements

- Regulatory Landscape: Global Guidelines and Evolving Standards

- Competitive Analysis: Leading Companies and Strategic Initiatives

- Breakthrough Technologies: Next-Generation Contrast Agents

- Sustainability and Safety: Innovations in Biocompatibility

- Clinical Applications: Expanding Use Cases in Cardiovascular and Neurology

- Regional Insights: Growth Hotspots and Emerging Markets

- Investment and Partnership Opportunities in the Value Chain

- Future Outlook: Predicting Market Trajectories and Disruptive Innovations

- Sources & References

Executive Summary: Key Trends and Forecasts for 2025–2030

The angiographic contrast media sector is experiencing a dynamic phase of innovation and expansion as it enters 2025, driven by advances in imaging technology, increasing procedural volumes, and a continued focus on patient safety. Over the next several years, the industry is expected to see significant developments in formulation, delivery, and accessibility of contrast agents used in angiography.

Key trends shaping the market are the ongoing shift toward non-ionic, low-osmolar, and iso-osmolar iodinated contrast agents, which continue to demonstrate lower incidence of adverse reactions and improved tolerability in high-risk patient populations. Market leaders such as GE HealthCare, Bayer AG, and Guerbet are investing in next-generation compounds with enhanced renal safety profiles amid growing awareness of contrast-induced nephropathy. In particular, there is heightened interest in agents such as iodixanol and ioversol, with ongoing studies evaluating their efficacy in complex cardiovascular and neurovascular procedures.

Another notable trend is the integration of artificial intelligence and digital health platforms with angiography, spurring the development of “smart” contrast delivery systems. These technologies enable precise dosing, real-time monitoring, and automated documentation, which collectively reduce medication errors and optimize contrast usage. Companies like Bracco are actively pursuing digital workflow solutions and contrast injector integration, which are expected to become more widespread by 2030.

Regulatory pathways are adapting to accommodate innovation as the demand for personalized and minimally invasive procedures grows. The United States Food and Drug Administration (FDA) and European Medicines Agency (EMA) are increasingly collaborating with manufacturers to streamline approval for novel agents and delivery systems that demonstrate clear clinical benefits and safety improvements.

Looking ahead, the forecast for 2025–2030 anticipates moderate to strong growth in the use of angiographic contrast media, particularly in emerging markets where healthcare infrastructure is rapidly advancing. There is also a projected increase in demand for gadolinium- and iodine-based agents in hybrid imaging and interventional radiology. Sustainability is emerging as a priority, with leading suppliers exploring biodegradable packaging and environmentally conscious manufacturing to address the environmental footprint of contrast media production.

Overall, the angiographic contrast media market is poised for a period of robust innovation and expansion, with patient-centered safety, digital integration, and global accessibility at the forefront of development efforts by major industry stakeholders.

Market Drivers: Demand, Demographics, and Technological Advancements

The development of angiographic contrast media is being shaped by several convergent market drivers in 2025 and the immediate years ahead. One of the primary forces is the rising prevalence of cardiovascular diseases (CVDs), which continues to be a leading cause of morbidity and mortality globally. The increased incidence of CVD, particularly in aging populations in North America, Europe, and Asia-Pacific, is driving demand for advanced diagnostic imaging procedures, including angiography. This demographic trend is particularly pronounced in countries with rapidly aging populations, such as Japan and Germany, where the utilization of contrast-enhanced imaging is expected to surge.

Healthcare infrastructure improvements and greater access to advanced diagnostic modalities are also fostering growth. More hospitals and clinics are investing in state-of-the-art imaging technologies that require high-quality, safe, and effective contrast agents. Additionally, regulatory agencies have encouraged the development of new formulations to enhance patient safety and diagnostic efficacy, prompting companies to innovate in both the composition and delivery mechanisms of contrast media.

Technological advancements are playing a pivotal role in accelerating contrast media development. Innovations such as low-osmolar and iso-osmolar contrast agents have significantly reduced the risk of adverse reactions, particularly nephrotoxicity, which remains a concern for patients with compromised renal function. Leading manufacturers, including GE HealthCare and Bayer, are actively focusing on next-generation agents designed for enhanced safety profiles and improved image quality. Moreover, the trend towards personalized medicine is encouraging the development of contrast agents tailored to specific patient populations and clinical needs.

Recent years have also seen increased investment in research and development, with major players exploring nanoparticle-based and targeted contrast agents. These novel formulations aim to provide better vascular visualization with lower doses, addressing both efficacy and safety concerns. For example, Bracco continues to expand its product portfolio with new agents optimized for various imaging modalities and patient cohorts.

Looking ahead, the market outlook for angiographic contrast media development remains robust. The integration of artificial intelligence (AI) into imaging workflows is expected to further refine the use of contrast agents, optimizing dosages and improving diagnostic accuracy. As healthcare systems worldwide shift towards value-based care, the demand for safer, more effective contrast media that enhance diagnostic outcomes without increasing risk will remain a key driver for innovation and market expansion over the next several years.

Regulatory Landscape: Global Guidelines and Evolving Standards

The regulatory landscape for angiographic contrast media is undergoing significant evolution as global authorities and industry stakeholders respond to emerging safety data, technological advancements, and patient-centered demands. In 2025, the focus remains on harmonizing international guidelines, enhancing pharmacovigilance, and supporting innovation while maintaining patient safety.

The U.S. Food and Drug Administration (FDA) continues to refine its guidance on contrast agent approval, particularly regarding gadolinium-based and iodinated contrast media. Recent updates emphasize the need for robust preclinical safety data, especially concerning nephrotoxicity and hypersensitivity reactions, and mandate post-market surveillance to detect rare adverse effects. The FDA is also promoting patient labeling and risk mitigation strategies for populations at higher risk, such as those with chronic kidney disease.

In the European Union, the European Medicines Agency (EMA) is actively working toward alignment with the International Council for Harmonisation (ICH) standards, ensuring that contrast media submissions include comprehensive clinical and non-clinical data. The Medical Device Regulation (MDR), fully implemented in 2021, has heightened scrutiny on medical devices and diagnostic agents, leading to more detailed technical documentation and post-market follow-up for angiographic contrast products.

Asia-Pacific markets, led by regulatory agencies such as Pharmaceuticals and Medical Devices Agency (PMDA) in Japan and the National Medical Products Administration (NMPA) in China, are increasingly converging with international norms. These agencies have issued updated guidance on clinical evaluation and quality standards, with particular attention to local clinical trial requirements and manufacturing practices. Notably, China’s recent regulatory reforms are streamlining market access for innovative contrast agents while maintaining rigorous quality assurance.

Globally, industry leaders like GE HealthCare, Bayer, and Bracco are actively engaged in regulatory dialogues, contributing to the development of voluntary standards and best practices. These companies are investing in next-generation contrast media with improved safety profiles, such as low-osmolar and iso-osmolar iodinated agents, and macrocyclic gadolinium compounds, aligning product development pipelines with evolving regulatory expectations.

Looking ahead to the next few years, the regulatory trajectory points toward increased transparency, real-world evidence integration, and digital tools for traceability and adverse event reporting. Regulators worldwide are expected to further harmonize requirements, reducing barriers to global market entry and accelerating the adoption of safer, more effective angiographic contrast media.

Competitive Analysis: Leading Companies and Strategic Initiatives

The competitive landscape of angiographic contrast media development in 2025 is characterized by the dominance of established pharmaceutical companies, intensified research and development activities, and strategic partnerships aimed at improving efficacy and safety profiles. As cardiovascular and interventional radiology procedures grow globally, the demand for advanced contrast agents is rising, prompting both incremental innovation and new product launches.

Key industry leaders such as GE HealthCare, Bayer, and Bracco continue to hold substantial market shares owing to their broad product portfolios and global distribution networks. These companies are investing in next-generation iodinated and gadolinium-based agents, with a heightened focus on agents that promise reduced nephrotoxicity and allergic reactions. For instance, Bayer is advancing its Ultravist™ line, emphasizing lower osmolality formulations to improve patient safety during angiographic procedures.

Another notable trend is the strategic collaboration between manufacturers and healthcare technology companies. GE HealthCare has embarked on partnerships to integrate artificial intelligence and imaging informatics with contrast media delivery systems, aiming to optimize dosage and minimize adverse events. These initiatives not only enhance clinical outcomes but also align with regulatory bodies’ increasing emphasis on patient safety and personalized medicine. Bracco, meanwhile, is expanding its R&D footprint in Asia and the Americas, reflecting a commitment to market-specific innovation and regulatory approvals tailored to regional requirements.

- Regulatory Momentum: Regulatory agencies in the United States, Europe, and Asia are expediting approvals of novel agents that demonstrate clear safety or workflow advantages. Leading companies are leveraging this momentum by prioritizing clinical trials for agents with improved renal safety and lower hypersensitivity profiles.

- Supply Chain Strengthening: In response to recent global supply disruptions, major manufacturers have announced investments in local production and redundancy measures. GE HealthCare has expanded its manufacturing footprint to ensure a more resilient supply of critical contrast agents.

- Sustainability Initiatives: Companies are increasingly focusing on the environmental impact of contrast media. Efforts include the development of biodegradable formulations and improved waste management protocols, supporting both regulatory compliance and corporate responsibility.

Looking ahead, the angiographic contrast media sector is expected to witness the emergence of targeted, organ-specific agents and further integration of contrast delivery with digital imaging solutions. Innovation, regulatory adaptability, and strategic alliances will remain pivotal for competitive differentiation, particularly as emerging markets contribute to global procedure volumes and drive localized product development.

Breakthrough Technologies: Next-Generation Contrast Agents

The landscape of angiographic contrast media is on the cusp of transformation, with the development of next-generation agents targeting improved safety, diagnostic accuracy, and patient outcomes. As of 2025, the primary focus for manufacturers is the reduction of nephrotoxicity and allergic reactions frequently associated with iodinated contrast media, as well as the expansion of applications in advanced imaging modalities.

Recent years have seen intensified research into iso-osmolar and low-osmolar iodinated contrast agents, which are designed to minimize adverse renal effects—an especially critical factor for at-risk populations such as those with chronic kidney disease. Companies like Bayer and GE HealthCare continue to innovate in this area, optimizing molecular structures to achieve better renal safety profiles while maintaining or improving image quality essential for angiographic procedures.

A significant breakthrough is the ongoing development of non-iodinated contrast agents, including gadolinium-based and emerging manganese-based formulations. These agents are being explored for use in patients contraindicated for iodinated media, and their compatibility with both CT and MRI modalities is a key driver for innovation. Bracco and Guerbet are actively involved in research and pipeline expansion in this segment, focusing on agents with superior safety margins and enhanced vascular imaging capabilities.

Another frontier is the creation of targeted and functionalized contrast agents, which go beyond conventional vascular opacification to provide molecular-level information. The integration of nanoparticles and ligand-based targeting mechanisms is anticipated to enable visualization of specific pathologies such as vulnerable atherosclerotic plaques or tumor angiogenesis. Early-stage collaborations between academic research centers and industry players are expected to yield clinical trial data by 2026–2027, paving the way for regulatory assessment and potential adoption in specialized interventional cardiology and oncology settings.

In the near future, advancements in artificial intelligence and imaging software are anticipated to synergize with new contrast media, allowing for dose optimization and real-time image enhancement. This convergence could reduce total contrast dose per procedure, further mitigating risk, and improving patient throughput.

Overall, the 2025–2028 horizon will likely see a shift from incremental improvements to disruptive innovation in angiographic contrast media, driven by a combination of safety imperatives, multimodality imaging requirements, and the push towards personalized diagnostics. Leading companies such as Bayer, GE HealthCare, Bracco, and Guerbet are poised to play central roles in bringing these next-generation agents to market.

Sustainability and Safety: Innovations in Biocompatibility

The development of angiographic contrast media in 2025 is characterized by significant advancements in sustainability and biocompatibility, reflecting both regulatory demands and clinical priorities for patient safety. As the global volume of angiographic procedures rises, manufacturers are prioritizing innovations that reduce adverse reactions, minimize environmental impact, and address patient populations with heightened sensitivities.

Iodinated contrast agents remain the standard for angiographic imaging, but recent years have seen a strong push toward formulating agents with lower osmolality and viscosity to decrease the risk of nephrotoxicity and allergic reactions. Leading companies such as GE HealthCare and Bayer AG have continued to refine their portfolios, developing new generations of iodinated compounds with enhanced safety profiles and improved tolerability for at-risk groups, such as patients with renal impairment.

In parallel, there is growing attention to the environmental persistence of contrast agents, especially iodinated and gadolinium-based products, which are known to accumulate in wastewater and resist conventional treatment. Responding to increasing scrutiny, industry leaders are investing in research to develop biodegradable or rapidly excretable contrast media. For example, GE HealthCare and Bayer AG have both publicized sustainability initiatives aimed at reducing the environmental footprint of their contrast products, including efforts to redesign molecular structures for faster breakdown and safer elimination.

Safety innovations are also extending to packaging and delivery systems. There is a notable shift toward prefilled syringes and closed-loop systems, which not only reduce the risk of contamination and dosing errors but also help minimize waste. Bayer AG, for example, has expanded its range of ready-to-use contrast media products, aligning with hospital sustainability initiatives and stricter waste management guidelines.

Looking ahead to the next few years, the outlook is shaped by the convergence of regulatory pressures and hospital procurement policies that increasingly favor sustainable and biocompatible solutions. The development pipeline is expected to bring forward both improved iodinated agents and novel non-iodine-based alternatives, potentially incorporating biodegradable carriers or plant-derived substances. With ongoing collaboration between manufacturers, healthcare providers, and regulatory bodies, the angiographic contrast media sector is set to deliver products that are not only clinically effective but also safer for patients and the environment.

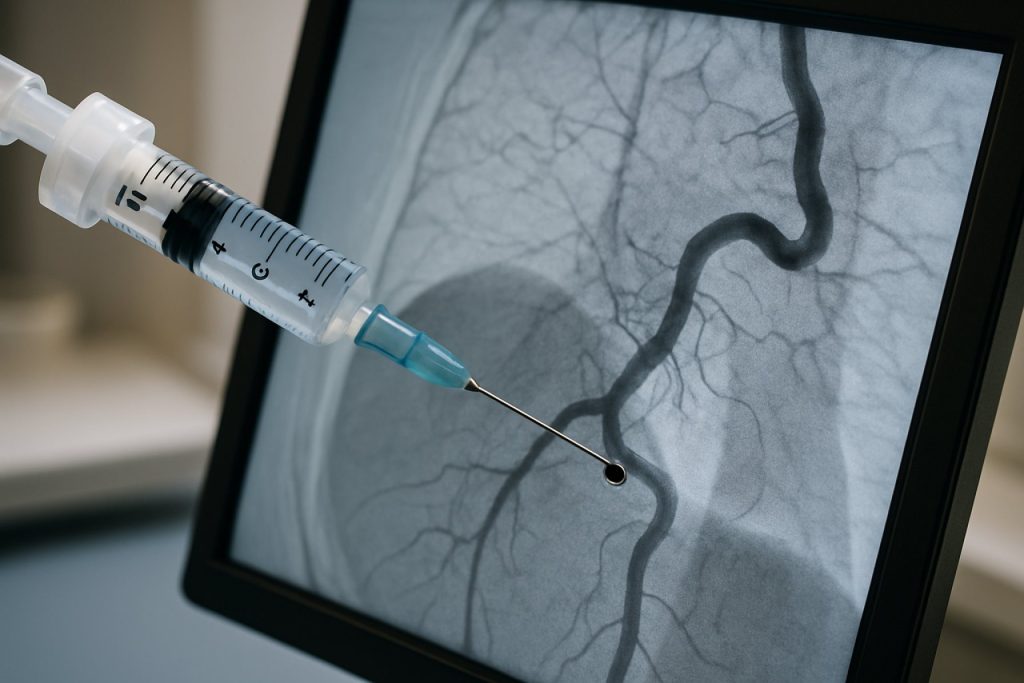

Clinical Applications: Expanding Use Cases in Cardiovascular and Neurology

The clinical applications of angiographic contrast media are expanding notably in cardiovascular and neurological domains, driven by advances in formulation, delivery, and imaging technology. As of 2025, the demand for high-quality, safe, and effective contrast agents continues to rise, with new products targeting unmet needs in both established and emerging use cases.

In cardiovascular imaging, the increasing complexity of interventional procedures—such as transcatheter aortic valve implantation (TAVI) and coronary angioplasty—necessitates contrast media optimized for rapid visualization, lower nephrotoxicity, and better compatibility with advanced imaging modalities. Leading manufacturers are developing next-generation iodinated and non-iodinated agents with improved safety profiles, including iso-osmolar and low-osmolar formulations. For example, GE HealthCare and Bayer continue to invest in R&D for agents that minimize renal adverse effects, a significant concern in cardiac patients with pre-existing kidney dysfunction.

In neurology, the use of angiographic contrast media is expanding beyond traditional cerebral angiography. Newer applications include perfusion imaging for acute stroke management and neurovascular disease assessment, where rapid, high-resolution visualization is critical. Companies such as Bracco are focusing on agents tailored for neuroimaging, with enhanced blood-brain barrier penetration and lower risk of neurotoxicity. The integration of contrast-enhanced techniques with artificial intelligence in imaging is also enabling more precise and earlier diagnosis of ischemic and hemorrhagic events.

Additionally, there is a growing trend toward patient-specific contrast dosing and administration protocols, enabled by digital health tools and smart injectors. This personalized approach aims to maximize diagnostic yield while reducing adverse reactions. Guerbet, a company specializing in contrast agents and related technologies, is actively developing solutions that enable more individualized and safer contrast management, particularly relevant in complex cardiovascular and neurovascular procedures.

Looking ahead to the next few years, the clinical landscape is set to benefit from continued innovation in contrast media composition, delivery systems, and regulatory approvals for broader use. Ongoing collaborations between device manufacturers, pharmaceutical companies, and healthcare providers are expected to accelerate the adoption of novel agents and expand the range of treatable conditions. As imaging becomes increasingly central to both diagnosis and minimally invasive therapy, the role of advanced angiographic contrast media in cardiovascular and neurological applications will remain pivotal.

Regional Insights: Growth Hotspots and Emerging Markets

The global landscape for angiographic contrast media is undergoing rapid transformation in 2025, with distinct growth hotspots emerging across both established and developing markets. North America and Western Europe continue to lead in terms of market share, driven by high procedural volumes, robust healthcare infrastructure, and early adoption of novel contrast agents. In the United States, ongoing investments in advanced imaging modalities and the rising prevalence of cardiovascular and neurovascular diseases support sustained demand for innovative angiographic contrast media. Major manufacturers, such as GE HealthCare and Bayer AG, are expanding their portfolios with lower-osmolar and iso-osmolar agents tailored for enhanced safety profiles and reduced nephrotoxicity, critical for high-risk patient populations.

Europe remains a critical region for both development and regulatory advancement. The implementation of updated European Union Medical Device Regulations (EU MDR) is shaping product launches and post-market surveillance, with companies like Guerbet actively collaborating with regulatory bodies to ensure compliance and accelerate approvals for next-generation iodinated and gadolinium-based agents. The emphasis on patient safety and environmental sustainability is particularly pronounced in the region, prompting research into agents with improved biodegradability and minimized environmental impact.

Asia-Pacific is poised as the fastest growing region for angiographic contrast media through the next few years. Increasing healthcare expenditure, rapid urbanization, and expansion of interventional cardiology and radiology services in countries such as China, India, and South Korea are driving market acceleration. Local suppliers, supported by large-scale healthcare infrastructure projects, are entering partnerships and licensing agreements with global players. For instance, Lumenis and domestic imaging solution providers are capitalizing on government-backed initiatives to improve imaging access and affordability. The region’s dynamic regulatory environment, with ongoing harmonization efforts such as the ASEAN Medical Device Directive, is expected to expedite market entry for new agents.

Latin America and the Middle East & Africa are emerging as promising markets, albeit with more modest growth rates. Targeted investments in hospital modernization, training for interventional procedures, and gradual reimbursement expansion are paving the way for increased adoption of advanced contrast agents. Companies are increasingly focusing on localized manufacturing and distribution strategies in these regions, as demonstrated by initiatives from sector leaders like Bracco to establish regional partnerships and joint ventures.

Looking ahead, regional disparities in regulatory timelines, healthcare access, and purchasing power will continue to shape the competitive landscape. However, the convergence of technology transfer, capacity building, and collaborative research is expected to foster a more balanced global market for angiographic contrast media over the coming years.

Investment and Partnership Opportunities in the Value Chain

Investment and partnership opportunities in the angiographic contrast media value chain are poised for significant growth as the diagnostic imaging sector evolves. Heading into 2025 and beyond, several drivers are shaping these opportunities, including increased demand for minimally invasive procedures, technological advancements in imaging, and a growing emphasis on safety and sustainability.

Major pharmaceutical and medical device companies remain at the forefront of angiographic contrast media development, with investments targeting both research and manufacturing capacity. For example, Bayer AG continues to invest in expanding its contrast media portfolio and global production capabilities, aiming to meet rising market demands and enhance product safety profiles. Similarly, GE HealthCare has demonstrated a commitment to partnerships and innovation in imaging agents, including the development of lower-risk, high-efficacy contrast agents tailored to new imaging modalities.

Strategic collaborations between pharmaceutical companies and academic or clinical research organizations are also intensifying. These partnerships aim to accelerate the discovery of next-generation contrast agents with improved biocompatibility and enhanced imaging precision. Notably, Guerbet has engaged in multiple alliances to explore macrocyclic and low-osmolality formulations, which are anticipated to become more prominent in the coming years due to their favorable safety profiles.

From a supply chain perspective, investments are focusing on the vertical integration of raw material sourcing and advanced manufacturing processes. Companies are seeking to secure reliable sources of key ingredients, such as iodine and gadolinium, while also investing in environmentally sustainable production practices. For instance, Bayer AG and Guerbet have both publicly committed to refining their manufacturing approaches to reduce environmental impact and ensure supply chain resilience.

Start-ups and smaller biotech firms represent another area of opportunity, particularly those specializing in targeted or novel contrast agent technologies. Larger industry players are increasingly pursuing acquisitions or development partnerships with these innovators to bolster their pipelines. Investment in digital health integration—such as AI-driven contrast dose optimization—also presents a growing frontier, with imaging system manufacturers like GE HealthCare exploring partnerships with software developers to improve diagnostic accuracy and patient safety.

Looking ahead, the angiographic contrast media sector is expected to see continued investment in R&D, manufacturing scale-up, and cross-sector collaborations. These efforts are likely to yield safer, more effective, and environmentally responsible products, positioning the industry for robust growth and dynamic partnership opportunities through the remainder of the decade.

Future Outlook: Predicting Market Trajectories and Disruptive Innovations

Looking ahead to 2025 and the following years, the angiographic contrast media landscape is poised for significant evolution, driven by technological innovation, regulatory shifts, and an increasing emphasis on patient safety and sustainability. The market trajectory is shaped by the convergence of several trends: the development of novel contrast agents, advances in imaging modalities, and growing demand for minimally invasive procedures.

Major manufacturers are intensifying research into next-generation iodinated and gadolinium-based agents with improved safety profiles, reduced nephrotoxicity, and enhanced image quality. Companies such as GE HealthCare, Bayer, and Bracco are investing in contrast agents with lower osmolality and viscosity, which can reduce adverse reactions and expand use among high-risk patient cohorts. There is also a growing focus on developing agents with tailored pharmacokinetics, allowing for more precise and personalized imaging protocols.

A disruptive wave is anticipated from the introduction of microbubble and nanoparticle-based contrast agents. These innovations promise not only enhanced imaging but also potential for theranostic applications—combining diagnosis and therapy in a single procedure. While still in the clinical trial phase, such agents are expected to reach the market within a few years, transforming the angiographic workflow and patient management.

Environmental sustainability has emerged as a critical concern. Leading producers are implementing eco-friendly manufacturing processes and exploring biodegradable contrast media to mitigate environmental impact, an initiative highlighted by Bayer in its sustainability programs. Regulatory authorities in the US, EU, and Asia-Pacific are also tightening guidelines for contrast agent approval, focusing on both patient and ecological safety, which is expected to drive further innovation and market differentiation.

Integration with advanced imaging technologies is accelerating. Artificial intelligence-enabled platforms are being paired with novel contrast agents to optimize dosing, image acquisition, and interpretation. This synergy is likely to reduce procedure times and further minimize patient exposure to contrast media.

In summary, the angiographic contrast media sector is on the cusp of substantial transformation. The next five years will likely see the commercialization of safer and more effective agents, greater use of AI-driven imaging, and a marked pivot toward environmental stewardship. This dynamic environment will reward companies capable of rapid innovation and adaptation to evolving clinical and regulatory demands.