How Robotic Biofouling Prevention Systems Are Transforming Ship Maintenance in 2025—And Why the Next 5 Years Will Redefine Marine Sustainability and Costs

- Executive Summary: 2025 Market Snapshot & Key Drivers

- Introduction to Robotic Biofouling Prevention Systems

- Current State of the Technology: Leading Solutions & Innovations

- Major Players & Industry Collaborations (e.g., hullwiper.co, jotun.com)

- Market Size, Growth Projections & Regional Trends (2025–2030)

- Environmental & Regulatory Impacts: Compliance and Sustainability Benefits

- Cost-Benefit Analysis: Operational Savings vs. Investment

- Emerging Use Cases: Shipping, Offshore Energy, Aquaculture & More

- Challenges, Limitations & Adoption Barriers

- Future Outlook: Next-Gen Robotics, AI Integration, and Long-Term Opportunities

- Sources & References

Executive Summary: 2025 Market Snapshot & Key Drivers

Robotic biofouling prevention systems are rapidly emerging as a transformative solution in maritime maintenance, addressing the persistent challenge of marine organism accumulation on vessel hulls and submerged structures. As of 2025, the global shipping and offshore industries are witnessing accelerated deployment of these systems, driven by tightening environmental regulations, the need for operational efficiency, and heightened focus on sustainability. Regulatory frameworks such as the International Maritime Organization’s (IMO) guidelines are increasingly pushing shipowners to adopt non-toxic, hull-cleaning alternatives to traditional biocidal coatings, fueling the shift towards robotic technologies.

Key players in this sector are developing and commercializing a diverse array of robotic solutions. Companies like HullWiper Ltd offer remotely operated vehicles (ROVs) for in-water hull cleaning, utilizing high-pressure water jets to remove biofouling without damaging anti-fouling coatings or releasing harmful substances. Ecoshield develops advanced hull protection and cleaning systems, often integrating robotic components for autonomous application and maintenance. SeaRobotics Corporation and Greensea Systems Inc. are also prominent, supplying autonomous and semi-autonomous robotic platforms tailored for ship hull inspections and cleaning, as well as offshore infrastructure.

The market momentum is underpinned by data pointing to significant cost savings and environmental benefits. According to industry analyses, effective robotic cleaning can yield fuel savings of 5–10% by maintaining smoother hull surfaces, translating to lower greenhouse gas emissions and reduced operational expenses for shipping companies. Moreover, such systems reduce the spread of invasive aquatic species, a concern increasingly regulated by port authorities and international bodies.

In 2025, investment in robotic biofouling prevention is being prioritized not only by commercial shipping lines but also by offshore energy operators and port authorities seeking to minimize downtime and comply with stricter environmental mandates. The continued advancement of artificial intelligence, sensor integration, and remotely operated technologies is expected to further enhance the autonomy and efficiency of these systems over the next several years. As the industry moves toward digitalization and green shipping practices, adoption rates of robotic solutions are projected to accelerate, positioning robotic biofouling prevention as a key enabler of sustainable maritime operations into the late 2020s.

Introduction to Robotic Biofouling Prevention Systems

Robotic biofouling prevention systems are rapidly transforming the landscape of maritime maintenance and environmental stewardship as the industry enters 2025. Biofouling—the unwanted accumulation of marine organisms such as algae, barnacles, and mussels on ship hulls and underwater structures—remains a significant challenge, causing increased drag, higher fuel consumption, greater maintenance costs, and heightened risk of invasive species transfer. Traditionally, combatting biofouling has relied on scheduled dry-docking and toxic antifouling coatings. However, rising regulatory pressure, especially the International Maritime Organization’s biofouling guidelines and regional restrictions on biocidal paints, has accelerated the adoption of alternative, more sustainable technologies.

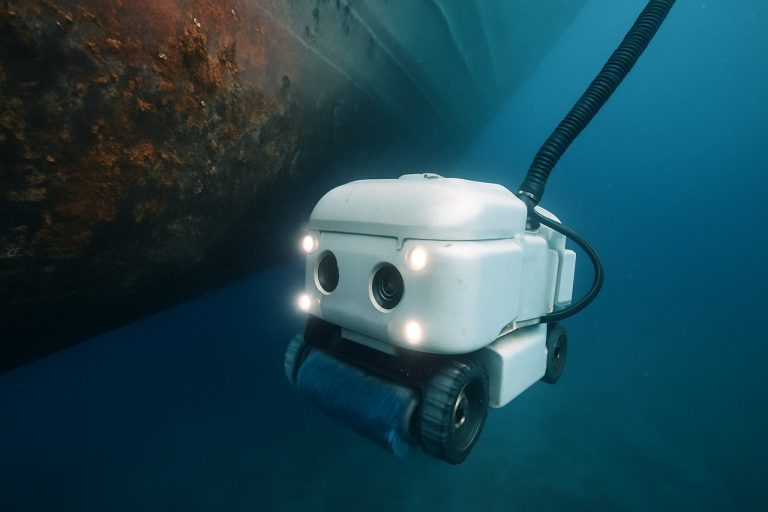

Robotic systems represent a technological leap by enabling proactive, in-water hull cleaning and inspection, reducing both operational downtime and environmental impact. These autonomous or remotely operated vehicles (AUVs/ROVs) use a combination of advanced navigation, imaging, and cleaning technologies—such as brushes, cavitation, or water jets—to remove biofouling before it becomes established. By performing frequent, gentle cleaning, robots prevent hard fouling and minimize the risk of damaging hull coatings.

In recent years, several companies have deployed robotic solutions in commercial trials and live operations. Notably, GARD, a prominent marine insurer, has highlighted the environmental and financial benefits of robotic hull cleaning, while port authorities in Europe and Asia are actively supporting pilot programs. HullWiper offers a remote-operated vehicle capable of cleaning vessels in major international ports without harming antifouling coatings or producing hazardous waste, as its onboard filtration system captures removed debris. Another key player, Ecoshine Robotics, operates cleaning robots designed for both in-water and dockside use, emphasizing eco-friendly operations with minimal water pollution.

The outlook for 2025 and beyond is marked by rapid commercialization and technological refinement. As regulatory frameworks tighten and carbon reduction targets draw nearer, ship operators are expected to increasingly integrate robotic biofouling prevention into fleet management strategies. Innovations in artificial intelligence, sensor fusion, and data analytics are anticipated to further enhance the autonomy and efficacy of these systems. Industry collaboration—between shipowners, ports, technology providers, and regulators—is poised to accelerate the global rollout of robotic cleaning solutions, establishing them as a cornerstone of sustainable maritime operations in the years ahead.

Current State of the Technology: Leading Solutions & Innovations

Robotic biofouling prevention systems have rapidly advanced from experimental prototypes to commercially deployed solutions, driven by the maritime industry’s urgent need to mitigate fouling-related costs, emissions, and regulatory pressures. As of 2025, the sector is characterized by a diverse array of autonomous and semi-autonomous robotic technologies designed for both in-water cleaning and proactive fouling prevention on ship hulls and underwater infrastructure.

Several leading companies are at the forefront of this technological evolution. HullWiper Ltd. markets a remotely operated vehicle (ROV) system that utilizes adjustable high-pressure water jets to remove biofouling without damaging hull coatings. Its adoption has been accelerated by the increasing scrutiny of hull cleaning practices in ports and the demand for environmentally responsible alternatives to diver-based cleaning. The HullWiper ROV’s operational footprint now spans major global ports, and ongoing improvements in brushless, non-abrasive cleaning modules reflect persistent innovation in response to coating and regulatory trends.

Another notable entrant, GARD AS, backs the Jotun Hull Skating Solutions project, which combines a magnetic, semi-autonomous robot (“HullSkater”) with advanced anti-fouling coatings. The HullSkater is designed for proactive, frequent hull inspections and cleaning, employing real-time data transmission and remote operations, enabling vessel operators to maintain hull performance and fuel efficiency while minimizing port delays. Industry trials and initial commercial deployments have demonstrated significant reductions in drag, greenhouse gas emissions, and transfer of invasive aquatic species.

Meanwhile, EcoWorks Marine and GreenSea Solutions are pioneering smaller-scale, modular robotic cleaners aimed at yacht, offshore, and aquaculture applications, reflecting a broadening of the market beyond commercial shipping. These systems emphasize rapid deployment, ease of use, and minimal operational disruption, supporting both scheduled maintenance and emergency antifouling interventions.

Data from pilot programs and early deployments indicate that robotic cleaning can extend intervals between costly drydockings and reduce annual fuel consumption by up to 10%, translating to substantial cost savings and compliance with tightening environmental standards. The International Maritime Organization’s 2023 guidelines on biofouling management have further spurred investment and collaboration among shipping lines, coating manufacturers, and robotics developers.

Looking ahead, the next few years will likely see further integration of artificial intelligence, hull condition analytics, and remote fleet management platforms with robotic systems. As regulatory and commercial incentives align, the market for robotic biofouling prevention is expected to grow, with ongoing technology refinement targeting faster cleaning cycles, improved autonomy, and enhanced compatibility with diverse vessel types.

Major Players & Industry Collaborations (e.g., hullwiper.co, jotun.com)

The field of robotic biofouling prevention systems has seen considerable growth and consolidation among key technology developers, ship operators, and coating manufacturers as we move into 2025. The sector continues to evolve through strategic partnerships, technological advancements, and expanded deployment of in-water robotic solutions that aim to minimize hull fouling and its associated environmental and operational costs.

A leading figure in the sector is HullWiper Ltd, whose remotely operated vehicle (ROV) system provides underwater hull cleaning without damaging existing coatings or creating harmful debris. The HullWiper system is now operational in over 25 international locations, with recent expansions into key Asian and European ports. The company has formed collaborations with several major shipping groups and port authorities to offer its service as a sustainable alternative to traditional hull cleaning methods.

Another major player is Jotun, a global leader in marine coatings, which has entered the robotic cleaning space through its Hull Skating Solutions (HSS). The HSS system marries Jotun’s advanced antifouling coatings with a semi-autonomous robot that can be deployed while the vessel is at berth, continuously inspecting and cleaning the hull to prevent biofouling buildup. Jotun’s collaborations with shipowners and classification societies have led to significant pilot projects and early commercial rollouts, underpinning a trend toward integrated hull management solutions.

Other notable entrants include Gard, a major marine insurer, which has supported pilot programs and industry forums focused on robotic in-water cleaning for risk mitigation and regulatory compliance. Meanwhile, companies such as Hydrex and ECOsubsea provide robotic and diverless hull cleaning systems, with ECOsubsea’s solution certified for environmentally friendly operations in strict regulatory jurisdictions like Norway and the UK.

Industry collaborations are intensifying, particularly between technology providers, coating manufacturers, and ship operators, to ensure that robotic systems are compatible with both antifouling paints and port environmental requirements. For instance, cross-industry consortia are working on standardized protocols for robotic cleaning and waste capture to address the International Maritime Organization’s (IMO) guidelines on biofouling management.

Looking ahead to the next few years, the market is expected to expand further as regulatory pressure on invasive species transfer and underwater emissions increases. The integration of robotics with digital hull monitoring and predictive maintenance platforms is anticipated to become standard practice, driven by both operational savings and compliance needs. The sector’s trajectory is being shaped by the ongoing collaboration between established marine coating brands, innovative robotic firms, and an increasingly proactive shipping industry.

Market Size, Growth Projections & Regional Trends (2025–2030)

The global market for robotic biofouling prevention systems is expected to experience robust growth between 2025 and 2030, driven by tightening maritime environmental regulations, rising operational costs associated with traditional hull cleaning, and technological advances in autonomous robotics. As of 2025, the market is transitioning from pilot deployments and early commercial adoption to broader fleet integration, particularly among major shipping lines and port authorities seeking sustainable and cost-effective biofouling management solutions.

Industry-leading companies such as HullWiper Ltd and EcoHull Cleaning are at the forefront, offering remotely operated vehicles (ROVs) and semi-autonomous robots designed for in-water hull cleaning without damaging antifouling coatings. These systems are gaining traction in regions with stringent environmental standards, notably in Europe, East Asia, and the Americas. For example, HullWiper Ltd, headquartered in the UAE, has expanded its operational bases to key ports in Scandinavia, the Mediterranean, and Asia-Pacific, reflecting regional demand and regulatory support for non-toxic, robotic cleaning methods.

The Asia-Pacific region is projected to register the highest compound annual growth rate (CAGR) through 2030, attributed to the vast shipping and shipbuilding industries in countries like China, Japan, and South Korea, as well as increasing regulatory enforcement in major ports. European nations, especially those in Northern Europe, continue to lead in early adoption due to proactive regulatory measures against invasive species and a strong focus on sustainable shipping practices. North America is witnessing increased pilot programs, with port authorities and large shipping conglomerates beginning to invest in robotic hull cleaning to comply with ballast water and biofouling management guidelines.

In terms of market size, the industry is expected to surpass several hundred million USD by 2030, with annual growth rates in the high single to low double digits, as more ship operators shift from manual or diver-based cleaning to automated and robotic solutions. Partnerships between robotics manufacturers and maritime service providers are accelerating deployment; for example, EcoHull Cleaning has collaborated closely with shipping fleets in Northern Europe to integrate real-time data collection and performance monitoring into its robotic systems.

Looking ahead, the outlook for robotic biofouling prevention systems remains positive, with anticipated growth driven by further technological refinement, the expansion of regulatory zones, and broader acceptance of autonomous maintenance solutions. Continued investment from both established maritime technology firms and new entrants is likely to stimulate innovation and competitive pricing over the coming years.

Environmental & Regulatory Impacts: Compliance and Sustainability Benefits

Robotic biofouling prevention systems are rapidly transforming environmental compliance and sustainability practices in the maritime and offshore industries as stricter regulations on hull cleaning and invasive species come into force for 2025 and beyond. Traditional methods of biofouling control, such as in-water cleaning with divers or abrasive devices, often generate substantial debris and can inadvertently release harmful biocides or non-native organisms into marine ecosystems. In response, robotic solutions are emerging as a cleaner, more controlled alternative, aligning closely with evolving international requirements.

The International Maritime Organization (IMO) continues to enforce its Guidelines for the Control and Management of Ships’ Biofouling, urging member states and shipping companies to adopt advanced preventive measures that minimize environmental impact. Robotic systems, such as those developed by HullWiper Ltd and ECOsubsea, use remotely operated vehicles equipped with non-abrasive cleaning tools and onboard filtration systems. These technologies capture removed fouling and prevent the release of invasive species and microplastics, supporting compliance with IMO guidelines and regional port regulations.

In 2025, ports in Australia, New Zealand, and select European countries are tightening hull cleaning protocols, requiring proof of environmentally responsible cleaning. Robotic systems with closed-loop water recovery and waste capture features—exemplified by ECOsubsea—are increasingly mandatory for vessels seeking entry into ecologically sensitive harbors. This shift is driven by documented cases where robotic cleaning has demonstrably reduced the risk of new species introduction and minimized the spread of harmful pathogens.

From a sustainability perspective, robotic biofouling prevention systems also support decarbonization goals by maintaining smoother hull surfaces, reducing drag, and thus lowering fuel consumption and associated greenhouse gas emissions. Operators such as HullWiper Ltd report that regular robotic cleaning can improve fuel efficiency by up to 10%, contributing to compliance with IMO’s Energy Efficiency Existing Ship Index (EEXI) and the Carbon Intensity Indicator (CII) requirements.

Looking ahead to the next few years, regulatory acceptance of robotic systems is expected to accelerate, with ongoing pilot programs and partnerships between technology providers and maritime authorities. As digital monitoring and reporting capabilities are integrated into robotic platforms, operators will be able to provide real-time data on cleaning efficacy and environmental containment, further easing compliance and fostering transparent, sustainable shipping practices.

Cost-Benefit Analysis: Operational Savings vs. Investment

As the maritime industry intensifies its search for sustainable and cost-effective strategies to combat biofouling, robotic biofouling prevention systems are gaining traction as a promising technological solution. Traditionally, vessel operators have relied on periodic dry-docking and the application of anti-fouling coatings, but these methods entail significant operational downtime and recurring costs. By contrast, robotic hull cleaning and inspection technologies offer continuous or scheduled maintenance, potentially reducing both direct expenditures and hidden costs associated with hull fouling.

The initial capital investment for robotic biofouling prevention systems varies widely, depending on the scale and sophistication of the technology. Autonomous in-water cleaning robots—such as those developed by HullWiper Ltd. and Ecoshield—may require a six-figure upfront purchase or lease, with additional costs for deployment, maintenance, and crew training. Despite these upfront expenses, the operational savings over the vessel’s lifecycle can be substantial. According to industry data, even moderate levels of hull fouling can increase fuel consumption by 10–30%, translating into hundreds of thousands of dollars in additional annual fuel costs for a single large vessel. By regularly removing biofouling without the need for dry-docking, robotic systems help maintain optimal hull smoothness and, consequently, fuel efficiency.

Further, the use of robotic systems can extend the lifespan of anti-fouling coatings by avoiding abrasive cleaning methods and reducing the frequency of reapplication cycles. This not only lowers material and labor costs but also minimizes environmental impact by reducing paint leaching and the need for biocide-based coatings—an increasing regulatory concern worldwide. Jotun, a leader in marine coatings, has partnered with technology firms to develop integrated hull management solutions that combine sensors, data analytics, and robotic cleaning, aiming to optimize both cleaning intervals and coating durability.

Looking ahead to 2025 and beyond, the total cost of ownership for robotic biofouling prevention systems is expected to decline as market competition intensifies and production scales up. Companies like Gard, a prominent marine insurer, are exploring risk-based incentives for adopting advanced hull cleaning technologies, which could further improve the return on investment for shipowners. Additionally, the integration of remote monitoring, AI-driven scheduling, and predictive maintenance is expected to enhance operational efficiency and reduce manual oversight costs.

Overall, while the upfront investment in robotic biofouling prevention systems remains significant, ongoing operational savings—in fuel, coating maintenance, and regulatory compliance—are set to outpace these costs within a few years of deployment. As environmental regulations tighten and digitalization accelerates across the maritime sector, the cost-benefit profile of robotic systems will likely become even more favorable.

Emerging Use Cases: Shipping, Offshore Energy, Aquaculture & More

The deployment of robotic biofouling prevention systems is gaining significant momentum across maritime industries, with 2025 set to be a pivotal year for wider adoption and commercialization. These autonomous and semi-autonomous robots are engineered to address both the operational and environmental challenges of marine biofouling—where organisms accumulate on hulls, underwater structures, and equipment—by delivering regular, non-toxic cleaning and inspection.

In the shipping sector, major lines and fleet operators are turning to robotic hull cleaning solutions to maintain fuel efficiency and comply with tightening biofouling regulations. Leading companies such as HullWiper Ltd and Greensea Systems Inc. provide remotely operated vehicles (ROVs) and hull cleaning robots that can remove fouling without abrasive damage or releasing harmful biocides. These systems are increasingly being incorporated into routine maintenance schedules at major ports worldwide, with data-driven scheduling to optimize cleaning frequency and minimize idle times.

Offshore energy platforms—oil, gas, and especially offshore wind—are integrating robotic solutions for both preventative and remedial cleaning of submerged structures, risers, and turbines. In 2024 and into 2025, companies like Rovco and Saab AB (through its Seaeye division) have deployed advanced ROVs and autonomous cleaning robots to mitigate the risks of corrosion and maintain the efficiency of critical infrastructure. The use of robotic systems reduces the need for human divers in hazardous environments, improves inspection accuracy, and helps operators comply with stricter environmental standards.

Aquaculture is another rapidly growing use case, as fish farms face mounting challenges from biofouling on nets and cages. Companies such as Akvapartner AS and Ecofoci are providing robotic net cleaners that operate continuously or on-demand, reducing the frequency of net changes and minimizing fish stress. These innovations are particularly relevant as the global demand for sustainable seafood increases and regulatory scrutiny over chemical anti-fouling agents intensifies.

Looking ahead to the next few years, further integration of machine learning and real-time monitoring is expected to enhance the autonomy and efficiency of these systems. Industry bodies and technology alliances are driving interoperability standards, while new entrants are focusing on compact, cost-effective robotic solutions for smaller vessels and coastal infrastructure. As biofouling prevention becomes a critical operational and compliance factor, robotic systems are set to become standard equipment across multiple maritime domains, with ongoing innovation driven by both environmental pressures and cost savings.

Challenges, Limitations & Adoption Barriers

Robotic biofouling prevention systems represent a promising advance in marine vessel maintenance, but their widespread adoption faces several challenges and limitations in 2025 and the coming years. Despite technological progress, key barriers persist across operational, economic, regulatory, and technical domains.

A major challenge is the integration of robotic systems into varied vessel types and operational profiles. Most commercial solutions, such as those developed by HullWiper Ltd. and Ecoshield, are primarily suited for large, flat surfaces typical of cargo ships and tankers. However, vessels with complex hull geometries or sensitive coatings may not benefit equally, limiting universal applicability. Additionally, robots must operate reliably in diverse marine environments, facing shifting water conditions, currents, and visibility, which can impact effectiveness and deployment frequency.

Economic barriers are also significant. The upfront cost of robotic systems, including purchase, installation, and crew training, can be prohibitive for smaller fleet operators or those with thin profit margins. Although companies like Seadronix and HullWiper Ltd. have made strides in offering cost-effective service models, the return on investment often depends on regulatory drivers and the frequency of hull cleanings required to achieve fuel savings or meet environmental standards. Furthermore, ongoing maintenance, spare parts availability, and potential system downtimes add to the total cost of ownership.

Regulatory and port acceptance also present hurdles. While international frameworks are evolving, local port authorities may have specific restrictions on in-water cleaning activities, regardless of the technology’s environmental credentials. For example, some ports still prohibit in-water cleaning to avoid releasing harmful biocides or invasive species, even when using advanced robots with onboard capture systems. Companies like HullWiper Ltd. have addressed this with debris-capture capabilities, but regulatory harmonization remains incomplete.

Technical limitations persist as well. Robotic systems can struggle with heavy or mature biofouling, requiring manual intervention. Automation and AI-driven navigation—being advanced by Seadronix—are improving, but sensor reliability and autonomous operation in turbid, debris-laden waters are ongoing research areas. Battery life and tether management further limit duration and coverage, especially on larger vessels.

In summary, while robotic biofouling prevention systems are maturing and attracting interest from major shipowners, their mainstream adoption in 2025 is tempered by vessel compatibility, cost, regulatory variance, and technology readiness. Industry collaboration, standardization, and further technical innovation will be crucial for overcoming these barriers in the next few years.

Future Outlook: Next-Gen Robotics, AI Integration, and Long-Term Opportunities

The future of robotic biofouling prevention systems is poised for significant advances driven by next-generation robotics, artificial intelligence (AI), and integrated sensor technologies. As regulatory pressures intensify, particularly regarding invasive species transfer and greenhouse gas emissions, maritime stakeholders are prioritizing proactive hull maintenance solutions. In 2025 and the coming years, robotic biofouling prevention systems are expected to transition from innovative alternatives to essential components of fleet management strategies.

Leading the sector are companies such as HullWiper, Echandia, and Greensea Systems Inc.. These firms are actively deploying and refining remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs) designed to perform in-water hull cleaning and biofouling prevention without damaging hull coatings or polluting surrounding waters. HullWiper, for example, operates a fleet of ROVs that utilize high-pressure water jets and onboard filtration to safely remove biofouling, while capturing debris for environmentally responsible disposal.

A key trend shaping the future is the integration of AI and machine learning in robotic cleaning platforms. By 2025, companies such as Greensea Systems Inc. are expected to expand the deployment of AI-driven navigation and hull mapping software, enabling robots to autonomously identify fouling hotspots, adapt cleaning routines, and optimize operational efficiency based on real-time sensor data. These advances will reduce labor requirements, minimize vessel downtime, and support predictive maintenance regimes.

Another anticipated development is the move towards continuous or semi-continuous hull cleaning using permanently installed robotic crawlers. Firms like Sealution and Jotun are developing systems that reside on the vessel, periodically cleaning the hull before biofouling can establish. The Jotun Hull Skater, for example, uses magnetic adhesion and advanced sensors for targeted cleaning, reducing the need for drydocking and mitigating invasive species transfer.

Collaboration with shipbuilders and integration with digital fleet management platforms is likely to accelerate. Partnerships between robotic system manufacturers, coating suppliers, and major shipping lines will facilitate standardized solutions and data sharing. This will support the development of performance benchmarks and compliance with upcoming regulations, such as those from the International Maritime Organization (IMO).

In summary, the outlook for robotic biofouling prevention systems in 2025 and beyond is marked by increased automation, smarter AI integration, and tighter ecosystem collaboration. These trends are set to deliver both environmental benefits and substantial operational cost savings, positioning robotics as a core technology in the future of maritime maintenance.