Polysomnography Equipment Manufacturing in 2025: Unveiling the Future of Sleep Diagnostics and Industry Growth. Explore the Innovations, Market Forces, and Strategic Shifts Shaping the Next Five Years.

- Executive Summary: 2025 Market Landscape and Key Takeaways

- Global Market Size, Growth Forecasts, and Regional Trends (2025–2030)

- Technological Innovations: AI, Wireless, and Wearable Polysomnography Devices

- Competitive Analysis: Leading Manufacturers and Strategic Moves

- Regulatory Environment and Industry Standards (AASM, FDA, ISO)

- Supply Chain Dynamics and Component Sourcing

- End-User Segments: Hospitals, Sleep Centers, and Home Diagnostics

- Emerging Markets and Expansion Opportunities

- Challenges: Reimbursement, Data Security, and Interoperability

- Future Outlook: Disruptive Trends and Strategic Recommendations

- Sources & References

Executive Summary: 2025 Market Landscape and Key Takeaways

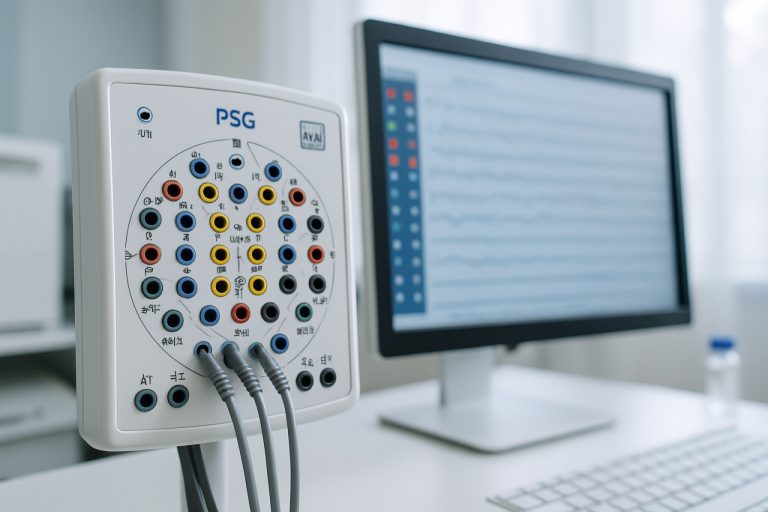

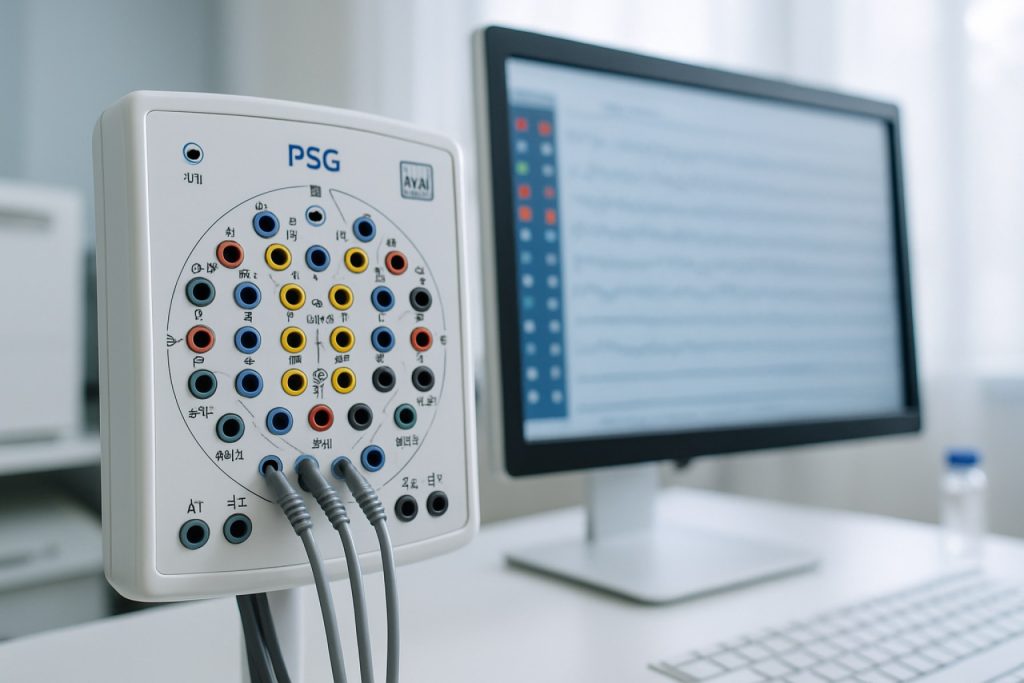

The global landscape for polysomnography equipment manufacturing in 2025 is characterized by robust innovation, expanding clinical demand, and a dynamic competitive environment. Polysomnography—comprehensive sleep study technology—remains a cornerstone in diagnosing sleep disorders such as obstructive sleep apnea, narcolepsy, and insomnia. The sector is witnessing accelerated growth, driven by rising awareness of sleep health, increasing prevalence of sleep-related conditions, and ongoing technological advancements.

Key manufacturers, including Philips, ResMed, Natus Medical Incorporated, and Compumedics Limited, continue to shape the market through product innovation and global expansion. These companies are investing in next-generation polysomnography systems that integrate wireless sensors, cloud-based data management, and artificial intelligence (AI) for automated scoring and analysis. For example, Philips and ResMed have both expanded their digital health portfolios, focusing on interoperability and remote patient monitoring, which are increasingly demanded by sleep clinics and home-based care providers.

The year 2025 sees a notable shift toward portable and home-based polysomnography solutions, reflecting both patient preference and healthcare system pressures to decentralize diagnostics. Manufacturers are responding with compact, user-friendly devices that maintain clinical-grade accuracy. Compumedics Limited and Natus Medical Incorporated have introduced systems designed for both in-lab and ambulatory use, supporting broader access to sleep diagnostics.

Regulatory compliance and quality assurance remain central to manufacturing strategies, with companies aligning their product development with evolving standards from bodies such as the American Academy of Sleep Medicine (AASM) and international regulatory agencies. This focus ensures that new devices meet stringent safety, accuracy, and data security requirements, which is critical as digital health integration deepens.

Looking ahead, the polysomnography equipment manufacturing sector is expected to maintain a strong growth trajectory through the next several years. Market drivers include the aging global population, increased screening for sleep disorders, and the integration of AI and machine learning for enhanced diagnostic precision. Strategic partnerships, mergers, and acquisitions are likely as leading players seek to expand their technological capabilities and geographic reach. The competitive landscape will continue to be defined by innovation, regulatory adaptation, and the ability to deliver scalable, patient-centric solutions.

Global Market Size, Growth Forecasts, and Regional Trends (2025–2030)

The global market for polysomnography (PSG) equipment is poised for steady growth from 2025 through 2030, driven by rising awareness of sleep disorders, technological advancements, and expanding healthcare infrastructure. Polysomnography, the gold standard for diagnosing sleep-related conditions such as obstructive sleep apnea, relies on sophisticated multi-parameter monitoring systems. The demand for these systems is increasing as sleep disorders become more widely recognized as significant public health concerns.

Key manufacturers in this sector include Philips, ResMed, Natus Medical Incorporated, and Compumedics Limited. These companies are investing in research and development to enhance the accuracy, portability, and connectivity of PSG devices. For example, Philips and ResMed have introduced systems with cloud-based data management and wireless sensor integration, catering to both clinical and home-based sleep studies.

Regionally, North America is expected to maintain its lead in market share through 2030, supported by a high prevalence of sleep disorders, established reimbursement frameworks, and the presence of major manufacturers. The United States, in particular, continues to see robust adoption of advanced PSG systems, with ongoing upgrades in sleep laboratories and increased use of home-based diagnostic solutions. Europe follows closely, with countries such as Germany, France, and the UK investing in sleep medicine infrastructure and digital health initiatives.

The Asia-Pacific region is projected to experience the fastest growth, fueled by rising healthcare expenditure, growing awareness of sleep health, and government initiatives to improve diagnostic capabilities. Manufacturers like Compumedics Limited have expanded their presence in markets such as China, India, and Southeast Asia, often through partnerships with local distributors and healthcare providers.

Looking ahead, the market outlook for 2025–2030 is shaped by several trends: miniaturization of PSG devices, integration with telemedicine platforms, and the development of AI-driven analytics for automated sleep staging and event detection. These innovations are expected to lower barriers to diagnosis, improve patient comfort, and enable broader adoption in both clinical and home settings. As regulatory standards evolve and reimbursement policies adapt to new technologies, established manufacturers and emerging players alike are likely to benefit from sustained demand for advanced polysomnography equipment.

Technological Innovations: AI, Wireless, and Wearable Polysomnography Devices

The landscape of polysomnography (PSG) equipment manufacturing is undergoing rapid transformation in 2025, driven by technological innovations in artificial intelligence (AI), wireless connectivity, and wearable device design. These advancements are reshaping both clinical and home-based sleep diagnostics, with leading manufacturers investing heavily in R&D to address the growing demand for more accessible, accurate, and patient-friendly solutions.

AI integration is a defining trend, with manufacturers embedding machine learning algorithms into PSG systems to automate data analysis, scoring, and artifact detection. This not only reduces the workload for sleep technicians but also enhances diagnostic accuracy and consistency. For example, Philips has incorporated AI-driven analytics into its sleep diagnostic platforms, enabling faster interpretation of complex sleep data. Similarly, ResMed is leveraging AI to improve signal quality and automate event detection in its PSG and home sleep testing devices.

Wireless technology is another major innovation, enabling untethered patient monitoring and greater comfort during sleep studies. Modern PSG systems now feature wireless sensors and data transmission, reducing the need for cumbersome cables and allowing for more natural sleep environments. Natus Medical Incorporated has introduced wireless PSG solutions that streamline setup and enhance patient mobility, while Compumedics Limited offers wireless headboxes and amplifiers designed for both clinical and ambulatory settings.

Wearable PSG devices are gaining traction as manufacturers respond to the demand for home-based sleep diagnostics. These compact, user-friendly systems are designed to capture multi-channel sleep data outside of traditional sleep labs. Philips and ResMed have both expanded their portfolios to include wearable and portable PSG solutions, supporting the shift toward decentralized sleep medicine. Additionally, Compumedics Limited has developed miniaturized PSG recorders that facilitate high-quality data collection in home environments.

Looking ahead, the convergence of AI, wireless, and wearable technologies is expected to further democratize sleep diagnostics, making comprehensive PSG accessible to broader populations. Manufacturers are anticipated to focus on enhancing interoperability with electronic health records, improving battery life, and expanding cloud-based analytics capabilities. As regulatory pathways for digital health solutions become clearer, the adoption of these next-generation PSG devices is likely to accelerate, positioning established players and innovative entrants at the forefront of a rapidly evolving market.

Competitive Analysis: Leading Manufacturers and Strategic Moves

The global polysomnography equipment manufacturing sector in 2025 is characterized by a concentrated group of established players, ongoing technological innovation, and strategic expansion into emerging markets. The competitive landscape is shaped by a mix of multinational corporations and specialized medical device firms, each leveraging proprietary technologies and partnerships to strengthen their market positions.

Among the most prominent manufacturers, Philips continues to be a dominant force, offering a comprehensive portfolio of sleep diagnostic systems. The company’s Alice series polysomnography systems are widely adopted in sleep centers worldwide, and Philips has recently emphasized cloud connectivity and AI-driven analytics to enhance diagnostic accuracy and workflow efficiency. Strategic investments in digital health and remote monitoring are expected to further solidify Philips’ leadership in the coming years.

Another key player, ResMed, is recognized for its innovation in both polysomnography and home sleep testing devices. ResMed’s focus on integrating cloud-based platforms with its diagnostic equipment enables seamless data sharing and telemedicine applications, a trend accelerated by the global shift toward remote healthcare. The company’s recent acquisitions and partnerships aim to expand its reach in both developed and emerging markets, particularly in Asia-Pacific and Latin America.

Natus Medical Incorporated is also a significant competitor, with a strong presence in neurodiagnostic and sleep diagnostic equipment. Natus has invested in expanding its product line to include advanced PSG systems with enhanced signal quality and user-friendly interfaces. The company’s strategy includes targeted R&D spending and collaborations with academic institutions to stay at the forefront of sleep medicine technology.

Other notable manufacturers include Compumedics Limited, an Australian company known for its Grael and Somté PSG systems, and Nihon Kohden Corporation, a Japanese firm with a diversified portfolio in neurophysiology and sleep diagnostics. Both companies are actively pursuing international expansion and product innovation, with a focus on miniaturization and wireless connectivity.

Strategic moves across the industry include mergers and acquisitions, partnerships with sleep clinics and research institutions, and increased investment in artificial intelligence for automated scoring and analysis. The competitive outlook for 2025 and beyond suggests continued consolidation among leading manufacturers, alongside the emergence of niche players specializing in portable and home-based PSG solutions. As regulatory standards evolve and demand for sleep diagnostics grows, manufacturers are expected to prioritize interoperability, cybersecurity, and patient-centric design to maintain their competitive edge.

Regulatory Environment and Industry Standards (AASM, FDA, ISO)

The regulatory environment and adherence to industry standards are central to the manufacturing of polysomnography (PSG) equipment, especially as the sector advances in 2025 and beyond. The landscape is shaped by a combination of national and international standards, with oversight from key organizations such as the American Academy of Sleep Medicine (AASM), the U.S. Food and Drug Administration (FDA), and the International Organization for Standardization (ISO).

The American Academy of Sleep Medicine (AASM) continues to play a pivotal role in defining the clinical and technical standards for PSG systems. The AASM’s guidelines, including the latest updates to the AASM Manual for the Scoring of Sleep and Associated Events, set forth the minimum technical specifications for PSG equipment, such as signal sampling rates, filter settings, and channel requirements. These standards are widely adopted by manufacturers to ensure their devices are suitable for clinical accreditation and reimbursement in the U.S. and internationally.

In the United States, the U.S. Food and Drug Administration (FDA) regulates PSG equipment as Class II medical devices. Manufacturers must comply with the FDA’s 510(k) premarket notification process, demonstrating substantial equivalence to legally marketed predicate devices. In 2025, the FDA continues to emphasize cybersecurity, interoperability, and post-market surveillance for sleep diagnostic devices, reflecting the increasing integration of digital health technologies and cloud-based data management in PSG systems. Leading manufacturers such as Philips and Natus Medical Incorporated maintain robust regulatory affairs teams to navigate these evolving requirements and ensure ongoing compliance.

Globally, ISO standards are integral to the design, manufacturing, and quality management of PSG equipment. ISO 13485:2016, which specifies requirements for a quality management system for medical devices, remains the benchmark for manufacturers seeking international market access. Additionally, ISO 80601-2-61:2017, which addresses the basic safety and essential performance of pulse oximeter equipment, is increasingly relevant as PSG systems incorporate multi-parameter monitoring. Companies such as ResMed and Fukuda Denshi align their manufacturing processes with these standards to facilitate global distribution and meet the expectations of healthcare providers and regulatory bodies.

Looking ahead, the regulatory environment is expected to become more stringent, with greater emphasis on data privacy, software validation, and real-world performance evidence. Manufacturers are investing in advanced quality systems and regulatory intelligence to anticipate changes and maintain market leadership. As digital transformation accelerates in sleep medicine, close collaboration with regulatory authorities and standards organizations will be essential for innovation and compliance in PSG equipment manufacturing.

Supply Chain Dynamics and Component Sourcing

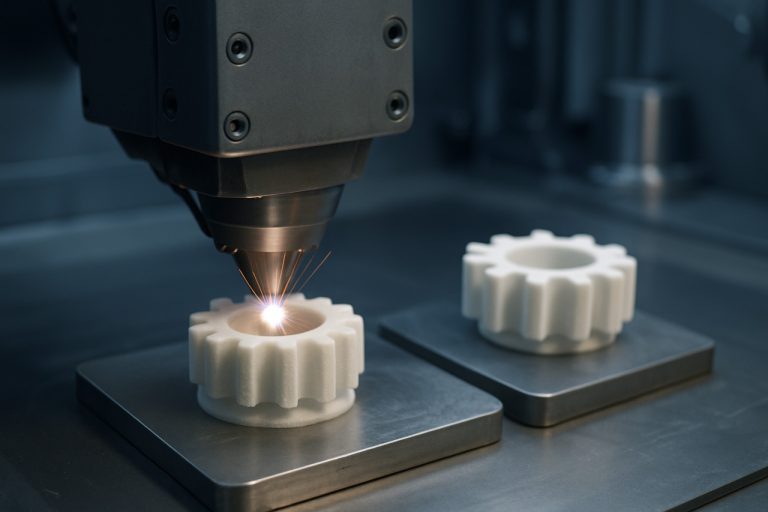

The supply chain dynamics and component sourcing landscape for polysomnography (PSG) equipment manufacturing in 2025 is shaped by a combination of technological innovation, global logistics challenges, and evolving regulatory requirements. PSG systems, which are essential for diagnosing sleep disorders, rely on a complex assembly of sensors, amplifiers, data acquisition modules, and software platforms. The sourcing of these components is increasingly globalized, with manufacturers seeking high-quality, reliable suppliers for critical parts such as EEG electrodes, respiratory sensors, and microprocessors.

Leading PSG equipment manufacturers, such as Philips, Natus Medical Incorporated, and Compumedics Limited, maintain diversified supplier networks to mitigate risks associated with geopolitical tensions and supply chain disruptions. The semiconductor shortage that impacted the medical device sector in previous years has prompted these companies to secure long-term contracts with chip manufacturers and invest in inventory buffers for essential electronic components. In 2025, there is a continued emphasis on dual sourcing strategies and nearshoring of certain components to reduce lead times and enhance supply chain resilience.

Component quality and regulatory compliance remain paramount. PSG equipment must adhere to stringent standards set by regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). This necessitates rigorous supplier qualification processes and traceability of materials, especially for patient-contact sensors and wireless communication modules. Companies like Nihon Kohden Corporation and ResMed have established in-house testing facilities and collaborate closely with suppliers to ensure compliance with international standards for medical electrical equipment.

Sustainability and ethical sourcing are gaining traction in the PSG equipment supply chain. Manufacturers are increasingly evaluating suppliers based on environmental impact, labor practices, and the use of conflict-free minerals. This trend is particularly evident among global players such as Philips, which has publicized its commitment to responsible sourcing and circular economy principles.

Looking ahead, the supply chain for PSG equipment is expected to become more digitalized, with the adoption of advanced tracking systems and predictive analytics to optimize inventory and anticipate disruptions. The integration of artificial intelligence in component sourcing and quality control is also anticipated to enhance efficiency and reliability. As demand for sleep diagnostics grows worldwide, manufacturers will continue to invest in robust, agile supply chains to support innovation and meet regulatory expectations.

End-User Segments: Hospitals, Sleep Centers, and Home Diagnostics

The end-user landscape for polysomnography (PSG) equipment is evolving rapidly in 2025, shaped by technological innovation, shifting healthcare delivery models, and the growing prevalence of sleep disorders. Traditionally, hospitals and dedicated sleep centers have been the primary users of PSG systems, but recent years have seen a marked expansion into home-based diagnostics, driven by both patient demand and advances in portable monitoring technology.

Hospitals remain a cornerstone of the PSG equipment market, particularly for complex cases requiring comprehensive overnight studies and multidisciplinary care. Leading manufacturers such as Philips and GE HealthCare continue to supply advanced, multi-channel PSG systems tailored for hospital sleep labs, integrating high-resolution data acquisition, video monitoring, and connectivity with electronic health records. These systems are designed for high throughput and reliability, supporting the needs of large healthcare institutions.

Sleep centers, both independent and hospital-affiliated, represent another significant segment. They often require flexible PSG solutions that can accommodate a range of diagnostic protocols, from full polysomnography to split-night studies and titration of therapies such as CPAP. Companies like Natus Medical Incorporated and Compumedics have developed modular PSG platforms that allow customization for different patient populations and research applications. In 2025, sleep centers are increasingly adopting cloud-based data management and remote review capabilities, enabling collaboration among clinicians and more efficient workflow.

The most dynamic growth, however, is occurring in the home diagnostics segment. The COVID-19 pandemic accelerated the adoption of home sleep testing, and this trend continues as payers and providers seek cost-effective, patient-friendly alternatives to in-lab studies. Manufacturers such as ResMed and Fisher & Paykel Healthcare have introduced compact, user-friendly PSG and polygraphy devices designed for unsupervised use in the home environment. These devices often feature wireless data transmission, automated scoring algorithms, and integration with telemedicine platforms, supporting remote diagnosis and follow-up.

Looking ahead, the boundaries between these end-user segments are expected to blur further. Hospitals and sleep centers are increasingly leveraging home-based PSG for pre-screening and follow-up, while home diagnostics providers are expanding their offerings to include more comprehensive multi-parameter monitoring. The continued miniaturization of sensors, advances in AI-driven data analysis, and regulatory support for remote diagnostics are likely to drive further growth and innovation across all end-user segments in the polysomnography equipment market.

Emerging Markets and Expansion Opportunities

The global landscape for polysomnography equipment manufacturing is experiencing significant transformation in 2025, driven by rising awareness of sleep disorders, expanding healthcare infrastructure, and technological advancements. Emerging markets, particularly in Asia-Pacific, Latin America, and parts of the Middle East, are at the forefront of this expansion, presenting lucrative opportunities for established manufacturers and new entrants alike.

In Asia-Pacific, rapid urbanization and increasing prevalence of sleep-related health issues are fueling demand for diagnostic solutions. Countries such as China and India are witnessing a surge in sleep clinics and hospital investments, prompting leading manufacturers to localize production and distribution. Natus Medical Incorporated, a prominent global supplier of sleep diagnostic equipment, has reported strategic partnerships and distribution agreements in these regions to enhance market penetration. Similarly, ResMed, known for its comprehensive sleep and respiratory care portfolio, continues to expand its manufacturing and service footprint in Asia, leveraging local collaborations to address region-specific needs.

Latin America is also emerging as a promising market, with Brazil and Mexico leading the adoption of advanced sleep diagnostic technologies. The region’s growing middle class and increased healthcare spending are encouraging manufacturers to introduce cost-effective and portable polysomnography systems. Philips, a global leader in health technology, has intensified its focus on Latin American markets by offering scalable solutions tailored to local clinical requirements and regulatory frameworks.

In the Middle East, investments in healthcare modernization and medical tourism are creating new avenues for polysomnography equipment suppliers. Governments in the Gulf Cooperation Council (GCC) countries are prioritizing non-communicable disease management, including sleep disorders, which is expected to drive demand for both in-lab and home-based diagnostic systems. Companies like Compumedics Limited, an Australian manufacturer specializing in sleep diagnostics, have reported increased interest and sales activities in the region, supported by local partnerships and training initiatives.

Looking ahead, the next few years are expected to see intensified competition and innovation as manufacturers respond to the unique needs of emerging markets. Key trends include the development of wireless and cloud-connected polysomnography devices, integration with telemedicine platforms, and the introduction of AI-driven analytics for faster and more accurate diagnosis. As regulatory environments mature and reimbursement policies evolve, manufacturers with agile supply chains and strong local alliances are well-positioned to capture growth in these dynamic regions.

Challenges: Reimbursement, Data Security, and Interoperability

The polysomnography equipment manufacturing sector faces several persistent and emerging challenges in 2025, particularly in the areas of reimbursement, data security, and interoperability. These issues are shaping both the pace of innovation and the adoption of new technologies in sleep diagnostics.

Reimbursement Complexity

Reimbursement for sleep studies remains a significant hurdle, especially as healthcare systems worldwide continue to scrutinize costs and shift toward value-based care. In the United States, changes in Medicare and private insurer policies have led to increased requirements for demonstrating medical necessity and cost-effectiveness of in-lab polysomnography versus home sleep apnea testing. This has pressured manufacturers to develop equipment that supports both traditional and home-based diagnostics, while also providing robust data to justify reimbursement claims. Leading manufacturers such as ResMed and Philips are actively engaging with payers and regulatory bodies to ensure their devices meet evolving clinical and documentation standards.

Data Security Concerns

With the proliferation of cloud-connected polysomnography systems and remote patient monitoring, data security has become a top priority. The sensitive nature of sleep study data, which often includes biometric and personal health information, makes it a target for cyber threats. Manufacturers are investing in advanced encryption, secure data transmission protocols, and compliance with international standards such as HIPAA and GDPR. Companies like Natus Medical Incorporated and Compumedics have emphasized cybersecurity in their product development, integrating multi-layered security features and regular software updates to address vulnerabilities.

Interoperability Challenges

Interoperability remains a critical challenge as sleep centers and hospitals increasingly demand seamless integration of polysomnography equipment with electronic health records (EHRs) and other digital health platforms. The lack of standardized data formats and communication protocols can hinder workflow efficiency and data sharing. Industry leaders, including Philips and ResMed, are collaborating with health IT organizations to promote open standards and develop APIs that facilitate interoperability. However, achieving universal compatibility across diverse healthcare IT ecosystems is an ongoing process that will likely extend over the next several years.

Looking ahead, the ability of manufacturers to address these challenges will be pivotal in determining their competitiveness and the broader adoption of advanced polysomnography technologies. Ongoing collaboration with healthcare providers, payers, and regulatory agencies will be essential to navigate the evolving landscape of reimbursement, data security, and interoperability in sleep diagnostics.

Future Outlook: Disruptive Trends and Strategic Recommendations

The polysomnography (PSG) equipment manufacturing sector is poised for significant transformation in 2025 and the coming years, driven by technological innovation, evolving clinical needs, and shifting regulatory landscapes. Several disruptive trends are expected to shape the industry’s trajectory, with implications for both established manufacturers and new entrants.

A primary driver is the integration of advanced digital technologies into PSG systems. Leading manufacturers such as Philips and Natus Medical Incorporated are investing in cloud connectivity, artificial intelligence (AI)-powered signal analysis, and wireless sensor technologies. These advancements aim to enhance diagnostic accuracy, streamline data management, and enable remote patient monitoring—features increasingly demanded by sleep clinics and home healthcare providers. For example, ResMed has expanded its portfolio to include cloud-based platforms that facilitate seamless data sharing between patients and clinicians, reflecting a broader industry shift toward interoperability and telemedicine.

Another disruptive trend is the miniaturization and portability of PSG devices. Traditional in-lab polysomnography systems are being complemented—and in some cases, challenged—by compact, wearable solutions. Companies like Compumedics Limited are developing lightweight, user-friendly devices that can be deployed in home settings without sacrificing diagnostic fidelity. This trend is expected to accelerate as healthcare systems seek to reduce costs and improve patient comfort, particularly in the context of rising sleep disorder prevalence and the ongoing need for scalable diagnostic solutions.

Regulatory developments will also play a pivotal role. The implementation of updated standards for medical device cybersecurity and data privacy, especially in the US and EU, will require manufacturers to invest in robust compliance frameworks. Organizations such as Masimo Corporation are already emphasizing secure data transmission and patient confidentiality in their product designs, anticipating stricter oversight and customer expectations.

Strategically, manufacturers are advised to prioritize R&D in AI-driven analytics, invest in partnerships with digital health platforms, and pursue modular product architectures that allow for rapid adaptation to emerging clinical requirements. Embracing open standards for data interoperability will be crucial for integration with electronic health records and third-party applications. Furthermore, expanding after-sales support and training services can help differentiate offerings in an increasingly competitive market.

In summary, the future of polysomnography equipment manufacturing will be defined by digital transformation, patient-centric design, and proactive regulatory compliance. Companies that anticipate these trends and adapt their strategies accordingly are likely to secure a competitive edge in the evolving sleep diagnostics landscape.

Sources & References

- Philips

- ResMed

- Natus Medical Incorporated

- Compumedics Limited

- Nihon Kohden Corporation

- American Academy of Sleep Medicine

- Natus Medical Incorporated

- ResMed

- Fukuda Denshi

- GE HealthCare

- Fisher & Paykel Healthcare

- Masimo Corporation