Microwave Photonics Components in 2025: Unleashing High-Speed Connectivity and Transforming Telecom, Defense, and Sensing. Explore Market Trajectories, Breakthrough Technologies, and Strategic Opportunities.

- Executive Summary: Key Findings and 2025 Outlook

- Market Size, Growth Forecasts, and Revenue Projections (2025–2030)

- Core Technologies: Photonic Integration, Modulators, and Detectors

- Emerging Applications: 5G/6G, Quantum Sensing, and Aerospace

- Competitive Landscape: Leading Players and Strategic Initiatives

- Supply Chain and Manufacturing Trends

- Regulatory Environment and Industry Standards (e.g., IEEE, OSA)

- Innovation Drivers: R&D, Patents, and University-Industry Collaboration

- Challenges: Scalability, Cost, and Integration Barriers

- Future Outlook: Disruptive Trends and Investment Opportunities

- Sources & References

Executive Summary: Key Findings and 2025 Outlook

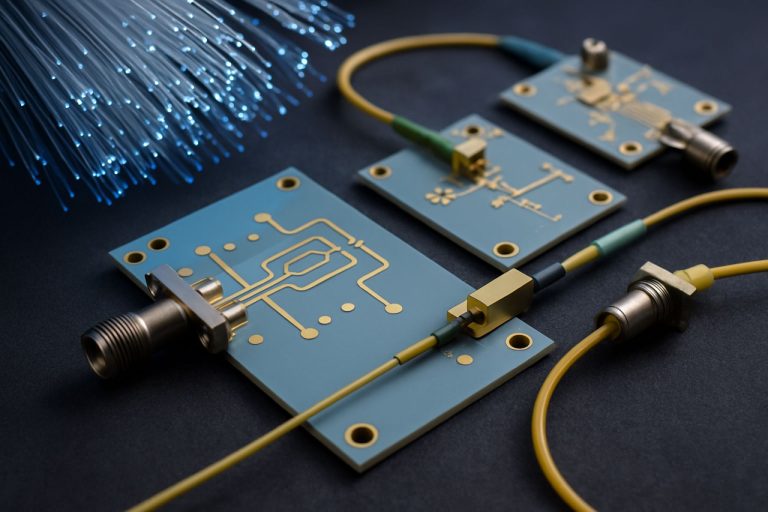

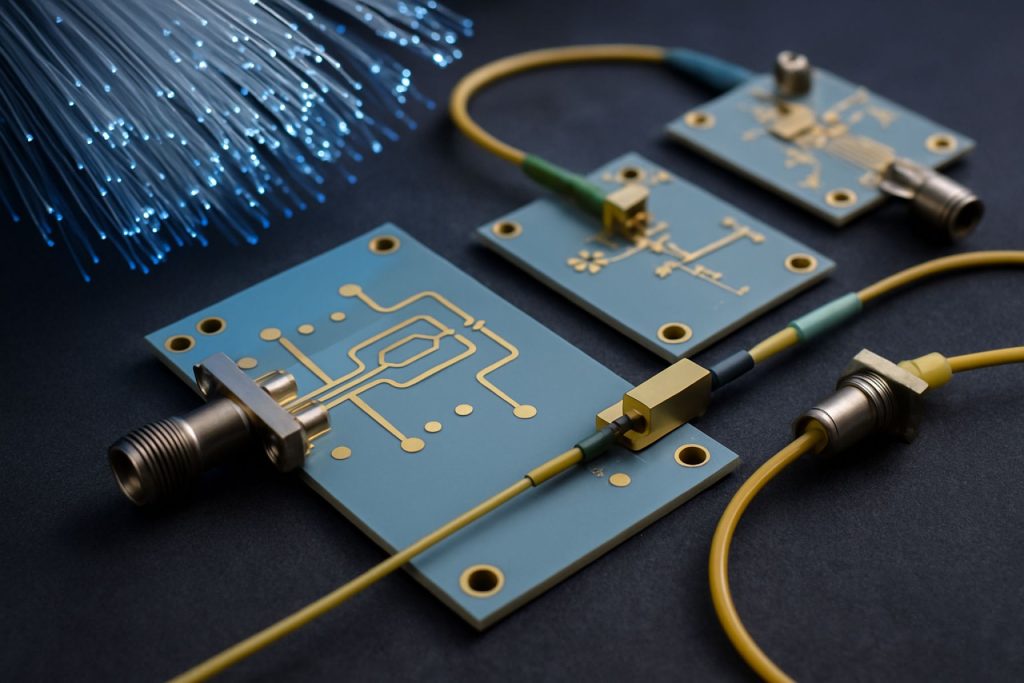

Microwave photonics components are at the forefront of enabling next-generation high-frequency signal processing, wireless communications, and advanced radar systems. As of 2025, the sector is experiencing robust growth, driven by the convergence of photonic integration, 5G/6G wireless infrastructure, and the increasing demand for high-bandwidth, low-latency data transmission. Key components include photonic integrated circuits (PICs), modulators, photodetectors, optical filters, and microwave-to-optical converters, all of which are critical for translating microwave signals into the optical domain and vice versa.

Leading industry players such as Infinera Corporation, Lumentum Holdings, and Coherent Corp. (formerly II-VI Incorporated) are investing heavily in the development of advanced photonic components. These companies are leveraging their expertise in indium phosphide (InP) and silicon photonics to deliver high-performance, scalable solutions for telecom, datacom, and defense applications. Infinera Corporation is notable for its vertically integrated approach, manufacturing its own PICs and optical engines, which are increasingly being adapted for microwave photonics use cases. Lumentum Holdings is recognized for its high-speed modulators and photodetectors, while Coherent Corp. provides a broad portfolio of optoelectronic components, including those tailored for RF-over-fiber and antenna remoting.

The adoption of microwave photonics components is accelerating in 2025, particularly in the context of 5G/6G wireless backhaul, satellite communications, and phased-array radar systems. The integration of photonic and electronic functions on a single chip is reducing system size, weight, and power consumption, which is critical for mobile and aerospace platforms. Industry consortia and standards bodies, such as the Japan Electronics and Information Technology Industries Association (JEITA) and the Optica (formerly OSA), are actively supporting interoperability and performance benchmarks for these components.

Looking ahead, the outlook for microwave photonics components remains highly positive. The ongoing transition to higher frequency bands (mmWave and sub-THz) in wireless and defense sectors is expected to further boost demand for advanced photonic solutions. Continued innovation in materials, such as lithium niobate and silicon nitride, and the maturation of wafer-scale manufacturing are poised to drive down costs and expand the addressable market. Strategic partnerships between component manufacturers and system integrators are anticipated to accelerate commercialization and deployment through 2025 and beyond.

Market Size, Growth Forecasts, and Revenue Projections (2025–2030)

The global market for microwave photonics components is poised for robust growth between 2025 and 2030, driven by escalating demand for high-speed wireless communications, 5G/6G infrastructure, and advanced radar and sensing systems. Microwave photonics—integrating photonic and microwave technologies—enables the processing, generation, and distribution of microwave and millimeter-wave signals using optical components, offering significant advantages in bandwidth, immunity to electromagnetic interference, and system miniaturization.

Key component categories include photonic integrated circuits (PICs), modulators, photodetectors, optical filters, and fiber-optic links. The market is witnessing rapid innovation, with leading manufacturers such as Lumentum, Coherent Corp. (formerly II-VI Incorporated), NeoPhotonics (now part of Lumentum), and Infinera advancing the integration and performance of these components. Lumentum and Coherent Corp. are particularly active in developing high-speed modulators and photodetectors for next-generation wireless and optical networks, while Infinera is recognized for its expertise in photonic integration and high-capacity optical transport solutions.

In 2025, the microwave photonics components market is estimated to be valued in the low single-digit billions (USD), with projections indicating a compound annual growth rate (CAGR) of approximately 20% through 2030. This growth is underpinned by the accelerating deployment of 5G and the anticipated rollout of 6G networks, which require advanced photonic solutions for radio-over-fiber, beamforming, and massive MIMO (multiple-input, multiple-output) systems. The defense and aerospace sectors are also significant contributors, leveraging microwave photonics for electronic warfare, radar, and satellite communications.

Geographically, North America, Europe, and East Asia (notably Japan and South Korea) are leading in both demand and innovation, supported by strong investments in telecom infrastructure and R&D. Companies such as Nokia and Ericsson are integrating microwave photonics components into their advanced wireless solutions, while Japanese firms like Fujitsu and NTT are active in photonic device development and deployment.

Looking ahead, the market outlook remains highly positive, with continued advances in silicon photonics, indium phosphide integration, and hybrid packaging expected to further reduce costs and expand application areas. As the ecosystem matures, collaborations between component manufacturers, system integrators, and telecom operators will be crucial in scaling production and meeting the stringent performance requirements of next-generation wireless and sensing systems.

Core Technologies: Photonic Integration, Modulators, and Detectors

Microwave photonics components are at the heart of next-generation communication, radar, and sensing systems, enabling the processing and distribution of high-frequency microwave signals using photonic technologies. As of 2025, the sector is witnessing rapid advancements in core technologies such as photonic integration, high-speed modulators, and sensitive photodetectors, driven by the demand for higher bandwidth, lower latency, and improved energy efficiency in 5G/6G networks, satellite communications, and defense applications.

Photonic integration is a key enabler for scalable and cost-effective microwave photonics. Integrated photonic circuits (PICs) combine multiple optical functions—such as modulation, filtering, and detection—on a single chip, reducing size, weight, and power consumption. Leading manufacturers like Infinera Corporation and Coherent Corp. (formerly II-VI Incorporated) are advancing indium phosphide (InP) and silicon photonics platforms, which support high-frequency operation and seamless integration with electronic components. Infinera Corporation has demonstrated monolithic integration of lasers, modulators, and detectors for coherent transmission, while Coherent Corp. is expanding its silicon photonics foundry services to address growing demand in telecom and datacom markets.

High-speed optical modulators are essential for converting microwave signals into the optical domain. Lithium niobate (LiNbO3) modulators remain a gold standard for their linearity and bandwidth, but recent years have seen a surge in thin-film lithium niobate (TFLN) and silicon-organic hybrid modulators, which offer improved integration and lower drive voltages. Lumentum Holdings Inc. and iXblue are prominent suppliers of advanced LiNbO3 modulators, with Lumentum Holdings Inc. focusing on high-volume manufacturing for telecom and defense, and iXblue targeting specialty markets such as quantum and space applications.

Photodetectors, particularly high-speed PIN and avalanche photodiodes (APDs), are critical for converting optical signals back to the electrical domain. Hamamatsu Photonics K.K. and Finisar Corporation (now part of Coherent Corp.) are leading suppliers of high-performance photodetectors, supporting bandwidths exceeding 50 GHz for advanced microwave photonics links. These components are increasingly being integrated with transimpedance amplifiers (TIAs) on a single chip, further reducing system complexity and noise.

Looking ahead, the next few years are expected to bring further miniaturization, higher levels of integration, and the adoption of new materials such as indium gallium arsenide (InGaAs) and graphene for even faster and more efficient microwave photonics components. Industry collaborations and foundry access programs, such as those promoted by EUROPRACTICE, are accelerating the transition from research to commercial deployment, positioning microwave photonics as a foundational technology for future high-frequency systems.

Emerging Applications: 5G/6G, Quantum Sensing, and Aerospace

Microwave photonics components are at the forefront of enabling next-generation technologies in 5G/6G communications, quantum sensing, and aerospace systems. As of 2025, the sector is witnessing rapid advancements driven by the need for higher bandwidth, lower latency, and enhanced signal processing capabilities. These components—such as photonic integrated circuits (PICs), modulators, photodetectors, and optical filters—are increasingly being adopted to overcome the limitations of traditional electronic systems, particularly in high-frequency and high-speed applications.

In the context of 5G and the emerging 6G networks, microwave photonics is critical for supporting the massive data rates and ultra-low latency required for applications like autonomous vehicles, smart cities, and immersive virtual reality. Companies such as Infinera Corporation and NeoPhotonics (now part of Lumentum Holdings) are actively developing advanced photonic components that enable high-speed optical signal processing and millimeter-wave generation, which are essential for radio-over-fiber (RoF) and distributed antenna systems. These solutions are being deployed in testbeds and early commercial rollouts, with expectations that photonic integration will become even more central as 6G research accelerates through 2027.

Quantum sensing is another area where microwave photonics components are making significant inroads. The ability to manipulate and detect quantum states at microwave frequencies requires ultra-low noise and high-precision photonic devices. Organizations like Thorlabs and Analog Devices are supplying critical components such as low-noise lasers, high-speed modulators, and photodetectors for quantum radar, magnetometry, and gravimetry systems. These components are being integrated into prototype quantum sensors, with field trials expected to expand in the next few years as governments and defense agencies invest in quantum technology infrastructure.

In aerospace, the demand for lightweight, high-performance, and radiation-tolerant microwave photonics components is growing. Applications range from satellite communications to phased-array radar and electronic warfare. iXblue (now part of Exail Technologies) and Lumentum Holdings are notable for their work in developing space-qualified photonic devices, including optical transceivers and frequency converters. These components are being tested in low Earth orbit (LEO) satellite constellations and next-generation avionics platforms, with further adoption anticipated as the commercial space sector expands.

Looking ahead, the convergence of photonic integration, advanced materials, and AI-driven design is expected to yield even more compact, efficient, and versatile microwave photonics components. Industry collaborations and government-backed initiatives are likely to accelerate commercialization, positioning microwave photonics as a foundational technology for the communications, quantum, and aerospace sectors through the late 2020s.

Competitive Landscape: Leading Players and Strategic Initiatives

The competitive landscape for microwave photonics components in 2025 is characterized by a dynamic mix of established photonics giants, specialized component manufacturers, and innovative startups. The sector is witnessing intensified activity as demand surges for high-speed, low-latency, and broadband solutions in 5G/6G wireless, satellite communications, radar, and quantum technologies. Key players are leveraging their expertise in photonic integration, advanced materials, and scalable manufacturing to secure leadership positions and expand their global reach.

Among the most prominent companies, Lumentum Holdings Inc. stands out for its broad portfolio of photonic integrated circuits (PICs), high-speed modulators, and optical amplifiers tailored for microwave photonics applications. Lumentum’s ongoing investments in silicon photonics and indium phosphide platforms are aimed at delivering higher performance and integration density, supporting next-generation radio-over-fiber and phased array antenna systems.

Coherent Corp. (formerly II-VI Incorporated) is another major force, offering a wide range of optoelectronic components, including high-frequency photodetectors, modulators, and lasers. The company’s strategic acquisitions and R&D initiatives are focused on expanding its capabilities in hybrid integration and packaging, which are critical for robust, miniaturized microwave photonics modules.

European players such as ams OSRAM and Thorlabs, Inc. are also active in this space. ams OSRAM leverages its expertise in advanced optoelectronic materials and integrated photonic devices, while Thorlabs provides a comprehensive catalog of microwave photonics components, including high-speed modulators, photodetectors, and fiber-optic links, supporting both research and commercial deployments.

In Asia, NEC Corporation and Fujitsu Limited are investing in the development of microwave photonics for 5G/6G infrastructure and defense applications. These companies are collaborating with national research institutes and telecom operators to accelerate the commercialization of photonic beamforming and radio-over-fiber technologies.

Strategic initiatives across the industry include joint ventures, technology licensing, and participation in international standardization efforts. For example, several leading players are members of the Japan Electronics and Information Technology Industries Association (JEITA) and the Optical Internetworking Forum (OIF), working to define interoperability standards and accelerate market adoption.

Looking ahead, the competitive landscape is expected to further intensify as companies race to deliver scalable, cost-effective, and energy-efficient microwave photonics solutions. The convergence of photonics and electronics, advances in heterogeneous integration, and the emergence of new materials such as lithium niobate on insulator (LNOI) are likely to reshape the market, with leading players poised to benefit from early investments and strategic partnerships.

Supply Chain and Manufacturing Trends

The supply chain and manufacturing landscape for microwave photonics components is undergoing significant transformation as the sector adapts to rising demand from 5G/6G wireless, satellite communications, and advanced radar systems. In 2025, the industry is characterized by a push toward higher integration, increased automation, and strategic partnerships to secure critical materials and manufacturing capacity.

Key players such as Analog Devices, Lumentum, and Coherent Corp. (formerly II-VI Incorporated) are investing in vertically integrated supply chains to mitigate risks associated with global semiconductor shortages and geopolitical uncertainties. These companies are expanding in-house wafer fabrication and photonic integration capabilities, particularly for indium phosphide (InP) and silicon photonics platforms, which are essential for high-frequency, low-loss microwave photonics devices.

Manufacturing trends in 2025 emphasize the adoption of advanced packaging techniques, such as co-packaged optics and heterogeneous integration, to reduce size, weight, and power consumption while boosting performance. Intel Corporation and NeoPhotonics (now part of Lumentum) are notable for their efforts in scaling silicon photonics manufacturing, leveraging existing CMOS foundries to achieve higher yields and lower costs. This approach is expected to accelerate the deployment of microwave photonics components in data centers and telecom infrastructure.

Supply chain resilience is a top priority, with manufacturers diversifying sourcing of key materials such as rare earth elements and specialty wafers. Companies like Mitsubishi Electric and ams OSRAM are establishing multi-region supply networks and investing in local production facilities to reduce lead times and buffer against disruptions. Additionally, there is a growing trend toward collaborative consortia and public-private partnerships, particularly in the US, EU, and Japan, to secure domestic manufacturing capabilities for strategic photonic components.

Looking ahead, the outlook for microwave photonics component manufacturing is shaped by continued investment in automation, AI-driven process control, and sustainable manufacturing practices. Industry leaders are expected to further integrate photonic and electronic supply chains, enabling faster innovation cycles and supporting the rapid evolution of next-generation wireless and sensing applications. As demand for high-frequency, high-bandwidth solutions grows, the sector’s ability to adapt its supply chain and manufacturing strategies will be critical to maintaining competitiveness and meeting global market needs.

Regulatory Environment and Industry Standards (e.g., IEEE, OSA)

The regulatory environment and industry standards for microwave photonics components are evolving rapidly as the sector matures and applications proliferate in telecommunications, defense, and sensing. In 2025, the landscape is shaped by a combination of international standards bodies, industry consortia, and government regulations, all aiming to ensure interoperability, safety, and performance in increasingly complex photonic systems.

Key standards organizations such as the IEEE and the Optica (formerly OSA) play central roles in defining technical specifications for microwave photonics components. The IEEE, through its Photonics Society, continues to update and expand standards like IEEE 802.3 for optical Ethernet and IEEE 1906.1 for nanoscale and molecular communication, both of which have implications for microwave photonics integration in high-speed networks. Optica, meanwhile, provides a platform for consensus-building on component characterization, measurement protocols, and system-level interoperability, with its technical groups and conferences serving as venues for standards development and dissemination.

In parallel, the International Telecommunication Union (ITU) maintains recommendations that impact the deployment of photonic components in radio-over-fiber and 5G/6G fronthaul applications, particularly regarding spectrum allocation and electromagnetic compatibility. The ITU’s ongoing work on IMT-2020 and IMT-2030 frameworks is expected to further influence component requirements for low-latency, high-bandwidth optical links in the coming years.

Industry consortia such as the Japan Electronics and Information Technology Industries Association (JEITA) and the Electronic Components Industry Association (ECIA) are also active in harmonizing component standards, especially for packaging, reliability, and environmental compliance. These organizations facilitate collaboration between manufacturers, suppliers, and end-users to address emerging challenges such as thermal management and photonic-electronic integration.

On the regulatory front, government agencies in the US, EU, and Asia are increasingly attentive to the security and supply chain integrity of photonic components, particularly those used in critical infrastructure. Export controls, such as those administered by the US Department of Commerce’s Bureau of Industry and Security, are being updated to reflect the strategic importance of advanced photonic technologies, including microwave photonics.

Looking ahead, the next few years will likely see the introduction of new standards for integrated microwave photonics platforms, driven by the need for higher levels of integration, energy efficiency, and compatibility with emerging quantum and AI-enabled systems. The convergence of photonics and electronics is expected to prompt further collaboration between standards bodies, with a focus on unified testing protocols and cross-domain interoperability. As the market expands, adherence to evolving standards will be critical for manufacturers seeking global market access and for end-users demanding reliable, high-performance solutions.

Innovation Drivers: R&D, Patents, and University-Industry Collaboration

Innovation in microwave photonics components is accelerating rapidly in 2025, driven by a confluence of R&D investments, patent activity, and robust university-industry collaboration. The sector is witnessing a surge in demand for high-speed, low-latency, and broadband solutions, particularly for applications in 5G/6G wireless, radar, satellite communications, and quantum technologies. This demand is fueling both fundamental research and applied development, with a focus on photonic integrated circuits (PICs), tunable filters, modulators, and low-noise microwave photonic links.

Leading industry players such as Infinera Corporation, Lumentum Holdings, and NeoPhotonics (now part of Lumentum) are investing heavily in R&D to push the boundaries of integration, miniaturization, and energy efficiency in microwave photonics. These companies are developing advanced indium phosphide (InP) and silicon photonics platforms, enabling higher levels of component integration and performance. For example, Infinera’s work on photonic integrated circuits is enabling new classes of high-bandwidth, low-latency optical transceivers, which are critical for next-generation microwave photonics systems.

Patent activity in this field remains robust, with a notable increase in filings related to integrated microwave photonic devices, tunable lasers, and high-speed modulators. Companies such as Coherent Corp. (formerly II-VI Incorporated) and Analog Devices are among those actively securing intellectual property in areas like optoelectronic oscillators and photonic signal processing. This patent race is not only a marker of innovation but also a strategic move to secure competitive advantage in a rapidly evolving market.

University-industry collaboration is a cornerstone of innovation in microwave photonics. Leading academic institutions, including the University of California, Santa Barbara and the Eindhoven University of Technology, are partnering with industry to translate cutting-edge research into commercial products. Initiatives such as the American Institute for Manufacturing Integrated Photonics (AIM Photonics) exemplify this trend, providing shared infrastructure and fostering joint R&D projects between universities, startups, and established companies. These collaborations are accelerating the development of new materials, device architectures, and packaging techniques, with a strong emphasis on manufacturability and scalability.

Looking ahead, the outlook for microwave photonics components is highly promising. The convergence of R&D investment, patent activity, and collaborative innovation is expected to yield breakthroughs in integration density, cost reduction, and performance. As 5G/6G, quantum communications, and advanced radar systems continue to evolve, the sector is poised for sustained growth and technological advancement through 2025 and beyond.

Challenges: Scalability, Cost, and Integration Barriers

The rapid evolution of microwave photonics components is reshaping telecommunications, radar, and sensing systems, but the sector faces persistent challenges in scalability, cost, and integration as it moves through 2025 and into the coming years. One of the primary hurdles is the transition from laboratory-scale prototypes to mass-manufacturable devices. While photonic integration platforms such as silicon photonics and indium phosphide have enabled significant miniaturization and performance improvements, scaling up production remains complex. The need for high-precision fabrication, tight process control, and advanced packaging drives up costs, limiting widespread adoption in cost-sensitive markets.

Leading manufacturers like Intel and Infinera have made notable progress in silicon photonics, leveraging their semiconductor expertise to push integration density and reduce per-unit costs. However, even these industry leaders face challenges in integrating active and passive photonic elements with electronic circuits on a single chip, especially for high-frequency microwave applications. The heterogenous integration of materials—such as combining III-V semiconductors for efficient light sources with silicon-based platforms—remains a technical and economic barrier, as it often requires complex bonding or epitaxial growth techniques.

Another significant challenge is the cost and complexity of packaging. Microwave photonics components are highly sensitive to alignment and environmental factors, necessitating advanced packaging solutions that can maintain performance while supporting high-volume manufacturing. Companies like Lumentum and Coherent Corp. (formerly II-VI Incorporated) are investing in automated assembly and testing processes to address these issues, but the industry as a whole is still working toward standardized, scalable packaging solutions that can drive down costs.

Integration with existing electronic systems also presents a barrier. The interface between photonic and electronic domains—such as high-speed analog-to-digital converters and RF front-ends—often introduces signal losses and bandwidth limitations. Efforts by companies like Analog Devices to develop hybrid photonic-electronic modules are promising, but seamless, low-cost integration remains a work in progress.

Looking ahead, the outlook for overcoming these challenges is cautiously optimistic. Industry consortia and standards bodies are working to establish common platforms and design rules, which could accelerate the adoption of scalable, cost-effective microwave photonics components. As manufacturing volumes increase and integration technologies mature, the sector is expected to see gradual reductions in cost and improvements in scalability, paving the way for broader deployment in 5G/6G, defense, and industrial applications.

Future Outlook: Disruptive Trends and Investment Opportunities

The landscape for microwave photonics components is poised for significant transformation in 2025 and the following years, driven by the convergence of photonic integration, advanced materials, and the surging demand for high-frequency, high-bandwidth applications. As 5G and the early stages of 6G networks expand, the need for components capable of processing signals in the millimeter-wave and sub-terahertz domains is accelerating. This is catalyzing investment in photonic integrated circuits (PICs), optoelectronic oscillators, and high-speed modulators, which are essential for next-generation wireless, radar, and satellite communications.

Key industry players are intensifying their focus on scalable, cost-effective manufacturing of microwave photonics components. Infinera Corporation and NeoPhotonics Corporation (now part of Lumentum) are advancing indium phosphide (InP) and silicon photonics platforms, enabling integration of lasers, modulators, and detectors on a single chip. These developments are crucial for reducing size, power consumption, and cost, while boosting performance for applications such as radio-over-fiber and phased array antennas.

Another disruptive trend is the adoption of lithium niobate on insulator (LNOI) technology, which offers ultra-high bandwidth and low-loss modulation. Companies like Lumentum Holdings Inc. and iXblue are investing in LNOI-based modulators and frequency shifters, targeting both defense and commercial markets. The integration of LNOI with silicon photonics is expected to unlock new levels of performance for microwave photonics links, particularly in quantum communications and advanced sensing.

The outlook for investment is further buoyed by the growing role of foundry services and open-access platforms. imec and Ligentec are expanding their silicon and silicon nitride photonics foundry capabilities, enabling startups and established firms to prototype and scale novel microwave photonics devices rapidly. This democratization of fabrication is expected to accelerate innovation cycles and lower barriers to entry.

Looking ahead, the intersection of artificial intelligence and photonic hardware is emerging as a new frontier. Companies such as Ayar Labs are developing optical I/O solutions that leverage microwave photonics for ultra-fast data movement in AI data centers. As AI workloads demand ever-higher bandwidth and lower latency, investment in microwave photonics components for data interconnects is projected to surge.

In summary, the next few years will see microwave photonics components at the heart of disruptive advances in wireless infrastructure, defense, quantum technologies, and AI hardware. Strategic investments in integration, new materials, and open-access manufacturing are set to define the competitive landscape, with leading companies and research institutes driving the sector toward broader adoption and new market opportunities.

Sources & References

- Infinera Corporation

- Lumentum Holdings

- Japan Electronics and Information Technology Industries Association (JEITA)

- NeoPhotonics

- Nokia

- Fujitsu

- iXblue

- Hamamatsu Photonics K.K.

- EUROPRACTICE

- Thorlabs

- Analog Devices

- ams OSRAM

- NEC Corporation

- Optical Internetworking Forum (OIF)

- Mitsubishi Electric

- ams OSRAM

- IEEE

- International Telecommunication Union (ITU)

- imec

- Ligentec

- Ayar Labs