Transforming Ocean Science in 2025: How Biogeochemical Sensor Networks Are Powering a New Era of Marine Monitoring and Data-Driven Sustainability. Explore the Innovations, Market Growth, and Future Impact.

- Executive Summary: 2025 Market Outlook and Key Drivers

- Technology Overview: Core Components and Sensor Innovations

- Leading Manufacturers and Industry Collaborations

- Market Size, Segmentation, and 2025–2030 Growth Forecasts

- Deployment Strategies: Fixed, Mobile, and Autonomous Platforms

- Data Integration, Cloud Analytics, and AI Applications

- Regulatory Landscape and International Standards

- Key Use Cases: Climate Change, Fisheries, and Pollution Monitoring

- Challenges: Power, Durability, and Data Security

- Future Trends: Next-Gen Sensors, Network Expansion, and Market Opportunities

- Sources & References

Executive Summary: 2025 Market Outlook and Key Drivers

The market for oceanic biogeochemical sensor networks is poised for significant growth in 2025, driven by escalating demand for real-time, high-resolution ocean data to address climate change, fisheries management, and marine ecosystem health. These sensor networks, which monitor parameters such as dissolved oxygen, pH, carbon dioxide, nutrients, and chlorophyll, are increasingly being deployed on autonomous platforms including floats, gliders, and moorings. The integration of advanced sensors with robust data telemetry and cloud-based analytics is transforming ocean observation capabilities, enabling both scientific research and commercial applications.

Key drivers in 2025 include international policy commitments to ocean monitoring, such as the United Nations Decade of Ocean Science for Sustainable Development (2021–2030), and the expansion of global initiatives like the Argo program, which now incorporates biogeochemical sensors on profiling floats. The proliferation of these networks is supported by technological advances in miniaturization, energy efficiency, and sensor calibration, allowing for longer deployments and improved data quality.

Leading manufacturers and suppliers are central to this market’s evolution. Sea-Bird Scientific, a subsidiary of Danaher Corporation, remains a dominant force, providing a wide range of biogeochemical sensors and integrated systems for oceanographic research. YSI, a Xylem brand, is recognized for its multiparameter sondes and nutrient analyzers, widely used in both coastal and open-ocean monitoring. Satlantic, also under Sea-Bird Scientific, specializes in optical sensors for measuring parameters like chlorophyll and dissolved organic matter. Axiom Data Science and Sontek (a Xylem brand) contribute data management and current profiling technologies, respectively, supporting the integration and utility of sensor networks.

In 2025, the deployment of sensor networks is expected to accelerate in regions of strategic interest, such as the Arctic, coral reef systems, and exclusive economic zones (EEZs), driven by both governmental and private sector investments. The increasing adoption of autonomous surface vehicles (ASVs) and underwater gliders equipped with biogeochemical sensors is expanding spatial and temporal coverage, while cloud-based platforms are enhancing data accessibility for stakeholders ranging from marine scientists to resource managers.

Looking ahead, the market outlook for oceanic biogeochemical sensor networks is robust, with continued innovation anticipated in sensor accuracy, power management, and network interoperability. Strategic collaborations between sensor manufacturers, research institutions, and governmental agencies are expected to further catalyze market expansion and technological advancement through 2025 and beyond.

Technology Overview: Core Components and Sensor Innovations

Oceanic biogeochemical sensor networks are at the forefront of marine environmental monitoring, providing real-time, high-resolution data on key parameters such as dissolved oxygen, pH, carbon dioxide, nutrients, and chlorophyll. These networks integrate advanced sensor technologies with robust communication and data management systems, enabling scientists and policymakers to track ocean health and biogeochemical cycles with unprecedented accuracy.

The core components of these networks include in situ sensors, autonomous platforms (such as floats, gliders, and moorings), data telemetry systems, and cloud-based data analytics. Sensor innovations in 2025 are characterized by miniaturization, improved stability, and enhanced multi-parameter capabilities. For example, the latest generation of optical and electrochemical sensors can simultaneously measure multiple analytes, reducing deployment costs and increasing spatial coverage. Companies like Sea-Bird Scientific and Xylem are leading the development of such multi-parameter sondes, with robust anti-fouling technologies and long-term calibration stability, critical for extended ocean deployments.

Autonomous platforms are another pillar of these networks. The Teledyne Marine Slocum glider and the Sofar Ocean Spotter buoy exemplify the integration of advanced biogeochemical sensors with mobile and stationary platforms, allowing for adaptive sampling strategies and persistent monitoring. These platforms are increasingly equipped with real-time satellite telemetry, enabling near-instantaneous data delivery to shore-based users.

Recent years have also seen the emergence of “smart” sensor networks, where distributed nodes communicate and self-organize to optimize data collection. The Monterey Bay Aquarium Research Institute (MBARI) has pioneered such approaches, deploying sensor arrays that autonomously adjust sampling rates in response to detected events like algal blooms or hypoxic upwelling. This adaptive capability is expected to become more widespread by 2025, driven by advances in edge computing and artificial intelligence.

Looking ahead, the next few years will likely see further integration of biogeochemical sensors with global ocean observing systems, such as the Argo program’s Biogeochemical Argo floats. These efforts, supported by organizations like Woods Hole Oceanographic Institution, are expanding the spatial and temporal resolution of oceanic biogeochemical data, providing critical insights into climate change, carbon cycling, and ecosystem health. As sensor costs decrease and reliability improves, the deployment of dense, interoperable sensor networks is poised to transform ocean science and resource management through 2025 and beyond.

Leading Manufacturers and Industry Collaborations

The landscape of oceanic biogeochemical sensor networks in 2025 is shaped by a dynamic interplay between leading manufacturers, technology innovators, and collaborative industry initiatives. As the demand for real-time, high-resolution ocean data intensifies—driven by climate monitoring, fisheries management, and environmental compliance—key players are expanding their portfolios and forging strategic partnerships to advance sensor capabilities and network integration.

Among the most prominent manufacturers, Sea-Bird Scientific continues to set industry benchmarks with its suite of biogeochemical sensors, including dissolved oxygen, pH, and nutrient analyzers. The company’s sensors are widely deployed on autonomous platforms such as Argo floats and gliders, supporting global ocean observation programs. Sea-Bird Scientific has also been active in collaborative projects with research consortia and government agencies, focusing on sensor miniaturization and enhanced calibration protocols.

Another major contributor, Xylem Inc., through its YSI and Aanderaa brands, offers a broad range of biogeochemical sensors and integrated monitoring systems. In 2025, Xylem Inc. is emphasizing interoperability and data standardization, working closely with international initiatives to ensure seamless data exchange across platforms. Their sensors are integral to coastal observatories and long-term monitoring arrays, supporting both scientific research and regulatory compliance.

European manufacturers such as NKE Instrumentation are also at the forefront, particularly in the development of robust, low-power sensors for deployment on profiling floats and moorings. NKE Instrumentation is a key supplier to the Euro-Argo program, contributing to the expansion of biogeochemical Argo floats across the Atlantic and Mediterranean.

Industry collaborations are accelerating innovation and deployment. The Ocean Observatories Initiative (OOI) in the United States exemplifies large-scale, multi-institutional efforts, integrating sensors from multiple manufacturers into a unified network for continuous, open-access data streams. Similarly, the Global Ocean Observing System (GOOS) fosters international coordination, setting standards and facilitating data sharing among sensor network operators worldwide.

Looking ahead, the next few years are expected to see further convergence between sensor manufacturers, data platform providers, and end-users. Emphasis will be placed on sensor longevity, reduced maintenance, and AI-driven data analytics. Strategic alliances—such as those between hardware manufacturers and cloud-based data service companies—are likely to define the next phase of growth, ensuring that oceanic biogeochemical sensor networks remain at the forefront of global environmental monitoring.

Market Size, Segmentation, and 2025–2030 Growth Forecasts

The global market for oceanic biogeochemical sensor networks is poised for robust growth between 2025 and 2030, driven by escalating demand for real-time ocean monitoring, climate research, and regulatory compliance. These sensor networks, which integrate advanced chemical, biological, and physical sensors with telemetry and data analytics, are increasingly deployed on autonomous platforms such as floats, gliders, moorings, and unmanned surface vehicles. The market is segmented by sensor type (e.g., dissolved oxygen, pH, nitrate, chlorophyll, carbon dioxide), platform (fixed, mobile, autonomous), end-user (government, research institutes, offshore energy, aquaculture), and geography.

Key industry players include Sea-Bird Scientific, a subsidiary of Danaher Corporation, which is recognized for its high-precision oceanographic sensors and integrated systems; YSI, a Xylem brand, specializing in multiparameter sondes and water quality monitoring solutions; and Teledyne Marine, offering a broad portfolio of sensors and autonomous platforms. Other notable contributors are Satlantic (now part of Sea-Bird Scientific), known for optical biogeochemical sensors, and Nortek, which provides acoustic Doppler instrumentation for ocean current and turbulence measurements.

Recent years have seen significant investments in large-scale sensor network deployments, such as the Argo Biogeochemical (BGC-Argo) float program, which aims to expand the global array of autonomous profiling floats equipped with biogeochemical sensors. This initiative, supported by international consortia and national agencies, is expected to drive demand for advanced sensor technologies and integrated data management solutions through 2030. The proliferation of real-time data requirements for climate modeling, fisheries management, and marine spatial planning is also fueling market expansion.

Regionally, North America and Europe currently lead in adoption, supported by strong governmental and academic research funding. However, Asia-Pacific is anticipated to exhibit the fastest growth, propelled by increasing investments in marine environmental monitoring and blue economy initiatives, particularly in China, Japan, and Australia.

Looking ahead to 2030, the market is expected to benefit from technological advancements such as miniaturized, low-power sensors, improved calibration protocols, and enhanced data analytics platforms. The integration of artificial intelligence and machine learning for automated anomaly detection and predictive modeling is likely to become a key differentiator among suppliers. As regulatory frameworks for ocean health monitoring tighten globally, the demand for comprehensive, interoperable sensor networks is projected to accelerate, positioning established manufacturers and innovative startups for sustained growth.

Deployment Strategies: Fixed, Mobile, and Autonomous Platforms

The deployment of oceanic biogeochemical sensor networks in 2025 is characterized by a strategic blend of fixed, mobile, and autonomous platforms, each tailored to address specific scientific and operational needs. These deployment strategies are central to advancing real-time monitoring of ocean health, carbon cycling, and ecosystem dynamics.

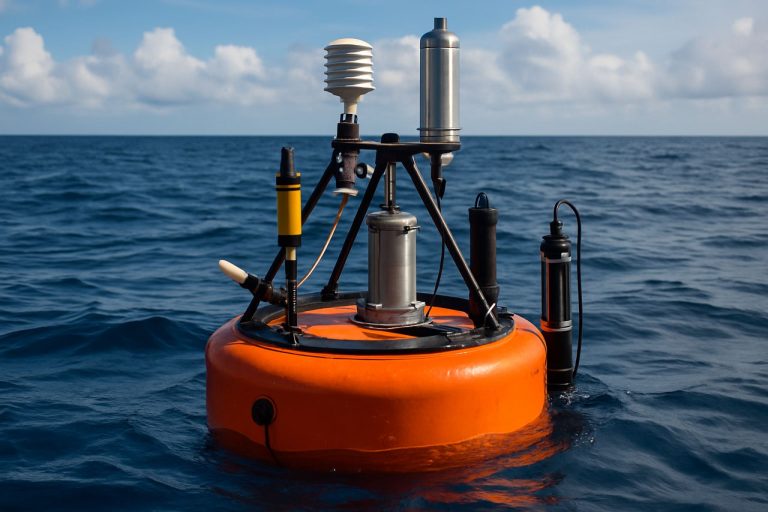

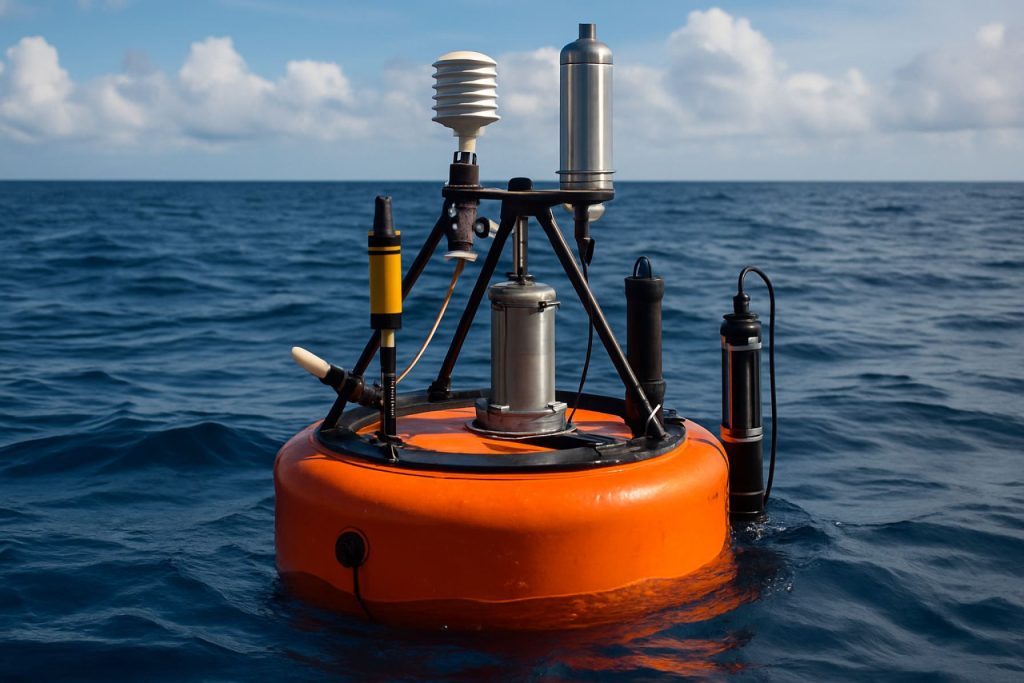

Fixed Platforms—such as moored buoys and cabled observatories—remain foundational for long-term, high-frequency data collection at key locations. Organizations like Teledyne Marine and Nortek supply robust sensor suites for these installations, enabling continuous measurement of parameters like dissolved oxygen, pH, nitrate, and chlorophyll. The Ocean Observatories Initiative (OOI) continues to expand its network of cabled and moored arrays, integrating new biogeochemical sensors to enhance spatial and temporal coverage. These fixed systems are critical for establishing baselines and detecting long-term trends, particularly in coastal and shelf environments.

Mobile Platforms—including research vessels, towed vehicles, and profiling floats—offer flexibility for targeted campaigns and adaptive sampling. The global Argo program, supported by manufacturers such as Sea-Bird Scientific and Satlantic (a division of Sea-Bird), is rapidly expanding its fleet of biogeochemical (BGC) Argo floats. By 2025, thousands of these autonomous floats are expected to be operational, providing unprecedented coverage of open-ocean biogeochemical processes. These platforms are increasingly equipped with advanced sensors for carbon, nutrients, and optical properties, supporting both research and operational oceanography.

Autonomous Platforms—such as gliders and autonomous surface vehicles (ASVs)—are at the forefront of innovation. Companies like Liquid Robotics (a Boeing company) and Kongsberg are deploying fleets of long-endurance vehicles capable of traversing vast ocean areas while collecting high-resolution biogeochemical data. These systems are being integrated into national and international observing networks, enabling persistent monitoring in remote or hazardous regions. The modularity of these platforms allows for rapid sensor upgrades and mission reconfiguration, a trend expected to accelerate through 2025 and beyond.

Looking ahead, the convergence of fixed, mobile, and autonomous strategies is driving the development of integrated sensor networks. Interoperability standards, real-time data transmission, and cloud-based analytics are being prioritized by industry leaders and research consortia. As sensor miniaturization and power efficiency improve, the deployment of denser and more diverse sensor arrays is anticipated, enhancing the spatial and temporal resolution of ocean biogeochemical observations. These advances will be critical for addressing emerging challenges in climate science, fisheries management, and marine ecosystem health.

Data Integration, Cloud Analytics, and AI Applications

The integration of oceanic biogeochemical sensor networks with advanced data management and analytics platforms is rapidly transforming marine science and environmental monitoring as of 2025. These sensor networks, deployed on autonomous vehicles, moorings, and floats, generate vast streams of real-time data on parameters such as dissolved oxygen, pH, nitrate, and chlorophyll. The challenge lies in efficiently aggregating, processing, and interpreting this data to support research, policy, and industry needs.

Major sensor manufacturers and integrators, such as Sea-Bird Scientific and Xylem, are equipping their platforms with cloud connectivity, enabling direct upload of sensor data to secure cloud environments. This shift allows for near-instantaneous access to high-resolution datasets by researchers and stakeholders worldwide. For example, Teledyne Marine has expanded its suite of gliders and floats with enhanced telemetry and cloud-based dashboards, supporting collaborative data analysis and mission planning.

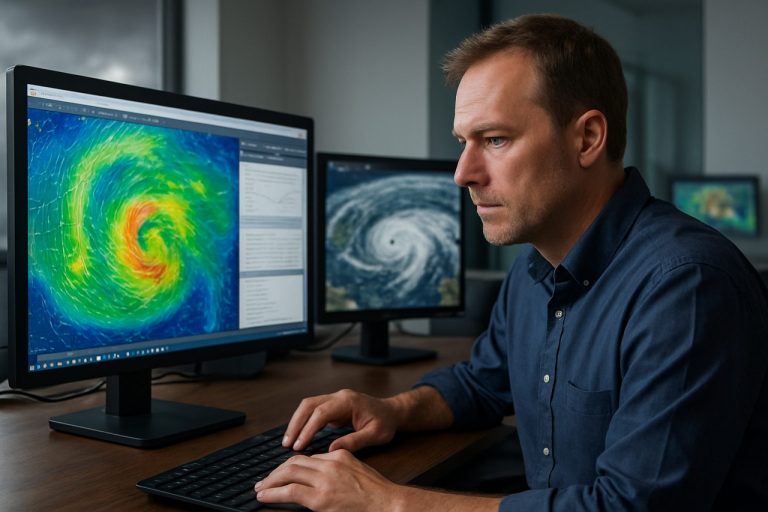

On the analytics front, the adoption of artificial intelligence (AI) and machine learning (ML) is accelerating. AI-driven algorithms are being used to detect anomalies, predict harmful algal blooms, and automate quality control of sensor data. Organizations such as Monterey Bay Aquarium Research Institute (MBARI) are pioneering the use of AI for real-time interpretation of biogeochemical signals, integrating data from distributed sensor arrays to generate actionable insights for ecosystem management.

Data integration efforts are also being standardized through open data initiatives and interoperability frameworks. The Ocean Observatories Initiative (OOI) and the European Multidisciplinary Seafloor and water column Observatory (EMSO) are leading examples, providing cloud-based portals that aggregate multi-parameter sensor data from diverse sources, harmonized for cross-platform analysis. These initiatives are increasingly leveraging cloud-native architectures to scale storage and computation, supporting both historical data mining and real-time analytics.

Looking ahead to the next few years, the convergence of sensor miniaturization, 5G/6G connectivity, and edge computing is expected to further enhance the capabilities of oceanic biogeochemical sensor networks. Companies are investing in onboard AI chips for preliminary data processing, reducing transmission costs and enabling faster response to environmental events. As these technologies mature, the sector anticipates a surge in autonomous, self-organizing sensor swarms capable of adaptive sampling and decentralized analytics, fundamentally reshaping how ocean health is monitored and managed.

Regulatory Landscape and International Standards

The regulatory landscape for oceanic biogeochemical sensor networks is rapidly evolving as governments, intergovernmental organizations, and industry stakeholders recognize the critical role of real-time ocean monitoring in addressing climate change, marine resource management, and environmental protection. In 2025, the focus is on harmonizing standards, ensuring data interoperability, and supporting the deployment of sensor networks that can reliably inform policy and scientific research.

At the international level, the International Maritime Organization (IMO) continues to play a central role in setting guidelines for marine environmental monitoring, particularly in relation to the International Convention for the Prevention of Pollution from Ships (MARPOL) and the Ballast Water Management Convention. These frameworks increasingly reference the need for robust, standardized sensor data to verify compliance and assess environmental impacts.

The UNESCO Intergovernmental Oceanographic Commission (IOC) is actively coordinating the Global Ocean Observing System (GOOS), which in 2025 is emphasizing the integration of biogeochemical sensors into global and regional networks. GOOS is working with member states and industry to develop best practices and technical standards for sensor calibration, data quality, and metadata, aiming for interoperability across platforms and nations.

On the technical side, the IEEE Oceanic Engineering Society and the International Organization for Standardization (ISO) are collaborating on standards for sensor interfaces, data formats, and communication protocols. The ISO 19115 standard for geographic information metadata and the IEEE 1451 family of standards for smart transducer interfaces are being adapted to accommodate the specific requirements of oceanic biogeochemical sensors, with new revisions expected in the next few years.

Industry consortia such as the Ocean Best Practices System (OBPS), supported by the IOC, are facilitating the sharing and adoption of standardized protocols for sensor deployment, maintenance, and data management. This is particularly important as commercial providers like Sea-Bird Scientific and Xylem expand their offerings of multi-parameter sensor platforms, which are increasingly being integrated into national and regional monitoring programs.

Looking ahead, regulatory bodies are expected to introduce more explicit requirements for sensor traceability, data transparency, and cybersecurity, reflecting the growing reliance on sensor networks for regulatory compliance and scientific decision-making. The next few years will likely see the formalization of certification schemes for sensor performance and data quality, as well as increased alignment between national regulations and international standards to support the global expansion of oceanic biogeochemical sensor networks.

Key Use Cases: Climate Change, Fisheries, and Pollution Monitoring

Oceanic biogeochemical sensor networks are rapidly transforming the way scientists, policymakers, and industry stakeholders monitor and respond to changes in marine environments. As of 2025, these networks—comprising distributed arrays of in situ sensors on moorings, autonomous vehicles, floats, and cabled observatories—are delivering unprecedented real-time data on key parameters such as dissolved oxygen, pH, carbon dioxide, nutrients, and chlorophyll. This data is critical for addressing three major use cases: climate change monitoring, fisheries management, and pollution detection.

- Climate Change Monitoring: Oceanic sensor networks are central to tracking the impacts of climate change, particularly ocean acidification and deoxygenation. The Monterey Bay Aquarium Research Institute (MBARI) and the Ocean Observatories Initiative (OOI) have deployed advanced biogeochemical sensors across the Pacific and Atlantic Oceans, providing continuous, high-resolution data on carbon cycling and heat content. These datasets are essential for validating climate models and informing international climate policy. In 2025, the expansion of the Argo program’s Biogeochemical Argo (BGC-Argo) floats is expected to double the number of active profiling floats, enhancing global coverage and enabling more accurate assessments of ocean carbon uptake and storage.

- Fisheries Management: Real-time biogeochemical data is increasingly used to support sustainable fisheries. Networks of sensors, such as those provided by Sea-Bird Scientific and Xylem, are deployed on fishing vessels, buoys, and autonomous platforms to monitor parameters like dissolved oxygen and chlorophyll-a, which are proxies for fish habitat suitability and primary productivity. In 2025, several national fisheries agencies are integrating these data streams into dynamic management frameworks, allowing for rapid response to harmful algal blooms and hypoxic events that threaten fish stocks.

- Pollution Monitoring: The detection and tracking of marine pollution—such as nutrient runoff, oil spills, and microplastics—relies on dense sensor networks capable of high-frequency sampling. Companies like YSI (a Xylem brand) and Satlantic (a Sea-Bird Scientific company) are at the forefront of developing multi-parameter sondes and optical sensors for deployment in coastal and offshore environments. In 2025, several large-scale deployments are underway in the Gulf of Mexico and the Baltic Sea, providing early warning of eutrophication and supporting remediation efforts.

Looking ahead, the next few years will see further miniaturization, increased sensor longevity, and improved data integration with satellite and modeling systems. These advances will make oceanic biogeochemical sensor networks even more indispensable for climate resilience, sustainable fisheries, and pollution mitigation worldwide.

Challenges: Power, Durability, and Data Security

Oceanic biogeochemical sensor networks are rapidly expanding in scale and complexity, but their deployment in harsh marine environments continues to present significant challenges related to power supply, durability, and data security. As of 2025, these issues are at the forefront of both research and commercial development, shaping the strategies of leading sensor manufacturers and network operators.

Power remains a primary constraint for long-term, autonomous sensor operation. Most oceanic sensors rely on battery power, which limits deployment duration and increases maintenance costs. While advances in low-power electronics and energy-efficient data transmission have extended operational lifespans, the industry is increasingly exploring alternative energy sources. Energy harvesting technologies—such as wave, solar, and microbial fuel cells—are being integrated into sensor platforms to supplement or replace batteries. Companies like Teledyne Marine and Sea-Bird Scientific are actively developing sensor systems with improved power management and energy harvesting capabilities, aiming to support multi-year deployments with minimal human intervention.

Durability is another persistent challenge, as sensors must withstand corrosive saltwater, biofouling, high pressure, and extreme temperatures. Material innovations, such as advanced composites and anti-fouling coatings, are being adopted to extend sensor lifespans and reduce maintenance. For example, Nortek and Xylem are incorporating robust housings and self-cleaning mechanisms into their oceanographic instruments. Additionally, modular sensor designs are gaining traction, allowing for easier replacement of damaged components and upgrades in the field.

Data security is an emerging concern as sensor networks become more interconnected and data transmission increasingly relies on wireless and satellite links. Protecting sensitive environmental data from interception or tampering is critical, especially for networks supporting regulatory monitoring or commercial operations. Industry leaders are beginning to implement end-to-end encryption and secure authentication protocols in their telemetry systems. Organizations such as Kongsberg and Sonardyne are investing in secure communication architectures, recognizing the growing risk of cyber threats to marine data infrastructure.

Looking ahead, the next few years are expected to see continued innovation in power autonomy, ruggedization, and cybersecurity for oceanic biogeochemical sensor networks. Collaboration between sensor manufacturers, marine operators, and cybersecurity experts will be essential to overcoming these challenges and ensuring reliable, long-term ocean monitoring.

Future Trends: Next-Gen Sensors, Network Expansion, and Market Opportunities

The landscape of oceanic biogeochemical sensor networks is poised for significant transformation in 2025 and the coming years, driven by rapid advances in sensor miniaturization, network integration, and real-time data analytics. These networks, which monitor key parameters such as dissolved oxygen, pH, carbon dioxide, nutrients, and chlorophyll, are critical for understanding ocean health, climate change impacts, and supporting sustainable marine resource management.

A major trend is the deployment of next-generation, multi-parameter sensors that offer improved accuracy, lower power consumption, and enhanced durability for long-term autonomous operation. Companies like Sea-Bird Scientific and Xylem are at the forefront, introducing compact sensor packages capable of simultaneous measurement of multiple biogeochemical variables. These innovations are enabling denser and more cost-effective sensor arrays, expanding coverage from coastal zones to the open ocean and even polar regions.

Network expansion is also accelerating, with global initiatives such as the Global Ocean Observing System (GOOS) and the Argo program integrating new biogeochemical floats and gliders equipped with advanced sensors. The recent launch of the Biogeochemical-Argo array, which aims to deploy thousands of profiling floats worldwide, exemplifies this trend. Industry partners, including Teledyne Marine and Satlantic (a brand of Sea-Bird Scientific), are supplying robust sensor platforms tailored for these autonomous vehicles.

Data management and interoperability are becoming central concerns as network complexity grows. Efforts are underway to standardize data formats and ensure seamless integration across platforms, with organizations like Ocean Observatories Initiative (OOI) providing open-access data portals and fostering collaboration between research, governmental, and commercial stakeholders.

Looking ahead, the market for oceanic biogeochemical sensor networks is expected to expand beyond traditional research applications. There is rising demand from sectors such as aquaculture, offshore energy, and environmental compliance, where real-time ocean monitoring supports operational efficiency and regulatory adherence. Companies like Nortek and Kongsberg are developing integrated solutions that combine biogeochemical sensing with physical oceanography and telemetry, targeting these emerging markets.

In summary, 2025 will mark a pivotal year for oceanic biogeochemical sensor networks, characterized by technological innovation, broader deployment, and diversification of end-user markets. Continued collaboration between industry leaders, research consortia, and regulatory bodies will be essential to realize the full potential of these networks in advancing ocean science and supporting sustainable blue economy growth.

Sources & References

- Sea-Bird Scientific

- YSI, a Xylem brand

- Axiom Data Science

- Teledyne Marine

- Sofar Ocean

- Monterey Bay Aquarium Research Institute

- NKE Instrumentation

- Ocean Observatories Initiative

- Global Ocean Observing System

- Liquid Robotics

- Kongsberg

- European Multidisciplinary Seafloor and water column Observatory (EMSO)

- International Maritime Organization

- UNESCO

- IEEE

- International Organization for Standardization

- Ocean Best Practices System