Dwarf Planet and Minor Body Exploration Platforms: 2025 Market Outlook and Strategic Technology Shifts. Discover how new mission architectures and propulsion breakthroughs are accelerating the race to the solar system’s most elusive worlds.

- Executive Summary: 2025–2030 Market Trajectory

- Key Players and Industry Ecosystem Overview

- Current State of Dwarf Planet/Minor Body Exploration Platforms

- Emerging Technologies: Propulsion, Autonomy, and Miniaturization

- Mission Architectures: From Flybys to Long-Duration Landers

- Market Size, Segmentation, and 5-Year Growth Forecast (2025–2030)

- Investment Trends and Funding Sources

- Regulatory Landscape and International Collaboration

- Case Studies: Leading Missions and Platform Innovations (e.g., NASA, ESA, JAXA)

- Future Outlook: Opportunities, Challenges, and Strategic Recommendations

- Sources & References

Executive Summary: 2025–2030 Market Trajectory

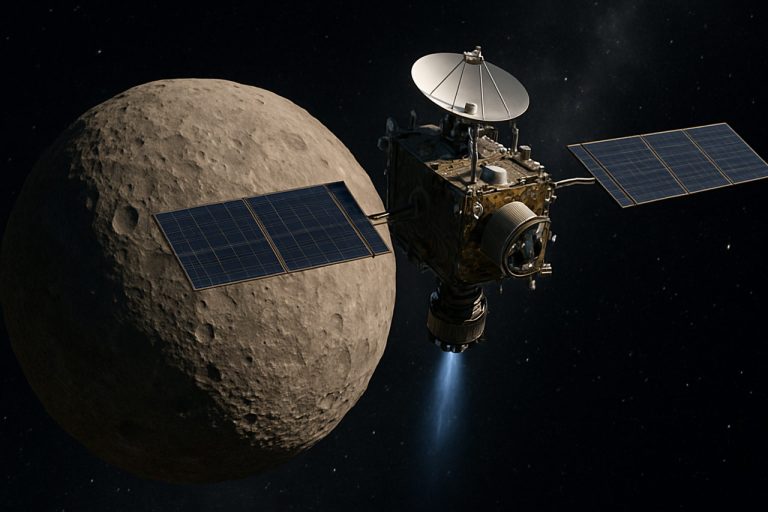

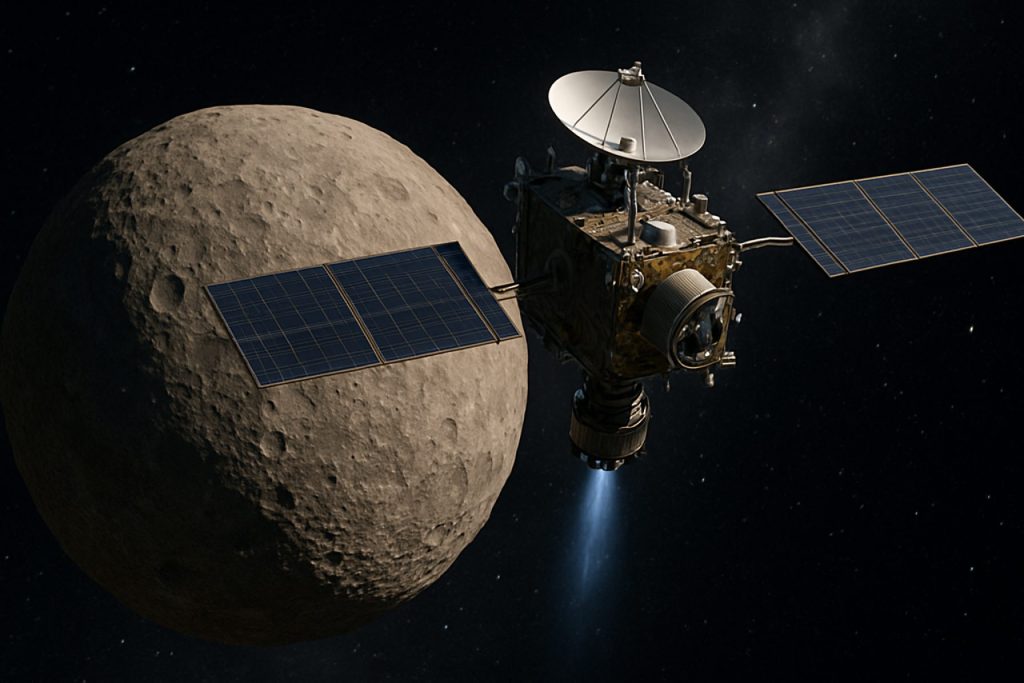

The period from 2025 through the end of the decade is poised to be transformative for the market and technology landscape of dwarf planet and minor body exploration platforms. This segment, encompassing spacecraft, landers, and supporting systems designed for missions to asteroids, comets, and dwarf planets, is experiencing renewed momentum driven by scientific, commercial, and planetary defense imperatives.

Key government agencies, notably NASA, European Space Agency (ESA), and Japan Aerospace Exploration Agency (JAXA), are leading the charge with ambitious missions. NASA’s Lucy mission, launched in 2021, will reach its first Trojan asteroid target in 2027, providing critical data on primitive solar system bodies. The Psyche mission, launched in 2023, is en route to the metallic asteroid 16 Psyche, with arrival expected in 2029, aiming to study a unique planetary core remnant. ESA’s Hera mission, scheduled for launch in late 2024, will rendezvous with the Didymos binary asteroid system in 2026, following up on the successful DART impactor test and advancing planetary defense capabilities.

Japan’s JAXA, building on the success of Hayabusa2, is developing the MMX (Martian Moons eXploration) mission, targeting the Martian moon Phobos with a 2026 launch, and is actively planning future asteroid sample return missions. These government-led efforts are complemented by increasing private sector engagement. Companies such as Astrobotic Technology and ispace, inc. are developing small landers and mobility platforms, leveraging lunar experience to target minor bodies in the late 2020s. Their modular, scalable spacecraft designs are expected to lower mission costs and enable more frequent, targeted exploration.

The market outlook for 2025–2030 is characterized by a shift from one-off flagship missions to a more sustainable cadence of exploration, enabled by advances in propulsion, autonomy, and miniaturization. The growing interest in in-situ resource utilization (ISRU) and planetary defense is expected to drive demand for platforms capable of prospecting, sample return, and impactor delivery. Partnerships between agencies and commercial suppliers are anticipated to accelerate technology maturation and mission cadence.

Overall, the next five years will see a transition from demonstration to operational capability in minor body exploration platforms, with a diverse array of missions and players shaping a dynamic and expanding market. The sector’s trajectory will be defined by the interplay of scientific discovery, commercial opportunity, and the imperative to safeguard Earth from potential asteroid threats.

Key Players and Industry Ecosystem Overview

The exploration of dwarf planets and minor bodies—such as asteroids, comets, and Kuiper Belt objects—has become a focal point for both governmental space agencies and emerging private sector players. As of 2025, the industry ecosystem is characterized by a blend of established national programs, innovative commercial ventures, and a growing network of technology suppliers and mission integrators.

Among governmental agencies, NASA remains a central figure, with its ongoing and upcoming missions such as the Lucy spacecraft, which is currently en route to study Jupiter’s Trojan asteroids, and the Psyche mission, targeting the metallic asteroid 16 Psyche. These missions leverage NASA’s extensive experience in deep space navigation, propulsion, and scientific instrumentation. Similarly, the European Space Agency (ESA) is advancing its Hera mission, scheduled to rendezvous with the Didymos binary asteroid system, building on the legacy of the Rosetta and Giotto comet missions.

Japan’s Japan Aerospace Exploration Agency (JAXA) has established itself as a leader in sample return technology, following the successes of Hayabusa2 (Ryugu) and Hayabusa (Itokawa). JAXA is actively planning follow-on missions, with international collaboration as a key component. China’s China National Space Administration (CNSA) is also entering the field, with plans for asteroid sample return and comet rendezvous missions in the late 2020s, signaling a growing multipolarity in minor body exploration.

On the commercial front, companies such as Asteroid Mining Corporation and Planetary Resources (now part of ConsenSys) have laid the groundwork for private sector involvement, though the sector remains in early stages. Momentus and Astrobotic Technology are developing in-space transportation and lander platforms that could support future commercial or scientific missions to minor bodies. These companies are focusing on modular spacecraft, propulsion systems, and mission services tailored for deep space environments.

The industry ecosystem is further supported by a network of suppliers specializing in propulsion (e.g., electric and solar sail systems), miniaturized scientific payloads, and autonomous navigation. Partnerships between agencies and private firms are expected to accelerate, with technology demonstration missions and rideshare opportunities lowering barriers to entry. Over the next few years, the sector is poised for increased activity, with new mission launches, technology maturation, and the potential for the first commercial contracts targeting resource prospecting or in-situ science on minor bodies.

Current State of Dwarf Planet/Minor Body Exploration Platforms

As of 2025, the exploration of dwarf planets and minor bodies—such as asteroids, comets, and Kuiper Belt objects—remains a frontier of planetary science, with several active and upcoming missions led by major space agencies and select private sector participants. These platforms are designed to address fundamental questions about the origins and evolution of the solar system, resource potential, and planetary defense.

The most prominent recent mission is NASA’s Lucy spacecraft, launched in 2021, which is currently en route to study multiple Jupiter Trojan asteroids. Lucy is expected to encounter its first target in 2025, providing unprecedented data on these primitive bodies. Meanwhile, NASA’s Psyche mission, launched in 2023, is on its way to the metallic asteroid 16 Psyche, with arrival anticipated in 2029. These missions utilize advanced solar electric propulsion, autonomous navigation, and miniaturized scientific payloads tailored for long-duration, deep-space operations.

In the realm of sample return, Japan Aerospace Exploration Agency (JAXA) has set a benchmark with its Hayabusa2 mission, which returned samples from asteroid Ryugu in 2020. Building on this success, JAXA is developing the MMX (Martian Moons eXploration) mission, scheduled for launch in 2026, targeting Phobos, a Martian moon with characteristics similar to captured minor bodies. European Space Agency (ESA) is also advancing the Hera mission, set to rendezvous with the Didymos binary asteroid system in 2026, following up on the DART impactor test for planetary defense.

Private sector involvement is growing, though still nascent. Companies such as Astrobotic Technology and Momentus are developing small spacecraft and transfer vehicles with potential applications for minor body exploration, leveraging rideshare launches and modular payloads. These platforms aim to reduce mission costs and enable more frequent, targeted exploration of smaller bodies.

Looking ahead, the next few years will see a transition from large, flagship missions to more distributed, cost-effective platforms, including cubesats and smallsats. The integration of autonomous systems, advanced propulsion, and in-situ resource utilization technologies is expected to further expand the capabilities and scientific return of minor body exploration. As international collaboration intensifies and commercial capabilities mature, the 2025–2030 period is poised to deliver a new wave of discoveries from the solar system’s most enigmatic objects.

Emerging Technologies: Propulsion, Autonomy, and Miniaturization

The exploration of dwarf planets and minor bodies—such as asteroids, comets, and Kuiper Belt objects—has become a focal point for advancing space science and technology. As of 2025, several emerging technologies are shaping the next generation of exploration platforms, with a strong emphasis on propulsion, autonomy, and miniaturization.

Propulsion systems are undergoing significant innovation to meet the unique challenges of reaching and maneuvering around distant, low-gravity bodies. Electric propulsion, particularly solar electric propulsion (SEP), is increasingly favored for its high efficiency and ability to provide continuous thrust over long durations. NASA has been a leader in this domain, with its Dawn mission having demonstrated the viability of ion propulsion for visiting both Vesta and Ceres. Building on this legacy, upcoming missions are expected to utilize advanced Hall-effect thrusters and next-generation ion engines, which offer improved thrust-to-power ratios and longer operational lifespans. Airbus and Thales Group are also developing electric propulsion systems for deep space applications, aiming to support both governmental and commercial missions targeting minor bodies.

Autonomy is another critical area of advancement. The vast distances and communication delays involved in dwarf planet and minor body missions necessitate spacecraft capable of making real-time decisions. Artificial intelligence (AI) and machine learning algorithms are being integrated into onboard systems to enable autonomous navigation, hazard avoidance, and scientific data prioritization. Japan Aerospace Exploration Agency (JAXA) has pioneered autonomous sampling and landing technologies with its Hayabusa missions, and is expected to further enhance these capabilities in future projects. Similarly, European Space Agency (ESA) is investing in AI-driven autonomy for its upcoming Hera mission, which will study the binary asteroid system Didymos.

Miniaturization is enabling a new class of small, cost-effective exploration platforms. CubeSats and smallsats are increasingly being deployed as secondary payloads or as part of distributed mission architectures. These platforms leverage advances in microelectronics, lightweight materials, and compact scientific instruments. Planet Labs and Rocket Lab are notable for their work in miniaturized satellite technology, with Rocket Lab also developing the Photon spacecraft bus for deep space missions. The trend toward miniaturization is expected to accelerate, allowing for more frequent and diverse exploration of minor bodies at reduced cost and risk.

Looking ahead, the convergence of advanced propulsion, autonomous operations, and miniaturized platforms is poised to transform the exploration of dwarf planets and minor bodies. These technologies will not only expand scientific understanding but also lay the groundwork for future resource utilization and planetary defense initiatives.

Mission Architectures: From Flybys to Long-Duration Landers

The exploration of dwarf planets and minor bodies—such as asteroids, comets, and Kuiper Belt objects—has evolved significantly, with mission architectures advancing from brief flybys to increasingly ambitious orbiters, landers, and sample-return platforms. As of 2025, the field is characterized by a blend of ongoing missions, imminent launches, and the development of next-generation spacecraft designed to address the scientific and technological challenges posed by these distant and diverse targets.

Historically, flyby missions like New Horizons’s 2015 encounter with Pluto and its subsequent 2019 flyby of Arrokoth demonstrated the feasibility and scientific value of rapid reconnaissance of distant bodies. These missions, led by NASA, provided unprecedented data on surface geology, composition, and atmospheres, but were limited by their brief observation windows.

The trend in the mid-2020s is toward more complex mission architectures. NASA’s Lucy mission, launched in 2021, is en route to multiple Jupiter Trojan asteroids, employing a multi-flyby trajectory that will yield comparative data across several minor bodies through 2033. Meanwhile, the Psyche mission, launched in 2023, is set to arrive at the metallic asteroid 16 Psyche in 2029, where it will enter orbit and conduct prolonged remote sensing, marking a shift from flybys to long-duration orbital studies.

Sample-return missions are also advancing. Japan Aerospace Exploration Agency (JAXA)’s Hayabusa2 successfully returned samples from asteroid Ryugu in 2020, and the agency is developing the MMX (Martian Moons eXploration) mission, scheduled for launch in 2026, which will attempt to return samples from Phobos, a Martian moon with characteristics akin to captured minor bodies. NASA’s OSIRIS-REx returned samples from asteroid Bennu in 2023, and the spacecraft is now retargeted for a 2029 flyby of the near-Earth asteroid Apophis.

Looking ahead, mission concepts are increasingly focused on landers and in-situ resource utilization (ISRU) demonstrators. European Space Agency (ESA) is developing the Hera mission, set to launch in 2024, which will rendezvous with the Didymos binary asteroid system and deploy CubeSats for close-up observations and surface interaction experiments. Private sector involvement is also growing, with companies such as Astrobotic Technology and ispace developing lander platforms and payload delivery services, though their primary focus remains lunar missions as of 2025.

In summary, the 2025 landscape for dwarf planet and minor body exploration is marked by a transition from flyby reconnaissance to sustained orbital and surface operations, with a growing emphasis on sample return and technology demonstration. The next few years are expected to see further diversification of mission architectures, leveraging both governmental and commercial capabilities to unlock the scientific and economic potential of these distant worlds.

Market Size, Segmentation, and 5-Year Growth Forecast (2025–2030)

The market for Dwarf Planet and Minor Body Exploration Platforms is poised for significant evolution between 2025 and 2030, driven by renewed governmental and commercial interest in deep space exploration, resource prospecting, and scientific discovery. This segment encompasses spacecraft, landers, orbiters, and supporting technologies designed for missions targeting asteroids, comets, and dwarf planets such as Ceres and Pluto.

As of 2025, the market remains relatively niche, with primary activity led by national space agencies and a handful of private sector entrants. The most prominent players include NASA, which has spearheaded missions like Dawn (Ceres, Vesta) and OSIRIS-REx (Bennu), and Japan Aerospace Exploration Agency (JAXA), known for the Hayabusa and Hayabusa2 asteroid sample return missions. The European Space Agency (ESA) is also a key participant, with its Hera mission targeting the Didymos binary asteroid system as part of the AIDA collaboration.

Market segmentation can be broadly categorized as follows:

- Government-led Missions: These dominate current activity, with agencies focusing on scientific research, planetary defense, and technology demonstration.

- Commercial Ventures: Companies such as Planetary Resources (now part of ConsenSys) and Deep Space Industries (acquired by Bradford Space) have laid groundwork for private sector involvement, particularly in asteroid mining and in-situ resource utilization (ISRU).

- Platform Types: Includes flyby spacecraft, orbiters, landers, and sample return vehicles, as well as supporting propulsion, navigation, and autonomy systems.

The market size in 2025 is estimated in the low hundreds of millions USD annually, primarily reflecting government R&D and mission budgets. However, the outlook for 2025–2030 is for robust growth, with a compound annual growth rate (CAGR) projected in the 8–12% range. This is underpinned by several factors:

- Planned missions such as NASA’s Psyche (to a metal-rich asteroid), ESA’s Hera, and JAXA’s MMX (Martian Moons eXploration) targeting Phobos and Deimos.

- Increasing international collaboration and new entrants from China, India, and the UAE, each expressing intent to pursue minor body exploration.

- Growing commercial interest in asteroid mining, with companies seeking to develop and deploy prospecting platforms and ISRU demonstrators.

By 2030, the market is expected to diversify further, with commercial contracts supplementing government missions, and new platform technologies—such as advanced electric propulsion and autonomous navigation—enabling more frequent and cost-effective missions. The sector’s growth will be closely tied to the maturation of supporting technologies and the realization of early commercial returns from resource prospecting and sample return.

Investment Trends and Funding Sources

Investment in dwarf planet and minor body exploration platforms is entering a dynamic phase in 2025, driven by both governmental and private sector initiatives. The focus is on developing spacecraft and technologies capable of reaching, orbiting, and analyzing small Solar System bodies such as asteroids, comets, and dwarf planets. These missions are motivated by scientific discovery, planetary defense, and the potential for resource utilization.

Government space agencies remain the primary investors in this domain. NASA continues to allocate significant funding to missions like the ongoing Lucy and Psyche spacecraft, which are exploring Trojan asteroids and a metal-rich asteroid, respectively. The Psyche mission, launched in 2023, is expected to reach its target in 2029, with ongoing funding through the mid-2020s. Similarly, European Space Agency (ESA) is advancing its Hera mission, part of the AIDA collaboration, to study the binary asteroid system Didymos/Dimorphos, with launch scheduled for late 2024 and operations extending into 2026.

In Asia, Japan Aerospace Exploration Agency (JAXA) is building on the success of its Hayabusa missions, with plans for further asteroid sample return missions under consideration for the late 2020s. These agencies are increasingly collaborating internationally, pooling resources and expertise to reduce costs and share scientific returns.

Private sector involvement is also growing, though at a more measured pace. Companies such as Planetary Resources and Deep Space Industries have historically attracted venture capital for asteroid mining concepts, though both have since shifted focus or been acquired. However, the underlying interest in commercial exploitation of minor bodies persists, with new entrants and established aerospace firms exploring partnerships with government agencies for technology demonstration and mission support.

Funding sources are diversifying, with public-private partnerships and international consortia becoming more common. The European Union’s Horizon Europe program and NASA’s Small Business Innovation Research (SBIR) grants are examples of mechanisms supporting early-stage technology development for minor body exploration. Additionally, the rise of space-focused venture capital funds and sovereign wealth investments in space infrastructure is expected to provide supplementary capital for innovative mission architectures and enabling technologies.

Looking ahead, the investment outlook for dwarf planet and minor body exploration platforms in the next few years is cautiously optimistic. While government funding remains the backbone, the gradual maturation of commercial interest and the emergence of new funding models are likely to accelerate the pace of technological advancement and mission deployment in this sector.

Regulatory Landscape and International Collaboration

The regulatory landscape and international collaboration for dwarf planet and minor body exploration platforms are evolving rapidly as more nations and private entities target asteroids, comets, and trans-Neptunian objects for scientific and commercial missions. As of 2025, the Outer Space Treaty of 1967 remains the foundational legal framework, emphasizing peaceful use, non-appropriation, and international cooperation. However, the treaty’s broad language leaves significant gaps regarding resource utilization and private sector involvement, prompting new national and multilateral initiatives.

The United States has taken a leading role in clarifying commercial rights through the NASA-backed Commercial Space Launch Competitiveness Act (2015), which grants U.S. citizens rights to resources extracted from asteroids, though not sovereignty over celestial bodies. This approach has influenced similar legislative efforts in Luxembourg and the United Arab Emirates, both aiming to attract private investment in space mining and exploration. Luxembourg’s Space Resources Act (2017) and the UAE’s National Space Law (2019) provide legal certainty for companies operating under their jurisdictions, fostering a competitive environment for minor body exploration platforms.

International collaboration is exemplified by missions such as Japan Aerospace Exploration Agency (JAXA)’s Hayabusa2 and European Space Agency (ESA)’s Hera, which involve partnerships across continents. The upcoming NASA Psyche mission, targeting a metal-rich asteroid, and the ESA Comet Interceptor, scheduled for launch in the late 2020s, further highlight the trend toward multinational science teams and shared data protocols. These collaborations are often formalized through bilateral agreements or memoranda of understanding, ensuring data sharing, joint operations, and coordinated planetary protection measures.

The United Nations Committee on the Peaceful Uses of Outer Space (COPUOS) continues to serve as a forum for dialogue, with recent sessions focusing on guidelines for the long-term sustainability of outer space activities, including those involving minor bodies. The development of non-binding international guidelines, such as the Space Resource Utilization Working Group under the Hague International Space Resources Governance Working Group, reflects ongoing efforts to harmonize national laws and prevent conflicts.

Looking ahead, the regulatory environment is expected to become more complex as commercial missions—such as those proposed by NASA’s CLPS partners and emerging private companies—move from demonstration to operational phases. The need for clear, enforceable rules on resource extraction, environmental protection, and liability will drive further international negotiations. The next few years will likely see increased emphasis on transparency, interoperability, and the establishment of norms to ensure that dwarf planet and minor body exploration remains peaceful, sustainable, and inclusive.

Case Studies: Leading Missions and Platform Innovations (e.g., NASA, ESA, JAXA)

The exploration of dwarf planets and minor bodies has become a focal point for space agencies seeking to unravel the early history of the solar system. As of 2025, several landmark missions and innovative platforms are shaping the landscape, with a strong emphasis on international collaboration and technological advancement.

One of the most influential missions in this domain was NASA‘s Dawn spacecraft, which concluded its operations in 2018 after successfully orbiting both Vesta and Ceres—the two largest bodies in the asteroid belt. Dawn’s ion propulsion system and autonomous navigation set a precedent for future missions, demonstrating the feasibility of multi-target exploration and long-duration operations around low-gravity bodies. The data returned from Ceres, in particular, continues to inform mission planning and scientific objectives for subsequent platforms.

Building on this legacy, NASA is advancing the Lucy mission, launched in 2021, which is en route to study multiple Jupiter Trojan asteroids through the late 2020s. Lucy’s trajectory and flyby strategy exemplify the growing capability to visit several minor bodies within a single mission, leveraging gravity assists and advanced trajectory design. Meanwhile, the Psyche mission, launched in 2023, is targeting the metallic asteroid 16 Psyche, with arrival expected in 2029. Psyche’s use of solar electric propulsion and deep-space autonomous operations will further validate technologies critical for future minor body exploration.

In parallel, the European Space Agency (ESA) is preparing the Hera mission, scheduled for launch in late 2024. Hera will rendezvous with the binary asteroid system Didymos and Dimorphos, following up on the successful DART impactor test by NASA. Hera’s suite of instruments, including CubeSat deployables, will provide high-resolution mapping and subsurface characterization, showcasing modular and collaborative platform design.

Japan’s Japan Aerospace Exploration Agency (JAXA) has also been a leader, with the Hayabusa2 mission returning samples from asteroid Ryugu in 2020. JAXA is now developing the MMX (Martian Moons eXploration) mission, set for launch in 2026, which will target the Martian moon Phobos—a body of ambiguous origin that may be a captured minor planet. MMX will deploy a lander and return samples, further pushing the boundaries of minor body exploration platforms.

Looking ahead, these missions are driving innovation in propulsion, autonomy, and miniaturization. The integration of small satellite technologies, such as CubeSats and deployable landers, is enabling more distributed and cost-effective science. As agencies like NASA, ESA, and JAXA continue to collaborate and share data, the next few years are poised to deliver unprecedented insights into the composition, structure, and evolution of dwarf planets and minor bodies, laying the groundwork for future resource utilization and planetary defense initiatives.

Future Outlook: Opportunities, Challenges, and Strategic Recommendations

The exploration of dwarf planets and minor bodies—such as asteroids, comets, and Kuiper Belt objects—remains a frontier of planetary science and resource prospecting. As of 2025, the sector is poised for significant advancements, driven by both governmental and private initiatives. The next few years are expected to see a transition from primarily scientific missions to a blend of science, technology demonstration, and early-stage resource utilization.

Key opportunities are emerging from the increasing miniaturization of spacecraft and the maturation of propulsion and autonomy technologies. For instance, the use of small, modular platforms—such as CubeSats and microsatellites—enables cost-effective reconnaissance and in-situ analysis of minor bodies. Agencies like NASA and European Space Agency (ESA) are actively developing such platforms, as seen in missions like NASA’s upcoming Janus and ESA’s Hera, which will study binary asteroids and the aftermath of kinetic impact, respectively.

Commercial players are also entering the field, with companies such as Planetary Resources and Deep Space Industries (now part of Bradford Space) having previously laid groundwork for asteroid prospecting. While these companies have shifted focus or restructured, their technological legacies—such as propulsion systems and resource extraction concepts—continue to influence new ventures. The next few years may see renewed commercial interest, especially as in-space manufacturing and refueling become more viable.

However, several challenges persist. The technical complexity of rendezvousing with and operating on small, low-gravity bodies requires advanced navigation, propulsion, and anchoring systems. The harsh radiation environment and communication delays further complicate mission design. Additionally, the regulatory landscape for resource extraction remains uncertain, with international frameworks still evolving.

Strategically, stakeholders should prioritize the following:

- Investing in robust, autonomous navigation and surface interaction technologies to enable safe and effective operations on diverse minor bodies.

- Fostering international collaboration to share mission data, reduce costs, and harmonize legal frameworks for resource utilization.

- Encouraging public-private partnerships to leverage commercial innovation and accelerate technology maturation.

- Supporting precursor missions that can validate key technologies—such as in-situ resource utilization (ISRU) and sample return—on near-Earth asteroids before targeting more distant targets like Kuiper Belt objects or dwarf planets such as Ceres and Pluto.

In summary, the period from 2025 onward is likely to witness a gradual but steady expansion in the capabilities and ambitions of dwarf planet and minor body exploration platforms. Success will depend on overcoming technical and regulatory hurdles, while capitalizing on the synergies between scientific discovery and commercial opportunity.

Sources & References

- NASA

- European Space Agency (ESA)

- Astrobotic Technology

- ispace, inc.

- NASA

- European Space Agency (ESA)

- Japan Aerospace Exploration Agency (JAXA)

- China National Space Administration (CNSA)

- Asteroid Mining Corporation

- Momentus

- Astrobotic Technology

- Airbus

- Thales Group

- Planet Labs

- Rocket Lab

- ispace

- Deep Space Industries