Unveiling the Next Frontier: How Lunar & Planetary Surface Mapping Technologies in 2025 Are Transforming Space Missions. Explore the Innovations, Market Growth, and Strategic Shifts Shaping the Future of Extraterrestrial Cartography.

- Executive Summary: 2025 Market Overview & Key Drivers

- Current State of Lunar & Planetary Surface Mapping Technologies

- Major Players and Industry Collaborations (e.g., NASA, ESA, ispace, JAXA)

- Core Technologies: LIDAR, Hyperspectral Imaging, and AI-Driven Mapping

- Market Size, Segmentation, and 2025–2030 Growth Forecast (18% CAGR)

- Emerging Applications: Resource Prospecting, Navigation, and Habitat Planning

- Challenges: Data Transmission, Surface Hazards, and Environmental Factors

- Regulatory Landscape and International Standards (e.g., COSPAR, NASA.gov)

- Investment Trends and Funding Initiatives (2025–2030)

- Future Outlook: Next-Gen Mapping, Autonomous Systems, and Commercial Opportunities

- Sources & References

Executive Summary: 2025 Market Overview & Key Drivers

The market for lunar and planetary surface mapping technologies is poised for significant growth in 2025, driven by renewed global interest in lunar exploration, commercial space initiatives, and advancements in remote sensing and robotics. The sector is characterized by a convergence of government-led missions, private sector innovation, and international collaboration, all aiming to generate high-resolution, geospatially accurate maps of extraterrestrial terrains.

Key drivers include the Artemis program, spearheaded by NASA, which is accelerating the deployment of advanced mapping payloads to support crewed lunar landings and resource prospecting. The Artemis III mission, scheduled for the late 2020s, is already catalyzing demand for detailed topographic and mineralogical data of the lunar south pole. In parallel, European Space Agency (ESA) and Japan Aerospace Exploration Agency (JAXA) are advancing their own lunar and planetary mapping initiatives, with ESA’s Lunar Pathfinder and JAXA’s SLIM lander both integrating state-of-the-art imaging and LIDAR systems.

Commercial entities are increasingly pivotal. Maxar Technologies is leveraging its heritage in Earth observation to develop high-resolution lunar mapping solutions, while ispace, inc. and Astrobotic Technology are providing lunar lander platforms equipped with mapping payloads for both governmental and private customers. Lockheed Martin and Northrop Grumman are also investing in surface mapping technologies as part of their broader lunar infrastructure and logistics offerings.

Technological advancements are rapidly enhancing mapping capabilities. Next-generation LIDAR, hyperspectral imaging, and synthetic aperture radar (SAR) are enabling unprecedented surface characterization, even in permanently shadowed regions. Robotics and AI-driven data processing are further improving the speed and accuracy of map generation, with companies like Bosch and Intuitive Machines contributing sensor and autonomy solutions for lunar rovers and landers.

Looking ahead, the market outlook for 2025 and beyond is robust, with increasing mission cadence, expanding commercial participation, and growing demand for high-fidelity surface data to support in-situ resource utilization, navigation, and infrastructure planning. As lunar and planetary surface mapping becomes foundational to exploration and commercialization, the sector is expected to see continued investment and technological breakthroughs, positioning it as a critical enabler of the new space economy.

Current State of Lunar & Planetary Surface Mapping Technologies

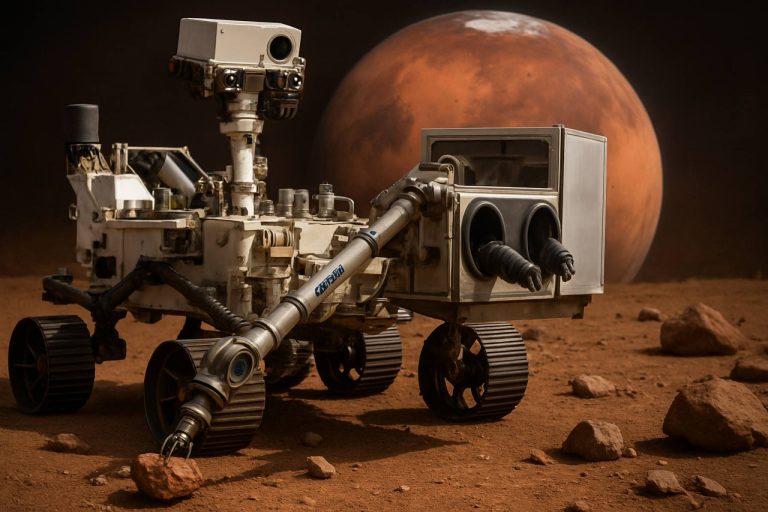

Lunar and planetary surface mapping technologies have advanced rapidly, driven by renewed international interest in lunar exploration and the prospect of crewed missions to the Moon and Mars. As of 2025, the field is characterized by a blend of high-resolution remote sensing, in-situ mapping, and autonomous robotic systems, with significant contributions from both governmental space agencies and private sector innovators.

A cornerstone of current lunar mapping is the use of high-resolution optical and radar imaging from orbiters. NASA’s Lunar Reconnaissance Orbiter (LRO), operational since 2009, continues to provide detailed topographic and compositional maps of the Moon’s surface, supporting landing site selection and resource identification for upcoming Artemis missions. The LRO’s Lunar Orbiter Laser Altimeter (LOLA) has set a benchmark for global lunar elevation data, with ongoing data releases enhancing surface models (NASA).

On the planetary front, the European Space Agency’s Mars Express and ExoMars Trace Gas Orbiter, as well as NASA’s Mars Reconnaissance Orbiter, have delivered high-resolution stereo imagery and altimetry, enabling 3D mapping of Martian terrain and subsurface features. These datasets are crucial for rover navigation and for planning future sample return missions (European Space Agency).

Recent years have seen the emergence of commercial players in lunar mapping. ispace, a Japanese lunar exploration company, has developed landers equipped with high-definition cameras and LIDAR systems, aiming to provide precision mapping services for both scientific and commercial clients. Similarly, Astrobotic Technology and Intuitive Machines—both selected by NASA’s Commercial Lunar Payload Services (CLPS) program—are deploying landers and rovers with advanced imaging and terrain mapping payloads, supporting resource prospecting and hazard avoidance for future missions.

Technological advances in LIDAR, synthetic aperture radar (SAR), and multispectral imaging are enabling higher resolution and more diverse datasets. Companies like Teledyne Technologies and Leica Geosystems are supplying sensors and systems for both orbital and surface-based mapping, with a focus on miniaturization and robustness for harsh extraterrestrial environments.

Looking ahead, the next few years will see the deployment of new mapping assets as part of NASA’s Artemis program, China’s Chang’e missions, and commercial lunar landers. These missions are expected to deliver unprecedented surface detail, including polar illumination models, regolith composition, and potential resource locations. The integration of AI-driven data processing and autonomous mapping by rovers will further accelerate the creation of high-fidelity lunar and planetary maps, supporting both scientific discovery and the emerging cislunar economy.

Major Players and Industry Collaborations (e.g., NASA, ESA, ispace, JAXA)

The landscape of lunar and planetary surface mapping technologies in 2025 is shaped by a dynamic interplay of established space agencies, emerging commercial entities, and international collaborations. These efforts are driven by the need for high-resolution, accurate surface data to support upcoming crewed and robotic missions, resource prospecting, and long-term lunar infrastructure planning.

Among the most prominent players, the National Aeronautics and Space Administration (NASA) continues to lead with its Artemis program, which relies on advanced mapping technologies for landing site selection and mission planning. NASA’s Lunar Reconnaissance Orbiter (LRO) remains a cornerstone, providing high-resolution topographic and imaging data. In 2025, NASA is also leveraging commercial partnerships through its Commercial Lunar Payload Services (CLPS) initiative, enabling private companies to deliver mapping payloads and instruments to the lunar surface.

The European Space Agency (ESA) is actively collaborating with international partners on lunar mapping. ESA’s involvement in the Lunar Pathfinder mission and its support for the Lunar Polar Exploration mission (LUPEX, in partnership with JAXA) are central to its mapping strategy. ESA’s expertise in synthetic aperture radar (SAR) and optical imaging is being integrated into joint missions, enhancing global lunar surface datasets.

Japan’s Japan Aerospace Exploration Agency (JAXA) is a key contributor, particularly through its Smart Lander for Investigating Moon (SLIM) mission, which aims to demonstrate pinpoint landing and high-resolution surface mapping. JAXA’s collaboration with India’s ISRO on LUPEX further exemplifies the trend toward multinational mapping initiatives.

On the commercial front, ispace, Inc. has emerged as a leading private lunar exploration company. Headquartered in Japan with global subsidiaries, ispace is developing surface mapping technologies as part of its HAKUTO-R program, which includes lunar landers and rovers equipped with imaging and mapping payloads. These efforts are designed to support both scientific and commercial objectives, such as resource identification and site characterization for future lunar industry.

Other notable contributors include Astrobotic Technology, Inc. and Intuitive Machines, LLC, both U.S.-based companies selected by NASA for CLPS missions. Their landers are equipped with advanced mapping instruments, including lidar, stereo cameras, and spectrometers, to generate detailed surface maps and support navigation and hazard avoidance.

Looking ahead, the next few years will see increased data sharing and interoperability among these major players, with a focus on open standards and collaborative mapping platforms. This trend is expected to accelerate the development of comprehensive, high-fidelity lunar and planetary surface maps, underpinning the next phase of exploration and commercial activity.

Core Technologies: LIDAR, Hyperspectral Imaging, and AI-Driven Mapping

Lunar and planetary surface mapping technologies are advancing rapidly, driven by renewed global interest in Moon and Mars exploration. As of 2025, three core technologies—LIDAR (Light Detection and Ranging), hyperspectral imaging, and AI-driven mapping—are at the forefront of this progress, enabling unprecedented detail and accuracy in surface characterization.

LIDAR systems have become a cornerstone for topographic mapping of extraterrestrial surfaces. These systems emit laser pulses and measure their return times to generate high-resolution 3D models of terrain. For instance, the National Aeronautics and Space Administration (NASA) has integrated LIDAR on several missions, including the Lunar Reconnaissance Orbiter (LRO), which continues to provide detailed lunar elevation data. Looking ahead, LIDAR payloads are planned for upcoming lunar landers and rovers, such as those developed by European Space Agency (ESA) and commercial partners, to support landing site selection and hazard avoidance.

Hyperspectral imaging, which captures data across hundreds of spectral bands, is revolutionizing the identification of minerals, volatiles, and surface composition. The Indian Space Research Organisation (ISRO) has demonstrated the power of this technology with its Chandrayaan-2 orbiter, mapping lunar surface mineralogy in fine detail. In the coming years, hyperspectral imagers are slated for deployment on both lunar and Martian missions, including those by Japan Aerospace Exploration Agency (JAXA) and private sector entrants, to support in-situ resource utilization (ISRU) and scientific discovery.

Artificial intelligence (AI) and machine learning are increasingly integral to processing the vast datasets generated by LIDAR and hyperspectral sensors. AI-driven mapping algorithms can autonomously classify terrain, detect geological features, and optimize navigation for robotic explorers. NASA and ESA are actively developing onboard AI systems for real-time data analysis, reducing reliance on Earth-based processing and enabling faster decision-making during surface operations. In parallel, companies such as Maxar Technologies are leveraging AI to enhance planetary mapping products for both government and commercial customers.

Looking to the next few years, the integration of LIDAR, hyperspectral imaging, and AI will underpin a new era of high-fidelity lunar and planetary surface maps. These advances will not only support scientific exploration but also lay the groundwork for sustainable human and robotic presence beyond Earth.

Market Size, Segmentation, and 2025–2030 Growth Forecast (18% CAGR)

The market for lunar and planetary surface mapping technologies is poised for robust expansion, with a projected compound annual growth rate (CAGR) of approximately 18% from 2025 to 2030. This growth is driven by a surge in lunar and planetary missions, increased public and private investment, and the maturation of advanced remote sensing and mapping instruments. The market encompasses a range of technologies, including high-resolution optical and radar imaging systems, LiDAR, hyperspectral sensors, and data processing software, all tailored for extraterrestrial surface characterization.

Key market segments include government space agencies, commercial space companies, and research institutions. Governmental organizations such as NASA, European Space Agency (ESA), and Indian Space Research Organisation (ISRO) remain primary drivers, commissioning mapping payloads for flagship missions like NASA’s Artemis program and ESA’s Lunar Pathfinder. These agencies are increasingly collaborating with private sector partners to accelerate technology development and deployment.

On the commercial side, companies such as Maxar Technologies and Planet Labs PBC—both established leaders in Earth observation—are leveraging their expertise to develop mapping solutions for lunar and planetary applications. Maxar, for instance, is supplying critical imaging and robotic systems for NASA’s lunar Gateway and surface missions. Meanwhile, Astrobotic Technology and ispace, inc. are developing landers and rovers equipped with advanced mapping payloads, targeting both scientific and commercial resource prospecting.

Technological segmentation is also notable. Optical imaging remains dominant for high-resolution surface mapping, but synthetic aperture radar (SAR) and LiDAR are gaining traction for their ability to penetrate regolith and provide topographic data in low-light or shadowed regions. Hyperspectral imaging is increasingly used for mineralogical analysis, supporting in-situ resource utilization (ISRU) initiatives. Software platforms for data fusion, 3D modeling, and real-time analytics are becoming integral, with companies like Hexagon AB and Esri adapting their geospatial solutions for extraterrestrial datasets.

Looking ahead to 2030, the market outlook is buoyed by planned lunar surface missions from both national agencies and commercial ventures, Mars sample return initiatives, and the anticipated growth of lunar infrastructure projects. The entry of new players and the expansion of public-private partnerships are expected to further diversify the market, while ongoing advancements in sensor miniaturization, autonomy, and AI-driven analytics will continue to enhance mapping capabilities and drive adoption across the sector.

Emerging Applications: Resource Prospecting, Navigation, and Habitat Planning

Lunar and planetary surface mapping technologies are rapidly advancing, driven by renewed international interest in Moon and Mars exploration. In 2025 and the coming years, these technologies are set to play a pivotal role in emerging applications such as resource prospecting, autonomous navigation, and habitat planning for both robotic and human missions.

A key trend is the deployment of high-resolution imaging and remote sensing instruments aboard orbiters, landers, and rovers. For example, NASA’s Lunar Reconnaissance Orbiter (LRO) continues to provide detailed topographic and mineralogical maps of the Moon, supporting site selection for Artemis missions and commercial landers. The LRO’s Lunar Orbiter Laser Altimeter (LOLA) and Narrow Angle Camera (NAC) are instrumental in identifying potential landing zones, mapping surface hazards, and locating resources such as water ice in permanently shadowed regions.

On the commercial front, companies like Astrobotic Technology and ispace are developing precision landing and navigation systems that rely on real-time terrain mapping. These systems use lidar, stereo cameras, and machine vision to autonomously guide landers and rovers, enabling safe landings and efficient surface operations. Astrobotic’s Peregrine and Griffin landers, for instance, are equipped with advanced navigation payloads to support NASA’s Commercial Lunar Payload Services (CLPS) program.

Resource prospecting is another major application. Instruments such as ground-penetrating radar (GPR), multispectral imagers, and neutron spectrometers are being integrated into upcoming missions to detect subsurface volatiles and minerals. Japan Aerospace Exploration Agency (JAXA)’s Smart Lander for Investigating Moon (SLIM) and European Space Agency (ESA)’s PROSPECT package (set to fly on Russia’s Luna-27) exemplify international efforts to map lunar resources with unprecedented detail.

For habitat planning, surface mapping data is essential for evaluating terrain stability, radiation exposure, and resource accessibility. Lockheed Martin and Northrop Grumman are leveraging these datasets to design lunar habitats and mobility systems, ensuring they are optimally located and protected. Additionally, Maxar Technologies is providing high-resolution satellite imagery and 3D mapping services to support mission planning and surface operations.

Looking ahead, the integration of AI-driven analytics and real-time data fusion from multiple platforms will further enhance the accuracy and utility of surface maps. These advancements will underpin the next generation of lunar and planetary exploration, enabling sustainable resource utilization, autonomous navigation, and the safe establishment of off-world habitats.

Challenges: Data Transmission, Surface Hazards, and Environmental Factors

Lunar and planetary surface mapping technologies are advancing rapidly, but several significant challenges persist as missions intensify in 2025 and beyond. Chief among these are data transmission limitations, surface hazards, and harsh environmental factors that impact both robotic and crewed exploration.

Data Transmission: The vast distances between Earth and other celestial bodies create substantial bottlenecks in data transmission. High-resolution mapping instruments, such as synthetic aperture radar (SAR), LiDAR, and multispectral imagers, generate enormous volumes of data. Transmitting this data back to Earth is constrained by limited bandwidth, power availability, and the need for robust error correction. For example, the National Aeronautics and Space Administration (NASA) Artemis program, which is deploying advanced mapping payloads on the lunar surface, relies on the Deep Space Network (DSN) for communications. However, the DSN’s capacity is shared among multiple missions, necessitating prioritization and data compression strategies. To address these issues, companies like Lockheed Martin and Northrop Grumman are developing next-generation relay satellites and optical communication systems to increase data throughput for upcoming lunar and Martian missions.

Surface Hazards: The rugged and unpredictable terrain of the Moon and Mars presents significant risks to mapping technologies. Dust, regolith, and sharp rocks can damage sensitive sensors and impede rover mobility. For instance, the lunar regolith’s abrasive nature can degrade optical components and mechanical systems. To mitigate these risks, Boeing and Airbus are engineering robust lander and rover platforms with enhanced dust protection and autonomous hazard avoidance capabilities. These systems integrate real-time mapping data to navigate and adapt to surface conditions, reducing the likelihood of mission failure due to environmental hazards.

Environmental Factors: Extreme temperature fluctuations, radiation, and low gravity environments further complicate surface mapping. Electronics and sensors must be shielded against radiation and designed to operate in cryogenic conditions. Thales Group and Honeywell are supplying radiation-hardened avionics and thermal management solutions for lunar and planetary missions. These technologies are critical for ensuring the longevity and reliability of mapping instruments during extended surface operations.

Looking ahead, the integration of artificial intelligence for onboard data processing, the deployment of dedicated communication relays, and the development of more resilient hardware are expected to address many of these challenges. As international and commercial lunar and planetary missions proliferate through the late 2020s, overcoming these obstacles will be essential for the success of high-fidelity surface mapping and, ultimately, for enabling sustained exploration and resource utilization.

Regulatory Landscape and International Standards (e.g., COSPAR, NASA.gov)

The regulatory landscape and international standards governing lunar and planetary surface mapping technologies are rapidly evolving as space exploration intensifies in 2025 and beyond. The increasing number of missions from governmental and commercial entities has prompted a renewed focus on harmonizing technical standards, data sharing protocols, and planetary protection guidelines.

A central player in this domain is the Committee on Space Research (COSPAR), which sets internationally recognized planetary protection policies. COSPAR’s guidelines are critical for missions involving surface mapping, as they define contamination control measures and data handling requirements to preserve scientific integrity and prevent biological contamination of celestial bodies. In 2024, COSPAR updated its policy framework to address the surge in lunar and Martian surface mapping missions, emphasizing open data standards and interoperability among mapping technologies.

In the United States, NASA plays a dual role as both a regulator and a technology leader. NASA’s Artemis program, which includes the Lunar Reconnaissance Orbiter and upcoming robotic landers, adheres to strict internal and international standards for surface mapping data. NASA’s Planetary Data System (PDS) sets the benchmark for data formatting, archiving, and accessibility, and is widely adopted by international partners. The agency is also collaborating with commercial partners under the Commercial Lunar Payload Services (CLPS) initiative, requiring compliance with NASA and COSPAR standards for all mapping payloads.

Internationally, the European Space Agency (ESA) and Japan Aerospace Exploration Agency (JAXA) are actively involved in developing interoperable mapping technologies and data standards. ESA’s involvement in the Lunar Pathfinder and future Mars missions includes adherence to COSPAR planetary protection protocols and the adoption of open data standards compatible with NASA’s PDS. JAXA’s Smart Lander for Investigating Moon (SLIM) mission, launched in 2023, is contributing high-resolution surface data under these frameworks.

The private sector is also increasingly subject to regulatory oversight. Companies such as Lockheed Martin, ispace, and Astrobotic Technology are required to comply with both national regulations and international standards when deploying mapping technologies on lunar and planetary surfaces. These companies often participate in international working groups to ensure their systems are compatible with global data-sharing and planetary protection requirements.

Looking ahead, the regulatory environment is expected to become more robust, with ongoing efforts to update COSPAR guidelines and harmonize standards across agencies and commercial actors. The focus will remain on ensuring scientific integrity, data interoperability, and responsible exploration as lunar and planetary surface mapping technologies proliferate in the coming years.

Investment Trends and Funding Initiatives (2025–2030)

The period from 2025 onward is poised to witness significant investment and funding momentum in lunar and planetary surface mapping technologies, driven by renewed global interest in lunar exploration, commercial lunar payload services, and Mars mission planning. Governmental space agencies, private sector leaders, and international consortia are all channeling resources into advanced mapping systems, high-resolution sensors, and autonomous data processing platforms.

A major catalyst is the ongoing NASA Artemis program, which is not only funding its own lunar surface mapping initiatives but also supporting commercial partners through the Commercial Lunar Payload Services (CLPS) program. This has led to contracts and grants for companies developing next-generation lidar, radar, and optical imaging payloads. For example, Lockheed Martin and Northrop Grumman are both investing in mapping technologies as part of their lunar lander and rover development efforts, with a focus on real-time terrain analysis and hazard detection.

On the international front, European Space Agency (ESA) is expanding its funding for lunar and planetary mapping through the Terrae Novae program, supporting both in-house projects and collaborations with European industry. ESA’s investments are directed at hyperspectral imaging, synthetic aperture radar, and AI-driven data fusion, with contracts awarded to companies such as Airbus and Thales Group for sensor development and mission integration.

Private investment is also accelerating, with venture capital and strategic corporate funding flowing into startups and scale-ups specializing in surface mapping. Astrobotic Technology and ispace have both secured multi-million dollar rounds to advance their mapping payloads and data services, targeting not only government contracts but also commercial customers in mining, construction, and resource prospecting on the Moon and Mars.

Looking ahead to 2030, the outlook is for continued growth, with new funding mechanisms emerging such as public-private partnerships, lunar infrastructure investment funds, and international consortia pooling resources for shared mapping platforms. The proliferation of small, affordable landers and orbiters—enabled by companies like Firefly Aerospace—is expected to further democratize access to high-resolution surface data, spurring innovation and competition across the sector.

Future Outlook: Next-Gen Mapping, Autonomous Systems, and Commercial Opportunities

The landscape of lunar and planetary surface mapping technologies is poised for significant transformation in 2025 and the years immediately following, driven by a convergence of advanced sensors, autonomous systems, and expanding commercial ambitions. As international and private sector lunar missions accelerate, the demand for high-resolution, real-time surface data is reshaping both the technical and business outlook of this sector.

A key trend is the integration of next-generation Light Detection and Ranging (LiDAR), hyperspectral imaging, and synthetic aperture radar (SAR) systems into both orbiters and landers. These technologies enable the creation of detailed topographic and compositional maps, essential for navigation, resource identification, and mission planning. For example, NASA’s Artemis program is deploying advanced mapping payloads on its CLPS (Commercial Lunar Payload Services) landers, with partners such as Intuitive Machines and Astrobotic Technology contributing landers equipped with precision mapping instruments. These missions are expected to deliver unprecedented surface data from the lunar south pole and other scientifically significant regions.

Autonomous mapping systems are also advancing rapidly. Rovers and landers are increasingly equipped with onboard AI and machine learning algorithms, enabling them to process sensor data in real time, adapt to unexpected terrain, and optimize their exploration routes without constant ground control intervention. ispace, a Japanese lunar exploration company, is developing autonomous navigation and mapping solutions for its upcoming missions, aiming to support both scientific and commercial activities such as in-situ resource utilization (ISRU).

Commercial opportunities are expanding as surface mapping becomes foundational for lunar infrastructure development, mining, and logistics. Companies like Lockheed Martin and Airbus are investing in modular mapping payloads and data services, anticipating demand from both governmental and private lunar ventures. The emergence of data-as-a-service models, where high-resolution lunar surface data is sold or licensed to customers, is expected to create new revenue streams and lower entry barriers for smaller players.

Looking ahead, the next few years will likely see the deployment of swarms of small, cooperative mapping robots, further enhancing coverage and redundancy. The integration of quantum sensors and miniaturized, radiation-hardened electronics promises even greater mapping fidelity and operational resilience. As lunar and planetary surface mapping technologies mature, they will underpin not only exploration but also the commercialization and eventual settlement of extraterrestrial environments.

Sources & References

- NASA

- European Space Agency

- Japan Aerospace Exploration Agency

- Maxar Technologies

- ispace, inc.

- Astrobotic Technology

- Lockheed Martin

- Northrop Grumman

- Bosch

- Teledyne Technologies

- ispace, Inc.

- Indian Space Research Organisation (ISRO)

- Planet Labs PBC

- Hexagon AB

- Esri

- Boeing

- Airbus

- Thales Group

- Honeywell

- Committee on Space Research (COSPAR)

- NASA

- European Space Agency (ESA)

- Lockheed Martin

- Astrobotic Technology