Quantum Random Number Generation Industry Report 2025: Market Growth, Technology Innovations, and Strategic Insights for the Next 5 Years

- Executive Summary & Market Overview

- Key Technology Trends in Quantum Random Number Generation

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Opportunities

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

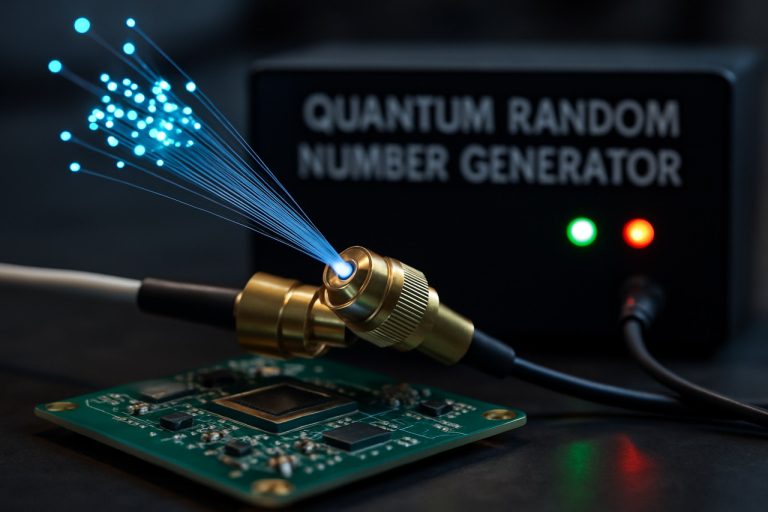

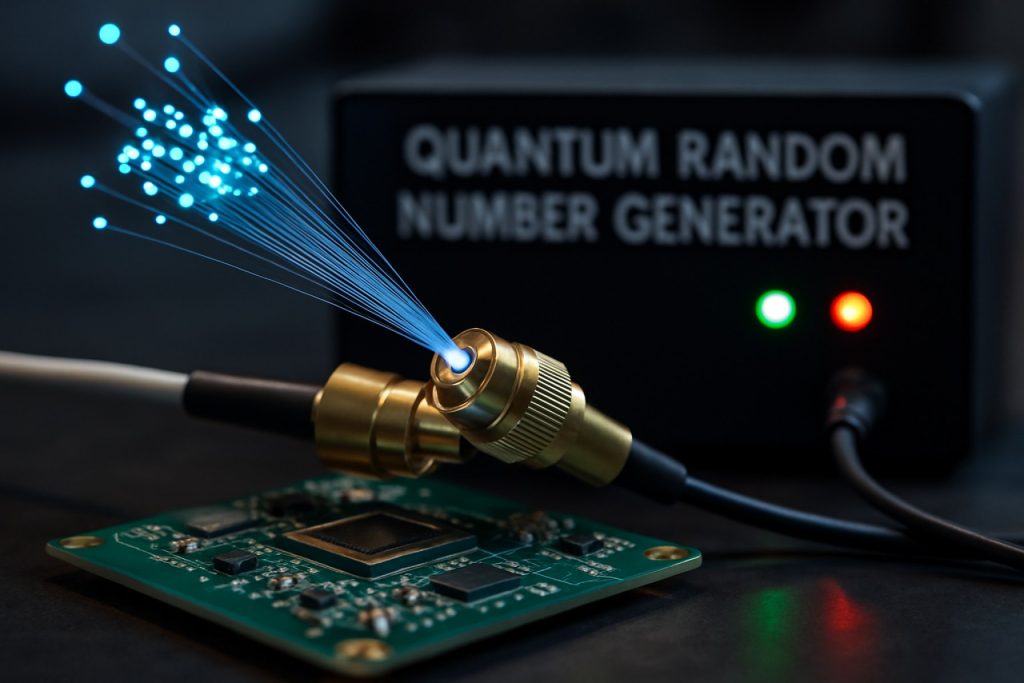

Quantum Random Number Generation (QRNG) leverages the inherent unpredictability of quantum mechanics to produce truly random numbers, a critical resource for cryptography, secure communications, and high-performance computing. Unlike classical random number generators, which rely on deterministic algorithms or physical processes susceptible to bias, QRNGs exploit quantum phenomena such as photon polarization or electron spin, ensuring randomness that is fundamentally irreproducible and immune to prediction.

The global QRNG market is poised for robust growth in 2025, driven by escalating cybersecurity threats, the proliferation of quantum computing research, and increasing regulatory emphasis on data privacy. According to International Data Corporation (IDC), the quantum technology sector—including QRNG—is expected to surpass $2 billion in annual revenue by 2026, with QRNG solutions representing a significant and rapidly expanding segment.

Key industry players such as ID Quantique, Qutools, and Quantinuum are accelerating innovation, offering both hardware and cloud-based QRNG services. These solutions are increasingly integrated into financial services, government defense systems, and next-generation telecommunications infrastructure, where the demand for unbreakable encryption is paramount. For instance, ID Quantique has partnered with major telecom operators to deploy QRNG-enhanced encryption in 5G networks, while Quantinuum is advancing cloud-accessible QRNG APIs for enterprise applications.

Geographically, North America and Europe lead in QRNG adoption, supported by strong R&D ecosystems and government-backed quantum initiatives. However, Asia-Pacific is emerging as a high-growth region, with countries like China and Japan investing heavily in quantum-safe infrastructure and indigenous QRNG development (Mordor Intelligence).

Despite its promise, the QRNG market faces challenges, including high initial costs, integration complexity, and the need for standardized certification protocols. Nevertheless, ongoing advancements in miniaturization, chip-based QRNGs, and cloud delivery models are expected to lower barriers to entry and broaden market accessibility in 2025 and beyond.

In summary, QRNG stands at the forefront of quantum-secure technology, with 2025 marking a pivotal year for commercialization, cross-industry adoption, and global market expansion.

Key Technology Trends in Quantum Random Number Generation

Quantum Random Number Generation (QRNG) leverages the inherent unpredictability of quantum phenomena to produce true random numbers, a critical resource for cryptography, secure communications, and high-stakes simulations. As of 2025, the QRNG landscape is shaped by several key technology trends that are accelerating both the performance and adoption of these systems.

- Integration with Photonic Chips: The miniaturization and integration of QRNGs onto photonic chips is a major trend, enabling compact, energy-efficient, and scalable solutions. Companies such as ID Quantique and Toshiba Corporation have demonstrated on-chip QRNGs that can be embedded directly into consumer electronics and IoT devices, paving the way for mass-market adoption.

- Cloud-Based QRNG Services: The rise of quantum-safe cloud services is driving demand for remote, on-demand access to quantum-generated randomness. Providers like Amazon Web Services and Google Cloud are piloting QRNG-as-a-service, allowing enterprises to integrate quantum randomness into cryptographic operations without investing in dedicated hardware.

- Enhanced Certification and Standardization: As QRNGs become critical for security infrastructure, there is a push for rigorous certification and standardization. Organizations such as the National Institute of Standards and Technology (NIST) are developing frameworks to evaluate the entropy, reliability, and security of quantum random number sources, ensuring trustworthiness for government and enterprise use.

- Hybrid Quantum-Classical RNGs: To address scalability and cost, hybrid systems that combine quantum entropy sources with classical post-processing are gaining traction. These systems, championed by firms like Quantinuum, offer high throughput and robust randomness, making them suitable for large-scale cryptographic applications.

- Advances in Quantum Entropy Sources: Research is expanding beyond traditional photon-based QRNGs to include electron spin, vacuum fluctuations, and other quantum phenomena. This diversification, highlighted in recent studies by Nature Quantum Information, is broadening the range of physical implementations and improving resilience against environmental noise.

These trends collectively signal a maturing QRNG market, with technology moving from laboratory prototypes to robust, standardized, and widely accessible solutions across industries in 2025.

Competitive Landscape and Leading Players

The competitive landscape of the quantum random number generation (QRNG) market in 2025 is characterized by a mix of established quantum technology firms, specialized startups, and collaborations with major semiconductor and cybersecurity companies. The market is driven by the increasing demand for high-quality randomness in cryptographic applications, secure communications, and emerging quantum computing environments.

Leading players in the QRNG sector include ID Quantique, widely recognized as a pioneer in commercial quantum random number generators. The company’s QRNG products are integrated into a variety of security solutions, including mobile devices and cloud platforms. QuantumCTek, based in China, has also established a strong presence, leveraging its expertise in quantum communication to deliver QRNG modules for government and enterprise clients.

Another significant player is Qutools, which focuses on compact and cost-effective QRNG devices for research and industrial applications. In the United States, Quantinuum (a merger of Honeywell Quantum Solutions and Cambridge Quantum) is advancing integrated quantum security solutions, including QRNG, for both classical and quantum networks.

Startups such as QuintessenceLabs and Random Quantum are gaining traction by offering cloud-based QRNG services and plug-and-play hardware modules, targeting fintech, IoT, and data center markets. These companies often emphasize compliance with international standards and certifications, which is increasingly important for enterprise adoption.

Strategic partnerships are shaping the competitive dynamics. For example, Toshiba has collaborated with telecom operators to integrate QRNG into secure network infrastructure, while Infineon Technologies is working with quantum startups to embed QRNG in next-generation security chips.

- Market leaders are investing in miniaturization and integration of QRNG into consumer electronics.

- There is a trend toward cloud-based QRNG services, enabling scalable and on-demand access to quantum randomness.

- Regulatory compliance and certification (e.g., NIST, ETSI) are becoming key differentiators among vendors.

Overall, the QRNG market in 2025 is marked by rapid innovation, cross-industry partnerships, and a growing emphasis on standardization, as leading players position themselves to address the expanding need for quantum-secure randomness in a digital-first world.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The quantum random number generation (QRNG) market is poised for robust expansion between 2025 and 2030, driven by escalating demand for high-security cryptographic solutions and the proliferation of quantum technologies across sectors. According to projections from MarketsandMarkets, the global QRNG market is expected to achieve a compound annual growth rate (CAGR) of approximately 35% during this period. This rapid growth is underpinned by increasing adoption in financial services, government, and telecommunications, where the need for truly unpredictable random numbers is critical for secure data encryption and authentication.

Revenue forecasts indicate that the QRNG market, valued at around USD 150 million in 2025, could surpass USD 700 million by 2030. This surge is attributed to both the maturation of quantum hardware and the integration of QRNG modules into cloud-based security services and consumer electronics. Notably, leading industry players such as ID Quantique and Quantinuum are expanding their product portfolios and forging strategic partnerships to accelerate market penetration and address diverse application needs.

In terms of volume, the shipment of QRNG devices is projected to grow from approximately 50,000 units in 2025 to over 300,000 units by 2030, reflecting both enterprise and consumer adoption. The Asia-Pacific region is anticipated to exhibit the highest growth rate, fueled by government investments in quantum infrastructure and cybersecurity initiatives, particularly in China, Japan, and South Korea. Meanwhile, North America and Europe are expected to maintain steady demand, driven by regulatory compliance requirements and the presence of established quantum technology ecosystems.

Key market drivers include the increasing sophistication of cyber threats, the limitations of classical random number generators, and the ongoing standardization efforts by organizations such as the National Institute of Standards and Technology (NIST). As quantum computing advances, the urgency for quantum-safe cryptographic primitives—of which QRNG is a foundational component—will further catalyze market growth. Overall, the 2025–2030 period is set to witness significant revenue and volume expansion, positioning QRNG as a cornerstone technology in the evolving landscape of digital security.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for Quantum Random Number Generation (QRNG) is experiencing robust growth, with regional dynamics shaped by technological adoption, regulatory frameworks, and investment in quantum technologies. In 2025, North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each present distinct opportunities and challenges for QRNG deployment and commercialization.

- North America: The region leads the QRNG market, driven by significant investments in quantum research and cybersecurity. The United States, in particular, benefits from strong government support, with agencies such as the National Institute of Standards and Technology (NIST) setting standards for quantum-safe cryptography. Major technology firms and startups are actively integrating QRNG into cloud services and secure communications. The presence of leading quantum hardware manufacturers and a mature digital infrastructure further accelerates adoption.

- Europe: Europe is characterized by a collaborative approach, with the European Commission funding large-scale quantum initiatives and cross-border projects. Countries like Germany, the Netherlands, and the UK are at the forefront, leveraging QRNG for secure government communications and financial services. The region’s emphasis on data privacy and compliance with regulations such as GDPR is fostering demand for quantum-secure solutions, including QRNG-based encryption.

- Asia-Pacific: Rapid technological advancement and government-backed quantum programs are propelling QRNG adoption in Asia-Pacific. China, Japan, and South Korea are investing heavily in quantum communication networks, with QRNG playing a critical role in securing data transmission. According to International Data Corporation (IDC), the region is expected to witness the fastest QRNG market growth through 2025, driven by the expansion of 5G, IoT, and financial technology sectors.

- Rest of World (RoW): While adoption is nascent, countries in the Middle East and Latin America are exploring QRNG for critical infrastructure protection and secure digital transformation. Initiatives by organizations such as the International Telecommunication Union (ITU) are raising awareness and facilitating knowledge transfer, laying the groundwork for future market expansion.

Overall, regional market dynamics in 2025 reflect a convergence of technological readiness, regulatory impetus, and strategic investment, positioning QRNG as a foundational technology for next-generation cybersecurity and data integrity across the globe.

Future Outlook: Emerging Applications and Investment Opportunities

The future outlook for Quantum Random Number Generation (QRNG) in 2025 is marked by accelerating adoption across diverse sectors and a surge in investment activity. As quantum technologies mature, QRNG is increasingly recognized as a foundational enabler for next-generation security, high-performance computing, and advanced simulation applications. The unique ability of QRNG to deliver truly unpredictable randomness—rooted in quantum mechanical phenomena—positions it as a critical component in the evolving landscape of cybersecurity and data integrity.

Emerging applications are particularly prominent in the financial services and telecommunications sectors. Financial institutions are exploring QRNG to enhance cryptographic protocols, secure transactions, and protect sensitive data against both classical and quantum-enabled cyber threats. Similarly, telecom operators are piloting QRNG-based solutions to secure 5G and future 6G networks, where the stakes for data privacy and integrity are exceptionally high. The integration of QRNG into hardware security modules and cloud-based key management services is also gaining traction, with companies such as ID Quantique and Quantinuum leading commercial deployments.

Beyond security, QRNG is finding new roles in scientific research, gaming, and the Internet of Things (IoT). In scientific computing, QRNG is used to generate unbiased random numbers for Monte Carlo simulations and complex modeling tasks, improving the reliability of results in fields such as pharmaceuticals and climate science. The gaming industry is leveraging QRNG to ensure fairness and unpredictability in online gaming environments, while IoT device manufacturers are embedding QRNG chips to secure device-to-device communications.

Investment opportunities in the QRNG market are expanding rapidly. According to MarketsandMarkets, the global quantum cryptography market—which includes QRNG—is projected to grow at a CAGR exceeding 30% through 2025, driven by rising demand for quantum-safe security solutions. Venture capital and corporate investments are flowing into startups and established players alike, with governments in the US, Europe, and Asia-Pacific launching dedicated quantum technology funding programs. Notably, the European Union’s Quantum Flagship initiative and the US National Quantum Initiative are catalyzing research and commercialization efforts.

In summary, 2025 is poised to be a pivotal year for QRNG, with expanding real-world applications and robust investment activity signaling a maturing market. Stakeholders across industries are advised to monitor technological advancements and regulatory developments to capitalize on emerging opportunities in this dynamic field.

Challenges, Risks, and Strategic Opportunities

Quantum Random Number Generation (QRNG) is poised to revolutionize cryptography and secure communications, but its path to widespread adoption in 2025 is marked by significant challenges, risks, and strategic opportunities. One of the primary challenges is the integration of QRNG hardware into existing digital infrastructure. Many current systems are not designed to accommodate quantum devices, necessitating costly upgrades or the development of hybrid solutions. Additionally, the miniaturization and cost reduction of QRNG modules remain technical hurdles, as most commercially available devices are still relatively expensive and bulky compared to classical random number generators (ID Quantique).

Another risk is the lack of universally accepted standards for QRNG performance and certification. Without clear benchmarks, it is difficult for end-users to assess the quality and security of quantum-generated randomness, potentially slowing adoption in critical sectors such as finance and government. Regulatory uncertainty further complicates the landscape, as different jurisdictions may impose varying requirements for cryptographic hardware (European Union Agency for Cybersecurity (ENISA)).

From a strategic perspective, the growing threat of quantum computing to classical encryption methods is creating a unique opportunity for QRNG providers. As organizations seek to future-proof their security infrastructure, demand for quantum-safe solutions is expected to rise sharply. This is particularly relevant in sectors handling sensitive data, such as banking, defense, and healthcare (Gartner). Strategic partnerships between QRNG developers and established cybersecurity firms can accelerate market penetration and foster trust among potential customers.

- Challenge: High production costs and technical complexity of QRNG hardware.

- Risk: Absence of standardized certification and regulatory frameworks.

- Opportunity: Rising demand for quantum-safe cryptography in anticipation of quantum computing threats.

- Opportunity: Collaboration with major cloud and telecom providers to embed QRNG in large-scale networks (Toshiba).

In summary, while QRNG faces notable obstacles in 2025, the convergence of regulatory developments, technological advancements, and heightened cybersecurity awareness presents substantial opportunities for market growth and innovation.

Sources & References

- International Data Corporation (IDC)

- ID Quantique

- Qutools

- Quantinuum

- Mordor Intelligence

- Toshiba Corporation

- Amazon Web Services

- Google Cloud

- National Institute of Standards and Technology (NIST)

- Nature Quantum Information

- QuantumCTek

- QuintessenceLabs

- Random Quantum

- Infineon Technologies

- MarketsandMarkets

- National Institute of Standards and Technology (NIST)

- European Commission

- International Telecommunication Union (ITU)

- European Union Agency for Cybersecurity (ENISA)