2025 Machine Vision Inspection Systems Market Report: Unveiling AI Innovations, Market Dynamics, and Global Growth Projections. Explore Key Trends, Competitive Analysis, and Strategic Opportunities Shaping the Industry.

- Executive Summary & Market Overview

- Key Technology Trends in Machine Vision Inspection Systems

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

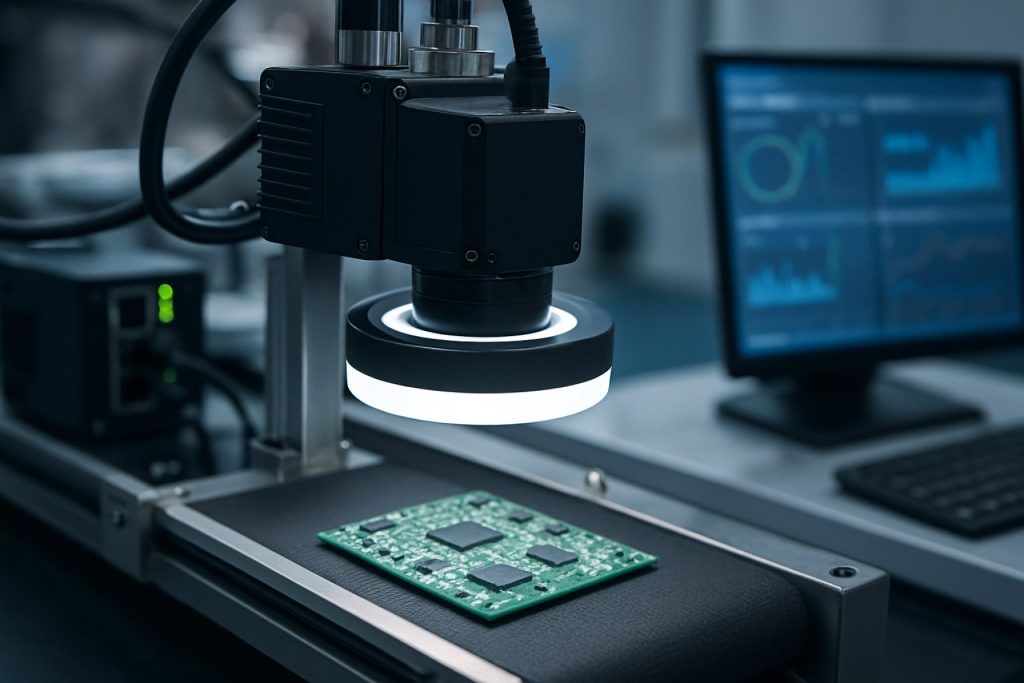

Machine vision inspection systems are advanced technologies that enable automated visual inspection, measurement, and analysis of products and processes in industrial environments. These systems integrate cameras, sensors, lighting, and software algorithms to detect defects, ensure quality, and optimize manufacturing efficiency. As of 2025, the global machine vision inspection systems market is experiencing robust growth, driven by increasing automation across industries such as automotive, electronics, pharmaceuticals, food & beverage, and packaging.

According to MarketsandMarkets, the global machine vision market is projected to reach USD 18.5 billion by 2025, growing at a CAGR of approximately 7.1% from 2020. This expansion is fueled by the rising demand for quality assurance, the need to reduce human error, and the adoption of Industry 4.0 practices. The integration of artificial intelligence (AI) and deep learning into machine vision systems is further enhancing their capabilities, enabling more complex and accurate inspections.

Regionally, Asia-Pacific dominates the market, accounting for the largest share due to the concentration of manufacturing hubs in China, Japan, South Korea, and Taiwan. The region’s rapid industrialization and investments in smart factories are key growth drivers. North America and Europe also represent significant markets, propelled by technological advancements and stringent regulatory standards for product quality and safety.

Key industry players such as KEYENCE CORPORATION, Cognex Corporation, OMRON Corporation, and SICK AG are continuously innovating, offering solutions with higher resolution, faster processing speeds, and improved user interfaces. These companies are also focusing on expanding their product portfolios to cater to diverse application needs, from surface inspection and assembly verification to barcode reading and robotic guidance.

- Automotive: Adoption of machine vision for defect detection, assembly verification, and safety compliance.

- Electronics: Use in PCB inspection, component alignment, and micro-defect identification.

- Pharmaceuticals: Ensuring packaging integrity, label verification, and contamination detection.

- Food & Beverage: Monitoring packaging, fill levels, and product consistency.

In summary, the machine vision inspection systems market in 2025 is characterized by technological innovation, expanding applications, and a strong push towards automation and quality control across multiple industries. The market’s trajectory is set to continue upward as manufacturers seek greater efficiency, accuracy, and compliance in their operations.

Key Technology Trends in Machine Vision Inspection Systems

Machine vision inspection systems are undergoing rapid technological transformation, driven by advances in artificial intelligence (AI), sensor technology, and edge computing. As of 2025, several key technology trends are shaping the evolution and adoption of these systems across manufacturing, logistics, and quality assurance sectors.

- AI-Powered Deep Learning: The integration of deep learning algorithms has significantly enhanced the accuracy and flexibility of machine vision inspection systems. Unlike traditional rule-based approaches, deep learning enables systems to identify complex patterns, subtle defects, and variations in products with minimal human intervention. This trend is particularly prominent in industries such as electronics and automotive, where defect types are diverse and often unpredictable. According to ABB, deep learning-based vision systems are reducing false positives and improving throughput in high-speed production lines.

- High-Resolution and Multispectral Imaging: The adoption of high-resolution cameras and multispectral imaging technologies is enabling the detection of minute defects and material inconsistencies that were previously undetectable. Multispectral and hyperspectral imaging allow for the inspection of features beyond the visible spectrum, such as moisture content or chemical composition, which is critical in food and pharmaceutical industries. Basler AG reports a surge in demand for cameras capable of capturing detailed images at high frame rates, supporting real-time inspection.

- Edge Computing and Real-Time Analytics: The deployment of edge computing is reducing latency and bandwidth requirements by processing image data locally, close to the source. This enables real-time decision-making and immediate feedback on production lines, which is essential for high-speed manufacturing environments. Cognex Corporation highlights that edge-enabled vision systems are increasingly being adopted to support Industry 4.0 initiatives and smart factory architectures.

- Cloud Integration and Data Connectivity: Cloud-based platforms are facilitating centralized data storage, remote monitoring, and advanced analytics. This connectivity allows manufacturers to aggregate inspection data from multiple sites, enabling predictive maintenance and continuous process optimization. Rockwell Automation notes that cloud integration is becoming a standard feature in new machine vision deployments.

- Collaborative Robotics (Cobots): Machine vision systems are increasingly being integrated with collaborative robots to automate complex inspection tasks. This synergy enhances flexibility and scalability, particularly in small-batch and high-mix production environments, as reported by Universal Robots.

These technology trends are collectively driving the adoption of machine vision inspection systems, enabling higher quality standards, operational efficiency, and adaptability to evolving manufacturing requirements in 2025.

Competitive Landscape and Leading Players

The competitive landscape of the machine vision inspection systems market in 2025 is characterized by a mix of established multinational corporations and innovative niche players, each leveraging advancements in artificial intelligence, deep learning, and high-speed imaging to differentiate their offerings. The market is moderately consolidated, with a few key players commanding significant market share, while a long tail of specialized vendors addresses industry-specific requirements.

Leading the global market are companies such as Cognex Corporation, Keyence Corporation, and Omron Corporation. These firms have maintained their dominance through continuous investment in R&D, robust global distribution networks, and comprehensive product portfolios that cater to automotive, electronics, pharmaceuticals, food & beverage, and packaging industries. Cognex Corporation, for example, has expanded its deep learning-based vision systems, enabling more complex defect detection and quality assurance tasks, while Keyence Corporation is recognized for its user-friendly, high-speed vision sensors and controllers.

Other significant players include SICK AG, Basler AG, National Instruments Corporation, and Adept Technology, Inc.. These companies focus on modular, scalable solutions and often collaborate with automation integrators to deliver customized inspection systems. SICK AG and Basler AG are particularly strong in Europe, leveraging their expertise in industrial cameras and smart sensors.

The competitive environment is further intensified by the entry of technology giants and startups specializing in AI-driven vision analytics. Companies such as ABB Ltd. and Siemens AG are integrating machine vision with broader industrial automation and IoT platforms, offering end-to-end solutions for smart factories. Meanwhile, emerging players are targeting niche applications—such as surface inspection in semiconductors or real-time defect detection in food processing—by developing highly specialized algorithms and edge-computing devices.

Strategic partnerships, mergers, and acquisitions remain prevalent as companies seek to expand their technological capabilities and geographic reach. For instance, recent collaborations between vision system providers and robotics manufacturers are enabling more seamless integration of inspection and automation on production lines, a trend expected to accelerate through 2025 (MarketsandMarkets).

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The global market for machine vision inspection systems is poised for robust growth between 2025 and 2030, driven by accelerating automation across manufacturing, electronics, automotive, and food & beverage sectors. According to projections by MarketsandMarkets, the machine vision market is expected to register a compound annual growth rate (CAGR) of approximately 7.8% during this period. Revenue is forecasted to rise from an estimated $17.2 billion in 2025 to over $25 billion by 2030, reflecting both increased adoption and technological advancements.

Volume-wise, the number of machine vision inspection systems shipped globally is anticipated to grow in tandem with revenue, as industries increasingly integrate these solutions for quality assurance, defect detection, and process optimization. International Data Corporation (IDC) projects that annual unit shipments could surpass 1.5 million by 2030, up from just over 900,000 units in 2025. This surge is attributed to the proliferation of smart factories and the expansion of Industry 4.0 initiatives, particularly in Asia-Pacific and North America.

Key growth drivers include the rising demand for high-speed, high-precision inspection in semiconductor and electronics manufacturing, as well as stringent regulatory requirements in pharmaceuticals and food processing. The integration of artificial intelligence (AI) and deep learning algorithms is further enhancing the capabilities of machine vision systems, enabling more complex and adaptive inspection tasks. According to Gartner, the adoption of AI-powered vision solutions is expected to accelerate, contributing significantly to market expansion.

Regionally, Asia-Pacific is projected to maintain its dominance, accounting for over 40% of global revenue by 2030, fueled by large-scale investments in manufacturing automation in China, Japan, and South Korea. North America and Europe are also expected to witness steady growth, supported by ongoing digital transformation and the modernization of legacy production lines.

In summary, the 2025–2030 outlook for machine vision inspection systems is characterized by strong CAGR, rising revenues, and increasing shipment volumes, underpinned by technological innovation and expanding industrial automation worldwide.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for machine vision inspection systems is poised for robust growth in 2025, with distinct regional dynamics shaping adoption and innovation. The following analysis examines the market landscape across North America, Europe, Asia-Pacific, and the Rest of the World, highlighting key trends, drivers, and competitive factors in each region.

- North America: North America remains a mature and technologically advanced market for machine vision inspection systems, driven by strong demand from the automotive, electronics, and food & beverage sectors. The United States, in particular, is witnessing increased investments in smart manufacturing and Industry 4.0 initiatives, fostering the integration of AI-powered vision systems. According to Automation.com, the region’s focus on quality assurance and regulatory compliance is accelerating the adoption of advanced inspection solutions. Strategic partnerships between system integrators and technology providers are further enhancing market penetration.

- Europe: Europe’s machine vision market is characterized by a high degree of automation in manufacturing, especially in Germany, France, and the UK. The automotive and pharmaceutical industries are key adopters, leveraging machine vision for defect detection and traceability. The European Union’s emphasis on sustainability and product safety is prompting manufacturers to invest in sophisticated inspection technologies. As reported by VDMA, the region is also seeing a surge in R&D activities, with local players focusing on developing compact, energy-efficient vision systems.

- Asia-Pacific: Asia-Pacific is the fastest-growing market for machine vision inspection systems, led by China, Japan, South Korea, and Taiwan. The region’s rapid industrialization, expanding electronics manufacturing base, and government initiatives supporting smart factories are key growth drivers. According to Mordor Intelligence, China’s aggressive push towards automation and quality control in manufacturing is resulting in significant demand for machine vision solutions. Local vendors are increasingly offering cost-competitive products, intensifying market competition.

- Rest of the World: In regions such as Latin America, the Middle East, and Africa, adoption of machine vision inspection systems is at a nascent stage but gaining momentum. Growth is primarily driven by the food & beverage and packaging industries, where quality assurance is becoming a priority. According to MarketsandMarkets, increasing foreign direct investment in manufacturing and the gradual shift towards automation are expected to boost market growth in these regions through 2025.

Overall, while North America and Europe continue to lead in technological innovation, Asia-Pacific is emerging as the largest and most dynamic market, with the Rest of the World showing promising potential for future expansion.

Future Outlook: Emerging Applications and Investment Hotspots

Looking ahead to 2025, the future of machine vision inspection systems is shaped by rapid technological advancements and expanding application domains. The integration of artificial intelligence (AI) and deep learning algorithms is expected to significantly enhance the accuracy, speed, and adaptability of inspection systems, enabling them to handle more complex and variable tasks across industries. This evolution is particularly evident in sectors such as electronics, automotive, pharmaceuticals, and food & beverage, where stringent quality standards and the need for automation are driving adoption.

Emerging applications are set to transform traditional manufacturing and quality assurance processes. In electronics, machine vision is increasingly used for high-precision inspection of printed circuit boards (PCBs), microchips, and display panels, where defect detection at the micron level is critical. The automotive industry is leveraging advanced vision systems for real-time inspection of components, weld seams, and paint finishes, supporting the shift toward electric vehicles and autonomous driving technologies. In pharmaceuticals, machine vision ensures compliance with regulatory requirements by automating the inspection of packaging, labeling, and product integrity, reducing the risk of recalls and enhancing patient safety. The food & beverage sector is also witnessing a surge in adoption for tasks such as contaminant detection, packaging verification, and sorting, driven by consumer demand for quality and safety.

Investment hotspots are emerging in regions with strong manufacturing bases and robust digital infrastructure. Asia-Pacific, led by China, Japan, and South Korea, continues to dominate the market due to aggressive investments in smart factories and Industry 4.0 initiatives. North America and Europe are also key markets, with significant funding directed toward R&D and the integration of machine vision with robotics and industrial IoT platforms. According to MarketsandMarkets, the global machine vision market is projected to reach USD 18.5 billion by 2025, with double-digit growth rates in emerging economies.

- AI-powered inspection for predictive maintenance and process optimization

- Edge computing for real-time, on-device analysis and reduced latency

- Cloud-based vision solutions enabling remote monitoring and analytics

- Integration with collaborative robots (cobots) for flexible automation

As machine vision inspection systems become more intelligent and accessible, investment is expected to flow into startups and established players developing specialized solutions for niche applications, such as medical device inspection, battery manufacturing, and renewable energy components. The convergence of vision technology with AI, IoT, and robotics will continue to unlock new value propositions, making 2025 a pivotal year for both innovation and market expansion in this sector.

Challenges, Risks, and Strategic Opportunities

Machine vision inspection systems are increasingly integral to modern manufacturing, but their adoption and scaling in 2025 present a complex landscape of challenges, risks, and strategic opportunities. One of the foremost challenges is the integration of advanced machine vision with legacy production lines. Many manufacturers operate with heterogeneous equipment, making seamless data flow and real-time analysis difficult. This integration challenge is compounded by the rapid evolution of machine vision hardware and software, which can lead to compatibility issues and increased total cost of ownership (A3 Association for Advancing Automation).

Another significant risk is the reliance on high-quality, annotated data for training machine learning algorithms that underpin modern vision systems. Inconsistent or insufficient data can result in false positives or negatives, undermining quality assurance and potentially leading to costly recalls or reputational damage. Additionally, as machine vision systems become more connected, cybersecurity risks escalate. Vulnerabilities in networked inspection systems can expose manufacturers to data breaches or operational disruptions (Gartner).

Despite these challenges, strategic opportunities abound. The ongoing shift toward Industry 4.0 and smart factories is driving demand for real-time, automated quality control, positioning machine vision as a critical enabler of predictive maintenance and process optimization. Companies that successfully implement vision inspection can achieve significant reductions in defect rates and operational costs, while also gaining valuable process insights (McKinsey & Company).

Furthermore, advances in deep learning and edge computing are expanding the capabilities of machine vision systems, enabling faster and more accurate inspections even in challenging environments. Strategic partnerships between vision technology providers and manufacturers are also emerging as a key trend, allowing for tailored solutions that address specific industry needs, such as food safety, electronics, or automotive manufacturing (IDC).

In summary, while machine vision inspection systems in 2025 face notable integration, data, and security risks, the strategic opportunities for efficiency, quality, and innovation are substantial for organizations that proactively address these challenges.

Sources & References

- MarketsandMarkets

- SICK AG

- ABB

- Rockwell Automation

- Universal Robots

- National Instruments Corporation

- Adept Technology, Inc.

- Siemens AG

- International Data Corporation (IDC)

- Automation.com

- VDMA

- Mordor Intelligence

- McKinsey & Company