2025 Advanced Wide-Bandgap Semiconductor Devices Market Report: Growth Drivers, Technology Innovations, and Strategic Insights for the Next 5 Years

- Executive Summary & Market Overview

- Key Technology Trends in Wide-Bandgap Semiconductors

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Opportunities

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

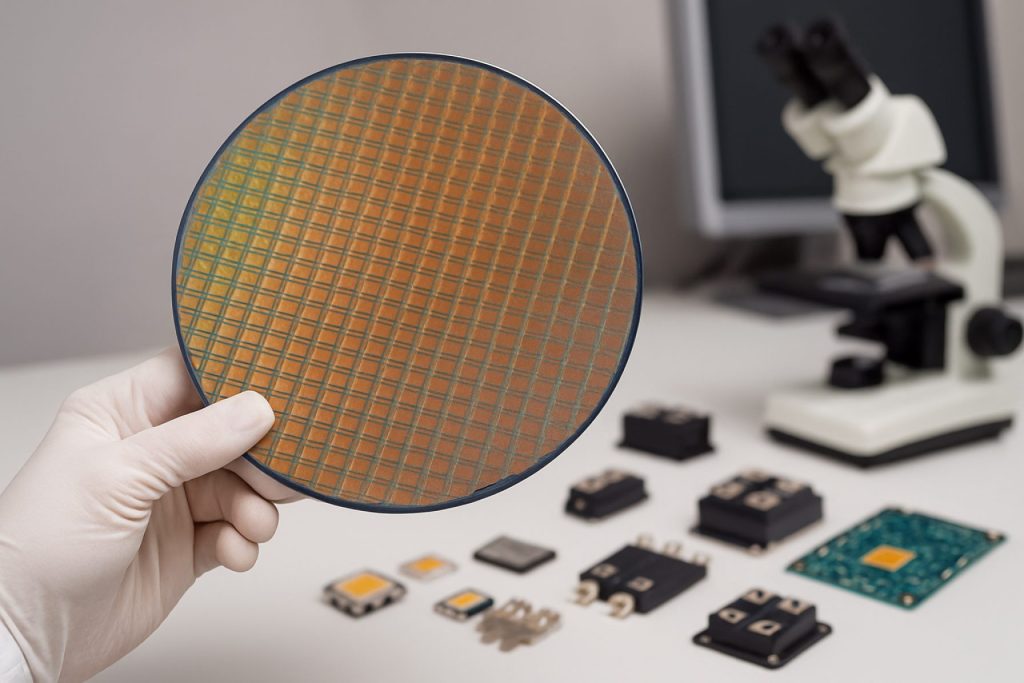

The global market for advanced wide-bandgap (WBG) semiconductor devices is poised for robust growth in 2025, driven by accelerating demand across electric vehicles (EVs), renewable energy systems, industrial automation, and high-frequency communications. Wide-bandgap semiconductors, primarily silicon carbide (SiC) and gallium nitride (GaN), offer superior performance over traditional silicon-based devices, including higher breakdown voltages, greater thermal conductivity, and enhanced efficiency at high frequencies and temperatures. These attributes are critical for next-generation power electronics and RF applications.

According to Yole Group, the WBG power device market is expected to surpass $5 billion in 2025, with SiC and GaN segments both experiencing double-digit compound annual growth rates (CAGR). The automotive sector remains the largest consumer, as OEMs and Tier 1 suppliers increasingly adopt SiC MOSFETs and GaN HEMTs to improve EV range, reduce charging times, and enhance overall system efficiency. STMicroelectronics and Infineon Technologies have both reported significant increases in SiC device shipments, reflecting this trend.

In the renewable energy sector, WBG devices are enabling more compact and efficient inverters for solar and wind applications, supporting the global transition to cleaner energy sources. Industrial automation and data centers are also adopting WBG semiconductors to reduce energy losses and improve power density in motor drives and power supplies. The telecommunications industry, particularly in 5G infrastructure, is leveraging GaN’s high-frequency capabilities for RF power amplifiers and base stations.

- Key market drivers include the global push for electrification, stringent energy efficiency regulations, and the need for miniaturization in electronic systems.

- Challenges persist in terms of higher initial costs, supply chain constraints, and the need for further advancements in manufacturing yields and reliability.

- Major players such as Wolfspeed, onsemi, and ROHM Semiconductor are investing heavily in capacity expansion and R&D to address these challenges and capture emerging opportunities.

Overall, 2025 is set to be a pivotal year for advanced WBG semiconductor devices, with market momentum underpinned by technological innovation, expanding end-use applications, and strategic investments across the value chain.

Key Technology Trends in Wide-Bandgap Semiconductors

In 2025, the landscape of advanced wide-bandgap (WBG) semiconductor devices is being shaped by rapid innovation, driven by the demand for higher efficiency, power density, and thermal performance in applications ranging from electric vehicles (EVs) to renewable energy and industrial automation. WBG materials such as silicon carbide (SiC) and gallium nitride (GaN) are at the forefront, enabling devices that outperform traditional silicon-based components in high-voltage and high-frequency environments.

A key trend is the commercialization of next-generation SiC MOSFETs and Schottky diodes, which offer lower on-resistance, higher breakdown voltages, and improved thermal conductivity. Leading manufacturers like Infineon Technologies and onsemi are expanding their SiC device portfolios, targeting automotive traction inverters and fast-charging infrastructure. The adoption of 200mm SiC wafers is also accelerating, promising greater economies of scale and improved device yields, as highlighted in recent industry updates from STMicroelectronics.

In parallel, GaN-based power devices are gaining traction in consumer electronics, data centers, and telecom power supplies due to their ultra-fast switching speeds and compact form factors. Companies such as Navitas Semiconductor and Transphorm are introducing high-voltage GaN FETs and integrated power ICs, enabling more efficient and smaller power adapters and server power modules. The integration of GaN devices with advanced packaging technologies, such as chip-scale packaging and embedded substrates, is further enhancing performance and reliability.

Another significant development is the emergence of hybrid modules that combine SiC and GaN devices, leveraging the strengths of both materials for specific application requirements. These modules are being adopted in high-performance motor drives and renewable energy inverters, where efficiency and thermal management are critical.

Looking ahead, research into ultra-wide bandgap materials like gallium oxide (Ga2O3) and aluminum nitride (AlN) is gaining momentum, with the potential to unlock even higher voltage and frequency capabilities. While commercialization is still in its early stages, pilot projects and prototype devices are being reported by research consortia and early-stage companies, as noted by Yole Group.

Overall, the evolution of advanced WBG semiconductor devices in 2025 is characterized by material innovation, device architecture improvements, and integration with system-level solutions, setting the stage for transformative changes across multiple high-growth sectors.

Competitive Landscape and Leading Players

The competitive landscape for advanced wide-bandgap (WBG) semiconductor devices in 2025 is characterized by rapid innovation, strategic partnerships, and significant investments from both established industry leaders and emerging players. WBG semiconductors, primarily silicon carbide (SiC) and gallium nitride (GaN) devices, are increasingly critical in applications such as electric vehicles (EVs), renewable energy systems, industrial power supplies, and 5G infrastructure.

Key market leaders include Infineon Technologies AG, STMicroelectronics, onsemi, Wolfspeed, Inc., and ROHM Co., Ltd.. These companies have established robust supply chains, advanced manufacturing capabilities, and extensive intellectual property portfolios, enabling them to maintain a competitive edge. For instance, Infineon Technologies AG has expanded its SiC production capacity and secured long-term supply agreements with automotive OEMs, while STMicroelectronics has invested heavily in vertical integration and R&D to accelerate GaN and SiC device commercialization.

Emerging players and specialized firms are also shaping the market. Navitas Semiconductor and Transphorm, Inc. are notable for their focus on GaN power ICs, targeting fast-charging, data center, and consumer electronics markets. Meanwhile, Littelfuse, Inc. and Cree, Inc. (now operating as Wolfspeed) are expanding their portfolios to address growing demand in industrial and automotive sectors.

- Strategic Alliances: Collaborations between device manufacturers and end-users, such as automotive and renewable energy companies, are accelerating technology adoption. For example, Tesla, Inc. and Toyota Motor Corporation have announced partnerships with SiC suppliers to enhance EV performance and efficiency.

- Geographic Expansion: Asian companies, including Mitsubishi Electric Corporation and Panasonic Corporation, are increasing their presence in the global WBG market through investments in new fabrication facilities and technology licensing.

- Barriers to Entry: High capital requirements, complex manufacturing processes, and the need for specialized expertise limit new entrants, reinforcing the dominance of established players.

Overall, the 2025 WBG semiconductor device market is defined by intense competition, technological differentiation, and a dynamic ecosystem of global and regional players, all vying to capture share in high-growth power electronics segments.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The market for advanced wide-bandgap (WBG) semiconductor devices is poised for robust growth between 2025 and 2030, driven by accelerating adoption in electric vehicles (EVs), renewable energy systems, and high-efficiency power electronics. According to projections from MarketsandMarkets, the global WBG semiconductor market—which includes silicon carbide (SiC) and gallium nitride (GaN) devices—is expected to achieve a compound annual growth rate (CAGR) of approximately 23% during this period. Revenue is forecasted to rise from an estimated $2.5 billion in 2025 to over $7 billion by 2030, reflecting both volume expansion and higher average selling prices as device performance improves.

Volume analysis indicates that the shipment of WBG devices, particularly SiC MOSFETs and GaN HEMTs, will see a significant uptick. Yole Group projects that SiC device shipments will surpass 1.5 billion units annually by 2030, up from around 400 million units in 2025. GaN device volumes are also expected to multiply, especially in consumer fast chargers and data center power supplies, with annual shipments exceeding 2 billion units by 2030.

- Automotive Sector: The electrification of vehicles is a primary growth engine, with SiC devices increasingly adopted in traction inverters and onboard chargers. STMicroelectronics and Infineon Technologies have both reported multi-year supply agreements with leading automakers, underlining the sector’s demand trajectory.

- Renewable Energy and Industrial: WBG devices are enabling higher efficiency and power density in solar inverters and industrial motor drives. Wolfspeed has announced major supply deals with solar inverter manufacturers, supporting the forecasted volume growth.

- Consumer and Data Center Applications: GaN-based power ICs are rapidly penetrating fast-charging adapters and server power supplies, with Navitas Semiconductor and Transphorm expanding production capacity to meet surging demand.

Overall, the 2025–2030 period will be characterized by double-digit CAGR, substantial revenue gains, and a sharp increase in unit shipments, as WBG semiconductors become mainstream across multiple high-growth sectors.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for advanced wide-bandgap (WBG) semiconductor devices—primarily silicon carbide (SiC) and gallium nitride (GaN) components—continues to expand rapidly, with distinct regional dynamics shaping growth trajectories through 2025.

North America remains a leader in WBG innovation, driven by robust investments in electric vehicles (EVs), renewable energy, and defense applications. The United States, in particular, benefits from a strong ecosystem of research institutions and established players such as Wolfspeed and onsemi. Federal initiatives, including the CHIPS and Science Act, are further incentivizing domestic manufacturing and R&D, supporting a projected double-digit CAGR for the region through 2025. The adoption of SiC MOSFETs and GaN HEMTs in automotive and industrial power electronics is a key growth driver.

Europe is experiencing accelerated demand for WBG devices, propelled by stringent carbon emission regulations and aggressive electrification targets. The region’s automotive sector, led by companies like STMicroelectronics and Infineon Technologies, is rapidly integrating SiC and GaN solutions into EV powertrains and charging infrastructure. The European Union’s focus on energy efficiency and grid modernization is also fostering adoption in renewable energy and industrial automation. According to Yole Group, Europe’s WBG device market is expected to outpace global averages, with significant investments in local supply chains and manufacturing capacity.

- Asia-Pacific is the fastest-growing region, accounting for the largest share of global WBG semiconductor demand. China, Japan, and South Korea are at the forefront, with government-backed initiatives to localize semiconductor production and support EV adoption. Chinese firms such as Sanan IC and Japanese giants like ROHM Semiconductor are expanding their WBG portfolios. The proliferation of 5G infrastructure, industrial robotics, and consumer electronics further accelerates regional growth. Market analysts from IC Insights project Asia-Pacific’s WBG market to maintain a CAGR above 20% through 2025.

- Rest of World (including Latin America, Middle East, and Africa) is at an earlier stage of adoption, with growth primarily driven by renewable energy projects and nascent EV markets. While the installed base is smaller, increasing foreign direct investment and technology transfer initiatives are expected to gradually boost demand for advanced WBG devices in these regions.

Overall, regional market dynamics for advanced WBG semiconductor devices in 2025 reflect a combination of policy support, industrial strategy, and end-market demand, with Asia-Pacific and Europe emerging as key growth engines alongside North America’s innovation leadership.

Future Outlook: Emerging Applications and Investment Opportunities

The future outlook for advanced wide-bandgap (WBG) semiconductor devices in 2025 is marked by rapid expansion into emerging applications and a surge in investment opportunities. WBG materials such as silicon carbide (SiC) and gallium nitride (GaN) are increasingly displacing traditional silicon in high-performance power electronics, driven by their superior efficiency, thermal stability, and switching speeds. This technological shift is catalyzing innovation across multiple sectors.

Key emerging applications include electric vehicles (EVs), renewable energy systems, 5G infrastructure, and industrial automation. In the EV sector, WBG devices are enabling faster charging, higher power density, and improved range, with major automakers and suppliers integrating SiC and GaN components into next-generation powertrains and onboard chargers. The renewable energy market is also benefiting, as WBG semiconductors enhance the efficiency and reliability of solar inverters and wind turbine converters, supporting the global transition to clean energy sources. Additionally, the rollout of 5G networks is accelerating demand for GaN-based radio frequency (RF) devices, which offer higher output power and efficiency for base stations and small cells.

Investment activity is robust, with both established semiconductor manufacturers and startups attracting significant capital. According to International Data Corporation (IDC), the global WBG semiconductor market is projected to grow at a compound annual growth rate (CAGR) exceeding 20% through 2025, fueled by strategic investments in manufacturing capacity and R&D. Leading players such as Infineon Technologies, Wolfspeed, and onsemi are expanding their production lines and forging partnerships to secure supply chains and accelerate innovation.

- Automotive: SiC MOSFETs and GaN HEMTs are being adopted for traction inverters, DC-DC converters, and charging infrastructure, with Tesla and Toyota among the early adopters.

- Renewables: Companies like Sungrow and Siemens Energy are integrating WBG devices into solar and wind power electronics.

- Telecommunications: Nokia and Ericsson are leveraging GaN RF devices for 5G base stations.

Looking ahead, the convergence of electrification, digitalization, and decarbonization trends is expected to sustain strong demand for advanced WBG semiconductors. Venture capital and government funding are likely to further accelerate innovation, making 2025 a pivotal year for both technological breakthroughs and market expansion in this sector.

Challenges, Risks, and Strategic Opportunities

The market for advanced wide-bandgap (WBG) semiconductor devices—primarily silicon carbide (SiC) and gallium nitride (GaN)—is poised for robust growth in 2025, but it faces a complex landscape of challenges, risks, and strategic opportunities. As these devices increasingly replace traditional silicon-based components in high-performance applications such as electric vehicles (EVs), renewable energy, and 5G infrastructure, several critical factors will shape the sector’s trajectory.

Challenges and Risks

- Manufacturing Complexity and Cost: WBG semiconductors require advanced fabrication processes and high-purity substrates, leading to higher production costs and lower yields compared to silicon. This cost premium remains a barrier to mass adoption, especially in price-sensitive markets (STMicroelectronics).

- Supply Chain Constraints: The supply of high-quality SiC and GaN wafers is limited, with a small number of suppliers dominating the market. This concentration increases vulnerability to disruptions and price volatility (Wolfspeed).

- Technical Barriers: Integrating WBG devices into existing systems requires new design paradigms, specialized packaging, and thermal management solutions. The lack of standardized testing and qualification protocols further complicates adoption (Infineon Technologies).

- Intellectual Property (IP) and Geopolitical Risks: The WBG sector is marked by intense patent activity and trade restrictions, particularly between the US, China, and Europe. Export controls and IP disputes could hinder global collaboration and market access (Semiconductor Industry Association).

Strategic Opportunities

- Automotive Electrification: The rapid electrification of vehicles is driving demand for SiC and GaN devices in powertrains, charging infrastructure, and onboard electronics. OEM partnerships and long-term supply agreements are emerging as key strategies (onsemi).

- Renewable Energy and Grid Modernization: WBG devices enable higher efficiency and power density in solar inverters, wind turbines, and energy storage systems, supporting the global transition to clean energy (Mitsubishi Electric).

- Vertical Integration and Ecosystem Development: Leading players are investing in upstream wafer production, device fabrication, and downstream application engineering to secure supply chains and accelerate innovation (ROHM Semiconductor).

In 2025, the interplay between these risks and opportunities will define the competitive landscape, with companies that can navigate supply chain constraints, drive down costs, and foster ecosystem partnerships best positioned for long-term success.

Sources & References

- STMicroelectronics

- Infineon Technologies

- Wolfspeed

- ROHM Semiconductor

- Wolfspeed, Inc.

- Littelfuse, Inc.

- Toyota Motor Corporation

- Mitsubishi Electric Corporation

- MarketsandMarkets

- Sanan IC

- IC Insights

- International Data Corporation (IDC)

- Sungrow

- Siemens Energy

- Nokia

- Semiconductor Industry Association