Unlocking the Future of Underwater Exploration: How AUV Swarm Coordination Systems Will Transform Maritime Operations in 2025 and Beyond. Discover the Breakthroughs Driving Autonomous Collaboration Beneath the Waves.

- Executive Summary: Key Trends and Market Drivers in 2025

- Technology Overview: Core Principles of AUV Swarm Coordination

- Leading Players and Industry Initiatives (e.g., kongsberg.com, teledynemarine.com, ieee.org)

- Market Size, Growth Projections, and Regional Hotspots (2025–2030)

- Enabling Technologies: AI, Communication Protocols, and Sensor Fusion

- Applications: Defense, Oceanography, Offshore Energy, and Environmental Monitoring

- Challenges: Interoperability, Security, and Environmental Impact

- Case Studies: Real-World Deployments and Demonstrations

- Regulatory Landscape and Industry Standards (e.g., ieee.org, asme.org)

- Future Outlook: Innovations, Investment Trends, and Strategic Opportunities

- Sources & References

Executive Summary: Key Trends and Market Drivers in 2025

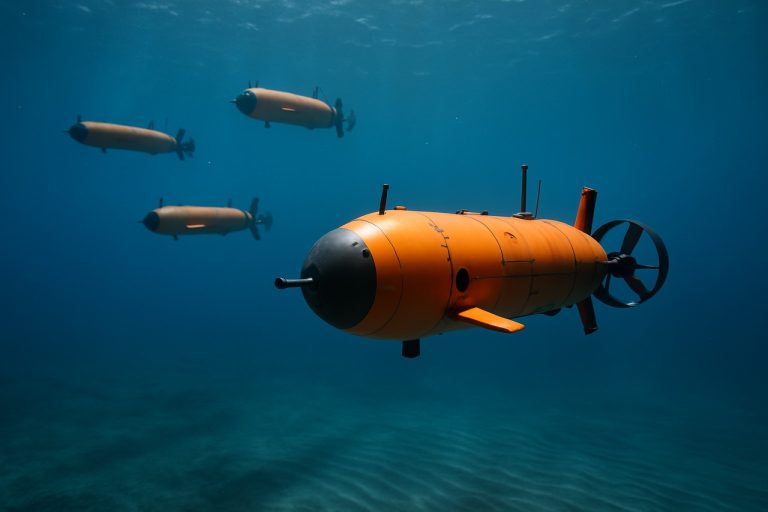

The market for Autonomous Underwater Vehicle (AUV) swarm coordination systems is entering a pivotal phase in 2025, driven by rapid advancements in artificial intelligence, underwater communication technologies, and the growing demand for scalable, efficient subsea operations. Swarm coordination—where multiple AUVs operate collaboratively to achieve complex tasks—has moved from experimental trials to early-stage commercial deployments, particularly in sectors such as offshore energy, defense, and marine research.

A key trend in 2025 is the integration of advanced AI algorithms and distributed decision-making frameworks, enabling AUV swarms to adapt in real time to dynamic underwater environments. Companies like Saab AB and Kongsberg Gruppen are at the forefront, leveraging their experience in subsea robotics to develop systems where fleets of AUVs can autonomously coordinate search patterns, data collection, and obstacle avoidance. These capabilities are crucial for large-scale seabed mapping, pipeline inspection, and environmental monitoring, where single-vehicle operations are increasingly seen as inefficient.

Another significant driver is the evolution of underwater communication protocols. Traditional acoustic modems are being supplemented by hybrid optical-acoustic systems, improving bandwidth and reliability for swarm coordination. Teledyne Marine and L3Harris Technologies are investing in robust communication solutions that allow real-time data sharing and collaborative mission planning among AUVs, even in challenging deep-sea conditions.

The defense sector remains a major catalyst, with navies in the US, Europe, and Asia-Pacific accelerating investments in AUV swarms for mine countermeasures, surveillance, and anti-submarine warfare. For example, Boeing and Leonardo S.p.A. are developing modular swarm-enabled platforms that can be rapidly reconfigured for diverse mission profiles, reflecting a shift toward multi-domain autonomous operations.

Looking ahead, the outlook for AUV swarm coordination systems is robust. The convergence of AI, improved energy storage, and miniaturized sensors is expected to lower operational costs and expand the range of commercial applications. Regulatory frameworks are also evolving, with industry bodies such as the International Marine Contractors Association supporting standardization efforts to ensure interoperability and safety. As these trends continue, the next few years are likely to see broader adoption of AUV swarms, transforming subsea operations across multiple industries.

Technology Overview: Core Principles of AUV Swarm Coordination

Autonomous Underwater Vehicle (AUV) swarm coordination systems represent a transformative approach to subsea operations, leveraging collective intelligence and distributed autonomy to accomplish complex tasks more efficiently than single vehicles. The core principles of AUV swarm coordination are rooted in decentralized control, robust inter-vehicle communication, adaptive mission planning, and real-time environmental awareness. As of 2025, these systems are rapidly advancing, driven by both defense and commercial sector demands for scalable, resilient, and cost-effective underwater solutions.

At the heart of AUV swarm coordination is decentralized decision-making, where each vehicle operates semi-independently while sharing mission-critical data with its peers. This approach enhances fault tolerance and allows the swarm to dynamically reconfigure in response to individual vehicle failures or changing mission parameters. Leading manufacturers such as Kongsberg Maritime and Saab have integrated advanced onboard processing and autonomy modules into their AUV platforms, enabling real-time data fusion and collaborative behaviors such as area coverage, target tracking, and adaptive sampling.

Communication remains a significant technical challenge due to the limitations of underwater acoustic channels, which are characterized by low bandwidth, high latency, and susceptibility to noise. To address this, swarm systems employ a combination of acoustic modems, optical links for short-range high-speed data transfer, and, increasingly, intelligent algorithms that minimize the need for constant communication. Companies like Teledyne Marine are developing robust acoustic networking solutions that support scalable swarm architectures, allowing dozens of AUVs to coordinate over large operational areas.

Another core principle is adaptive mission planning, where swarms autonomously adjust their behaviors based on real-time sensor inputs and evolving mission objectives. This is achieved through distributed artificial intelligence and machine learning algorithms, which are being actively developed and field-tested by organizations such as Naval Group and Boeing for both military and civilian applications. These capabilities enable swarms to perform complex tasks such as cooperative search and rescue, environmental monitoring, and mine countermeasures with minimal human intervention.

Looking ahead to the next few years, the outlook for AUV swarm coordination systems is marked by increasing autonomy, improved interoperability, and greater operational scale. Industry collaborations and standardization efforts, led by bodies like the National Marine Manufacturers Association, are expected to accelerate the adoption of interoperable protocols and open architectures. As sensor miniaturization and onboard processing power continue to advance, AUV swarms will become more capable, flexible, and integral to subsea operations across defense, energy, and scientific research sectors.

Leading Players and Industry Initiatives (e.g., kongsberg.com, teledynemarine.com, ieee.org)

The field of Autonomous Underwater Vehicle (AUV) swarm coordination systems is rapidly advancing, with several leading industry players and organizations spearheading innovation and deployment. As of 2025, the focus is on enhancing multi-vehicle autonomy, robust underwater communication, and real-time collaborative mission execution. These developments are driven by the growing demand for efficient subsea exploration, environmental monitoring, and defense applications.

A key player in this sector is Kongsberg Gruppen, a Norwegian technology company renowned for its advanced maritime solutions. Kongsberg’s AUVs, such as the HUGIN series, are increasingly being integrated with swarm coordination capabilities, enabling multiple vehicles to operate collaboratively for large-scale seabed mapping and inspection missions. The company’s ongoing research emphasizes interoperability and adaptive mission planning, which are critical for effective swarm operations.

Another major contributor is Teledyne Marine, a division of Teledyne Technologies Incorporated. Teledyne Marine offers a diverse portfolio of AUVs and underwater communication systems. In recent years, the company has focused on developing modular swarm architectures, allowing fleets of AUVs to share data and coordinate tasks dynamically. Their Bluefin and Gavia AUV platforms are being equipped with advanced networking and autonomy modules, supporting synchronized operations in complex underwater environments.

On the research and standardization front, the Institute of Electrical and Electronics Engineers (IEEE) plays a pivotal role. IEEE’s Oceanic Engineering Society and related working groups are actively developing standards and protocols for underwater vehicle communication and swarm coordination. These efforts aim to ensure interoperability between systems from different manufacturers and to address challenges such as latency, bandwidth limitations, and secure data exchange.

Other notable industry initiatives include collaborative projects between defense agencies and private sector leaders, focusing on the deployment of AUV swarms for mine countermeasures, surveillance, and environmental assessment. Companies like Saab and L3Harris Technologies are also investing in swarm-enabled AUVs, leveraging their expertise in underwater robotics and secure communications.

Looking ahead, the next few years are expected to see increased field trials and commercial deployments of AUV swarms, with emphasis on real-time adaptive behaviors, energy-efficient operations, and integration with surface and aerial assets. Industry leaders are collaborating with academic and governmental organizations to accelerate the adoption of swarm technologies, setting the stage for transformative advances in underwater autonomy and mission effectiveness.

Market Size, Growth Projections, and Regional Hotspots (2025–2030)

The market for Autonomous Underwater Vehicle (AUV) Swarm Coordination Systems is poised for significant expansion between 2025 and 2030, driven by increasing demand for advanced underwater exploration, defense applications, and offshore energy operations. As of 2025, the global AUV sector is witnessing a shift from single-unit deployments to coordinated swarms, enabling more efficient data collection, area coverage, and mission resilience. This evolution is underpinned by advancements in artificial intelligence, underwater communication protocols, and miniaturization of sensor technologies.

Key industry players such as Kongsberg Gruppen, a Norwegian technology leader, and Saab, a Swedish defense and security company, are actively developing and integrating swarm coordination capabilities into their AUV portfolios. Kongsberg Gruppen has demonstrated multi-vehicle operations for subsea mapping and inspection, while Saab continues to enhance its Seaeye range with collaborative mission features. In the United States, Hydroid (a subsidiary of Huntington Ingalls Industries) is investing in swarm-enabled REMUS vehicles, targeting both defense and commercial markets.

From a market size perspective, the AUV swarm coordination segment is expected to outpace the broader AUV market, with annual growth rates projected in the double digits through 2030. This acceleration is attributed to the growing adoption of swarm systems for large-scale oceanographic surveys, pipeline inspections, and mine countermeasure operations. The defense sector remains a primary driver, with navies in North America, Europe, and Asia-Pacific increasing procurement of swarm-capable AUVs for surveillance and security missions. For instance, the U.S. Navy’s ongoing investment in distributed maritime operations is fostering demand for scalable swarm solutions from domestic suppliers such as Hydroid and L3Harris Technologies.

Regionally, North America and Western Europe are anticipated to remain the largest markets for AUV swarm coordination systems through 2030, supported by robust defense budgets and active offshore energy sectors. However, the Asia-Pacific region is emerging as a hotspot, with countries like China and South Korea accelerating indigenous development and deployment of swarm-enabled AUVs for maritime security and resource exploration. Companies such as China Shipbuilding Industry Corporation are investing heavily in swarm technologies to support national strategic objectives.

Looking ahead, the market outlook for AUV swarm coordination systems is characterized by rapid technological innovation, expanding application domains, and intensifying competition among established and emerging players. The next five years are expected to see increased standardization, interoperability, and integration of AI-driven autonomy, further propelling market growth and regional adoption.

Enabling Technologies: AI, Communication Protocols, and Sensor Fusion

The evolution of Autonomous Underwater Vehicle (AUV) swarm coordination systems in 2025 is being driven by rapid advancements in artificial intelligence (AI), robust underwater communication protocols, and sophisticated sensor fusion technologies. These enabling technologies are critical for achieving the high levels of autonomy, reliability, and adaptability required for multi-vehicle operations in complex and dynamic underwater environments.

AI algorithms, particularly those based on deep learning and reinforcement learning, are increasingly being integrated into AUV swarms to facilitate real-time decision-making, adaptive mission planning, and collaborative behaviors. Companies such as Kongsberg Maritime and Saab are at the forefront, developing AI-driven autonomy suites that allow AUVs to dynamically allocate tasks, avoid obstacles, and optimize search patterns without human intervention. These systems leverage distributed intelligence, enabling each vehicle to process sensor data locally while sharing critical information with the swarm to enhance collective situational awareness.

Communication remains a significant challenge for underwater swarms due to the limitations of acoustic, optical, and electromagnetic transmission in the marine environment. In 2025, there is a notable shift towards hybrid communication protocols that combine acoustic modems for long-range, low-bandwidth messaging with optical and even short-range radio frequency (RF) links for high-speed data exchange when vehicles are in close proximity. Teledyne Marine and EvoLogics are actively developing and deploying advanced acoustic modems and networking solutions that support multi-node, low-latency communication essential for coordinated swarm maneuvers.

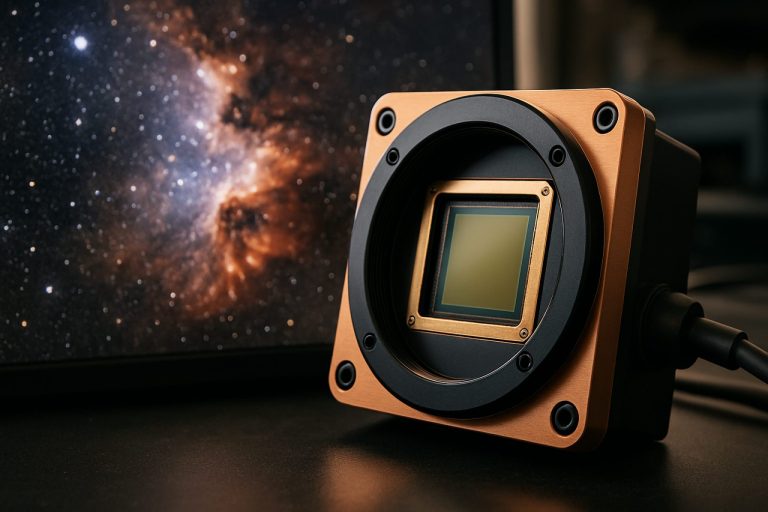

Sensor fusion is another cornerstone of effective AUV swarm coordination. By integrating data from diverse sources—such as sonar, inertial navigation systems, Doppler velocity logs, and environmental sensors—AUVs can achieve robust localization, mapping, and target detection even in GPS-denied and cluttered underwater settings. Bluefin Robotics (a subsidiary of General Dynamics Mission Systems) and L3Harris are investing in multi-sensor integration platforms that enable real-time data fusion, supporting both individual vehicle autonomy and swarm-level coordination.

Looking ahead, the convergence of AI, advanced communication protocols, and sensor fusion is expected to enable larger, more resilient, and more intelligent AUV swarms. These systems are poised to transform applications ranging from subsea infrastructure inspection and environmental monitoring to defense and search-and-rescue operations, with ongoing field trials and commercial deployments anticipated to accelerate through 2025 and beyond.

Applications: Defense, Oceanography, Offshore Energy, and Environmental Monitoring

Autonomous Underwater Vehicle (AUV) swarm coordination systems are rapidly advancing, with significant applications emerging across defense, oceanography, offshore energy, and environmental monitoring sectors in 2025 and the near future. These systems leverage distributed intelligence, real-time communication, and adaptive mission planning to enable fleets of AUVs to operate collaboratively, offering enhanced efficiency, resilience, and data collection capabilities compared to single-vehicle deployments.

In the defense sector, AUV swarms are increasingly prioritized for mine countermeasures, anti-submarine warfare, and persistent maritime surveillance. Leading defense contractors such as Saab and Naval Group are actively developing and demonstrating swarm-enabled AUVs capable of coordinated search, detection, and mapping of underwater threats. For example, Saab’s AUV systems are being integrated with advanced autonomy and communication modules to support multi-vehicle operations, while Naval Group is collaborating with European navies to test swarm-based minehunting concepts. These efforts are expected to transition from trials to operational deployments within the next few years, driven by the need for scalable and cost-effective underwater security solutions.

In oceanography, swarm-coordinated AUVs are revolutionizing large-scale data collection and environmental monitoring. Organizations such as Kongsberg and Teledyne Marine are equipping their AUV platforms with swarm algorithms that enable synchronized sampling, adaptive mission re-tasking, and real-time data sharing. This allows for high-resolution mapping of oceanographic parameters, such as temperature, salinity, and biogeochemical properties, over vast areas and extended periods. The ability to deploy coordinated swarms is particularly valuable for studying dynamic phenomena like algal blooms, ocean currents, and climate change impacts.

Offshore energy operators are also adopting AUV swarms for subsea infrastructure inspection, pipeline monitoring, and leak detection. Companies like Ocean Infinity are pioneering the use of large AUV fleets, supported by advanced swarm control systems, to conduct simultaneous multi-point inspections and rapid response missions. This approach reduces operational downtime, enhances safety, and lowers costs compared to traditional single-vehicle or manned operations.

Environmental monitoring agencies and research institutions are leveraging AUV swarms for habitat mapping, pollution tracking, and biodiversity assessments. The distributed nature of swarms enables comprehensive coverage of sensitive or remote areas, supporting regulatory compliance and conservation efforts. As swarm coordination technologies mature, integration with surface and aerial autonomous systems is anticipated, further expanding the scope and impact of multi-domain environmental monitoring.

Looking ahead, continued advancements in underwater communication, onboard processing, and AI-driven autonomy are expected to drive broader adoption and operationalization of AUV swarm coordination systems across these sectors, with 2025 marking a pivotal year for real-world deployments and cross-sector collaborations.

Challenges: Interoperability, Security, and Environmental Impact

The rapid evolution of Autonomous Underwater Vehicle (AUV) swarm coordination systems is accompanied by significant challenges, particularly in the areas of interoperability, security, and environmental impact. As the deployment of AUV swarms expands in 2025 and beyond, these issues are increasingly central to both commercial and defense stakeholders.

Interoperability remains a primary hurdle. AUVs are produced by a range of manufacturers, each employing proprietary communication protocols and control architectures. This fragmentation complicates the integration of heterogeneous swarms, limiting mission flexibility and scalability. Industry leaders such as Kongsberg Gruppen and Saab are actively developing modular, open-architecture systems to address these barriers, but widespread adoption is still in progress. The lack of standardized interfaces also impedes collaboration between civilian and military operators, a concern highlighted by ongoing multinational exercises and joint research initiatives.

Security is another critical concern, especially as AUV swarms are increasingly tasked with sensitive operations such as subsea infrastructure inspection, mine countermeasures, and maritime surveillance. The underwater environment poses unique cybersecurity challenges: acoustic communication channels are inherently bandwidth-limited and susceptible to interception or jamming. Companies like L3Harris Technologies and Leonardo are investing in robust encryption and authentication protocols tailored for underwater networks. However, the risk of cyber-physical attacks—where adversaries could potentially hijack or disrupt swarm behavior—remains a pressing issue, prompting ongoing research into resilient, decentralized control algorithms.

Environmental impact is under increasing scrutiny as AUV swarms become more prevalent. Concerns include potential disturbances to marine life from acoustic emissions, physical interactions, and the risk of vehicle loss or debris. Manufacturers such as Teledyne Marine are exploring quieter propulsion systems and eco-friendly materials to mitigate these effects. Regulatory bodies and organizations like the United Nations are also pushing for stricter guidelines on underwater noise and operational best practices, which are expected to influence system design and deployment strategies in the coming years.

Looking ahead, the sector is likely to see increased collaboration on interoperability standards, the integration of advanced security frameworks, and the adoption of environmentally responsible technologies. These efforts will be crucial for unlocking the full potential of AUV swarm coordination systems while ensuring safe, secure, and sustainable operations in the world’s oceans.

Case Studies: Real-World Deployments and Demonstrations

The deployment and demonstration of Autonomous Underwater Vehicle (AUV) swarm coordination systems have accelerated in 2025, reflecting both technological maturation and growing operational demand. Several high-profile case studies illustrate the current state and near-term outlook for these systems, with a focus on multi-vehicle collaboration, adaptive mission planning, and real-time data sharing.

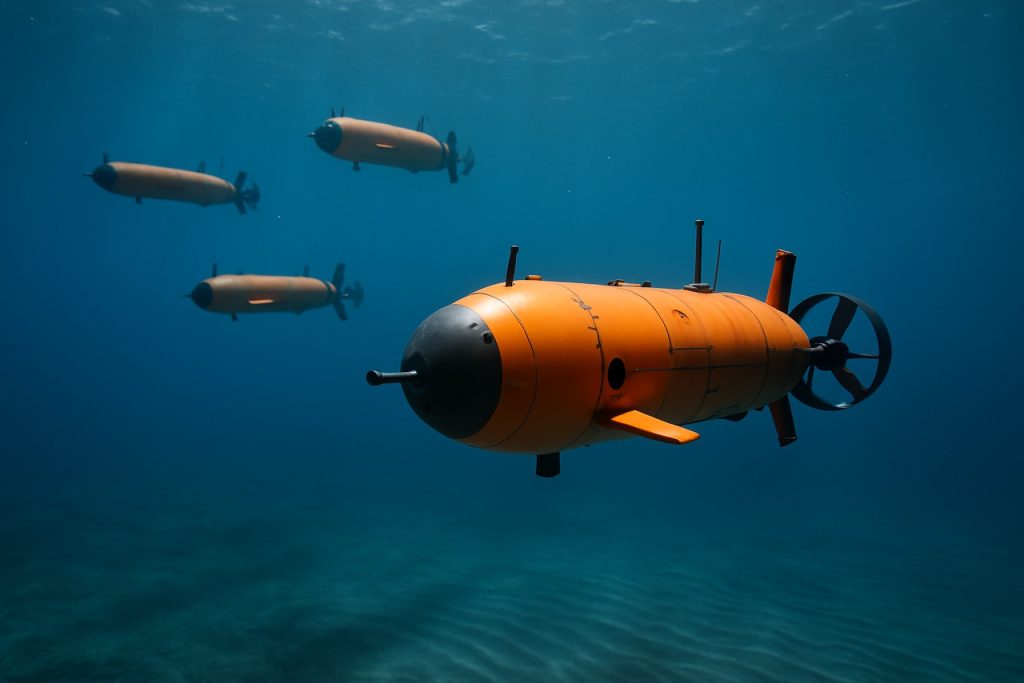

One of the most notable recent demonstrations was conducted by Saab AB, a leader in underwater robotics. In early 2025, Saab showcased a coordinated swarm of its Sabertooth AUVs performing complex inspection and mapping tasks in the North Sea. The demonstration highlighted the vehicles’ ability to autonomously divide survey areas, avoid collisions, and relay data through acoustic modems, significantly reducing mission time compared to single-vehicle operations. Saab’s system leverages distributed intelligence, allowing each AUV to adapt its path based on real-time environmental feedback and the actions of its peers.

Similarly, Kongsberg Gruppen has advanced its HUGIN AUV family with swarm capabilities, as evidenced by a 2025 trial in Norwegian coastal waters. Multiple HUGIN AUVs were deployed to conduct synchronized seabed mapping and environmental monitoring. The vehicles utilized a combination of pre-mission planning and in-mission adaptive behaviors, coordinated via robust underwater communication protocols. Kongsberg’s approach emphasizes interoperability, enabling integration with other unmanned systems and surface vessels for expanded mission profiles.

In the United States, Lockheed Martin has partnered with the U.S. Navy to test swarm coordination for mine countermeasure missions. In a series of exercises in 2024–2025, Lockheed Martin’s Marlin AUVs operated as a networked swarm, autonomously searching for and classifying underwater objects. The system demonstrated resilience to communication dropouts and the ability to re-task vehicles dynamically, a critical requirement for military and disaster response scenarios.

Looking ahead, the outlook for AUV swarm coordination systems is robust. Industry leaders are investing in enhanced autonomy, improved underwater communications, and AI-driven mission management. The integration of swarm AUVs with surface and aerial unmanned systems is expected to become more prevalent, supporting applications from offshore energy to marine research and defense. As these technologies mature, real-world deployments are anticipated to expand in both scale and complexity, with ongoing demonstrations by companies such as Saab AB, Kongsberg Gruppen, and Lockheed Martin setting the pace for the industry.

Regulatory Landscape and Industry Standards (e.g., ieee.org, asme.org)

The regulatory landscape and industry standards for Autonomous Underwater Vehicle (AUV) swarm coordination systems are rapidly evolving as the deployment of these technologies accelerates in 2025 and beyond. The increasing complexity and operational scale of AUV swarms—used for applications such as oceanographic research, offshore energy, and maritime security—necessitate robust frameworks to ensure interoperability, safety, and reliability.

Key industry bodies are actively shaping the standards environment. The IEEE has been instrumental in developing protocols for autonomous systems, including the IEEE P2751 standard, which addresses interoperability and communication for underwater robotics. This standard is expected to see further refinement and adoption in 2025, focusing on secure, reliable, and low-latency communication between multiple AUVs operating as a coordinated swarm.

The ASME (American Society of Mechanical Engineers) is also contributing to the regulatory framework by updating its codes and guidelines for the design, testing, and operation of marine robotics. These updates increasingly account for the unique challenges posed by swarm operations, such as collective decision-making, distributed sensing, and collision avoidance in dynamic underwater environments.

Internationally, the International Maritime Organization (IMO) is monitoring the proliferation of autonomous maritime systems, including AUV swarms, to assess the need for amendments to the International Regulations for Preventing Collisions at Sea (COLREGs). In 2025, discussions are ongoing regarding the legal status of AUV swarms, their identification, and their integration into existing maritime traffic management systems.

Industry consortia and manufacturers are also playing a significant role. Companies such as Kongsberg and Saab are collaborating with regulatory bodies to ensure their AUV swarm solutions comply with emerging standards. These firms are actively participating in working groups and pilot projects to validate interoperability and safety protocols in real-world scenarios.

Looking ahead, the next few years will likely see the formalization of certification schemes for AUV swarm systems, covering aspects such as cybersecurity, fail-safe operation, and environmental impact. The convergence of standards from organizations like IEEE, ASME, and IMO is expected to facilitate broader adoption and cross-vendor compatibility, while also addressing public and environmental safety concerns. As regulatory clarity increases, the industry is poised for accelerated innovation and deployment of AUV swarms across commercial and scientific domains.

Future Outlook: Innovations, Investment Trends, and Strategic Opportunities

The future of Autonomous Underwater Vehicle (AUV) swarm coordination systems is poised for significant transformation in 2025 and the years immediately following, driven by rapid technological innovation, increased investment, and evolving strategic priorities across defense, scientific, and commercial sectors. Swarm coordination—where multiple AUVs operate collaboratively to achieve complex underwater missions—has become a focal point for both established industry leaders and emerging technology firms.

Key players such as Kongsberg Gruppen, a Norwegian maritime technology leader, and Saab, with its robust underwater robotics division, are actively developing advanced swarm algorithms and communication protocols. These systems enable fleets of AUVs to autonomously share data, adapt to dynamic environments, and execute coordinated maneuvers, significantly enhancing mission efficiency and resilience. Kongsberg Gruppen has demonstrated multi-vehicle operations in real-world scenarios, while Saab continues to integrate AI-driven decision-making into its AUV platforms.

Investment in AUV swarm technologies is accelerating, particularly from defense agencies seeking to bolster maritime security and surveillance capabilities. The U.S. Navy, through collaborations with industry and academia, is prioritizing swarm-enabled AUVs for mine countermeasures and persistent undersea monitoring. European defense initiatives are similarly channeling funds into collaborative autonomy, with companies like Leonardo and Thales Group advancing modular swarm systems for both military and dual-use applications.

On the commercial front, offshore energy and subsea infrastructure operators are recognizing the value of AUV swarms for large-scale inspection, environmental monitoring, and asset management. Ocean Infinity, a UK-based marine robotics company, is pioneering the deployment of large AUV fleets for high-resolution seabed mapping and data acquisition, leveraging swarm coordination to reduce operational costs and timelines.

Looking ahead, the next few years will likely see breakthroughs in underwater communication—such as improved acoustic and optical networking—enabling more robust and scalable swarm operations. The integration of edge computing and machine learning will further empower AUVs to make decentralized decisions, adapt to unforeseen challenges, and optimize mission outcomes in real time. Strategic partnerships between technology developers, defense agencies, and commercial operators are expected to intensify, fostering an ecosystem that accelerates innovation and adoption.

In summary, the outlook for AUV swarm coordination systems in 2025 and beyond is marked by rapid technological progress, growing investment, and expanding strategic opportunities across multiple sectors. As these systems mature, they are set to redefine the capabilities and economics of underwater operations worldwide.

Sources & References

- Saab AB

- Kongsberg Gruppen

- Teledyne Marine

- L3Harris Technologies

- Boeing

- Leonardo S.p.A.

- International Marine Contractors Association

- Naval Group

- National Marine Manufacturers Association

- Institute of Electrical and Electronics Engineers (IEEE)

- Naval Group

- Ocean Infinity

- United Nations

- Lockheed Martin

- ASME

- International Maritime Organization

- Thales Group