Bioelectronic Ion Channel Modulation in 2025: Transforming Neuromodulation and Disease Treatment with Next-Gen Precision. Explore the Market Forces, Technology Advances, and Strategic Opportunities Shaping the Future.

- Executive Summary: 2025 Market Landscape and Key Drivers

- Technology Overview: Mechanisms of Ion Channel Modulation

- Current and Emerging Applications in Medicine

- Competitive Landscape: Leading Companies and Innovators

- Market Size, Segmentation, and 2025–2030 Forecasts

- Regulatory Environment and Clinical Trial Milestones

- Key Partnerships, M&A, and Investment Trends

- Challenges: Technical, Ethical, and Adoption Barriers

- Future Outlook: Next-Generation Devices and Therapies

- Strategic Recommendations for Stakeholders

- Sources & References

Executive Summary: 2025 Market Landscape and Key Drivers

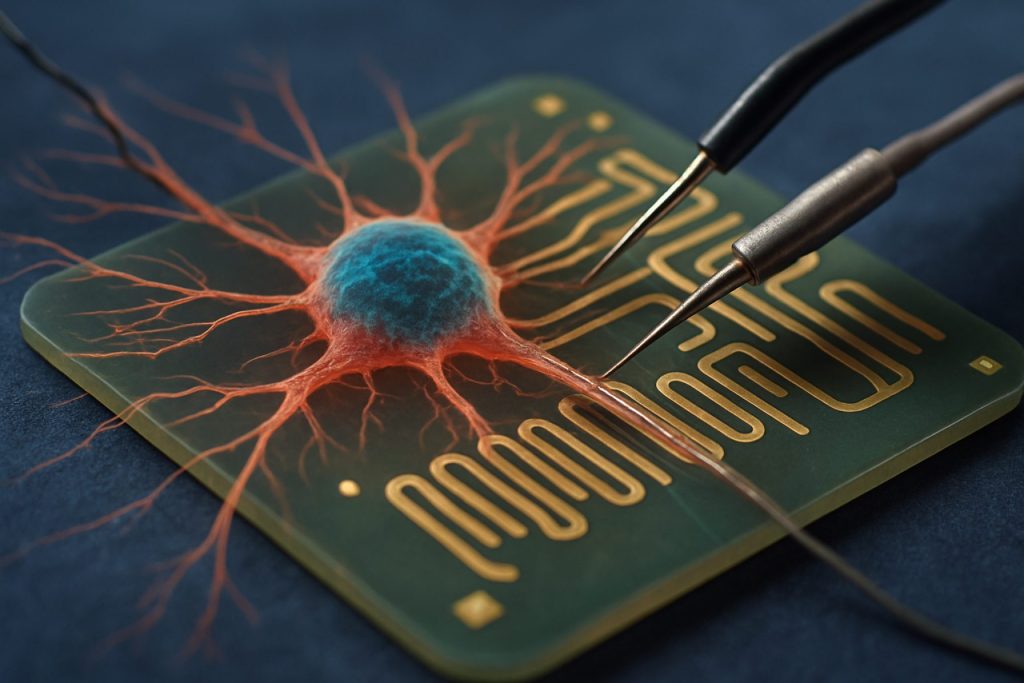

Bioelectronic ion channel modulation is rapidly emerging as a transformative approach in neuromodulation, pain management, and chronic disease therapy. As of 2025, the market landscape is characterized by a convergence of advances in microelectronics, materials science, and neurobiology, enabling precise, minimally invasive modulation of ion channels in excitable tissues. This technology leverages electrical, optical, or magnetic stimuli to regulate ion channel activity, offering alternatives to pharmacological interventions and addressing unmet needs in conditions such as epilepsy, chronic pain, cardiac arrhythmias, and neurodegenerative diseases.

Key drivers in 2025 include the maturation of implantable and wearable bioelectronic devices, supported by robust R&D investments from both established medtech leaders and innovative startups. Companies such as Medtronic and Boston Scientific continue to expand their neuromodulation portfolios, integrating advanced bioelectronic interfaces capable of targeting specific ion channels. Meanwhile, emerging players are developing next-generation devices with enhanced biocompatibility, wireless power delivery, and closed-loop feedback systems, aiming for greater efficacy and patient comfort.

The regulatory environment is also evolving, with agencies such as the U.S. Food and Drug Administration (FDA) providing clearer pathways for the approval of bioelectronic therapies. This has accelerated clinical translation, with several pivotal trials underway or recently completed for devices targeting ion channel dysfunction in neurological and cardiac disorders. For example, Nevro Corp. is advancing spinal cord stimulation systems that modulate pain signaling via ion channel pathways, while Abbott is investing in closed-loop neuromodulation platforms for movement disorders and chronic pain.

Strategic collaborations between device manufacturers, academic institutions, and pharmaceutical companies are further catalyzing innovation. These partnerships are focused on integrating bioelectronic modulation with digital health platforms, enabling real-time monitoring and personalized therapy adjustments. Additionally, the adoption of advanced materials—such as flexible polymers and bioresorbable electronics—is enhancing device longevity and reducing adverse immune responses.

Looking ahead, the next few years are expected to see continued growth in the adoption of bioelectronic ion channel modulation, driven by expanding clinical evidence, increasing patient and clinician acceptance, and ongoing technological refinement. The sector is poised for significant impact across multiple therapeutic areas, with the potential to redefine standards of care for a range of chronic and refractory conditions.

Technology Overview: Mechanisms of Ion Channel Modulation

Bioelectronic ion channel modulation represents a rapidly advancing frontier in neuromodulation and therapeutic device technology. This approach leverages precise electrical, magnetic, or optical stimuli to modulate the activity of specific ion channels embedded in cellular membranes, thereby influencing cellular excitability and signaling. As of 2025, the field is witnessing significant progress in both fundamental mechanisms and translational applications, driven by advances in materials science, microfabrication, and device miniaturization.

At the core of bioelectronic ion channel modulation are devices capable of delivering targeted stimuli to modulate ion channel gating. These devices often utilize microelectrode arrays, flexible biointerfaces, or optoelectronic components to achieve high spatial and temporal resolution. For example, microelectrode arrays fabricated from biocompatible materials such as platinum-iridium alloys or conductive polymers are being refined to interface with neural and cardiac tissues, enabling selective activation or inhibition of voltage-gated sodium, potassium, or calcium channels. Companies like Boston Scientific Corporation and Medtronic plc are at the forefront of developing implantable neurostimulators and cardiac rhythm management devices that incorporate these principles.

Recent years have also seen the emergence of optogenetic and magnetogenetic approaches, where light-sensitive or magnetically responsive proteins are genetically introduced into target cells, allowing for non-invasive, remote control of ion channel activity. While these techniques are still primarily in the research phase, several biotechnology firms and academic-industry collaborations are working to translate these methods into clinical-grade devices. The integration of such bioelectronic interfaces with closed-loop feedback systems is a key trend, enabling real-time monitoring and adaptive modulation of ion channel activity based on physiological signals.

Another notable development is the use of organic bioelectronic materials, such as organic electrochemical transistors (OECTs), which offer soft, conformable interfaces with biological tissues. These materials are being explored for their ability to transduce ionic signals into electronic outputs and vice versa, providing a direct means to modulate ion channel function. Companies like Nevro Corp. are exploring next-generation bioelectronic therapies for chronic pain and other neurological disorders, leveraging advances in device miniaturization and precision targeting.

Looking ahead, the next few years are expected to bring further integration of artificial intelligence and machine learning algorithms into bioelectronic modulation platforms, enhancing the specificity and adaptability of ion channel targeting. Regulatory pathways are also evolving, with agencies such as the U.S. Food and Drug Administration (FDA) providing guidance for the approval of novel bioelectronic devices. As the technology matures, collaborations between device manufacturers, academic institutions, and healthcare providers will be critical in translating these advances into widespread clinical practice.

Current and Emerging Applications in Medicine

Bioelectronic ion channel modulation is rapidly advancing as a transformative approach in medical therapeutics, leveraging precise electrical or optical control of ion channels to treat a range of diseases. As of 2025, this field is witnessing significant momentum, with both established medical device manufacturers and innovative startups driving clinical translation and commercialization.

One of the most prominent applications is in neuromodulation, where bioelectronic devices target specific ion channels in neural tissues to modulate nerve activity. Companies such as Medtronic and Boston Scientific have expanded their portfolios beyond traditional deep brain and spinal cord stimulators to explore next-generation devices capable of more selective, ion channel-specific modulation. These systems aim to improve outcomes in chronic pain, epilepsy, and movement disorders by reducing off-target effects and enhancing therapeutic precision.

Emerging startups are also making notable strides. For example, Nevro is developing high-frequency spinal cord stimulation platforms that may interact with specific sodium and calcium channels, offering new hope for patients with refractory neuropathic pain. Meanwhile, research collaborations with academic institutions are accelerating the translation of optogenetic and electroceutical technologies, which use light or finely tuned electrical signals to modulate ion channels in targeted cell populations.

In cardiology, bioelectronic modulation of cardiac ion channels is being explored to treat arrhythmias and heart failure. Companies like Abbott are investigating implantable devices that can dynamically adjust cardiac electrophysiology, potentially reducing reliance on pharmacological interventions and their associated side effects. Early-stage clinical trials are underway, with initial data suggesting improved rhythm control and patient quality of life.

Beyond neurology and cardiology, bioelectronic ion channel modulation is being investigated for autoimmune and inflammatory disorders. The concept of “electroceuticals”—therapies that use electrical impulses to modulate immune cell ion channels—has gained traction, with organizations such as GlaxoSmithKline (through its bioelectronics R&D initiatives) investing in collaborative research to develop implantable devices for conditions like rheumatoid arthritis and Crohn’s disease.

Looking ahead, the next few years are expected to bring further integration of artificial intelligence and closed-loop feedback systems, enabling real-time adjustment of stimulation parameters based on patient-specific ion channel activity. As regulatory pathways become clearer and clinical evidence accumulates, bioelectronic ion channel modulation is poised to become a cornerstone of precision medicine, offering new hope for patients with previously intractable conditions.

Competitive Landscape: Leading Companies and Innovators

The competitive landscape for bioelectronic ion channel modulation in 2025 is characterized by a dynamic mix of established medical device manufacturers, emerging biotech startups, and academic spinouts, all racing to commercialize next-generation neuromodulation and electroceutical therapies. This sector is driven by the convergence of advances in microelectronics, materials science, and neurobiology, enabling precise, minimally invasive modulation of ion channels for therapeutic benefit.

Among the global leaders, Medtronic continues to leverage its expertise in neuromodulation devices, expanding its portfolio to include bioelectronic systems targeting specific ion channels implicated in chronic pain, epilepsy, and movement disorders. The company’s ongoing investments in closed-loop and adaptive stimulation technologies are expected to yield new FDA submissions in the next few years, with a focus on improved patient outcomes and device longevity.

Another major player, Boston Scientific, is actively developing implantable devices that utilize targeted electrical fields to modulate ion channel activity in peripheral nerves. Their research collaborations with academic institutions are accelerating the translation of preclinical findings into clinical trials, particularly in the areas of inflammatory disease and cardiac arrhythmias.

On the innovation front, startups such as Nevro are pioneering high-frequency stimulation platforms designed to selectively influence sodium and calcium channels, offering new hope for patients with refractory neuropathic pain. Nevro’s proprietary waveform technology is under evaluation in multiple international studies, with early data suggesting superior efficacy and reduced side effects compared to conventional neuromodulation.

Emerging biotech firms, including Axonics, are also making significant strides. Axonics is known for its rechargeable sacral neuromodulation systems, and is now exploring next-generation devices capable of real-time ion channel sensing and feedback-controlled stimulation. These innovations are expected to enter pivotal clinical trials by 2026, targeting indications such as overactive bladder and fecal incontinence.

Academic spinouts and collaborative consortia, such as those supported by the National Institutes of Health, are contributing foundational research and early-stage prototypes, particularly in the use of organic bioelectronic interfaces and optogenetic approaches for ion channel modulation. These efforts are likely to fuel further partnerships and licensing deals with industry leaders over the next few years.

Looking ahead, the competitive landscape is expected to intensify as regulatory pathways for bioelectronic therapies become clearer and reimbursement models evolve. Companies with robust clinical pipelines, scalable manufacturing capabilities, and strong intellectual property positions are poised to shape the future of ion channel-targeted bioelectronic medicine through 2025 and beyond.

Market Size, Segmentation, and 2025–2030 Forecasts

The market for bioelectronic ion channel modulation is poised for significant growth between 2025 and 2030, driven by advances in neuromodulation, precision medicine, and the convergence of electronics with biological systems. This sector encompasses devices and platforms that modulate ion channels—key proteins governing electrical signaling in nerves, muscles, and other tissues—using electrical, optical, or hybrid bioelectronic approaches. The market is segmented by application (neurological disorders, cardiac arrhythmias, pain management, and others), technology (implantable, wearable, and external devices), and end-user (hospitals, research institutes, and home care).

In 2025, the global market size for bioelectronic ion channel modulation is estimated to be in the low single-digit billions (USD), with the largest share attributed to neurological disorder management, particularly epilepsy and chronic pain. This is underpinned by the commercial success and ongoing development of implantable neurostimulators and closed-loop systems. Companies such as Medtronic and Boston Scientific are leading in implantable neuromodulation devices, with product lines that increasingly target specific ion channel pathways for more precise therapeutic effects. Nevro is also notable for its high-frequency spinal cord stimulation systems, which modulate pain signaling at the ion channel level.

Segmentation by technology shows implantable devices dominating the market in 2025, but wearable and minimally invasive external devices are expected to grow rapidly, especially as companies like NeuroMetrix and Nuvectra (prior to its acquisition) have developed non-invasive neuromodulation platforms. The cardiac segment, while smaller, is seeing innovation in bioelectronic pacemakers and arrhythmia management devices, with Abbott and Biotronik investing in next-generation solutions that interact with cardiac ion channels.

Looking ahead to 2030, the market is forecasted to grow at a compound annual growth rate (CAGR) of 8–12%, potentially reaching USD 6–8 billion globally. Growth drivers include the expansion of indications (e.g., autoimmune and metabolic diseases), integration of AI for closed-loop feedback, and the emergence of optoelectronic and nanomaterial-based modulators. The Asia-Pacific region is expected to see the fastest growth due to increasing healthcare investment and adoption of advanced medical devices.

- Key players: Medtronic, Boston Scientific, Nevro, Abbott, Biotronik, NeuroMetrix

- Major applications: Neurological disorders, pain management, cardiac arrhythmias

- Growth factors: Precision targeting, minimally invasive devices, AI integration, expanding indications

Overall, the bioelectronic ion channel modulation market is transitioning from niche neurological applications to broader clinical use, with robust growth expected through 2030 as technology and clinical evidence mature.

Regulatory Environment and Clinical Trial Milestones

The regulatory landscape for bioelectronic ion channel modulation is rapidly evolving as the field matures and devices move from preclinical research into human trials. In 2025, regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are increasingly engaging with developers to establish clear pathways for approval of these novel therapies. The FDA’s Center for Devices and Radiological Health (CDRH) has expanded its Breakthrough Devices Program to include several bioelectronic neuromodulation platforms, reflecting the agency’s recognition of their potential to address unmet medical needs.

A notable milestone in 2024 was the initiation of first-in-human clinical trials for implantable ion channel modulators targeting chronic pain and epilepsy. Companies like Nevro Corp., known for its spinal cord stimulation systems, have announced plans to adapt their platforms for more targeted ion channel modulation, leveraging closed-loop feedback and advanced electrode designs. Meanwhile, Bioness Inc. has reported progress in regulatory submissions for peripheral nerve stimulation devices that modulate specific ion channels implicated in neuropathic pain.

In Europe, the new Medical Device Regulation (MDR) framework, fully enforced since 2021, is shaping the clinical evidence requirements for bioelectronic devices. Companies are now required to provide robust clinical data demonstrating not only safety and performance but also long-term benefit and risk profiles. This has led to a surge in multicenter, randomized controlled trials across the EU, with several studies expected to reach primary endpoints by late 2025. BIOTRONIK, a leader in cardiac rhythm management, is actively collaborating with academic centers to evaluate next-generation implantables that modulate cardiac ion channels for arrhythmia management.

- 2025 Outlook: Regulatory agencies are expected to issue updated guidance documents specific to bioelectronic ion channel modulation, clarifying requirements for premarket approval and post-market surveillance.

- Several pivotal trials, including those sponsored by Nevro Corp. and Bioness Inc., are anticipated to report results, potentially paving the way for the first market authorizations of these devices in the U.S. and EU.

- Industry consortia and standards bodies are working to harmonize device classification and performance standards, with input from manufacturers such as BIOTRONIK and regulatory stakeholders.

Overall, 2025 is poised to be a pivotal year for the regulatory and clinical advancement of bioelectronic ion channel modulation, with the potential for the first commercial approvals and the establishment of new regulatory precedents that will shape the sector for years to come.

Key Partnerships, M&A, and Investment Trends

The bioelectronic ion channel modulation sector is experiencing a surge in strategic partnerships, mergers and acquisitions (M&A), and targeted investments as the field matures and clinical translation accelerates. In 2025, collaborations between device manufacturers, pharmaceutical companies, and academic institutions are intensifying, driven by the promise of precision neuromodulation and next-generation therapies for neurological, cardiac, and metabolic disorders.

A notable trend is the convergence of bioelectronics and traditional pharma, exemplified by alliances between established medical device firms and biopharma leaders. For instance, Medtronic, a global leader in neuromodulation devices, has expanded its partnerships with biotechnology companies to co-develop closed-loop systems that modulate specific ion channels implicated in chronic pain and epilepsy. Similarly, Boston Scientific continues to invest in research collaborations with academic centers to refine their neuromodulation platforms for targeted ion channel engagement.

Startups specializing in nanoscale bioelectronic interfaces, such as Nevro and Axonics, have attracted significant venture capital and strategic investments in 2024–2025. These companies are developing minimally invasive devices capable of modulating ion channel activity with high spatial and temporal precision, targeting indications ranging from chronic pain to overactive bladder. Their success has prompted larger players to pursue acquisition strategies to secure access to proprietary technologies and intellectual property.

On the M&A front, 2025 is witnessing increased activity as established device manufacturers seek to broaden their bioelectronic portfolios. Medtronic and Boston Scientific have both signaled intentions to acquire smaller firms with expertise in ion channel-targeted neuromodulation, aiming to accelerate product development and regulatory approval timelines. These moves are complemented by investments from global healthcare conglomerates such as Johnson & Johnson, which is expanding its digital surgery and neuromodulation divisions through both direct investment and partnership models.

Academic-industry partnerships remain a cornerstone of innovation, with leading research universities entering into multi-year agreements with device manufacturers to translate basic ion channel research into clinical-grade bioelectronic therapies. These collaborations are often supported by public funding agencies and non-profit organizations, further de-risking early-stage development.

Looking ahead, the sector is expected to see continued consolidation and cross-sector investment, particularly as clinical data from ongoing trials validate the efficacy and safety of ion channel modulation devices. The entry of new players and the expansion of existing partnerships will likely accelerate the commercialization of next-generation bioelectronic therapies, positioning the field for robust growth through the latter half of the decade.

Challenges: Technical, Ethical, and Adoption Barriers

Bioelectronic ion channel modulation, which leverages electronic interfaces to precisely control ion channel activity in living tissues, is rapidly advancing but faces a complex array of challenges as it moves toward broader clinical and commercial adoption in 2025 and the coming years. These challenges span technical, ethical, and adoption-related domains, each presenting unique hurdles for researchers, device manufacturers, and healthcare providers.

Technical Challenges remain at the forefront. Achieving stable, long-term integration of bioelectronic devices with biological tissues is a persistent issue. Devices must maintain biocompatibility and avoid immune responses or tissue damage over extended periods. Miniaturization is another critical hurdle, as effective modulation often requires nanoscale interfaces to interact with individual ion channels or small cell populations. Companies such as Nevro Corp. and Boston Scientific Corporation are actively developing implantable neuromodulation systems, but translating these to the subcellular precision required for ion channel targeting remains a significant engineering challenge. Powering these devices wirelessly and ensuring reliable data transmission without causing tissue heating or interference is also a major concern.

Ethical Barriers are increasingly prominent as bioelectronic modulation approaches clinical reality. The ability to modulate neural and cardiac ion channels raises questions about patient autonomy, consent, and the potential for unintended behavioral or physiological effects. Regulatory bodies such as the U.S. Food and Drug Administration are closely scrutinizing these technologies, requiring robust preclinical and clinical data to ensure safety and efficacy. The prospect of using bioelectronic devices for cognitive or mood enhancement, rather than strictly therapeutic purposes, further complicates the ethical landscape and may prompt new regulatory frameworks in the near future.

Adoption Barriers include both clinical and market-related factors. Clinicians may be hesitant to adopt new bioelectronic therapies without clear evidence of superiority over existing pharmacological or device-based treatments. Reimbursement pathways for novel devices are often unclear, and the high cost of development and manufacturing can limit accessibility. Leading device manufacturers such as Medtronic plc and Abbott Laboratories are investing in clinical trials and physician education to address these concerns, but widespread adoption will likely depend on demonstrating long-term benefits, cost-effectiveness, and patient acceptance.

Looking ahead, overcoming these challenges will require coordinated efforts among device developers, regulatory agencies, clinicians, and patient advocacy groups. Advances in materials science, wireless power transfer, and closed-loop control algorithms are expected to drive technical progress, while ongoing dialogue around ethics and policy will shape the responsible integration of bioelectronic ion channel modulation into mainstream medicine.

Future Outlook: Next-Generation Devices and Therapies

Bioelectronic ion channel modulation is rapidly advancing as a frontier in both medical device innovation and therapeutic development. As of 2025, the field is witnessing a convergence of microelectronics, materials science, and neurobiology, enabling precise, minimally invasive interventions targeting ion channels—key regulators of cellular excitability and signaling. The next few years are expected to see significant progress in both device sophistication and clinical translation.

Several companies are at the forefront of developing next-generation bioelectronic devices that modulate ion channels for therapeutic benefit. Medtronic, a global leader in neuromodulation, continues to refine implantable neurostimulators that target specific neural circuits, with ongoing research into closed-loop systems capable of real-time feedback and adaptive modulation of ion channel activity. Similarly, Boston Scientific is expanding its neuromodulation portfolio, focusing on devices that can deliver highly targeted electrical pulses to modulate pain pathways and other neurological functions.

Emerging players are leveraging advances in flexible electronics and biointerfaces. Nevro is developing high-frequency spinal cord stimulation systems, which are believed to act in part by modulating sodium and calcium ion channels in dorsal horn neurons, offering relief for chronic pain without the paresthesia associated with traditional stimulation. Meanwhile, startups and academic spinouts are exploring organic electronic materials and nanoscale electrodes to achieve more selective and less invasive ion channel modulation.

On the therapeutic front, bioelectronic modulation is being investigated for a range of conditions beyond chronic pain, including epilepsy, cardiac arrhythmias, and inflammatory diseases. The U.S. Food and Drug Administration (FDA) has signaled support for innovative neuromodulation therapies, with several breakthrough device designations granted in recent years. This regulatory momentum is expected to accelerate clinical trials and market entry for novel devices targeting ion channel dysfunction.

Looking ahead, integration of artificial intelligence and machine learning is poised to enhance device personalization, enabling dynamic adjustment of stimulation parameters based on patient-specific ion channel responses. Additionally, collaborations between device manufacturers and pharmaceutical companies are anticipated, aiming to combine bioelectronic modulation with targeted drug delivery for synergistic effects.

By 2027, the market is likely to see the first commercial deployment of fully implantable, wireless, and battery-free bioelectronic devices capable of long-term, closed-loop ion channel modulation. These advances promise to transform the management of neurological, cardiovascular, and immunological disorders, ushering in a new era of precision medicine.

Strategic Recommendations for Stakeholders

Bioelectronic ion channel modulation is rapidly emerging as a transformative approach in neuromodulation, pain management, and the treatment of chronic diseases. As the field matures in 2025, stakeholders—including device manufacturers, healthcare providers, investors, and regulatory bodies—must adopt strategic actions to capitalize on opportunities and address evolving challenges.

- Device Manufacturers: Companies developing bioelectronic devices should prioritize miniaturization, biocompatibility, and wireless capabilities. The integration of advanced materials and microfabrication techniques is essential for next-generation implants and wearables. Firms like Medtronic and Boston Scientific are already investing in closed-loop systems and adaptive stimulation algorithms, which are expected to set new standards for efficacy and patient comfort. Strategic partnerships with academic institutions and startups can accelerate innovation and reduce time-to-market.

- Healthcare Providers: Clinicians and hospital systems should invest in training and infrastructure to support the adoption of bioelectronic therapies. Early engagement with device manufacturers can facilitate clinical trials and real-world evidence generation, which are critical for reimbursement and regulatory approval. Providers should also monitor ongoing studies in ion channel modulation for indications such as epilepsy, chronic pain, and cardiac arrhythmias, as these are likely to be among the first to benefit from commercialized solutions.

- Investors: Venture capital and strategic investors should focus on companies with robust intellectual property portfolios and clear regulatory pathways. The sector is witnessing increased activity from established players and innovative startups, particularly in the U.S. and Europe. Investors should assess the scalability of device platforms and the potential for expansion into adjacent therapeutic areas, such as metabolic or inflammatory diseases.

- Regulatory Bodies: Agencies must continue to refine frameworks for evaluating the safety and efficacy of bioelectronic devices, especially those targeting ion channels. Collaboration with industry leaders like Medtronic and Boston Scientific can help shape guidelines that balance innovation with patient safety. Regulatory sandboxes and expedited review pathways may be necessary to keep pace with technological advances.

- Outlook: Over the next few years, the convergence of bioelectronics, data analytics, and personalized medicine is expected to drive significant growth. Stakeholders who proactively address interoperability, cybersecurity, and long-term device performance will be best positioned to lead in this evolving landscape.