CCD-Based Astronomical Imaging Sensors in 2025: Market Dynamics, Technological Breakthroughs, and the Road Ahead. Discover how evolving sensor architectures are redefining deep-space observation and research.

- Executive Summary: 2025 Market Overview and Key Takeaways

- CCD Sensor Technology: Current State and Recent Advancements

- Major Manufacturers and Industry Leaders (e.g., teledyneimaging.com, andor.oxinst.com, st.com)

- Market Size, Growth Projections, and Regional Trends (2025–2030)

- Emerging Applications in Astronomy and Space Science

- Comparative Analysis: CCD vs. CMOS in Astronomical Imaging

- Supply Chain, Materials, and Manufacturing Innovations

- Regulatory Landscape and Industry Standards (e.g., ieee.org, spie.org)

- Challenges: Cost, Performance, and Competition from New Technologies

- Future Outlook: Next-Generation CCD Sensors and Strategic Opportunities

- Sources & References

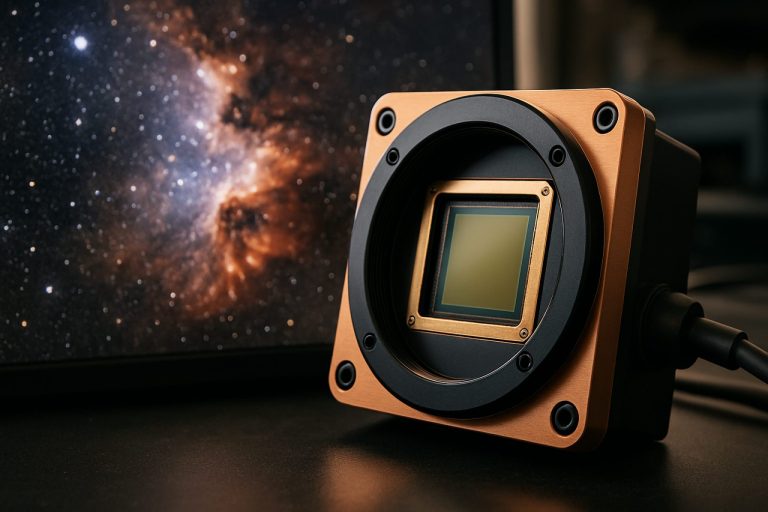

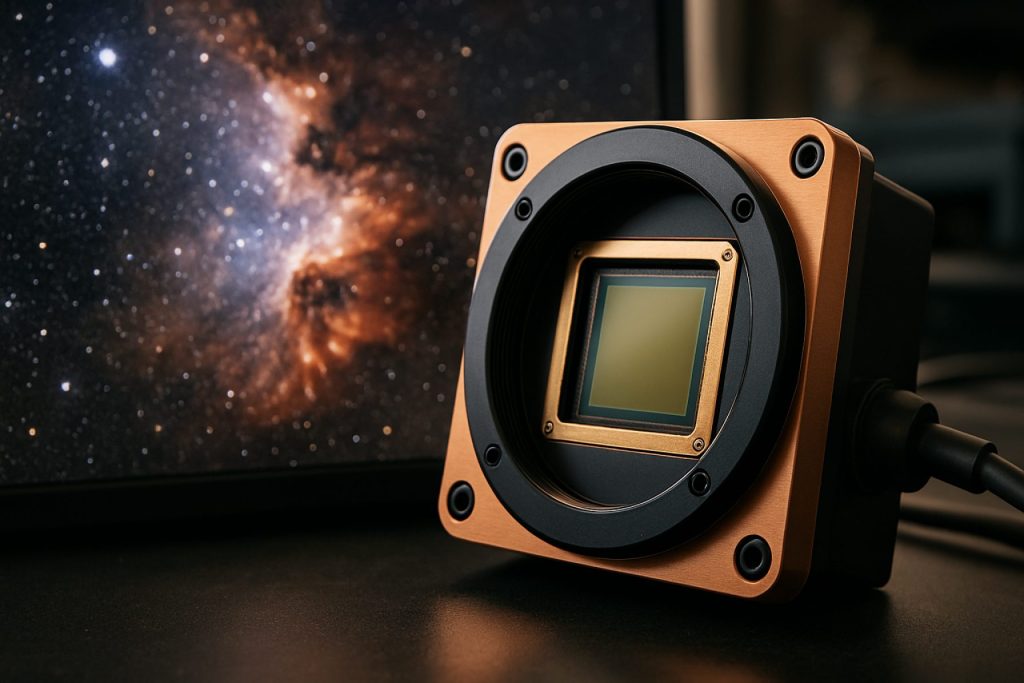

Executive Summary: 2025 Market Overview and Key Takeaways

The market for CCD-based astronomical imaging sensors in 2025 remains a specialized yet vital segment within the broader scientific imaging landscape. Despite the increasing adoption of CMOS technology in many imaging applications, CCD (Charge-Coupled Device) sensors continue to be the preferred choice for high-precision astronomical research due to their superior noise characteristics, high quantum efficiency, and proven reliability in long-exposure and low-light conditions. Leading manufacturers such as Teledyne Technologies Incorporated, Hamamatsu Photonics K.K., and Andor Technology Ltd. (a subsidiary of Oxford Instruments) remain at the forefront of CCD sensor development, supplying critical components for observatories, space agencies, and research institutions worldwide.

In 2025, the demand for CCD-based sensors is primarily driven by large-scale astronomical projects and legacy observatories that require the highest image fidelity for applications such as deep-sky surveys, exoplanet detection, and spectroscopic analysis. Notably, the continued operation and upgrades of major facilities—including the Hubble Space Telescope and ground-based observatories—rely on the unique attributes of CCD technology. Hamamatsu Photonics K.K. and Teledyne Technologies Incorporated are recognized for their custom, high-performance CCDs tailored for scientific missions, while Andor Technology Ltd. provides advanced camera systems integrating these sensors for turnkey astronomical imaging solutions.

However, the market outlook for CCD-based astronomical sensors is characterized by both stability and gradual transition. While new investments in CCD technology persist for mission-critical and ultra-sensitive applications, the broader trend in sensor development is shifting toward CMOS-based solutions, which offer advantages in speed, power consumption, and integration. Nevertheless, the installed base of CCD-equipped telescopes and the long operational lifespans of astronomical instruments ensure a sustained, if niche, demand for CCD sensors and replacement parts through at least the late 2020s.

Key takeaways for 2025 include:

- CCD sensors remain indispensable for high-precision astronomical imaging, especially in scientific research and legacy observatory systems.

- Market activity is concentrated among a small number of specialized manufacturers, notably Teledyne Technologies Incorporated, Hamamatsu Photonics K.K., and Andor Technology Ltd..

- While CMOS technology is gaining ground, the unique performance characteristics of CCDs ensure their continued relevance in astronomy for the foreseeable future.

- Ongoing support, customization, and innovation from leading suppliers are critical to meeting the evolving needs of the astronomical community.

CCD Sensor Technology: Current State and Recent Advancements

Charge-Coupled Device (CCD) sensors have long been the backbone of astronomical imaging, prized for their high quantum efficiency, low noise, and uniform response. As of 2025, CCD technology remains integral to both professional and advanced amateur astronomy, despite the growing presence of CMOS alternatives. The current state of CCD-based astronomical imaging sensors is characterized by incremental improvements in sensitivity, readout speed, and radiation hardness, as well as ongoing efforts to extend their operational lifespans in demanding environments.

Key manufacturers such as Teledyne Technologies Incorporated (through its Teledyne e2v division) and Hamamatsu Photonics K.K. continue to supply high-performance CCDs for major observatories and space missions. Teledyne e2v, for example, is known for its deep-depletion CCDs, which offer enhanced sensitivity in the near-infrared and are widely used in large-scale survey telescopes. Their sensors are featured in instruments like the Vera C. Rubin Observatory’s LSST Camera, which is expected to begin full science operations in the coming years. Hamamatsu, meanwhile, provides custom CCD solutions for both ground-based and space-based telescopes, focusing on low dark current and high dynamic range.

Recent advancements include the development of larger-format CCDs with higher pixel counts, enabling wider fields of view and finer spatial resolution. Innovations in back-illumination and anti-reflective coatings have further improved quantum efficiency, particularly at shorter wavelengths. Additionally, manufacturers are addressing the challenge of radiation-induced degradation, especially for space applications, by refining fabrication processes and implementing on-chip charge injection techniques to mitigate charge transfer inefficiency.

In the next few years, the outlook for CCD-based astronomical imaging sensors is shaped by several trends:

- Continued deployment in flagship observatories, such as the European Space Agency’s Euclid mission, which relies on large-format CCDs from Teledyne Technologies Incorporated for its visible imaging channel.

- Ongoing demand for custom, high-reliability CCDs in specialized applications, including exoplanet detection and time-domain astronomy.

- Incremental improvements in readout electronics, enabling faster data acquisition without compromising noise performance.

- Gradual integration of hybrid systems, where CCDs are paired with CMOS sensors to leverage the strengths of both technologies.

While CMOS sensors are gaining ground in some astronomical applications due to their speed and lower power consumption, CCDs remain unmatched in terms of uniformity and low noise for long-exposure, high-precision imaging. Leading suppliers such as Teledyne Technologies Incorporated and Hamamatsu Photonics K.K. are expected to maintain their pivotal roles in the sector, supporting both ongoing and next-generation astronomical projects through 2025 and beyond.

Major Manufacturers and Industry Leaders (e.g., teledyneimaging.com, andor.oxinst.com, st.com)

The landscape of CCD-based astronomical imaging sensors in 2025 is shaped by a select group of manufacturers with deep expertise in high-sensitivity, low-noise sensor technology. These companies supply critical components for professional observatories, space missions, and advanced amateur astronomy, maintaining a focus on performance, reliability, and innovation.

Teledyne Imaging is a prominent force in the sector, encompassing several specialized subsidiaries such as Teledyne e2v and Teledyne DALSA. Teledyne Imaging is renowned for its custom and off-the-shelf CCD sensors, which are widely used in major astronomical projects, including space telescopes and ground-based observatories. Their sensors are recognized for high quantum efficiency, large formats, and radiation tolerance, making them suitable for demanding scientific applications. Teledyne e2v, in particular, has supplied CCDs for flagship missions like ESA’s Gaia and NASA’s Hubble Space Telescope, and continues to innovate with new sensor architectures tailored for next-generation telescopes.

Andor Technology, a part of Oxford Instruments, is another industry leader, specializing in high-performance scientific cameras for astronomy and other research fields. Andor Technology offers a range of CCD-based cameras optimized for low-light imaging, long exposures, and high dynamic range. Their products are frequently chosen for both professional and advanced amateur observatories, with ongoing development in cooling technology and readout electronics to further reduce noise and enhance sensitivity.

STMicroelectronics is a global semiconductor manufacturer with a significant presence in imaging sensor technology. STMicroelectronics produces CCD and CMOS sensors for a variety of applications, including scientific and industrial imaging. While the company is increasingly focused on CMOS advancements, its legacy and ongoing support for CCD technology remain important for specialized astronomical uses, particularly where the unique characteristics of CCDs—such as superior uniformity and low dark current—are required.

Other notable contributors include Hamamatsu Photonics, which supplies high-sensitivity CCDs for scientific imaging, and Gpixel, a newer entrant offering large-format scientific sensors. These companies are responding to evolving demands for larger sensor formats, improved quantum efficiency, and enhanced radiation hardness, ensuring CCD technology remains relevant for astronomy in the near future.

Looking ahead, while the broader imaging industry is shifting toward CMOS, the expertise and product lines of these manufacturers ensure that CCD-based sensors will continue to play a vital role in astronomical research through at least the late 2020s, particularly for applications where their unique advantages are irreplaceable.

Market Size, Growth Projections, and Regional Trends (2025–2030)

The global market for CCD-based astronomical imaging sensors is expected to experience moderate but steady growth from 2025 through 2030, driven by ongoing investments in both professional and amateur astronomy, as well as the continued demand for high-sensitivity imaging in scientific research. While CMOS sensors have made significant inroads in many imaging applications, CCD (Charge-Coupled Device) technology remains a preferred choice for high-precision astronomical imaging due to its superior noise characteristics, quantum efficiency, and uniformity.

Key manufacturers such as Hamamatsu Photonics, Teledyne Technologies, and Andor Technology (a subsidiary of Oxford Instruments) continue to supply advanced CCD sensors and camera systems to observatories, research institutions, and OEMs worldwide. These companies are focusing on incremental improvements in sensor architecture, cooling technologies, and readout electronics to maintain CCD’s competitive edge in scientific imaging.

In terms of market size, the astronomical imaging sensor segment is a niche within the broader scientific imaging market. Estimates for 2025 suggest a global market value in the low hundreds of millions of USD, with CCD-based sensors accounting for a significant, though gradually declining, share as CMOS alternatives gain traction. However, for applications requiring ultra-low noise and high dynamic range—such as deep-sky imaging, exoplanet detection, and spectroscopy—CCD sensors remain indispensable.

Regionally, North America and Europe are expected to maintain their dominance in the CCD-based astronomical imaging sensor market, owing to the presence of major observatories, space agencies, and research consortia. The United States, in particular, benefits from ongoing projects funded by NASA and the National Science Foundation, which continue to specify CCD technology for flagship telescopes and survey instruments. Europe, with organizations like the European Southern Observatory, also sustains robust demand for high-end CCD sensors.

Asia-Pacific is projected to see the fastest relative growth, led by increased investments in astronomical infrastructure in China, Japan, and India. Companies such as Hamamatsu Photonics (Japan) are well-positioned to supply both domestic and international projects, leveraging their expertise in sensor fabrication and system integration.

Looking ahead to 2030, the market outlook for CCD-based astronomical imaging sensors will depend on the pace of technological innovation and the evolving requirements of next-generation telescopes. While CMOS technology will continue to erode some market share, the unique performance attributes of CCDs ensure their continued relevance in high-end astronomical applications, particularly where scientific rigor and data quality are paramount.

Emerging Applications in Astronomy and Space Science

Charge-Coupled Device (CCD) imaging sensors have long been foundational in astronomical observation, and their role continues to evolve as new applications emerge in astronomy and space science. In 2025 and the coming years, CCD-based sensors are expected to remain integral to both ground-based and space-borne observatories, even as complementary technologies such as CMOS sensors gain traction.

One of the most significant ongoing applications is in large-scale sky surveys and time-domain astronomy. Projects like the Vera C. Rubin Observatory’s Legacy Survey of Space and Time (LSST) rely on custom-designed, large-format CCD arrays to capture wide-field, high-resolution images of the night sky. These sensors are engineered for low noise, high quantum efficiency, and precise photometric performance, enabling the detection of faint and transient astronomical phenomena. The LSST camera, for example, incorporates a mosaic of 189 CCDs, each manufactured to stringent specifications for scientific imaging (Teledyne Technologies).

In the realm of exoplanet research, CCDs continue to be deployed in both space-based and ground-based telescopes for high-precision photometry and spectroscopy. Missions such as the European Space Agency’s PLATO, scheduled for launch in the mid-2020s, utilize large-area CCD detectors to monitor stellar brightness variations and identify exoplanet transits (European Space Agency). The stability and uniformity of CCDs make them well-suited for these demanding applications, where even minute changes in light intensity must be reliably measured.

CCD technology is also being adapted for use in next-generation adaptive optics systems, which correct for atmospheric distortion in real time. High-speed, low-noise CCDs are employed as wavefront sensors, providing the rapid feedback necessary for precise optical corrections in large telescopes. Companies such as Hamamatsu Photonics and Teledyne Technologies continue to innovate in this area, offering specialized CCDs with enhanced sensitivity and readout speeds tailored for astronomical instrumentation.

Looking ahead, the outlook for CCD-based astronomical imaging sensors remains robust, particularly in scientific domains where their low dark current, high dynamic range, and proven reliability are critical. While CMOS sensors are making inroads due to their speed and integration capabilities, leading manufacturers like Hamamatsu Photonics, Teledyne Technologies, and European Space Agency are expected to support and advance CCD technology for specialized astronomical and space science missions through at least the latter half of the decade.

Comparative Analysis: CCD vs. CMOS in Astronomical Imaging

In 2025, charge-coupled device (CCD) sensors continue to play a significant role in astronomical imaging, despite the rapid advancements and growing adoption of complementary metal-oxide-semiconductor (CMOS) technology. CCDs have long been the standard in professional astronomy due to their high quantum efficiency, low readout noise, and uniform pixel response, which are critical for capturing faint celestial objects and conducting precise photometric measurements.

Leading manufacturers such as Teledyne Technologies and Hamamatsu Photonics remain at the forefront of CCD sensor production for scientific and astronomical applications. Teledyne Technologies supplies large-format, back-illuminated CCDs for major observatories and space missions, emphasizing their continued relevance in high-end research. Similarly, Hamamatsu Photonics provides specialized CCDs optimized for low-light detection and high dynamic range, which are essential for deep-sky imaging and spectroscopy.

Recent years have seen incremental improvements in CCD technology, such as enhanced anti-blooming features, improved cooling systems, and larger sensor formats. These advances are particularly important for wide-field surveys and time-domain astronomy, where uniformity and stability are paramount. For example, the Vera C. Rubin Observatory’s Legacy Survey of Space and Time (LSST) employs a massive mosaic of CCDs to achieve its ambitious survey goals, underscoring the technology’s ongoing importance in flagship astronomical projects.

However, the landscape is shifting as CMOS sensors make significant inroads, especially in areas where high frame rates, lower power consumption, and on-chip processing are advantageous. Despite this, CCDs retain a competitive edge in applications demanding the utmost in sensitivity and photometric accuracy. The continued investment by manufacturers like Gpixel—which offers both CCD and CMOS solutions—demonstrates that CCDs are still being developed and supported for scientific imaging.

Looking ahead to the next few years, the outlook for CCD-based astronomical imaging sensors is characterized by a gradual transition rather than abrupt obsolescence. While CMOS will likely dominate new commercial and some research applications, CCDs are expected to remain integral to large-scale observatories and specialized instruments where their unique performance characteristics are unmatched. Ongoing support from established suppliers and the deployment of new CCD-based instruments in major observatories suggest that CCD technology will continue to be a cornerstone of astronomical imaging through at least the late 2020s.

Supply Chain, Materials, and Manufacturing Innovations

The supply chain for CCD-based astronomical imaging sensors in 2025 is characterized by a combination of legacy expertise, ongoing material innovation, and strategic manufacturing partnerships. While CMOS sensors have gained ground in many imaging applications, CCDs remain the gold standard for high-sensitivity, low-noise astronomical imaging, especially in large-scale observatories and scientific missions.

The global supply of scientific-grade CCDs is highly concentrated among a few specialized manufacturers. Teledyne Technologies Incorporated (through its Teledyne e2v division) and Hamamatsu Photonics K.K. are the principal suppliers, providing custom and standard CCDs for major astronomical projects. Teledyne e2v, based in the UK, is renowned for its deep-depletion, back-illuminated CCDs, which are used in flagship observatories and space telescopes. Hamamatsu, headquartered in Japan, offers a broad portfolio of scientific CCDs, including large-format and high-quantum-efficiency devices, and is a key supplier for both ground-based and space-based astronomy.

Material innovation remains a focus, with manufacturers optimizing silicon purity, wafer processing, and anti-reflective coatings to enhance quantum efficiency and reduce readout noise. Back-illumination and deep-depletion technologies, pioneered by Teledyne Technologies Incorporated and Hamamatsu Photonics K.K., continue to be refined for improved sensitivity in the ultraviolet and near-infrared bands. In 2025, there is also increased interest in hybrid sensor architectures, where CCDs are combined with advanced electronics for faster readout and lower power consumption.

The manufacturing process for astronomical CCDs is highly specialized, involving custom photolithography, precision doping, and stringent quality control. Lead times for large-format, scientific-grade CCDs remain long—often 12-24 months—due to the complexity of fabrication and the need for extensive testing. Supply chain resilience is a concern, as the number of foundries capable of producing high-performance CCDs has dwindled over the past decade. Both Teledyne Technologies Incorporated and Hamamatsu Photonics K.K. have invested in maintaining in-house wafer processing and packaging capabilities to mitigate risks associated with external foundry dependencies.

Looking ahead, the outlook for CCD-based astronomical imaging sensors is stable but niche. While the overall market is not expected to grow rapidly, demand from large-scale astronomical surveys, space missions, and specialized research instruments will sustain production. Manufacturers are expected to continue incremental improvements in materials and process control, with a focus on reliability and performance for mission-critical applications. Strategic collaborations between observatories, space agencies, and sensor manufacturers will remain essential to ensure the continued availability and advancement of CCD technology for astronomy.

Regulatory Landscape and Industry Standards (e.g., ieee.org, spie.org)

The regulatory landscape and industry standards for CCD-based astronomical imaging sensors in 2025 are shaped by a combination of international technical standards, voluntary compliance frameworks, and evolving best practices. These standards ensure interoperability, data quality, and safety in the design, manufacture, and deployment of CCD (Charge-Coupled Device) sensors for astronomical applications.

A central role in standardization is played by the Institute of Electrical and Electronics Engineers (IEEE), which maintains a suite of standards relevant to imaging sensor performance, data interfaces, and electromagnetic compatibility. The IEEE 1451 family, for example, addresses smart sensor interfaces, while IEEE 1596 and related standards cover high-speed data transfer protocols—both critical for large-scale astronomical observatories using CCD arrays. In 2025, ongoing revisions to these standards are expected to further address the needs of high-throughput, low-noise imaging required by next-generation telescopes.

The International Society for Optics and Photonics (SPIE) continues to be a key forum for the dissemination of best practices and the development of consensus around performance metrics for CCD sensors. SPIE’s conferences and publications in 2025 are anticipated to focus on calibration protocols, quantum efficiency measurement, and dark current characterization—parameters essential for astronomical imaging fidelity. SPIE also facilitates collaboration between manufacturers, such as Teledyne Technologies Incorporated and Hamamatsu Photonics K.K., and research institutions to harmonize testing methodologies.

On the manufacturing side, companies like Teledyne Technologies Incorporated and Hamamatsu Photonics K.K. are active participants in standards development, often aligning their product lines with international guidelines to ensure compatibility with major observatories and space agencies. These manufacturers typically adhere to ISO 9001 quality management standards and, for space applications, to ECSS (European Cooperation for Space Standardization) requirements, which are increasingly referenced in procurement specifications for astronomical CCDs.

Looking ahead, the regulatory environment is expected to place greater emphasis on environmental compliance, including RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) directives, as CCD production involves materials of concern. Additionally, as data volumes from astronomical surveys grow, interoperability standards for data formatting and metadata—such as those promoted by the International Astronomical Union (IAU)—will become more critical for global data sharing and analysis.

In summary, the regulatory and standards framework for CCD-based astronomical imaging sensors in 2025 is characterized by active collaboration between industry, standards bodies, and the scientific community, with a focus on performance, interoperability, and environmental responsibility.

Challenges: Cost, Performance, and Competition from New Technologies

CCD-based astronomical imaging sensors have long been the backbone of professional and amateur astronomy, prized for their high quantum efficiency, low noise, and uniform response. However, as of 2025, the sector faces significant challenges stemming from cost pressures, evolving performance requirements, and intensifying competition from alternative sensor technologies.

One of the primary challenges is the high manufacturing cost of CCDs. The fabrication process for scientific-grade CCDs is complex, requiring specialized foundries and rigorous quality control. This has led to a concentration of production among a few specialized manufacturers. Teledyne Technologies and Hamamatsu Photonics are among the leading suppliers, providing custom and large-format CCDs for major observatories and space missions. However, the limited scale of the astronomy market, combined with the high cost of maintaining dedicated CCD production lines, has resulted in rising prices and longer lead times for new sensors.

Performance remains a strong point for CCDs, especially in applications demanding extremely low read noise and high dynamic range. For example, the Teledyne e2v division continues to supply advanced CCDs for flagship projects such as the European Space Agency’s Euclid mission and the Vera C. Rubin Observatory. These sensors are engineered for scientific precision, but their development cycles are lengthy and costly, making rapid innovation difficult.

The most significant competitive threat comes from CMOS imaging sensors, which have seen rapid advances in recent years. CMOS sensors now offer lower power consumption, faster readout speeds, and increasingly competitive noise characteristics. Major sensor manufacturers such as Sony Corporation and onsemi have invested heavily in scientific CMOS (sCMOS) technology, targeting both research and industrial imaging markets. As a result, new astronomical instruments—especially those requiring high frame rates or large focal planes—are increasingly adopting CMOS over CCDs.

Looking ahead, the outlook for CCD-based astronomical imaging sensors is mixed. While they will likely remain indispensable for certain high-precision applications through the late 2020s, the shrinking supplier base and ongoing R&D investments in CMOS technology suggest a gradual shift in market dominance. The next few years will be critical for CCD manufacturers to innovate or specialize further, as observatories and research institutions weigh the trade-offs between legacy performance and the flexibility of emerging sensor platforms.

Future Outlook: Next-Generation CCD Sensors and Strategic Opportunities

The landscape for CCD-based astronomical imaging sensors in 2025 is characterized by both technological evolution and strategic repositioning. While CMOS sensors have made significant inroads in many imaging applications, CCDs remain the gold standard for high-precision, low-noise astronomical observations, particularly in large-scale observatories and space missions. The next few years are poised to see a blend of incremental innovation and targeted investment in CCD technology, driven by the unique demands of astronomy and the enduring strengths of CCD architectures.

Key manufacturers such as Teledyne Technologies and Hamamatsu Photonics continue to supply advanced CCDs for flagship astronomical projects. Teledyne Technologies (through its Teledyne e2v division) is a principal supplier for major observatories, including the European Southern Observatory and the Vera C. Rubin Observatory, providing large-format, back-illuminated CCDs with high quantum efficiency and low readout noise. Hamamatsu Photonics remains a leader in scientific-grade CCDs, focusing on custom solutions for space telescopes and ground-based instruments.

In 2025, the strategic focus is on enhancing CCD performance through improved manufacturing processes, such as deep-depletion technology for better red sensitivity and advanced anti-reflection coatings to maximize photon collection. There is also a push toward larger wafer sizes and monolithic sensor arrays, enabling wider fields of view and higher resolution for next-generation survey telescopes. These advances are critical for projects like the European Space Agency’s Euclid mission and the continued operation of the Hubble Space Telescope, both of which rely on high-performance CCDs.

Despite the rise of CMOS, the astronomical community’s investment in CCDs is underpinned by their proven stability, uniformity, and radiation hardness—qualities essential for long-duration space missions and precision photometry. Strategic opportunities in the coming years include the development of hybrid imaging systems that combine CCD and CMOS technologies, leveraging the strengths of both. Additionally, there is growing interest in custom CCD designs for niche applications, such as adaptive optics and time-domain astronomy, where ultra-low noise and high dynamic range are paramount.

Looking ahead, the market for CCD-based astronomical sensors is expected to remain robust in specialized segments, supported by ongoing collaborations between sensor manufacturers and leading research institutions. As observatories plan upgrades and new missions, the demand for bespoke, high-performance CCDs will persist, ensuring continued innovation and strategic relevance for established suppliers like Teledyne Technologies and Hamamatsu Photonics.

Sources & References

- Teledyne Technologies Incorporated

- Hamamatsu Photonics K.K.

- Andor Technology Ltd.

- Teledyne Imaging

- Andor Technology

- STMicroelectronics

- European Space Agency

- Institute of Electrical and Electronics Engineers (IEEE)

- International Society for Optics and Photonics (SPIE)