Compound Semiconductor Photonics Industry Report 2025: Market Dynamics, Growth Projections, and Strategic Insights for the Next 5 Years

- Executive Summary & Market Overview

- Key Technology Trends in Compound Semiconductor Photonics

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

Compound semiconductor photonics refers to the use of compound semiconductor materials—such as gallium arsenide (GaAs), indium phosphide (InP), and gallium nitride (GaN)—in the design and manufacture of photonic devices. These materials offer superior electronic and optical properties compared to traditional silicon, enabling high-performance applications in optical communications, sensing, lighting, and advanced display technologies. The global market for compound semiconductor photonics is experiencing robust growth, driven by surging demand for high-speed data transmission, 5G infrastructure, and next-generation consumer electronics.

In 2025, the compound semiconductor photonics market is projected to reach new heights, with industry analysts forecasting a compound annual growth rate (CAGR) exceeding 8% through the end of the decade. This expansion is underpinned by the proliferation of data centers, the rollout of 5G networks, and the increasing adoption of photonic integrated circuits (PICs) in telecommunications and data communications. According to MarketsandMarkets, the global compound semiconductor market—including photonics—was valued at over USD 40 billion in 2023, with photonics applications accounting for a significant and growing share.

Key industry players such as Coherent Corp., Lumentum Holdings Inc., and ams OSRAM are investing heavily in R&D to develop advanced photonic devices, including lasers, modulators, and detectors. These innovations are critical for enabling high-speed optical interconnects, LiDAR systems for autonomous vehicles, and miniaturized sensors for medical diagnostics. The Asia-Pacific region, led by China, Japan, and South Korea, continues to dominate production and consumption, supported by strong government initiatives and a robust electronics manufacturing ecosystem (Germany Trade & Invest).

- Telecommunications: Demand for high-bandwidth optical transceivers and switches is accelerating, driven by cloud computing and video streaming.

- Consumer Electronics: Compound semiconductor photonics enable advanced displays, facial recognition, and augmented reality features.

- Automotive: LiDAR and advanced driver-assistance systems (ADAS) are increasingly reliant on compound photonic devices.

In summary, the compound semiconductor photonics market in 2025 is characterized by rapid innovation, expanding end-use applications, and a dynamic competitive landscape. The sector is poised for sustained growth as photonic technologies become integral to digital infrastructure and smart devices worldwide.

Key Technology Trends in Compound Semiconductor Photonics

Compound semiconductor photonics is witnessing rapid technological evolution in 2025, driven by the surging demand for high-speed data transmission, advanced sensing, and energy-efficient optoelectronic devices. This field leverages materials such as gallium arsenide (GaAs), indium phosphide (InP), and gallium nitride (GaN) to create photonic devices with superior performance compared to traditional silicon-based solutions.

One of the most significant trends is the integration of compound semiconductors with silicon photonics. Hybrid integration techniques are enabling the combination of the high-speed and wavelength versatility of III-V materials with the scalability and cost-effectiveness of silicon platforms. This is particularly transformative for data centers and telecommunications, where companies like Intel and Coherent Corp. are advancing heterogeneous integration to deliver faster, more efficient optical transceivers.

Another key trend is the proliferation of miniaturized and high-performance photonic integrated circuits (PICs). These circuits, often based on InP and GaAs, are being developed for applications ranging from LiDAR in autonomous vehicles to advanced medical diagnostics. The ability to integrate multiple photonic functions on a single chip is reducing system complexity and power consumption, as highlighted in recent reports by Yole Group.

In the realm of sensing, compound semiconductors are enabling breakthroughs in quantum photonics and mid-infrared (mid-IR) applications. Quantum dot lasers and single-photon detectors, primarily fabricated from III-V materials, are enhancing the sensitivity and precision of quantum communication and imaging systems. Meanwhile, GaN-based devices are expanding into ultraviolet (UV) and visible light applications, supporting innovations in environmental monitoring and solid-state lighting, as noted by Strategy Analytics.

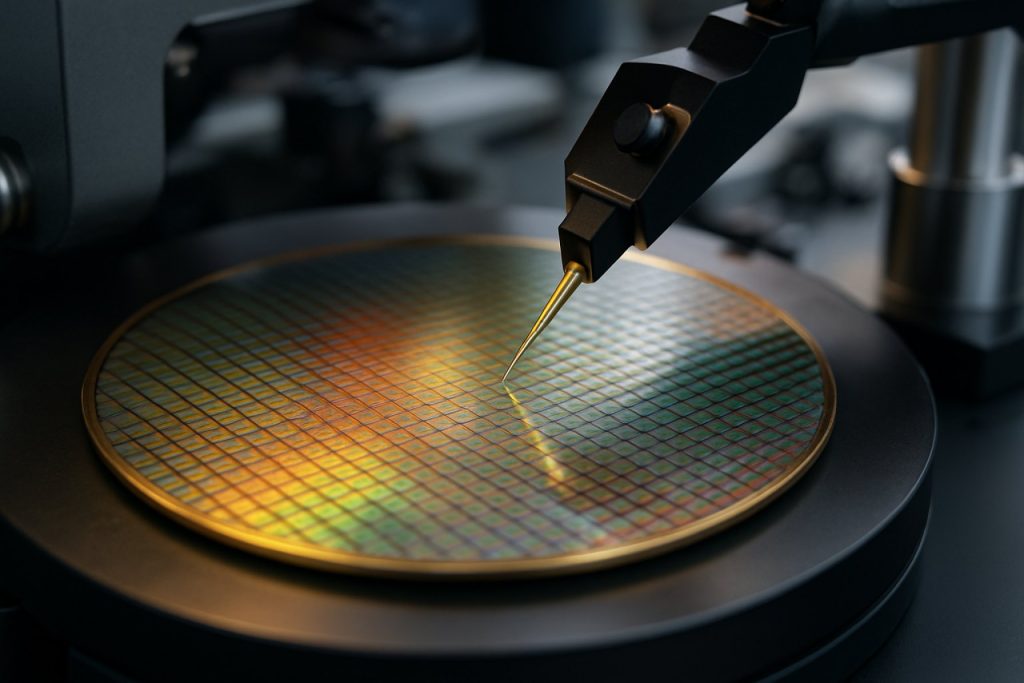

Finally, advances in manufacturing processes, such as wafer-scale epitaxy and advanced packaging, are improving yield and reducing costs. This is accelerating the commercialization of compound semiconductor photonic devices across consumer electronics, automotive, and industrial sectors. The ongoing collaboration between research institutions and industry leaders, including imec and ams OSRAM, is expected to further drive innovation and adoption in 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape of the compound semiconductor photonics market in 2025 is characterized by a dynamic mix of established industry leaders, innovative startups, and strategic collaborations. The market is driven by the increasing demand for high-speed data transmission, advanced sensing technologies, and energy-efficient optoelectronic devices across telecommunications, automotive, consumer electronics, and industrial sectors.

Key players dominating the market include ams OSRAM, Lumentum Holdings Inc., Coherent Corp. (formerly II-VI Incorporated), Broadcom Inc., and TRIOPTICS GmbH. These companies leverage extensive R&D capabilities and robust intellectual property portfolios to maintain their competitive edge, particularly in the development of advanced photonic integrated circuits (PICs), high-performance lasers, and light-emitting diodes (LEDs) based on compound semiconductors such as gallium arsenide (GaAs), indium phosphide (InP), and gallium nitride (GaN).

In 2025, ams OSRAM continues to lead in the production of compound semiconductor-based LEDs and laser diodes, serving automotive lighting, sensing, and industrial applications. Lumentum Holdings Inc. remains a key supplier of photonic solutions for optical networking and 3D sensing, benefiting from the ongoing expansion of 5G infrastructure and data center investments. Coherent Corp. has strengthened its position through strategic acquisitions and a diversified product portfolio spanning optical communications, materials processing, and life sciences.

Emerging players and startups are also making significant inroads, particularly in niche segments such as quantum photonics, miniaturized sensors, and integrated photonic platforms. Collaborations between industry leaders and research institutions are accelerating innovation, with joint ventures and licensing agreements facilitating the commercialization of next-generation compound semiconductor photonic devices.

Geographically, Asia-Pacific remains a hotbed of activity, with companies like San’an Optoelectronics and Epistar Corporation expanding their manufacturing capacities and R&D investments. North America and Europe continue to foster innovation through strong government support and a focus on high-value applications.

Overall, the competitive landscape in 2025 is marked by rapid technological advancements, strategic partnerships, and a race to capture emerging opportunities in data communications, automotive LiDAR, and advanced sensing, positioning compound semiconductor photonics as a critical enabler of next-generation technologies.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The compound semiconductor photonics market is poised for robust growth in 2025, driven by escalating demand across telecommunications, data centers, automotive LiDAR, and consumer electronics. According to projections from MarketsandMarkets, the global compound semiconductor market, which includes photonics applications, is expected to achieve a compound annual growth rate (CAGR) of approximately 7–9% from 2025 through 2030. This growth is underpinned by the increasing adoption of high-speed optical communication and the proliferation of 5G infrastructure, both of which rely heavily on compound semiconductor-based photonic devices such as lasers, photodetectors, and modulators.

Revenue forecasts for 2025 indicate that the compound semiconductor photonics segment will generate between $15 billion and $18 billion globally, with Asia-Pacific leading the market due to its concentration of electronics manufacturing and rapid deployment of next-generation networks. Global Information, Inc. highlights that the photonics sub-segment is expected to outpace other compound semiconductor applications, such as power electronics, due to surging investments in optical transceivers and photonic integrated circuits (PICs).

In terms of volume, the market is projected to see a significant increase in unit shipments of compound semiconductor photonic devices, particularly those based on gallium arsenide (GaAs) and indium phosphide (InP). These materials are favored for their superior electron mobility and direct bandgap properties, which are essential for high-efficiency light emission and detection. Yole Group estimates that the volume of photonic devices will grow at a CAGR of 8–10% during the forecast period, with the highest growth rates observed in vertical-cavity surface-emitting lasers (VCSELs) and photodetectors for 3D sensing and automotive applications.

- Key growth drivers in 2025: Expansion of 5G and fiber-optic networks, increased adoption of advanced driver-assistance systems (ADAS), and the integration of photonic sensors in smartphones and wearables.

- Regional outlook: Asia-Pacific remains the dominant region, followed by North America and Europe, with China, South Korea, and the U.S. as primary contributors to market expansion.

Overall, 2025 marks a pivotal year for compound semiconductor photonics, setting the stage for accelerated growth and technological innovation through 2030.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global compound semiconductor photonics market is poised for significant growth in 2025, with regional dynamics shaped by technological innovation, end-user demand, and government initiatives. The market encompasses optoelectronic devices such as lasers, LEDs, photodetectors, and modulators, leveraging materials like gallium arsenide (GaAs), indium phosphide (InP), and gallium nitride (GaN).

- North America: North America remains a leader in compound semiconductor photonics, driven by robust investments in 5G infrastructure, data centers, and defense applications. The United States, in particular, benefits from a strong ecosystem of research institutions and industry players such as Coherent Corp. and Lumentum Holdings Inc.. The region’s focus on next-generation optical communication and LiDAR for autonomous vehicles is expected to accelerate market expansion in 2025. According to MarketsandMarkets, North America will maintain a substantial market share due to early adoption of advanced photonic technologies.

- Europe: Europe’s compound semiconductor photonics market is characterized by strong government support for photonics research and a thriving automotive sector. Countries like Germany, the UK, and France are investing in smart manufacturing and Industry 4.0, which rely heavily on photonic sensors and communication modules. The European Union’s Photonics21 initiative continues to foster innovation and collaboration across the continent. In 2025, Europe is expected to see steady growth, particularly in applications related to healthcare diagnostics and environmental monitoring.

- Asia-Pacific: Asia-Pacific is projected to be the fastest-growing region, fueled by rapid industrialization, expanding telecommunications networks, and the presence of major manufacturers such as Sony Corporation and Samsung Electronics. China, Japan, and South Korea are at the forefront, with significant investments in 5G, IoT, and consumer electronics. The region’s cost-competitive manufacturing and government-backed R&D initiatives are expected to drive double-digit growth in 2025, as reported by Global Market Insights.

- Rest of World: The Rest of World segment, including Latin America, the Middle East, and Africa, is witnessing gradual adoption of compound semiconductor photonics. Growth is primarily driven by increasing demand for high-speed internet and renewable energy solutions. While market penetration remains lower compared to other regions, ongoing infrastructure projects and international partnerships are expected to create new opportunities in 2025.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for compound semiconductor photonics in 2025 is marked by rapid technological advancements and expanding application domains, driving robust investment activity. Compound semiconductors, such as gallium arsenide (GaAs), indium phosphide (InP), and gallium nitride (GaN), are increasingly critical in photonic devices due to their superior electron mobility, direct bandgap, and high-frequency performance. These properties are catalyzing innovation across several high-growth sectors.

Emerging Applications

- Data Centers and Optical Communications: The exponential growth in data traffic is fueling demand for high-speed optical transceivers and photonic integrated circuits (PICs) based on compound semiconductors. These devices enable faster, more energy-efficient data transmission, supporting the backbone of cloud computing and 5G/6G networks. According to Omdia, the global optical components market is expected to surpass $20 billion by 2025, with compound semiconductor-based solutions capturing a significant share.

- LiDAR and Sensing: Automotive LiDAR, industrial automation, and consumer electronics are increasingly adopting compound semiconductor photonics for their superior sensitivity and miniaturization potential. The integration of GaAs and InP lasers in LiDAR systems is pivotal for the advancement of autonomous vehicles and smart infrastructure, as highlighted by Yole Group.

- Quantum Technologies: Compound semiconductors are foundational for quantum photonics, including single-photon sources and detectors. These components are essential for quantum communication and computing, with research and pilot deployments accelerating in 2025, as noted by IDC.

- Healthcare and Biophotonics: The use of compound semiconductor lasers and detectors in medical imaging, diagnostics, and therapeutic devices is expanding. Their precision and wavelength versatility enable new modalities in non-invasive diagnostics and real-time monitoring, according to MarketsandMarkets.

Investment Hotspots

- Asia-Pacific: China, South Korea, and Taiwan are leading in manufacturing capacity expansion and R&D, supported by government initiatives and private capital. The region is expected to account for over 50% of global compound semiconductor photonics investments in 2025 (SEMI).

- North America and Europe: Strategic investments are focused on next-generation photonic integration, quantum technologies, and automotive applications. Public-private partnerships and venture capital are accelerating commercialization, as reported by Silicon Europe.

In summary, 2025 will see compound semiconductor photonics at the forefront of innovation, with emerging applications and regional investment hotspots shaping the competitive landscape and technological trajectory.

Challenges, Risks, and Strategic Opportunities

The compound semiconductor photonics sector in 2025 faces a complex landscape of challenges, risks, and strategic opportunities as it underpins critical advancements in telecommunications, data centers, automotive LiDAR, and next-generation consumer electronics. One of the foremost challenges is the high cost and technical complexity of manufacturing compound semiconductors, such as gallium arsenide (GaAs), indium phosphide (InP), and gallium nitride (GaN), compared to traditional silicon-based photonics. These materials require specialized fabrication processes and equipment, leading to higher capital expenditures and limiting scalability for mass-market applications. Supply chain vulnerabilities, particularly for rare materials and high-purity substrates, further exacerbate production risks, as highlighted by Semiconductor Industry Association.

Intellectual property (IP) risks are also significant, given the rapid pace of innovation and the concentration of key patents among a few leading players. This can create barriers to entry for new market participants and increase the risk of litigation, as noted by International Data Corporation (IDC). Additionally, the sector is exposed to geopolitical risks, especially as the U.S., China, and Europe vie for leadership in advanced photonics technologies, potentially leading to export controls and trade restrictions that disrupt global supply chains.

Despite these challenges, strategic opportunities abound. The accelerating demand for high-speed optical interconnects in data centers and 5G/6G networks is driving investment in compound semiconductor photonics, with the market projected to grow at a CAGR exceeding 8% through 2025, according to MarketsandMarkets. The automotive sector presents another major opportunity, as LiDAR and advanced driver-assistance systems (ADAS) increasingly rely on compound semiconductor-based photonic devices for enhanced performance and reliability. Furthermore, the push toward miniaturization and integration of photonic components with electronic circuits (heterogeneous integration) opens new avenues for innovation and cost reduction.

- Strategic partnerships between foundries, material suppliers, and system integrators are emerging as a key success factor, enabling shared R&D and risk mitigation.

- Government incentives and funding for domestic semiconductor manufacturing, particularly in the U.S. and EU, are expected to bolster the sector’s resilience and competitiveness.

- Advances in wafer-scale manufacturing and new substrate technologies could lower costs and improve yields, addressing a core barrier to broader adoption.

In summary, while the compound semiconductor photonics market in 2025 is shaped by significant technical and geopolitical risks, it also offers substantial growth opportunities for players able to navigate these complexities through innovation, collaboration, and strategic investment.

Sources & References

- MarketsandMarkets

- Lumentum Holdings Inc.

- ams OSRAM

- Germany Trade & Invest

- Strategy Analytics

- imec

- ams OSRAM

- Broadcom Inc.

- TRIOPTICS GmbH

- Epistar Corporation

- Global Information, Inc.

- Photonics21

- Global Market Insights

- Omdia

- IDC

- Silicon Europe

- Semiconductor Industry Association