Table of Contents

- Executive Summary: High-Density Klystron Momentum in 2025

- Market Size & Forecast Through 2030

- Key Technology Breakthroughs Accelerating Klystron Performance

- Major Players & Strategic Initiatives (e.g., thalesgroup.com, canon-electronics.co.jp, cpii.com)

- Application Trends: Satellite, Radar, Particle Accelerators, and Beyond

- Supply Chain and Manufacturing Innovations

- Competitive Landscape and Emerging Entrants

- Regulatory, Standards, and Industry Association Initiatives (e.g., ieee.org, asme.org)

- Investment, Funding, and Partnership Dynamics

- Future Outlook: Disruptive Scenarios and Strategic Recommendations

- Sources & References

Executive Summary: High-Density Klystron Momentum in 2025

The ongoing development of high-density klystrons in 2025 reflects a period of accelerated innovation and investment, underpinned by increasing global demand for advanced radio frequency (RF) and microwave power sources across scientific, defense, and communications sectors. High-density klystrons, characterized by their enhanced power output and compact design, are crucial for next-generation particle accelerators, radar systems, and satellite communications. In 2025, the sector is marked by active R&D programs, production advances, and integration of novel materials and digital control systems.

Significant events shaping the high-density klystron landscape include major upgrades and new installations at international scientific facilities. The European Organization for Nuclear Research (CERN) continues to support klystron development for its accelerator complexes, with recent milestones in the modernization of high-power RF sources to support the High-Luminosity Large Hadron Collider project. In the United States, SLAC National Accelerator Laboratory remains at the forefront, advancing the design and deployment of compact, high-efficiency klystrons for accelerator-driven science and medical technologies.

On the manufacturing front, industry leaders such as Thales and Communications & Power Industries (CPI) are scaling up the production of next-generation klystrons. Thales has introduced new high-density models targeting both scientific and military markets, focusing on reliability, power efficiency, and digital integration. CPI, meanwhile, has expanded its high-power klystron portfolio, emphasizing customized solutions for high-energy physics and national defense customers.

The ongoing transition toward solid-state RF amplifiers in some markets exerts competitive pressure; however, high-density klystrons retain a technological edge for ultra-high power and efficiency requirements. Collaborative initiatives, such as those between DESY (Deutsches Elektronen-Synchrotron) and industry partners, are driving innovation in modular klystron arrays and digital control architectures, aimed at improving operational flexibility and reducing maintenance downtime.

Looking ahead, the outlook for high-density klystron development remains robust. With major accelerator upgrades planned globally and persistent demand from defense and space sectors, manufacturers are expected to invest further in miniaturization, thermal management, and lifecycle extension technologies. The convergence of digital and RF engineering is set to define the next wave of high-density klystron innovation, positioning the sector for sustained momentum through the late 2020s.

Market Size & Forecast Through 2030

The market for high-density klystron technology is poised for significant evolution through 2030, driven by rising global demand for high-power radiofrequency (RF) sources in applications such as particle accelerators, satellite communications, and advanced radar systems. As of 2025, leading manufacturers are reporting steady growth in both order volumes and R&D investment. Communications & Power Industries (CPI), one of the primary suppliers of klystrons for accelerator and defense applications, continues to expand production capacities and develop higher-efficiency, compact models to meet evolving customer requirements.

In 2024, Thales Group introduced next-generation klystrons for space and defense, focusing on higher output power and improved reliability, which are critical for high-density applications. This trend is echoed by Toshiba Electron Tubes & Devices, which reported increased demand for high-density klystrons in global accelerator projects and advanced radar systems.

Estimating market size, industry participants suggest the global klystron market—valued at approximately USD 600–700 million in 2024—will see a compound annual growth rate (CAGR) of 5–7% through 2030, with high-density variants contributing a growing share. This forecast is underpinned by major infrastructure investments in scientific research: for example, klystrons are integral to projects like the European XFEL and upgrades at facilities such as CERN, with supplier partnerships from Communications & Power Industries (CPI) and Thales Group.

Key drivers in the coming years include the push for higher beam quality and power stability in accelerator science, as well as the emergence of new defense and communications platforms requiring compact, robust, and efficient RF sources. Companies are increasingly investing in digital control integration and advanced cooling to further increase klystron density and operational lifespan, as reported in technical updates from Toshiba Electron Tubes & Devices.

By 2030, high-density klystrons are expected to account for a significant portion of overall klystron sales, particularly in regions investing heavily in scientific infrastructure and next-generation defense systems. This outlook suggests sustained innovation and competitive differentiation among established manufacturers, as well as opportunities for new entrants leveraging advanced materials and digitalization.

Key Technology Breakthroughs Accelerating Klystron Performance

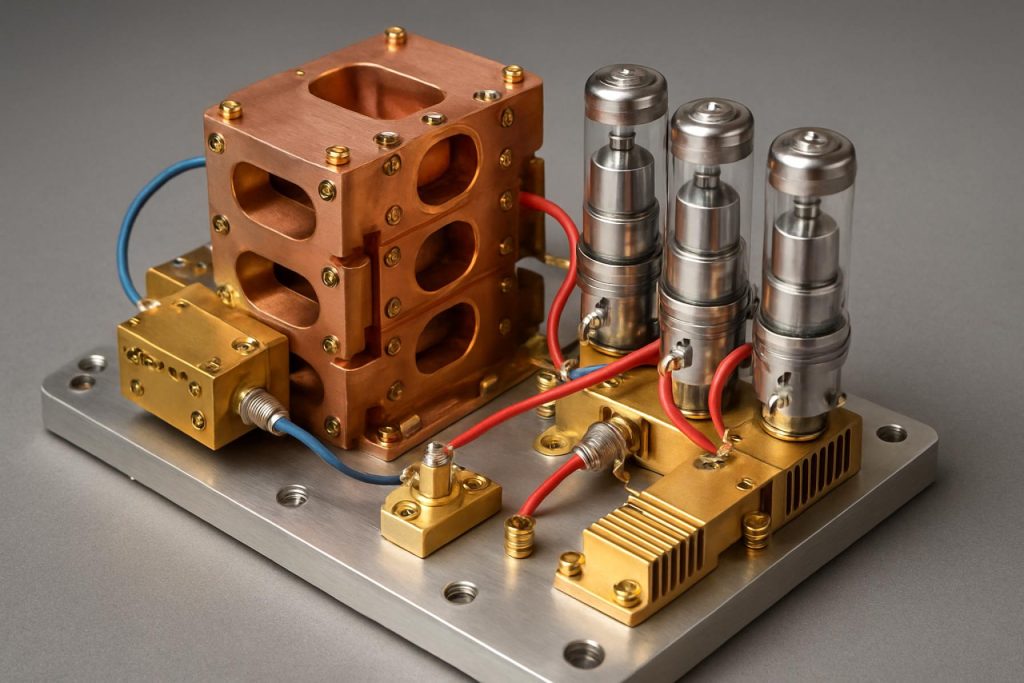

The ongoing push for higher efficiency and output in RF and microwave technology is driving significant developments in high-density klystron design. In 2025, leading manufacturers are focusing on advancing electron beam compression, thermal management, and materials integration to achieve greater power density without compromising reliability or operational lifespan.

A notable milestone was reached with the introduction of multi-beam klystrons (MBKs) that utilize parallel electron beams to dramatically increase output power and efficiency. Thales Group has deployed next-generation MBKs for both scientific and defense applications, reporting enhanced current density and improved phase stability, which are critical for particle accelerators and radar systems. These klystrons now routinely operate at output levels exceeding 10 MW, with higher packaging density and modular architectures enabling easier integration into modern RF systems.

Another breakthrough comes from innovations in cathode and collector design, where Communications & Power Industries (CPI) has implemented advanced dispenser cathodes and heat-resistant alloys to support higher current loads in compact footprints. Their latest high-power klystron models feature improved thermal dissipation, allowing for continuous wave (CW) operation at elevated average power levels. These advances are essential for applications such as satellite communications, medical linacs, and large-scale scientific installations where space and cooling resources are limited.

In parallel, European research consortia and industry partners are collaborating on miniaturization of high-density klystrons for accelerator-driven systems. The CERN Linear Collider Collaboration has highlighted the integration of high-density MBK units in proposed next-generation linear accelerators, aiming for higher gradient fields and lower operational costs through improved efficiency and reduced system complexity.

Looking ahead, the next few years are expected to see further optimization of high-density klystron modules, particularly through the adoption of novel ceramic materials, additive manufacturing, and digital control systems. Industry roadmaps indicate a shift towards “smart” klystrons with embedded diagnostics and adaptive tuning to maximize both lifespan and RF output under dynamic load conditions. As high-density klystrons mature, their impact is set to extend beyond traditional domains, with emerging roles in quantum information systems and advanced wireless power transfer.

Major Players & Strategic Initiatives (e.g., thalesgroup.com, canon-electronics.co.jp, cpii.com)

The development of high-density klystrons, essential components for advanced radar, satellite communication, and high-energy physics applications, is currently spearheaded by a select group of global industry leaders. In 2025, these major players are intensifying their focus on delivering higher power outputs, improved efficiency, and enhanced reliability to meet the expanding demands of government, scientific, and commercial customers.

Among the foremost entities, Thales Group continues its long-standing expertise in klystron technology. The company is investing in the development of compact, high-density klystrons optimized for space and terrestrial applications. Thales’ recent projects highlight advanced cooling techniques and modular architectures to enable higher power densities, supporting both scientific accelerators and next-generation satellite payloads.

Similarly, Communications & Power Industries (CPI) is actively engaged in expanding its product line of high-power klystrons, with a particular emphasis on models for scientific research and defense radar. CPI’s latest high-density klystrons are engineered for robust operation in challenging environments, incorporating improved thermal management and modular designs for easier integration and maintenance. The company’s ongoing contracts with research institutions such as particle accelerator facilities underscore its strategic commitment to innovation in this sector.

In Asia, Canon Electronics Inc. has bolstered its presence in the market by advancing the manufacturability and performance of its klystron lineup. Canon’s initiatives focus on leveraging proprietary materials and precision fabrication techniques to achieve higher output per unit volume, addressing the needs of both domestic and international research programs.

Beyond product development, these companies are also engaging in strategic partnerships and supply agreements to secure their roles in future high-energy physics projects and satellite constellations coming online through 2025 and beyond. For instance, Thales and CPI have both announced collaborations with leading research laboratories and space agencies, aiming to co-develop application-specific klystron solutions.

Looking ahead, the competitive landscape is expected to remain dynamic, with ongoing R&D investments targeting even greater integration, miniaturization, and operational efficiency. Given the critical nature of klystrons in enabling advanced scientific and communication infrastructure, these major players are well-positioned to shape the evolution of high-density klystron technology over the next several years.

Application Trends: Satellite, Radar, Particle Accelerators, and Beyond

High-density klystron development is experiencing significant momentum in 2025, driven by escalating demands across satellite communications, radar systems, particle accelerators, and emerging quantum technologies. The ongoing shift toward higher power densities, efficiency, and miniaturization is a response to both commercial and government sector requirements for more capable and reliable RF (radio frequency) power sources.

In the satellite communications domain, klystrons remain integral for ground station uplinks and high-throughput data links. Companies such as Communications & Power Industries (CPI) are advancing klystron designs that feature improved thermal management and compact footprints, enabling higher frequencies and increased output power for next-generation geostationary and low-Earth orbit (LEO) satellites. CPI’s latest high-power klystrons, for example, support multi-kilowatt output at Ku- and Ka-bands, aligning with the bandwidth and reliability needs of satellite operators.

Radar applications, particularly in defense and air traffic control, are catalyzing adoption of high-density klystrons that combine high peak power with pulse fidelity and frequency agility. Thales has reported ongoing development of X- and S-band klystron amplifiers optimized for continuous and pulsed operations, supporting advanced radar architectures such as active electronically scanned arrays (AESA). These solutions address the growing need for compact, rugged transmitters capable of operating in harsh environments.

Particle accelerators, including those operated by research institutions and medical facilities, are another growth vector for high-density klystrons. Tesla Engineering Ltd has highlighted recent contracts to supply high-power klystrons and modulators for synchrotron light sources and free electron lasers, where long-term stability and precise control of megawatt-scale RF pulses are critical. Collaborations with national laboratories and international consortia remain central to advancing both output power and operational lifetimes.

Looking forward, the next few years will likely see further integration of advanced materials and additive manufacturing in klystron production, as well as digital control electronics for real-time performance optimization. Efforts by organizations like CERN are expected to accelerate technology transfer into commercial markets, particularly as particle physics pushes toward ever-higher energies and more compact accelerator footprints.

Overall, high-density klystrons are poised to remain a cornerstone of high-power RF systems through the remainder of the decade, with ongoing innovation supporting both legacy and new application frontiers.

Supply Chain and Manufacturing Innovations

The development of high-density klystrons is experiencing significant advancements in supply chain and manufacturing innovation, as the sector responds to increasing demand from applications such as particle accelerators, satellite communications, and radar systems. As we move into 2025, manufacturers are emphasizing streamlined component sourcing, vertical integration, and digitalization to improve both product performance and production efficiency.

Key industry players, including Communications & Power Industries (CPI) and TESLA, are investing in automated manufacturing processes and advanced quality assurance systems to support the stringent requirements of high-density klystrons. For example, CPI has integrated robotics into the assembly of vacuum electron devices, reducing manual intervention and ensuring tighter tolerances in critical subassemblies such as electron guns and resonant cavities. This automation addresses the challenge of producing highly consistent and reliable klystrons, which are essential for high-power and high-frequency applications.

Supply chain resilience is also a focal point in 2025, as geopolitical uncertainties and raw material shortages have underscored the need for robust supplier networks. Companies are diversifying their sources for high-purity metals and specialized ceramics, which are core to klystron construction. Some, like CPI, have established strategic partnerships with domestic and regional suppliers to mitigate risks associated with international logistics and export controls.

Additive manufacturing (AM) is emerging as a transformative force in high-density klystron development. Leading firms are prototyping RF components using selective laser melting and other AM techniques to accelerate design cycles and enable complex geometries previously unachievable with traditional machining. TESLA reports early success in producing waveguide and coupling components with reduced lead times and material waste, providing a competitive edge in fulfilling custom requirements for research and defense clients.

Digital twins and advanced simulation tools are further enabling manufacturers to model thermal and electromagnetic behaviors in klystron assemblies before physical fabrication, reducing prototyping costs and improving first-pass yield. The integration of these technologies is expected to continue through 2025 and beyond, fostering a more agile and responsive supply chain.

Looking ahead, the sector anticipates expanding capacity to meet projected growth in global accelerator and satellite projects. The convergence of automation, supply chain diversification, and manufacturing innovation positions the high-density klystron market for robust evolution in the next few years, with leading companies actively shaping industry standards and capabilities.

Competitive Landscape and Emerging Entrants

The competitive landscape for high-density klystron development in 2025 is marked by both established players and emerging entrants, responding to increasing global demand for higher power, efficiency, and compactness in RF amplification, particularly for applications in particle accelerators, radar systems, and advanced communications.

Legacy manufacturers such as Communications & Power Industries (CPI) and TMD Technologies are continuing to advance their high-density klystron product lines. In early 2024, Communications & Power Industries announced the release of new multi-megawatt klystron models, designed specifically for next-generation linear colliders and high-energy physics facilities. These klystrons are engineered for higher power density and improved thermal management, addressing the push for more compact and reliable modules in scientific and defense markets.

Meanwhile, TMD Technologies has focused on enhancing klystron efficiency and modularity, targeting radar system upgrades and space-constrained environments. The company has expanded its R&D investment to accelerate the integration of advanced materials and digital control systems, aiming for initial market introduction of new high-density prototypes by late 2025.

On the global front, Thales Group remains a key contender, particularly in Europe and Asia, and has signaled ongoing collaboration with major accelerator projects to supply high-power, compact klystrons that meet evolving technical requirements. In 2024, Thales delivered upgraded high-frequency klystrons for international accelerator facilities, and outlined development plans for even denser RF sources through 2026.

Emerging entrants are increasingly present in the high-density segment. For instance, several Chinese manufacturers, such as China Electronics Corporation (CEC), have begun scaling up indigenous klystron production, targeting both domestic infrastructure and export markets. CEC’s recent investments in automated manufacturing and high-voltage insulation technologies are aimed at achieving performance parity with Western counterparts within the next two to three years.

Additionally, university spin-offs and collaborative consortia are contributing to the competitive mix, often focusing on novel techniques such as additive manufacturing for cooling structures or advanced cathode materials. These entrants are supported by public R&D funding, particularly in the US, EU, and parts of Asia, aiming to reduce cost and accelerate the commercialization of breakthrough high-density klystron designs.

Looking ahead, the competitive landscape is expected to intensify through 2025 and beyond, with both established and new players focused on innovation in power density, reliability, and digital integration—driven by the expanding needs of scientific, medical, and defense sectors.

Regulatory, Standards, and Industry Association Initiatives (e.g., ieee.org, asme.org)

Recent years have seen significant regulatory and standards-related activity surrounding high-density klystron development, reflecting the component’s essential role in scientific research, satellite communications, and defense systems. As the push for increased power density and efficiency in klystron tubes intensifies, regulatory bodies and industry associations are responding with updated guidelines and collaborative initiatives to ensure safety, interoperability, and performance.

The IEEE continues to play a central role in standardizing terminology, measurement methods, and test procedures for microwave vacuum electron devices, including high-density klystrons. The IEEE’s standards committees, particularly those under the Microwave Theory and Techniques Society (MTT-S), have focused on updating standards to address the higher voltages, thermal loads, and electromagnetic compatibility concerns that arise with new high-density devices. In 2025, ongoing efforts include the revision of IEEE Std 187-2021, which sets recommended practices for measuring high-power microwave amplifiers, to better reflect the performance metrics of next-generation klystrons.

Internationally, the International Electrotechnical Commission (IEC) is collaborating with national standards bodies to harmonize safety and performance standards for high-power vacuum tubes. This is especially crucial as klystrons are increasingly deployed in particle accelerators and advanced radar systems. The IEC’s Technical Committee 45 (Nuclear Instrumentation) and Subcommittee 45B (Radiation protection instrumentation) have highlighted the need for robust standards addressing electromagnetic interference (EMI) and high-voltage safety specific to dense klystron modules.

Industry associations are also taking a proactive stance. The Vacuum Electronics Manufacturers Association (VEMA) has initiated working groups in 2024–2025 to establish best practices for the thermal management and reliability assessment of high-density klystrons. These initiatives aim to support both legacy and emerging manufacturers in meeting stricter regulatory expectations, especially as end-users such as national laboratories and defense agencies demand higher mean-time-between-failure (MTBF) metrics.

Looking forward, regulatory and standards initiatives are expected to increasingly emphasize environmental factors, such as the reduction of hazardous substances in klystron manufacturing and lifecycle management. Efforts from organizations like the ASME are anticipated to influence pressure vessel codes and thermal design standards for klystron cooling systems. Collectively, these actions point to a more unified and safety-focused regulatory landscape in the next few years, paving the way for broader adoption and innovation in high-density klystron technology.

Investment, Funding, and Partnership Dynamics

High-density klystron development has become a focal point for investment, funding, and partnership activity in 2025, underscoring its strategic importance in advanced communications, scientific research, and defense applications. The increasing demand for higher power, compact RF sources has triggered significant initiatives among established manufacturers, governmental agencies, and research institutions.

In the United States, Communications & Power Industries (CPI) remains a pivotal player, continually investing in R&D and production upgrades for next-generation klystrons. CPI’s commitment is evident through ongoing collaborations with national laboratories and its expanding portfolio of high-density klystron products tailored for accelerators, radar, and satellite communications. In 2025, CPI has announced capital investments aimed at increasing manufacturing capacity and improving efficiency for advanced klystron lines.

European engagement is led by Thales Group, which has deepened partnerships with space and defense agencies to co-develop high-density klystrons for emerging satellite payloads and radar systems. Thales’ recent alliances with European Space Agency projects and joint ventures with national research institutes highlight a trend toward cross-border collaboration and pooled funding for high-risk, high-reward klystron technologies.

In Asia, Toshiba Corporation continues its leadership in klystron innovation, with sustained investments in miniaturization and efficiency improvements. Toshiba’s partnership with Japanese government agencies and universities is aimed at advancing klystron applications for next-generation particle accelerators and high-resolution medical imaging systems. The company’s 2025 roadmap includes increased funding for R&D and strategic alliances with global system integrators.

National research laboratories, such as SLAC National Accelerator Laboratory, are recipients of both federal and private-sector funding earmarked for high-density klystron development. SLAC’s collaborations with OEMs and academic institutions reflect a growing ecosystem of shared intellectual property and risk. New partnership models, including multi-institution consortia, are emerging to accelerate technology transfer from laboratory to market.

Looking ahead, the outlook for high-density klystron investment remains robust, with funding expected to rise in tandem with the expansion of high-energy physics infrastructure, advanced radar networks, and secure space communications. The trend toward co-funded, cross-border projects and the involvement of both public and private stakeholders is likely to intensify, shaping the trajectory of klystron innovation through 2025 and beyond.

Future Outlook: Disruptive Scenarios and Strategic Recommendations

High-density klystron technology is poised for meaningful advancements in 2025 and the near future, reflecting both market demand for higher power microwave sources and progress in materials and manufacturing. The primary drivers include the expansion of next-generation particle accelerators, high-power radar systems, advanced satellite communications, and emerging applications in directed energy systems.

Key manufacturers such as Communications & Power Industries (CPI) and TMD Technologies are accelerating R&D efforts aimed at increasing klystron efficiency, output power density, and operational lifespans. In 2025, CPI has announced enhanced klystron models for scientific accelerators, focusing on compact multi-megawatt output tubes with improved thermal management. These designs directly address the challenges of packing more RF power into smaller footprints, critical for both space- and ground-based systems.

On the technical front, innovations in cathode materials and additive manufacturing are unlocking new possibilities for high-density klystrons. Communications & Power Industries is exploring advanced cathode structures and vacuum envelope fabrication techniques to extend tube life and reliability at higher operating voltages. Similarly, TESLA is investing in modular klystron architectures that facilitate rapid maintenance and integration into accelerator arrays.

The short-term disruptive scenario is the integration of solid-state RF drivers with conventional vacuum electron devices, yielding hybrid systems that can dynamically allocate power and enhance fault tolerance. This is particularly relevant for defense and scientific projects requiring both peak power and redundancy. CPI and TMD Technologies have signaled ongoing research into such hybrid modules, aiming for commercial prototypes within the next two to three years.

Strategically, organizations investing in high-density klystron development should prioritize:

- Collaboration with particle accelerator facilities (e.g., CERN and national labs) to align performance requirements with evolving research goals.

- Adoption of digital twin and advanced simulation tools for rapid prototyping and reliability prediction, as supported by CPI’s recent digital design initiatives.

- Strengthening supply chains for critical materials and custom ceramics to mitigate risks associated with geopolitical instability.

In summary, the outlook for high-density klystron development through 2025 and beyond is defined by incremental but impactful technical improvements, hybridization with solid-state systems, and strategic industry-academic partnerships. These trends position leading manufacturers to support the next wave of high-power RF applications across scientific, defense, and communications domains.