2025 High-Efficiency Perovskite Photovoltaic Fabrication Market Report: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Opportunities Through 2030

- Executive Summary & Market Overview

- Key Technology Trends in Perovskite Photovoltaic Fabrication

- Competitive Landscape and Leading Players

- Market Growth Forecasts and Revenue Projections (2025–2030)

- Regional Analysis: Market Dynamics by Geography

- Challenges, Risks, and Barriers to Adoption

- Opportunities and Strategic Recommendations

- Future Outlook: Emerging Applications and Investment Hotspots

- Sources & References

Executive Summary & Market Overview

High-efficiency perovskite photovoltaic (PV) fabrication represents a transformative segment within the global solar energy market, characterized by rapid technological advancements and increasing commercial interest. Perovskite solar cells (PSCs) have emerged as a leading next-generation PV technology due to their remarkable power conversion efficiencies (PCEs), low-cost materials, and compatibility with scalable manufacturing processes. As of 2025, laboratory-scale perovskite cells have achieved certified efficiencies exceeding 26%, rivaling and, in some cases, surpassing traditional silicon-based PV technologies National Renewable Energy Laboratory.

The market for high-efficiency perovskite PV fabrication is driven by several factors:

- Continued improvements in device stability and scalability, addressing historical challenges related to moisture sensitivity and long-term performance.

- Growing investments from both public and private sectors, with major players such as Oxford PV and Saule Technologies advancing pilot production lines and commercial modules.

- Rising demand for lightweight, flexible, and semi-transparent solar solutions, enabling new applications in building-integrated photovoltaics (BIPV), portable electronics, and automotive sectors.

According to recent market analyses, the global perovskite solar cell market is projected to grow at a compound annual growth rate (CAGR) exceeding 30% through 2030, with the high-efficiency segment capturing a significant share due to its superior performance metrics MarketsandMarkets. Key regions driving this growth include Europe, Asia-Pacific, and North America, where supportive policy frameworks and research funding are accelerating commercialization efforts.

Despite these positive trends, the sector faces ongoing challenges related to large-scale manufacturing, material toxicity (notably lead content), and regulatory approval for widespread deployment. However, collaborative initiatives between research institutions and industry stakeholders are actively addressing these barriers, with several demonstration projects and pilot lines already operational European Commission.

In summary, high-efficiency perovskite photovoltaic fabrication stands at the forefront of solar innovation in 2025, poised to disrupt established PV markets and enable new energy solutions across diverse industries. The coming years will be pivotal as the technology transitions from laboratory breakthroughs to mass-market adoption.

Key Technology Trends in Perovskite Photovoltaic Fabrication

High-efficiency perovskite photovoltaic (PV) fabrication is at the forefront of solar technology innovation in 2025, driven by rapid advancements in materials engineering, device architecture, and scalable manufacturing processes. Perovskite solar cells (PSCs) have demonstrated remarkable progress, with certified power conversion efficiencies (PCEs) surpassing 26% in laboratory settings, rivaling and even exceeding traditional silicon-based cells in some tandem configurations. This leap in efficiency is largely attributed to breakthroughs in compositional engineering, interface optimization, and defect passivation techniques.

One of the most significant trends is the development of multi-cation and mixed-halide perovskite compositions, which enhance both efficiency and operational stability. By incorporating elements such as cesium, rubidium, and formamidinium, researchers have achieved improved crystallinity and reduced ion migration, leading to higher device performance and longer lifetimes. Additionally, the use of passivation layers—such as 2D perovskites or organic molecules—at grain boundaries and interfaces has been shown to suppress non-radiative recombination, further boosting PCEs and device durability.

Another key trend is the integration of perovskite layers with silicon in tandem architectures. These tandem cells leverage the complementary absorption spectra of both materials, enabling theoretical efficiencies above 30%. In 2024, several pilot lines demonstrated perovskite-silicon tandem modules with stabilized efficiencies above 28%, and commercial-scale production is anticipated to ramp up in 2025, according to National Renewable Energy Laboratory (NREL) and imec.

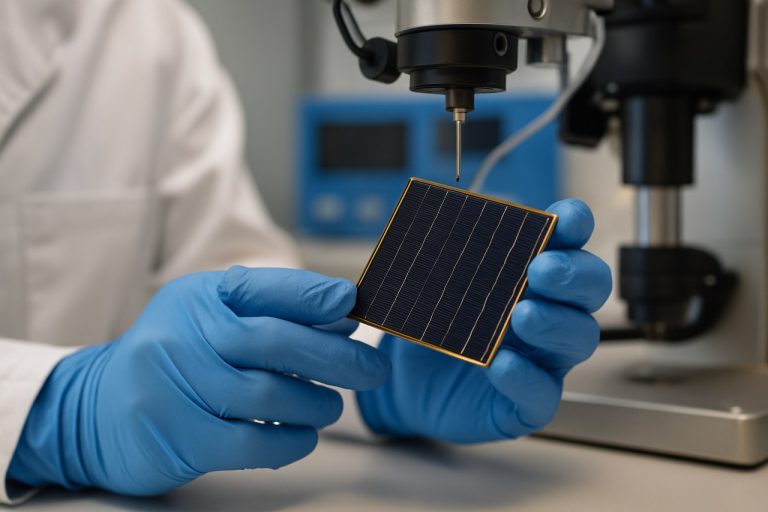

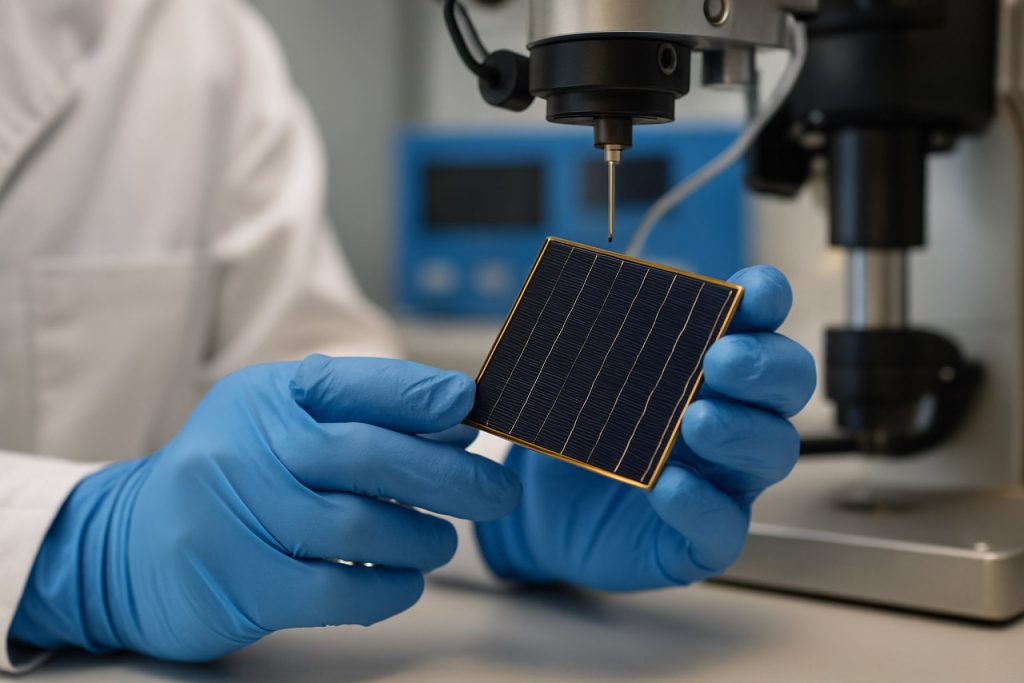

Scalable fabrication methods are also evolving rapidly. Techniques such as slot-die coating, blade coating, and inkjet printing are being refined for roll-to-roll manufacturing, which is essential for cost-effective, large-area module production. These methods are compatible with flexible substrates, opening new markets for lightweight and portable solar applications. Companies like Oxford PV and Microquanta Semiconductor are leading the commercialization of high-efficiency perovskite PV modules, with pilot production lines already operational.

In summary, the convergence of advanced materials, tandem architectures, and scalable manufacturing is propelling high-efficiency perovskite PV fabrication toward commercial viability in 2025. These trends are expected to accelerate the deployment of perovskite-based solar technologies, offering a pathway to lower-cost, higher-performance renewable energy solutions.

Competitive Landscape and Leading Players

The competitive landscape for high-efficiency perovskite photovoltaic (PV) fabrication in 2025 is characterized by rapid innovation, strategic partnerships, and increasing investment from both established solar manufacturers and specialized startups. The sector is driven by the race to commercialize perovskite solar cells (PSCs) with efficiencies surpassing 25%, while addressing challenges related to stability, scalability, and cost-effective mass production.

Key players in this market include a mix of global corporations and agile startups. Oxford PV remains a frontrunner, leveraging its proprietary tandem cell technology that combines perovskite and silicon, achieving certified efficiencies above 28%. The company has scaled up its pilot production line in Germany and is targeting commercial module deployment in 2025. First Solar, traditionally a leader in thin-film photovoltaics, has increased its R&D focus on perovskite integration, exploring hybrid modules and investing in collaborative research initiatives.

Asian manufacturers are also intensifying their efforts. JinkoSolar and Trina Solar have announced joint ventures and research partnerships with academic institutions to accelerate perovskite cell development and pilot production lines. These companies are leveraging their established supply chains and manufacturing expertise to address the scalability bottleneck that has historically limited perovskite adoption.

Startups such as Saule Technologies and Energy Materials Corporation are pioneering roll-to-roll printing and inkjet fabrication methods, aiming to reduce production costs and enable flexible, lightweight PV applications. Their focus on novel encapsulation techniques and barrier materials is critical for improving the operational stability of perovskite modules.

The competitive landscape is further shaped by significant public and private funding. The European Union’s Horizon Europe program and the U.S. Department of Energy’s Solar Energy Technologies Office have both increased grant allocations for perovskite research and pilot manufacturing projects (European Commission, U.S. Department of Energy). This influx of capital is fostering cross-sector collaborations and accelerating the path to commercialization.

In summary, the 2025 market for high-efficiency perovskite PV fabrication is highly dynamic, with leading players focusing on technological breakthroughs, manufacturing scale-up, and strategic alliances to secure early mover advantages in the next generation of solar technology.

Market Growth Forecasts and Revenue Projections (2025–2030)

The high-efficiency perovskite photovoltaic (PV) fabrication market is poised for robust growth between 2025 and 2030, driven by rapid advancements in material science, scalable manufacturing techniques, and increasing demand for next-generation solar technologies. According to projections by IDTechEx, the global perovskite PV market is expected to surpass $2.1 billion in annual revenue by 2030, with a compound annual growth rate (CAGR) exceeding 30% from 2025 onward. This surge is attributed to the transition from laboratory-scale efficiencies to commercially viable, high-throughput fabrication processes that enable mass production of perovskite solar cells with power conversion efficiencies (PCE) above 25%.

Key market drivers include the integration of perovskite layers with silicon in tandem architectures, which are projected to capture a significant share of new solar installations due to their superior efficiency and lower levelized cost of electricity (LCOE). Wood Mackenzie forecasts that by 2027, tandem perovskite-silicon modules will account for over 10% of new utility-scale solar deployments in Europe and Asia-Pacific, regions leading in perovskite PV adoption.

Revenue growth is further supported by strategic investments from major energy conglomerates and venture capital, as well as government-backed pilot projects in China, the European Union, and the United States. For instance, Oxford PV secured over $100 million in funding to scale up its perovskite cell manufacturing capacity, targeting gigawatt-scale output by 2026. Similarly, First Solar has announced expanded R&D initiatives to integrate perovskite technology into its product portfolio.

- By 2025, pilot-scale production lines are expected to reach commercial yields, with initial revenues estimated at $250–300 million globally.

- From 2026 to 2028, accelerated adoption in residential and commercial rooftop segments will drive annual market growth rates above 35%.

- By 2030, cumulative installed capacity of high-efficiency perovskite PV is projected to exceed 20 GW worldwide, with annual revenues approaching $2.5 billion, according to BloombergNEF.

Overall, the period from 2025 to 2030 will mark a pivotal phase for high-efficiency perovskite PV fabrication, characterized by rapid commercialization, expanding manufacturing footprints, and significant revenue generation across global markets.

Regional Analysis: Market Dynamics by Geography

The regional dynamics of the high-efficiency perovskite photovoltaic (PV) fabrication market in 2025 are shaped by varying levels of research investment, manufacturing capacity, regulatory support, and end-user adoption across key geographies. Asia-Pacific, Europe, and North America are the primary regions driving innovation and commercialization, each with distinct market characteristics.

Asia-Pacific continues to dominate the global perovskite PV fabrication landscape, led by China, Japan, and South Korea. China’s robust solar manufacturing ecosystem, government incentives, and aggressive renewable energy targets have accelerated the scale-up of perovskite PV production. Major Chinese firms are investing in pilot lines and gigawatt-scale facilities, leveraging existing supply chains and expertise in thin-film technologies. Japan and South Korea focus on high-efficiency modules and advanced encapsulation techniques, supported by strong R&D from institutions and partnerships with local electronics giants. The region benefits from cost-competitive manufacturing and rapid technology transfer, positioning it as a global leader in perovskite PV deployment (International Energy Agency).

Europe is characterized by a strong emphasis on research, sustainability, and regulatory frameworks. The European Union’s Green Deal and Horizon Europe programs have funneled significant funding into perovskite PV research, with a focus on eco-friendly fabrication processes and long-term stability. Germany, the UK, and Switzerland host leading academic and industrial consortia, driving breakthroughs in tandem silicon-perovskite cells and scalable roll-to-roll manufacturing. European manufacturers are also exploring local supply chains to reduce dependency on imported materials, aligning with regional energy security goals (European Commission).

- North America is witnessing increased venture capital and government funding for perovskite PV startups, particularly in the United States. The U.S. Department of Energy’s Solar Energy Technologies Office supports pilot projects and commercialization efforts, while private sector players focus on integrating perovskite layers with existing silicon PV infrastructure. The region’s market growth is tempered by regulatory hurdles and the need for proven long-term durability, but partnerships between national labs and industry are accelerating technology validation (U.S. Department of Energy).

In summary, while Asia-Pacific leads in manufacturing scale and cost efficiency, Europe excels in sustainable innovation, and North America drives commercialization through public-private collaboration. These regional dynamics are expected to shape the competitive landscape and adoption trajectory of high-efficiency perovskite PV fabrication in 2025.

Challenges, Risks, and Barriers to Adoption

The adoption of high-efficiency perovskite photovoltaic (PV) fabrication faces several significant challenges, risks, and barriers that could impede its widespread commercialization in 2025. Despite remarkable laboratory-scale efficiencies, translating these results into scalable, reliable, and economically viable manufacturing processes remains a complex endeavor.

- Stability and Longevity: One of the most critical challenges is the intrinsic instability of perovskite materials. Exposure to moisture, oxygen, ultraviolet light, and thermal stress can rapidly degrade device performance, leading to concerns about long-term operational stability. While encapsulation and compositional engineering have improved lifespans, perovskite PVs still lag behind established silicon technologies in terms of proven durability over 20-25 years, which is a key requirement for bankability and investor confidence (National Renewable Energy Laboratory).

- Scalability and Manufacturing Consistency: Achieving uniform, defect-free perovskite films on large-area substrates is technically challenging. Variations in film thickness, crystallinity, and interface quality can significantly impact device performance and yield. The transition from spin-coating in laboratories to scalable methods such as slot-die coating or vapor deposition introduces new complexities, including process control and reproducibility (IEA Photovoltaic Power Systems Programme).

- Material Supply and Toxicity: Many high-efficiency perovskite formulations rely on lead, raising environmental and regulatory concerns. The risk of lead leakage during operation or disposal poses a barrier, especially in regions with stringent environmental standards. Research into lead-free alternatives is ongoing, but these materials have yet to match the performance of their lead-based counterparts (Nature Energy).

- Intellectual Property and Standardization: The perovskite PV landscape is fragmented, with numerous patents and proprietary processes. This fragmentation can hinder collaboration, slow down technology transfer, and create legal uncertainties for manufacturers seeking to scale up production (Wood Mackenzie).

- Bankability and Market Acceptance: Investors and project developers remain cautious due to the lack of long-term field data and established performance warranties. The absence of standardized testing protocols and certification pathways further complicates market entry (PV Magazine).

Addressing these challenges will be crucial for high-efficiency perovskite PVs to achieve commercial viability and compete with incumbent solar technologies in 2025 and beyond.

Opportunities and Strategic Recommendations

The high-efficiency perovskite photovoltaic (PV) fabrication market in 2025 presents significant opportunities driven by rapid advancements in material science, scalable manufacturing techniques, and growing demand for cost-effective renewable energy solutions. As perovskite solar cells (PSCs) continue to achieve record-breaking power conversion efficiencies—surpassing 25% in laboratory settings—commercial interest is intensifying, particularly for tandem and flexible applications. Strategic recommendations for stakeholders focus on technology optimization, supply chain development, and market positioning.

- Scale-Up and Manufacturing Innovation: Companies should prioritize the transition from lab-scale to industrial-scale fabrication. Techniques such as roll-to-roll printing and vapor deposition are emerging as viable pathways for mass production, offering lower costs and higher throughput. Investment in pilot lines and partnerships with established manufacturers can accelerate commercialization (National Renewable Energy Laboratory).

- Stability and Encapsulation Solutions: Addressing the long-term stability of perovskite modules remains a critical challenge. Strategic collaborations with materials science firms to develop advanced encapsulation and barrier layers can enhance product durability, a key requirement for utility-scale and rooftop installations (imec).

- Supply Chain Localization: Securing reliable sources of high-purity precursors and developing local supply chains for critical materials (e.g., lead, tin, organic cations) can mitigate geopolitical risks and reduce costs. Engaging with chemical suppliers and recycling initiatives will be essential for sustainable growth (International Energy Agency).

- Market Differentiation through Tandem and Flexible Modules: Perovskite-silicon tandem cells and flexible perovskite modules offer unique value propositions for building-integrated photovoltaics (BIPV), portable electronics, and automotive applications. Companies should invest in R&D to tailor products for these high-growth segments (Fraunhofer Society).

- Regulatory and Certification Readiness: Early engagement with certification bodies and proactive compliance with emerging standards (e.g., IEC, UL) will streamline market entry and build customer trust, especially in regions with stringent quality requirements (UL Solutions).

In summary, the 2025 landscape for high-efficiency perovskite PV fabrication is ripe with opportunity for agile players who can innovate in manufacturing, ensure product reliability, and strategically position themselves in emerging application areas.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for high-efficiency perovskite photovoltaic (PV) fabrication in 2025 is marked by rapid technological advancements, expanding application domains, and intensifying investment activity. As perovskite solar cells (PSCs) approach and surpass 25% power conversion efficiency in laboratory settings, the focus is shifting toward scalable manufacturing and integration into diverse energy systems. This transition is catalyzing new applications and attracting significant capital from both public and private sectors.

Emerging applications for high-efficiency perovskite PVs are broadening beyond traditional rooftop and utility-scale solar. Notably, the lightweight and flexible nature of perovskite modules is enabling their use in building-integrated photovoltaics (BIPV), portable electronics, and even vehicle-integrated solar solutions. The potential for tandem cell architectures—where perovskites are layered atop silicon or other materials—promises to break efficiency barriers and further reduce the levelized cost of electricity (LCOE) National Renewable Energy Laboratory. Additionally, the compatibility of perovskite fabrication with roll-to-roll and inkjet printing processes is opening doors for large-area, low-cost production, which is particularly attractive for emerging markets and off-grid applications.

Investment hotspots in 2025 are expected to concentrate in regions with strong policy support and established photovoltaic manufacturing ecosystems. Asia-Pacific, led by China, South Korea, and Japan, continues to dominate due to robust R&D infrastructure and government incentives for next-generation solar technologies International Energy Agency. Europe is also emerging as a key player, with the European Union’s Green Deal and Horizon Europe programs channeling funds into perovskite commercialization and pilot production lines European Commission. In the United States, venture capital and Department of Energy grants are fueling startups focused on scaling perovskite manufacturing and improving device stability U.S. Department of Energy.

- Key investment targets include companies developing scalable deposition techniques, encapsulation solutions for improved durability, and hybrid tandem modules.

- Collaborations between academic institutions and industry are accelerating the path from lab to market, with several pilot lines expected to reach pre-commercial scale by late 2025.

- Strategic partnerships with established silicon PV manufacturers are also emerging, leveraging existing supply chains and distribution networks.

Overall, 2025 is poised to be a pivotal year for high-efficiency perovskite PV fabrication, with commercialization efforts intensifying and new applications driving both technological and investment momentum.

Sources & References

- National Renewable Energy Laboratory

- Oxford PV

- Saule Technologies

- MarketsandMarkets

- European Commission

- imec

- Microquanta Semiconductor

- First Solar

- JinkoSolar

- Trina Solar

- European Commission

- IDTechEx

- Wood Mackenzie

- BloombergNEF

- International Energy Agency

- Nature Energy

- Fraunhofer Society

- UL Solutions