Low-Voltage Powerline Communication Systems in 2025: Powering the Next Wave of Smart Infrastructure. Explore How Rapid Innovation and Market Growth Are Transforming Connectivity Over Existing Electrical Networks.

- Executive Summary: Key Findings & 2025 Outlook

- Market Overview: Defining Low-Voltage Powerline Communication Systems

- 2025–2030 Market Forecast: Growth Drivers, Trends, and 18% CAGR Analysis

- Technology Landscape: Innovations, Protocols, and System Architectures

- Competitive Analysis: Leading Players, Market Shares, and Strategic Moves

- Application Deep Dive: Smart Grids, Home Automation, and Industrial IoT

- Regional Insights: North America, Europe, Asia-Pacific, and Emerging Markets

- Challenges & Barriers: Technical, Regulatory, and Market Adoption Hurdles

- Future Outlook: Disruptive Technologies and Long-Term Opportunities

- Conclusion & Strategic Recommendations

- Sources & References

Executive Summary: Key Findings & 2025 Outlook

Low-voltage powerline communication (PLC) systems are increasingly recognized as a pivotal technology for enabling data transmission over existing electrical wiring, particularly in smart grid, home automation, and industrial control applications. In 2025, the market for low-voltage PLC systems is characterized by robust growth, driven by the expanding adoption of smart meters, energy management solutions, and the proliferation of Internet of Things (IoT) devices. Key findings indicate that advancements in modulation techniques and noise mitigation have significantly improved the reliability and data rates of PLC systems, making them more competitive with wireless alternatives.

Major industry players, such as STMicroelectronics, Renesas Electronics Corporation, and Texas Instruments Incorporated, have introduced new chipsets and reference designs that support higher bandwidth and enhanced interoperability with existing communication standards. Regulatory support from organizations like the Institute of Electrical and Electronics Engineers (IEEE) and the International Telecommunication Union (ITU) has further accelerated standardization, fostering a more unified ecosystem for PLC deployment.

In 2025, the integration of PLC with renewable energy systems and electric vehicle (EV) charging infrastructure is a notable trend, as utilities seek cost-effective solutions for real-time monitoring and control. The technology’s ability to leverage existing wiring reduces installation costs and complexity, making it particularly attractive for retrofitting older buildings and expanding smart grid coverage in emerging markets.

Looking ahead, the outlook for low-voltage PLC systems remains positive. Continued investment in research and development is expected to yield further improvements in data throughput and cybersecurity. The convergence of PLC with other communication technologies, such as wireless mesh networks, is anticipated to create hybrid solutions that maximize reliability and coverage. As governments and utilities worldwide intensify efforts to modernize energy infrastructure and promote energy efficiency, low-voltage PLC systems are poised to play a central role in the digital transformation of power distribution networks.

Market Overview: Defining Low-Voltage Powerline Communication Systems

Low-voltage powerline communication (PLC) systems are technologies that enable data transmission over existing electrical wiring operating at voltages typically below 1,000 volts. These systems leverage the infrastructure of power distribution networks to deliver communication signals, eliminating the need for dedicated cabling. In 2025, the market for low-voltage PLC systems is characterized by growing adoption across residential, commercial, and industrial sectors, driven by the proliferation of smart grid initiatives, home automation, and the increasing demand for cost-effective connectivity solutions.

The core advantage of low-voltage PLC lies in its ability to utilize ubiquitous power lines for both power and data, facilitating applications such as smart metering, remote monitoring, lighting control, and electric vehicle charging management. This dual-use capability is particularly attractive in retrofitting scenarios, where installing new communication infrastructure would be costly or disruptive. Key industry players, including Silicon Laboratories Inc., STMicroelectronics N.V., and Renesas Electronics Corporation, have developed advanced PLC chipsets and modules that support robust, high-speed data transfer while maintaining compliance with international standards.

The market landscape is shaped by the evolution of PLC standards such as G3-PLC and PRIME, which ensure interoperability and security across devices from different manufacturers. Organizations like the G3-PLC Alliance and the PRIME Alliance play a pivotal role in promoting these standards and fostering ecosystem development. Regulatory frameworks in regions such as the European Union and Asia-Pacific are also encouraging the deployment of PLC-based solutions as part of broader energy efficiency and digitalization strategies.

In summary, the 2025 market for low-voltage powerline communication systems is defined by technological innovation, standardization, and expanding application areas. As smart infrastructure projects accelerate worldwide, PLC is poised to remain a foundational technology for reliable, scalable, and cost-effective connectivity over existing electrical networks.

2025–2030 Market Forecast: Growth Drivers, Trends, and 18% CAGR Analysis

Between 2025 and 2030, the low-voltage powerline communication (PLC) systems market is projected to experience robust growth, with an anticipated compound annual growth rate (CAGR) of approximately 18%. Several key drivers are expected to fuel this expansion. The increasing adoption of smart grid technologies by utilities is a primary catalyst, as PLC systems enable reliable, cost-effective data transmission over existing electrical infrastructure. This is particularly valuable for advanced metering infrastructure (AMI), demand response, and grid automation applications, where real-time communication is essential for operational efficiency and energy management.

Another significant growth driver is the proliferation of smart homes and buildings, where PLC systems facilitate seamless connectivity for energy management devices, lighting controls, and security systems. The ability to leverage existing wiring reduces installation costs and complexity, making PLC an attractive solution for both retrofits and new constructions. Additionally, the ongoing electrification of transportation, including the deployment of electric vehicle (EV) charging stations, is expected to boost demand for PLC-based communication to support load management and billing integration.

Emerging trends in the market include the integration of PLC with other communication technologies, such as wireless and fiber-optic networks, to create hybrid solutions that enhance reliability and coverage. The development of advanced modulation techniques and noise mitigation strategies is also improving the performance and scalability of PLC systems, addressing traditional challenges related to signal attenuation and interference on low-voltage networks.

Regionally, growth is anticipated to be strongest in Asia-Pacific and Europe, driven by large-scale smart grid rollouts and supportive regulatory frameworks. For example, initiatives by organizations such as the Enedis in France and State Grid Corporation of China are accelerating the deployment of PLC-enabled infrastructure. In North America, utilities and technology providers like Itron, Inc. are also expanding their PLC offerings to meet evolving grid modernization goals.

Overall, the 2025–2030 outlook for low-voltage PLC systems is characterized by strong demand across utility, residential, and commercial sectors, underpinned by technological advancements and the global push for smarter, more efficient energy networks.

Technology Landscape: Innovations, Protocols, and System Architectures

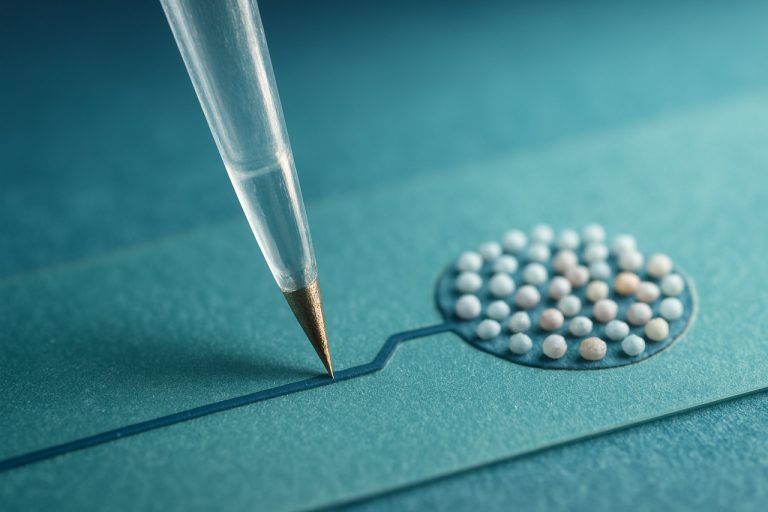

Low-voltage powerline communication (PLC) systems have evolved significantly, leveraging existing electrical wiring to transmit data for applications such as smart metering, home automation, and grid management. The technology landscape in 2025 is characterized by a convergence of advanced modulation techniques, robust protocols, and flexible system architectures that address the challenges of noise, attenuation, and interoperability inherent to powerline environments.

Recent innovations focus on enhancing data rates and reliability. Orthogonal Frequency Division Multiplexing (OFDM) has become a standard modulation scheme, enabling high-speed data transmission while mitigating the effects of multipath fading and narrowband interference. Adaptive modulation and coding further optimize throughput based on real-time channel conditions, a feature increasingly supported by modern PLC chipsets.

On the protocol front, the International Telecommunication Union (ITU) and IEEE have established key standards such as ITU-T G.hn (G.9960/G.9961) and IEEE 1901, which ensure interoperability across devices and vendors. These protocols support both narrowband and broadband PLC, with G.hn gaining traction for its versatility in supporting data, voice, and video over powerlines. Security enhancements, including AES-128 encryption and robust authentication mechanisms, are now integral to protocol stacks, addressing privacy and cyber-physical threats.

System architectures have shifted towards hybrid models, integrating PLC with wireless technologies like Wi-Fi and Zigbee to form resilient, self-healing networks. This hybridization is particularly evident in smart grid deployments, where PLC serves as the backbone for last-mile connectivity, complemented by wireless for redundancy and coverage in challenging environments. Mesh networking capabilities, supported by leading PLC system providers such as STMicroelectronics and Renesas Electronics Corporation, further enhance scalability and reliability.

Looking ahead, the integration of artificial intelligence for dynamic network management and the adoption of IPv6 for device addressing are poised to drive the next wave of PLC innovation. As regulatory bodies and industry alliances continue to refine standards and certification processes, low-voltage PLC systems are set to play a pivotal role in the digital transformation of energy infrastructure and smart homes.

Competitive Analysis: Leading Players, Market Shares, and Strategic Moves

The low-voltage powerline communication (PLC) systems market in 2025 is characterized by a dynamic competitive landscape, with several established players and emerging innovators vying for market share. The sector is driven by the increasing adoption of smart grid technologies, home automation, and the need for reliable, cost-effective communication solutions over existing electrical infrastructure.

Key industry leaders include Siemens AG, Schneider Electric SE, and ABB Ltd, all of which leverage their extensive portfolios in electrical and automation solutions to integrate PLC technologies into broader smart energy and building management systems. These companies maintain significant market shares due to their global reach, established customer bases, and ongoing investments in R&D.

Another major player, Panasonic Corporation, has focused on consumer and industrial applications, particularly in Asia, where rapid urbanization and smart city initiatives drive demand for PLC-enabled devices. Renesas Electronics Corporation and STMicroelectronics N.V. are prominent in the semiconductor segment, providing specialized PLC chipsets and modules that enable OEMs to develop interoperable and standards-compliant solutions.

Strategic moves in 2025 include increased collaboration between PLC technology providers and utility companies to accelerate smart meter rollouts and grid modernization projects. For example, Landis+Gyr AG has partnered with utilities across Europe and North America to deploy advanced metering infrastructure (AMI) leveraging PLC for reliable data transmission. Additionally, alliances between chipset manufacturers and IoT platform providers are fostering the development of integrated solutions for smart homes and industrial automation.

Market share dynamics are influenced by regional regulatory frameworks and standardization efforts. The adoption of G3-PLC and PRIME standards, championed by organizations such as the G3-PLC Alliance and the PRIME Alliance, has enabled interoperability and spurred competition among vendors. Companies that actively contribute to these standards and offer certified products are better positioned to capture new contracts, especially in regions with government-mandated smart grid initiatives.

In summary, the competitive landscape for low-voltage PLC systems in 2025 is shaped by the strategic positioning of multinational conglomerates, the technological advancements of semiconductor firms, and the collaborative efforts to standardize and scale PLC deployments globally.

Application Deep Dive: Smart Grids, Home Automation, and Industrial IoT

Low-voltage powerline communication (PLC) systems have become a cornerstone technology in the evolution of smart grids, home automation, and industrial IoT (IIoT) applications. By leveraging existing electrical wiring for data transmission, PLC enables robust, cost-effective connectivity without the need for additional cabling. This section explores the specific applications and benefits of low-voltage PLC in these three domains.

- Smart Grids: In smart grid infrastructure, low-voltage PLC is instrumental for advanced metering infrastructure (AMI), demand response, and grid automation. Utilities use PLC to connect smart meters, enabling real-time data collection, remote monitoring, and outage management. For example, Enel and EDF have deployed PLC-based AMI systems to enhance grid reliability and efficiency. PLC’s ability to traverse transformers and reach end-user premises makes it ideal for last-mile communication, supporting distributed energy resources and integrating renewable generation.

- Home Automation: PLC technology underpins many home automation solutions by providing a communication backbone for smart lighting, HVAC control, and security systems. Standards such as G.hn and HomePlug have enabled interoperability among devices from different manufacturers. Companies like Legrand and Schneider Electric offer PLC-enabled products that allow homeowners to control appliances, monitor energy usage, and automate routines via mobile apps or voice assistants. The use of existing wiring ensures broad coverage and reduces installation complexity, making PLC attractive for both retrofits and new builds.

- Industrial IoT (IIoT): In industrial environments, PLC facilitates reliable communication in harsh or electromagnetically noisy settings where wireless signals may be unreliable. Applications include machine-to-machine (M2M) communication, predictive maintenance, and process automation. Siemens and ABB integrate PLC modules into their industrial automation platforms, enabling real-time data exchange between sensors, actuators, and control systems. PLC’s resilience to interference and its ability to leverage existing infrastructure make it a preferred choice for factories, warehouses, and process plants.

As the demand for connected devices and intelligent infrastructure grows, low-voltage PLC systems are poised to play an increasingly vital role in enabling seamless, scalable, and secure communication across smart grids, homes, and industrial environments.

Regional Insights: North America, Europe, Asia-Pacific, and Emerging Markets

The global landscape for low-voltage powerline communication (PLC) systems in 2025 is shaped by distinct regional trends, regulatory frameworks, and market drivers. In North America, adoption is propelled by the modernization of grid infrastructure and the proliferation of smart home technologies. Utilities and technology providers, such as GE and Schneider Electric, are integrating PLC for advanced metering infrastructure (AMI) and demand response programs. The region benefits from established standards and a focus on grid reliability, though legacy infrastructure in some areas can pose integration challenges.

In Europe, the market is characterized by strong regulatory support for energy efficiency and smart grid deployment. The European Union’s directives on energy management and digitalization have accelerated PLC adoption, particularly for smart metering and distributed energy resources. Companies like Siemens AG and Enel are at the forefront, leveraging PLC to enable real-time data exchange and grid automation. The region’s dense urban environments and harmonized standards facilitate widespread implementation, although interoperability across national borders remains a technical focus.

The Asia-Pacific region is experiencing rapid growth in PLC deployment, driven by urbanization, expanding electrification, and government initiatives for smart cities. Countries such as China, Japan, and South Korea are investing heavily in smart grid technologies, with support from organizations like State Grid Corporation of China and Toshiba Energy Systems & Solutions Corporation. The diversity of grid topologies and the need for cost-effective communication solutions make PLC an attractive option, though the region faces challenges related to standardization and the integration of legacy systems.

Emerging markets in Latin America, Africa, and parts of Southeast Asia are increasingly recognizing the value of PLC for grid modernization and rural electrification. Here, PLC offers a practical solution for extending communication capabilities without the need for new infrastructure. Utilities and governments are partnering with global technology providers to pilot and scale PLC-based solutions, focusing on reliability and affordability. However, market growth is tempered by limited technical expertise and the need for supportive regulatory environments.

Overall, while the pace and focus of PLC adoption vary by region, the global trend in 2025 points toward increased investment in low-voltage PLC systems as a cornerstone of smart grid and energy management strategies.

Challenges & Barriers: Technical, Regulatory, and Market Adoption Hurdles

Low-voltage powerline communication (PLC) systems, which transmit data over existing electrical wiring, face a range of challenges and barriers that impact their widespread adoption and performance. These hurdles can be broadly categorized into technical, regulatory, and market-related issues.

Technical Challenges: One of the primary technical obstacles is the inherently noisy and unpredictable nature of low-voltage powerlines. Electrical wiring was not originally designed for data transmission, resulting in significant signal attenuation, electromagnetic interference, and variable impedance. These factors can degrade communication reliability and limit achievable data rates. Additionally, the presence of household appliances and switching devices can introduce impulsive noise, further complicating signal integrity. Ensuring interoperability between devices from different manufacturers is another technical challenge, as proprietary protocols and varying standards can hinder seamless communication across the network.

Regulatory Barriers: Regulatory frameworks for PLC systems vary significantly across regions, affecting both device certification and permissible frequency bands. In some jurisdictions, strict electromagnetic compatibility (EMC) requirements limit the power and frequency range that PLC devices can use, constraining their performance. For example, the European Telecommunications Standards Institute and Federal Communications Commission in the United States set specific limits on emissions to prevent interference with radio services. Navigating these regulations can be complex for manufacturers, especially when seeking to market products internationally.

Market Adoption Hurdles: Despite the potential for cost-effective networking using existing infrastructure, market adoption of low-voltage PLC systems has been slower than anticipated. Competing technologies such as Wi-Fi and wireless mesh networks often offer higher data rates and easier installation, reducing the perceived value proposition of PLC. Consumer awareness and trust in PLC technology remain limited, partly due to past experiences with inconsistent performance. Furthermore, the lack of unified global standards can deter large-scale investments by utilities and device manufacturers, as interoperability and future-proofing remain concerns.

Addressing these challenges requires ongoing collaboration between industry stakeholders, standards organizations, and regulatory bodies. Advances in signal processing, adaptive modulation, and error correction are helping to mitigate technical issues, while harmonization of standards and clearer regulatory guidance could facilitate broader market acceptance in the coming years.

Future Outlook: Disruptive Technologies and Long-Term Opportunities

The future of low-voltage powerline communication (PLC) systems is poised for significant transformation, driven by disruptive technologies and evolving market demands. As the global push for smart infrastructure intensifies, PLC is expected to play a pivotal role in enabling seamless connectivity for smart grids, home automation, and industrial IoT applications. The integration of advanced modulation techniques, such as orthogonal frequency-division multiplexing (OFDM), and adaptive noise mitigation algorithms is set to enhance data rates and reliability, addressing traditional challenges of signal attenuation and electromagnetic interference.

One of the most promising long-term opportunities lies in the convergence of PLC with other communication technologies, such as wireless mesh networks and fiber optics. Hybrid solutions can leverage the ubiquity of powerlines for last-mile connectivity while utilizing wireless or fiber backbones for high-speed data transmission. This approach is being explored by industry leaders like Siemens AG and Schneider Electric SE, who are investing in interoperable platforms for smart energy management and building automation.

The rise of electric vehicles (EVs) and distributed energy resources (DERs) is also expected to drive demand for robust PLC systems. As EV charging infrastructure expands, PLC can facilitate secure communication between charging stations, vehicles, and grid operators, supporting dynamic load management and billing. Organizations such as IEEE are actively developing new standards to ensure interoperability and cybersecurity in these emerging applications.

Looking ahead to 2025 and beyond, the adoption of artificial intelligence (AI) and machine learning (ML) in PLC networks is anticipated to unlock new efficiencies. AI-driven network management can optimize routing, predict faults, and dynamically allocate bandwidth, making PLC a more attractive option for mission-critical applications. Furthermore, the ongoing miniaturization of PLC chipsets by manufacturers like STMicroelectronics is expected to lower costs and enable integration into a wider array of consumer and industrial devices.

In summary, the future outlook for low-voltage PLC systems is characterized by technological convergence, enhanced performance through AI, and expanding use cases in smart infrastructure and energy management. Continued collaboration between industry stakeholders and standards bodies will be essential to realize the full potential of PLC as a backbone for the connected world.

Conclusion & Strategic Recommendations

Low-voltage powerline communication (PLC) systems have emerged as a versatile and cost-effective solution for data transmission over existing electrical wiring, particularly in smart grid, home automation, and industrial monitoring applications. As of 2025, the technology continues to evolve, driven by advancements in modulation techniques, noise mitigation, and interoperability standards. Despite these improvements, challenges such as electromagnetic interference, limited bandwidth, and regulatory constraints persist, necessitating a strategic approach for stakeholders aiming to maximize the benefits of PLC systems.

To capitalize on the potential of low-voltage PLC, industry players should prioritize the following strategic recommendations:

- Invest in Standards Compliance and Interoperability: Adhering to internationally recognized standards, such as those developed by the IEEE and International Telecommunication Union (ITU), ensures device compatibility and future-proofs deployments. Collaboration with standardization bodies can also help shape evolving protocols to better address real-world deployment challenges.

- Enhance Noise Immunity and Security: Ongoing research and development should focus on advanced signal processing and encryption techniques to mitigate the effects of electrical noise and bolster cybersecurity. Partnerships with technology providers like STMicroelectronics and Renesas Electronics Corporation can accelerate the integration of robust solutions.

- Leverage Hybrid Communication Architectures: Combining PLC with wireless or fiber-optic technologies can overcome the inherent limitations of each medium, providing greater reliability and coverage. Utilities and solution integrators should explore hybrid models, as promoted by organizations such as the G3-PLC Alliance.

- Engage in Regulatory Advocacy: Active participation in regulatory discussions with bodies like the European Commission and Federal Communications Commission (FCC) can help shape favorable policies and spectrum allocations for PLC technologies.

- Focus on Scalable and Modular Solutions: Designing PLC systems with scalability in mind allows for incremental upgrades and easier integration with emerging smart infrastructure, supporting long-term investment protection.

In conclusion, the future of low-voltage PLC systems hinges on a balanced approach that addresses technical, regulatory, and market-driven factors. By embracing innovation, fostering collaboration, and advocating for supportive policies, stakeholders can ensure the continued growth and relevance of PLC technologies in the evolving digital landscape.

Sources & References

- STMicroelectronics

- Texas Instruments Incorporated

- Institute of Electrical and Electronics Engineers (IEEE)

- International Telecommunication Union (ITU)

- Silicon Laboratories Inc.

- G3-PLC Alliance

- PRIME Alliance

- Itron, Inc.

- Siemens AG

- ABB Ltd

- Landis+Gyr AG

- G3-PLC Alliance

- Enel

- Legrand

- GE

- European Commission