2025 Nanoneedle-Based Biosensing Technologies Market Report: In-Depth Analysis of Growth Drivers, Innovations, and Global Opportunities. Explore Market Size, Key Players, and Strategic Forecasts for the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Nanoneedle-Based Biosensing

- Competitive Landscape and Leading Players

- Market Size, Growth Forecasts & CAGR Analysis (2025–2030)

- Regional Market Analysis: North America, Europe, Asia-Pacific & Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

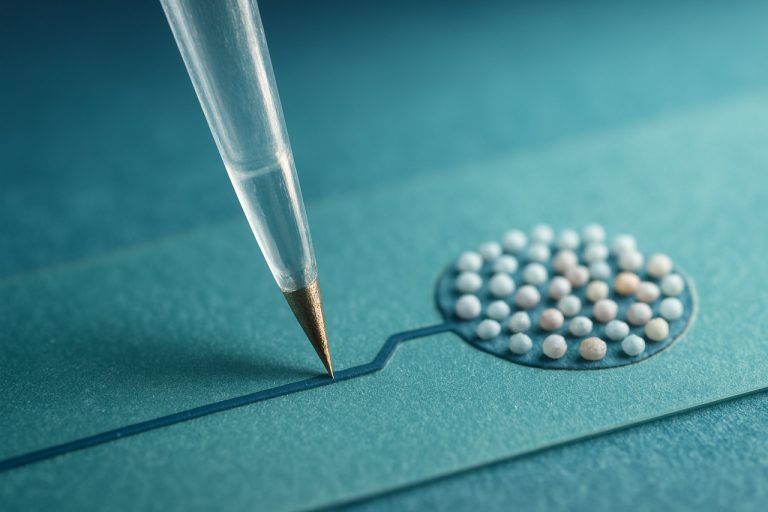

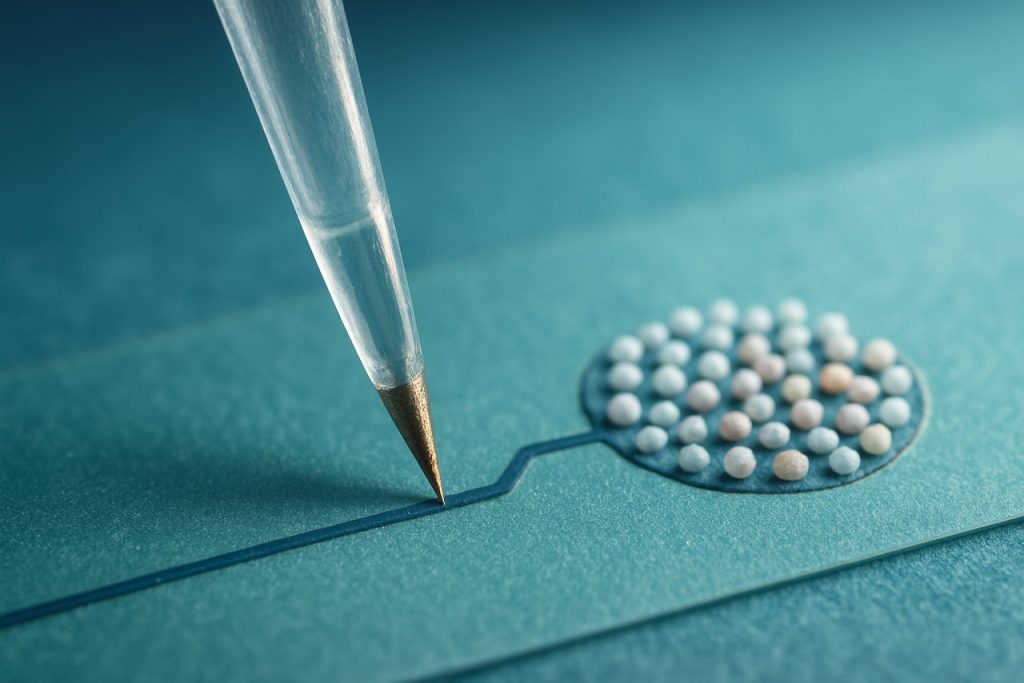

Nanoneedle-based biosensing technologies represent a cutting-edge segment within the broader biosensor market, leveraging nanoscale needle-like structures to achieve highly sensitive and selective detection of biomolecules. These devices are engineered to penetrate cell membranes or interact with biological samples at the molecular level, enabling real-time, minimally invasive diagnostics and monitoring. As of 2025, the global nanoneedle biosensor market is experiencing robust growth, driven by advancements in nanofabrication, increasing demand for point-of-care diagnostics, and the rising prevalence of chronic diseases requiring early and precise detection.

According to recent market analyses, the nanoneedle biosensor segment is projected to expand at a compound annual growth rate (CAGR) exceeding 15% through 2030, outpacing the broader biosensor market. This acceleration is attributed to the unique capabilities of nanoneedle platforms, such as single-molecule sensitivity, rapid response times, and compatibility with lab-on-a-chip systems. Key application areas include early cancer detection, infectious disease diagnostics, glucose monitoring, and drug delivery monitoring, with significant investments from both public and private sectors fueling innovation and commercialization efforts.

Geographically, North America and Europe currently lead in research output and commercialization, supported by strong academic-industry collaborations and favorable regulatory environments. However, Asia-Pacific is emerging as a high-growth region, propelled by expanding healthcare infrastructure and increased R&D spending in countries like China, Japan, and South Korea. Major industry players and research institutions, such as Thermo Fisher Scientific, Abbott Laboratories, and Nanoneedle, are actively developing next-generation platforms and forging strategic partnerships to accelerate market adoption.

- Key drivers: Miniaturization, demand for rapid diagnostics, and integration with digital health platforms.

- Challenges: Scalability of manufacturing, regulatory approval pathways, and ensuring biocompatibility.

- Opportunities: Personalized medicine, wearable biosensors, and expansion into veterinary and environmental monitoring.

In summary, nanoneedle-based biosensing technologies are poised to transform the landscape of molecular diagnostics and personalized healthcare. The market outlook for 2025 and beyond is highly favorable, underpinned by technological breakthroughs, expanding clinical applications, and a growing emphasis on early disease detection and monitoring.

Key Technology Trends in Nanoneedle-Based Biosensing

Nanoneedle-based biosensing technologies are at the forefront of next-generation diagnostic and analytical platforms, leveraging the unique properties of nanostructures to achieve unprecedented sensitivity and specificity. As of 2025, several key technology trends are shaping the evolution and commercialization of these biosensors.

- Integration with Microfluidics and Lab-on-a-Chip Systems: The convergence of nanoneedle biosensors with microfluidic platforms is enabling rapid, multiplexed, and minimally invasive diagnostics. This integration allows for precise sample handling and real-time analysis, which is particularly valuable for point-of-care testing and personalized medicine applications. Companies such as Thermo Fisher Scientific and Abbott Laboratories are actively investing in microfluidic-enabled biosensing devices.

- Advancements in Nanofabrication Techniques: Progress in nanofabrication, including electron-beam lithography and focused ion beam milling, has led to the production of highly uniform and reproducible nanoneedle arrays. These advances are critical for scaling up manufacturing and ensuring device consistency, as highlighted in recent reports by IDTechEx.

- Surface Functionalization and Biorecognition: Enhanced surface chemistry techniques are improving the selectivity of nanoneedle biosensors. Functionalization with aptamers, antibodies, or molecularly imprinted polymers enables the detection of a wide range of biomarkers, from nucleic acids to proteins and small molecules. Research institutions and companies such as Oxford Nanoimaging are pioneering these approaches.

- Integration with Wearable and Implantable Devices: The miniaturization and biocompatibility of nanoneedle sensors are driving their adoption in wearable and implantable health monitoring systems. This trend is supported by collaborations between medtech firms and academic labs, as seen in initiatives by Medtronic and Boston Scientific.

- AI-Driven Data Analysis: The vast datasets generated by nanoneedle biosensors are increasingly being analyzed using artificial intelligence and machine learning algorithms. This enables more accurate interpretation of complex biological signals and supports the development of predictive diagnostics, as reported by Gartner.

Collectively, these trends are accelerating the adoption of nanoneedle-based biosensing technologies across clinical diagnostics, environmental monitoring, and bioprocessing, positioning the sector for robust growth through 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape for nanoneedle-based biosensing technologies in 2025 is characterized by a dynamic mix of established biosensor companies, innovative startups, and academic spin-offs, all vying for leadership in a rapidly evolving market. The sector is driven by the demand for ultra-sensitive, minimally invasive diagnostic tools in healthcare, environmental monitoring, and biotechnology research.

Key players in this space include Nanoneedle Bioscience, which has pioneered silicon nanoneedle arrays for real-time, label-free detection of biomolecules, and NanoMedical Diagnostics, known for its graphene-based nanoneedle platforms that offer high sensitivity for protein and nucleic acid detection. These companies have established strategic partnerships with major healthcare providers and research institutions to accelerate clinical validation and commercialization.

Academic spin-offs such as Imperial College London and Massachusetts Institute of Technology (MIT) have also contributed significantly, translating cutting-edge research into commercial prototypes. Their focus has been on integrating nanoneedle arrays with microfluidic systems and advanced data analytics, enhancing multiplexing capabilities and throughput.

Startups like Sensyne Health and Cardea Bio are leveraging proprietary nanoneedle fabrication techniques and machine learning algorithms to differentiate their offerings. These firms emphasize rapid, point-of-care diagnostics and personalized medicine applications, targeting unmet needs in infectious disease detection and oncology.

The competitive environment is further shaped by collaborations with large diagnostics and life sciences companies such as Thermo Fisher Scientific and Roche, which are investing in nanoneedle technology through partnerships, licensing agreements, and acquisitions. These alliances aim to integrate nanoneedle biosensors into existing diagnostic platforms, expanding their reach and accelerating regulatory approval processes.

- Market leaders are focusing on improving sensitivity, specificity, and scalability of nanoneedle biosensors.

- Intellectual property portfolios and regulatory pathways are key differentiators among competitors.

- Geographically, North America and Europe dominate in terms of innovation and commercialization, but Asia-Pacific is emerging rapidly due to increased R&D investments.

Overall, the nanoneedle-based biosensing technology market in 2025 is marked by intense innovation, strategic collaborations, and a race to achieve clinical adoption, with leading players positioning themselves to capture significant shares in the expanding biosensor market.

Market Size, Growth Forecasts & CAGR Analysis (2025–2030)

The global market for nanoneedle-based biosensing technologies is poised for robust expansion between 2025 and 2030, driven by increasing demand for ultra-sensitive diagnostic tools in healthcare, environmental monitoring, and biotechnology research. According to recent projections by MarketsandMarkets, the biosensors market as a whole is expected to reach over USD 45 billion by 2030, with nanoneedle-based platforms representing a rapidly growing subsegment due to their unique capabilities in single-molecule detection and minimally invasive sampling.

In 2025, the nanoneedle-based biosensing market is estimated to be valued at approximately USD 350 million, reflecting early adoption in academic research, point-of-care diagnostics, and pharmaceutical development. The sector is forecasted to achieve a compound annual growth rate (CAGR) of 28–32% through 2030, outpacing the broader biosensor market. This accelerated growth is attributed to ongoing advancements in nanofabrication, integration with microfluidic systems, and the rising prevalence of chronic diseases that necessitate early and precise biomarker detection.

Key drivers of market expansion include:

- Increased investment in nanotechnology R&D by both public and private sectors, as highlighted by National Science Foundation funding trends.

- Regulatory support for innovative diagnostic devices, particularly in the US and EU, which is expediting clinical translation and commercialization.

- Growing partnerships between academic institutions and industry players, such as collaborations reported by Thermo Fisher Scientific and leading universities, to accelerate product development and validation.

Regionally, North America and Europe are expected to maintain dominance due to established healthcare infrastructure and strong innovation ecosystems. However, Asia-Pacific is projected to witness the fastest CAGR, fueled by expanding healthcare access, government initiatives in precision medicine, and a burgeoning biotechnology sector, as noted by Frost & Sullivan.

By 2030, the nanoneedle-based biosensing market is anticipated to surpass USD 1.5 billion, with significant contributions from applications in early cancer detection, infectious disease diagnostics, and personalized medicine. The rapid pace of technological innovation and increasing clinical validation are expected to further accelerate market penetration and adoption across diverse end-user segments.

Regional Market Analysis: North America, Europe, Asia-Pacific & Rest of World

The regional market landscape for nanoneedle-based biosensing technologies in 2025 is shaped by varying levels of research investment, regulatory environments, and healthcare infrastructure across North America, Europe, Asia-Pacific, and the Rest of the World (RoW).

- North America: The United States leads the global market, driven by robust funding for nanotechnology research, a strong presence of biotechnology firms, and early adoption in clinical diagnostics. The region benefits from initiatives by agencies such as the National Institutes of Health and the National Science Foundation, which have prioritized biosensing innovation. The U.S. Food and Drug Administration’s (FDA) evolving regulatory framework for nanomedicine is also facilitating faster commercialization. Canada, while smaller in market size, is seeing increased academic-industry collaborations, particularly in point-of-care diagnostics.

- Europe: Europe’s market is characterized by strong public-private partnerships and a focus on translational research. The European Commission’s Horizon Europe program has allocated significant funding to nanobiosensing projects, fostering innovation in disease detection and personalized medicine. Countries like Germany, the UK, and the Netherlands are at the forefront, with established clusters of nanotechnology startups and research institutes. Regulatory harmonization efforts by the European Medicines Agency are streamlining market entry for new biosensing devices.

- Asia-Pacific: The Asia-Pacific region is experiencing the fastest growth, propelled by rising healthcare expenditures, expanding biotechnology sectors, and government support in countries such as China, Japan, and South Korea. China’s Ministry of Science and Technology and Japan’s Japan Science and Technology Agency are investing heavily in nanomedicine R&D. Local companies are increasingly collaborating with global players to accelerate technology transfer and commercialization, particularly in cancer diagnostics and infectious disease monitoring.

- Rest of World (RoW): In regions such as Latin America, the Middle East, and Africa, adoption remains nascent but is expected to grow as healthcare modernization initiatives take hold. International organizations and NGOs are piloting nanoneedle-based biosensors for infectious disease surveillance and rural diagnostics, with support from entities like the World Health Organization.

Overall, while North America and Europe currently dominate the nanoneedle-based biosensing market, Asia-Pacific’s rapid expansion and RoW’s emerging opportunities are expected to reshape the competitive landscape by 2025.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for nanoneedle-based biosensing technologies in 2025 is marked by rapid innovation, expanding application domains, and increasing investor interest. As the demand for ultra-sensitive, minimally invasive diagnostic tools grows, nanoneedle biosensors are poised to play a transformative role across healthcare, environmental monitoring, and biotechnology sectors.

Emerging applications are particularly prominent in point-of-care diagnostics, where nanoneedle arrays enable real-time, label-free detection of biomarkers at the single-molecule level. This capability is driving research into early cancer detection, infectious disease screening, and personalized medicine. For example, recent advances in silicon and carbon-based nanoneedle platforms have demonstrated the ability to detect circulating tumor DNA and viral RNA with unprecedented sensitivity, paving the way for earlier intervention and improved patient outcomes (Nature Nanotechnology).

Beyond clinical diagnostics, nanoneedle biosensors are gaining traction in environmental monitoring, where their high surface-to-volume ratio and tunable surface chemistry allow for the detection of trace contaminants, toxins, and pathogens in water and air samples. This is particularly relevant as regulatory standards tighten and the need for rapid, on-site testing increases (MarketsandMarkets).

Investment hotspots are emerging in regions with strong nanotechnology ecosystems, such as North America, Western Europe, and parts of Asia-Pacific. Venture capital and strategic corporate investments are flowing into startups and research initiatives focused on scalable manufacturing, integration with microfluidics, and the development of multiplexed platforms capable of simultaneous detection of multiple analytes. Notably, collaborations between academic institutions and industry leaders are accelerating the commercialization of nanoneedle biosensors, with several companies announcing pilot-scale production and regulatory submissions in 2024 and 2025 (BCC Research).

- Point-of-care diagnostics and wearable health monitoring devices

- Environmental biosensing for water and air quality

- Food safety and agricultural pathogen detection

- Drug discovery and high-throughput screening

Looking ahead, the convergence of nanoneedle biosensing with artificial intelligence and data analytics is expected to unlock new value propositions, enabling predictive diagnostics and real-time health management. As regulatory pathways become clearer and manufacturing processes mature, nanoneedle-based biosensing technologies are set to become a cornerstone of next-generation biosensing solutions in 2025 and beyond.

Challenges, Risks, and Strategic Opportunities

Nanoneedle-based biosensing technologies are at the forefront of next-generation diagnostics, offering unprecedented sensitivity and specificity for detecting biomolecules at the single-cell or even single-molecule level. However, the path to widespread adoption in 2025 is shaped by a complex interplay of challenges, risks, and strategic opportunities.

Challenges and Risks

- Manufacturing Scalability: The fabrication of nanoneedles with consistent geometry and surface chemistry remains a significant hurdle. Variability in production can lead to inconsistent sensor performance, impeding large-scale commercialization. Advanced nanofabrication techniques, such as electron-beam lithography, are costly and time-consuming, limiting throughput and increasing unit costs (Nature Nanotechnology).

- Biocompatibility and Safety: Ensuring that nanoneedles do not induce cytotoxicity or immune responses is critical, especially for in vivo applications. Long-term biocompatibility studies are still limited, and regulatory pathways for approval remain uncertain, posing risks for clinical translation (U.S. Food and Drug Administration).

- Integration with Existing Systems: Seamless integration of nanoneedle sensors with current diagnostic platforms and data analytics infrastructure is technically challenging. Issues such as signal transduction, data standardization, and device miniaturization must be addressed to enable real-time, point-of-care applications (IDTechEx).

- Market and Regulatory Uncertainty: The nascent stage of the market means that reimbursement models, regulatory standards, and end-user acceptance are still evolving. This uncertainty can deter investment and slow down the pace of innovation (MarketsandMarkets).

Strategic Opportunities

- Personalized Medicine: Nanoneedle biosensors can enable ultra-sensitive, minimally invasive monitoring of disease biomarkers, supporting the shift toward personalized and precision medicine. This aligns with global healthcare trends and opens new revenue streams for early adopters (Grand View Research).

- Point-of-Care Diagnostics: The miniaturization and high sensitivity of nanoneedle-based devices position them as ideal candidates for rapid, decentralized diagnostics in resource-limited settings, expanding market reach beyond traditional healthcare facilities.

- Collaborative Innovation: Strategic partnerships between nanotechnology firms, diagnostics companies, and academic institutions can accelerate R&D, streamline regulatory approval, and foster ecosystem development, mitigating some of the inherent risks.

In summary, while nanoneedle-based biosensing technologies face notable technical, regulatory, and market challenges in 2025, they also present compelling opportunities for innovation and market disruption, particularly in the realms of personalized medicine and point-of-care diagnostics.

Sources & References

- Thermo Fisher Scientific

- IDTechEx

- Medtronic

- Boston Scientific

- NanoMedical Diagnostics

- Imperial College London

- Massachusetts Institute of Technology (MIT)

- Roche

- MarketsandMarkets

- National Science Foundation

- Frost & Sullivan

- National Institutes of Health

- European Commission

- European Medicines Agency

- Ministry of Science and Technology

- Japan Science and Technology Agency

- World Health Organization

- Nature Nanotechnology

- BCC Research

- Grand View Research