2025 Nanophotonic Metamaterials Fabrication Market Report: Technology Innovations, Competitive Dynamics, and Global Growth Projections. Explore Key Trends, Regional Insights, and Strategic Opportunities Shaping the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Nanophotonic Metamaterials Fabrication

- Competitive Landscape and Leading Players

- Market Size, Growth Forecasts, and CAGR Analysis (2025–2030)

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges, Risks, and Barriers to Adoption

- Opportunities and Strategic Recommendations

- Future Outlook: Emerging Applications and Investment Hotspots

- Sources & References

Executive Summary & Market Overview

Nanophotonic metamaterials fabrication refers to the design and manufacturing of artificial materials engineered at the nanoscale to manipulate light in ways not possible with natural substances. These materials exhibit unique optical properties—such as negative refractive index, cloaking, and superlensing—by structuring subwavelength features that interact with electromagnetic waves. The global market for nanophotonic metamaterials fabrication is poised for robust growth in 2025, driven by advancements in nanofabrication techniques, increasing demand for miniaturized photonic devices, and expanding applications across telecommunications, imaging, sensing, and quantum computing.

According to MarketsandMarkets, the metamaterials market is projected to reach USD 4.5 billion by 2025, with nanophotonic metamaterials representing a significant and rapidly expanding segment. The surge in research and development, particularly in North America, Europe, and Asia-Pacific, is accelerating the commercialization of these materials. Key industry players and research institutions are leveraging advanced lithography, self-assembly, and nanoimprint technologies to achieve precise control over material properties at the nanoscale.

The telecommunications sector is a primary driver, with nanophotonic metamaterials enabling ultra-compact optical components for next-generation data transmission and processing. In addition, the medical imaging and biosensing markets are adopting these materials for their ability to enhance sensitivity and resolution beyond conventional limits. The defense and aerospace industries are also investing in nanophotonic metamaterials for stealth, secure communications, and advanced sensor systems, as highlighted by Defense Advanced Research Projects Agency (DARPA) initiatives.

Despite the promising outlook, the market faces challenges related to large-scale, cost-effective fabrication and integration with existing semiconductor processes. However, ongoing innovations in scalable nanofabrication—such as roll-to-roll processing and directed self-assembly—are expected to mitigate these barriers. Strategic collaborations between academia, industry, and government agencies are further catalyzing technology transfer and commercialization, as noted by National Science Foundation (NSF) funded programs.

In summary, the nanophotonic metamaterials fabrication market in 2025 is characterized by rapid technological progress, expanding end-use applications, and increasing investment. The sector is set to play a pivotal role in shaping the future of photonics, with significant implications for communications, healthcare, defense, and beyond.

Key Technology Trends in Nanophotonic Metamaterials Fabrication

Nanophotonic metamaterials fabrication is witnessing rapid technological evolution, driven by the demand for advanced optical devices in telecommunications, sensing, and quantum computing. As of 2025, several key technology trends are shaping the landscape of nanophotonic metamaterials fabrication:

- Advanced Lithography Techniques: Electron-beam lithography (EBL) and focused ion beam (FIB) milling remain foundational for fabricating nanostructures with sub-10 nm precision. However, the industry is increasingly adopting nanoimprint lithography (NIL) for scalable, cost-effective production, enabling high-throughput manufacturing of complex metamaterial patterns. This shift is crucial for commercial viability and large-area device integration (Imperial College London).

- Integration of 2D Materials: The incorporation of atomically thin materials such as graphene and transition metal dichalcogenides (TMDs) into metamaterial architectures is enabling tunable optical properties and enhanced device performance. Hybrid fabrication approaches, combining traditional nanofabrication with chemical vapor deposition (CVD) and transfer techniques, are becoming standard for next-generation photonic devices (Nature Reviews Materials).

- Direct Laser Writing and Additive Manufacturing: Multiphoton lithography and other direct laser writing methods are gaining traction for their ability to create three-dimensional (3D) nanostructures with high spatial resolution. These techniques facilitate the fabrication of volumetric metamaterials, expanding the functional possibilities beyond planar designs (Materials Today).

- Machine Learning-Driven Process Optimization: Artificial intelligence (AI) and machine learning (ML) are increasingly used to optimize fabrication parameters, predict material behaviors, and accelerate the design-to-fabrication cycle. This data-driven approach is reducing trial-and-error, improving yield, and enabling the rapid prototyping of novel metamaterial structures (Nature Reviews Materials).

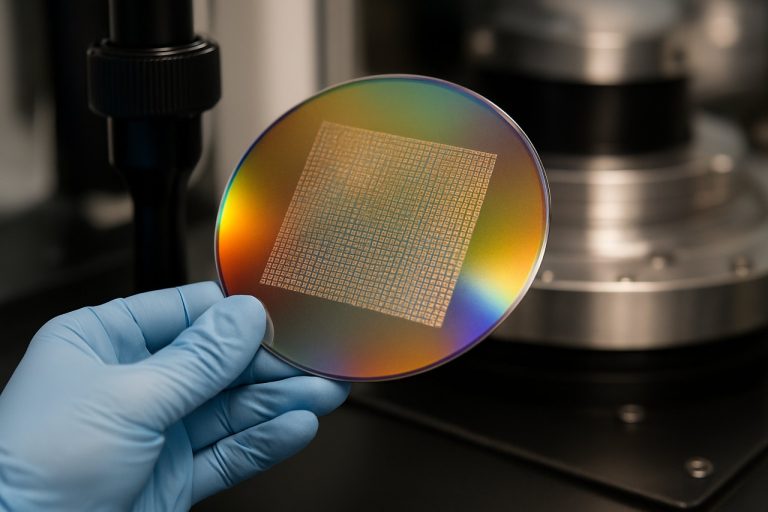

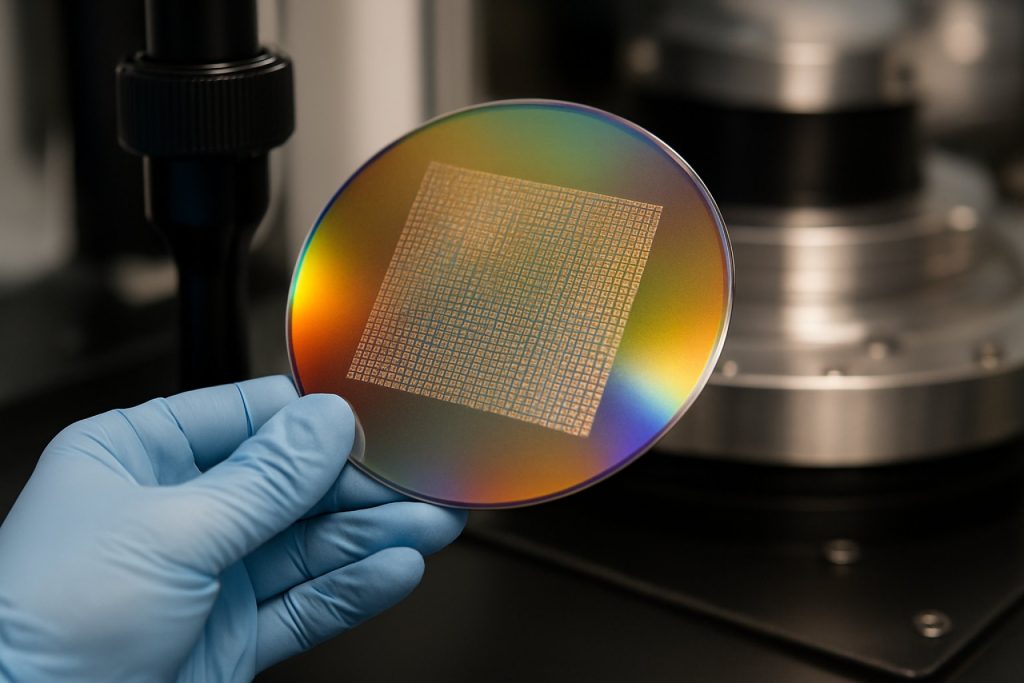

- Wafer-Scale and Roll-to-Roll Manufacturing: To meet industrial-scale demands, wafer-scale fabrication and roll-to-roll processing are being developed for metamaterials. These methods promise to bridge the gap between laboratory-scale innovation and commercial deployment, particularly for applications in photonic chips and flexible optoelectronics (U.S. Department of Energy).

Collectively, these trends are accelerating the transition of nanophotonic metamaterials from research labs to real-world applications, with 2025 poised to see significant advances in both fabrication capabilities and market adoption.

Competitive Landscape and Leading Players

The competitive landscape of nanophotonic metamaterials fabrication in 2025 is characterized by a dynamic mix of established photonics companies, advanced materials specialists, and innovative startups. The sector is driven by rapid advancements in nanofabrication techniques, increasing demand for miniaturized optical components, and the integration of metamaterials into commercial photonic devices. Key players are leveraging proprietary fabrication processes, strategic partnerships, and significant R&D investments to maintain technological leadership and capture emerging market opportunities.

Among the leading players, National Institute of Standards and Technology (NIST) continues to set benchmarks in nanofabrication standards and process optimization, collaborating with both industry and academia to accelerate the commercialization of nanophotonic metamaterials. Imperial College London and Massachusetts Institute of Technology (MIT) are at the forefront of research, frequently publishing breakthroughs in scalable fabrication methods such as electron-beam lithography, nanoimprint lithography, and self-assembly techniques.

On the commercial front, Nanoscribe GmbH has established itself as a leader in high-precision 3D laser lithography, enabling the production of complex nanostructures for photonic applications. ams OSRAM and Lumentum Holdings Inc. are integrating metamaterial-based components into next-generation optical sensors and communication devices, leveraging their global manufacturing capabilities and established customer bases.

Startups such as Meta Materials Inc. are disrupting the market with novel fabrication approaches, including roll-to-roll nanoimprinting and scalable self-assembly, targeting applications in augmented reality, LiDAR, and advanced imaging. These companies are attracting significant venture capital and forming partnerships with major electronics and automotive manufacturers to accelerate product development and market entry.

The competitive environment is further shaped by regional initiatives, particularly in the US, Europe, and East Asia, where government-backed programs and consortia are fostering innovation and supporting pilot manufacturing lines. The race to achieve cost-effective, high-throughput fabrication remains a central challenge, with players differentiating themselves through process scalability, material performance, and integration capabilities.

Overall, the nanophotonic metamaterials fabrication market in 2025 is marked by intense competition, rapid technological evolution, and a growing emphasis on commercial scalability, positioning leading players to capitalize on expanding opportunities across telecommunications, sensing, and consumer electronics sectors.

Market Size, Growth Forecasts, and CAGR Analysis (2025–2030)

The global market for nanophotonic metamaterials fabrication is poised for robust expansion between 2025 and 2030, driven by escalating demand in telecommunications, advanced imaging, and quantum computing. According to projections from MarketsandMarkets, the broader metamaterials market is expected to reach USD 4.5 billion by 2025, with nanophotonic segments contributing a significant share due to their unique optical properties and miniaturization capabilities.

From 2025 to 2030, the nanophotonic metamaterials fabrication market is anticipated to register a compound annual growth rate (CAGR) of approximately 23–27%. This growth is underpinned by rapid advancements in nanofabrication techniques, such as electron-beam lithography, nanoimprint lithography, and self-assembly methods, which are enabling scalable and cost-effective production of complex nanostructures. The increasing integration of nanophotonic metamaterials in photonic integrated circuits, sensors, and next-generation display technologies is further accelerating market expansion.

Regionally, North America and Asia-Pacific are expected to dominate market share, with significant investments in R&D and commercialization activities. The United States, in particular, benefits from strong government and private sector funding, as highlighted by initiatives from the National Science Foundation and collaborations with leading research universities. Meanwhile, China, Japan, and South Korea are rapidly scaling up their nanophotonics manufacturing capabilities, supported by national innovation strategies and robust electronics sectors.

Key industry players, including Nanoscribe, Meta Materials Inc., and NKT Photonics, are investing heavily in R&D to enhance fabrication precision, throughput, and material versatility. These efforts are expected to yield new product launches and strategic partnerships, further fueling market growth.

- Telecommunications: The rollout of 6G and advanced optical networks is driving demand for nanophotonic metamaterials with tailored refractive indices and low-loss characteristics.

- Healthcare and Imaging: High-resolution imaging and biosensing applications are spurring adoption of nanostructured metamaterials for improved sensitivity and specificity.

- Quantum Technologies: The pursuit of scalable quantum photonic devices is creating new opportunities for innovative fabrication approaches.

Overall, the nanophotonic metamaterials fabrication market is set for dynamic growth through 2030, propelled by technological innovation, expanding end-use applications, and increasing global investment.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The regional landscape for nanophotonic metamaterials fabrication in 2025 is shaped by varying levels of technological maturity, investment, and end-user demand across North America, Europe, Asia-Pacific, and the Rest of the World (RoW).

North America remains a global leader, driven by robust R&D ecosystems and significant funding from both government and private sectors. The United States, in particular, benefits from the presence of leading research institutions and a strong semiconductor industry, fostering innovation in nanofabrication techniques such as electron-beam lithography and nanoimprint lithography. Strategic collaborations between academia and industry, as seen in initiatives supported by the National Science Foundation and DARPA, accelerate the commercialization of advanced nanophotonic metamaterials for applications in telecommunications, sensing, and quantum computing.

Europe is characterized by a coordinated approach to research and standardization, with the European Commission funding large-scale projects under Horizon Europe. Countries like Germany, the UK, and France are at the forefront, leveraging their advanced photonics and materials science sectors. European manufacturers emphasize scalable, environmentally sustainable fabrication processes, including roll-to-roll nanoimprinting and self-assembly methods, to meet the region’s stringent regulatory and sustainability standards.

- Asia-Pacific is the fastest-growing region, propelled by aggressive investments in nanotechnology infrastructure, particularly in China, Japan, and South Korea. China’s government-backed initiatives, such as those led by the National Natural Science Foundation of China, have resulted in rapid advancements in large-area, cost-effective fabrication techniques. Japan’s focus on precision engineering and South Korea’s integration of nanophotonics into consumer electronics further drive regional growth. The region’s manufacturing prowess enables mass production of nanophotonic metamaterials for displays, sensors, and 5G/6G components.

- Rest of World (RoW) includes emerging markets in Latin America, the Middle East, and Africa, where adoption is nascent but growing. These regions are primarily importers of nanophotonic metamaterials, with local fabrication limited by infrastructure and expertise gaps. However, targeted investments and technology transfer initiatives, often in partnership with global players, are beginning to establish foundational capabilities.

Overall, regional disparities in nanophotonic metamaterials fabrication are narrowing as global collaboration intensifies and scalable, cost-effective manufacturing technologies mature. This dynamic is expected to accelerate the adoption of nanophotonic metamaterials across diverse industries worldwide in 2025 and beyond.

Challenges, Risks, and Barriers to Adoption

The fabrication of nanophotonic metamaterials in 2025 faces a complex array of challenges, risks, and barriers that hinder widespread adoption and commercial scalability. One of the primary technical challenges is the requirement for extreme precision at the nanoscale. Achieving consistent feature sizes below 100 nm across large substrates remains difficult, as even minor deviations can significantly alter the optical properties of the metamaterial. Advanced lithography techniques, such as electron-beam lithography and focused ion beam milling, offer high resolution but are limited by low throughput and high costs, making them unsuitable for mass production (Nature Reviews Materials).

Material selection and compatibility also present significant barriers. Many nanophotonic metamaterials rely on noble metals like gold and silver, which are expensive and can suffer from high optical losses at visible and near-infrared wavelengths. Efforts to use alternative materials, such as transparent conducting oxides or transition metal nitrides, are ongoing but face their own fabrication and integration challenges (Materials Today).

Scalability is another critical issue. While laboratory-scale demonstrations have shown promising results, translating these processes to wafer-scale or roll-to-roll manufacturing remains a significant hurdle. Uniformity, defect control, and reproducibility are difficult to maintain over large areas, which is essential for commercial applications in photonic circuits, sensors, and displays (U.S. Department of Energy).

Economic risks are also substantial. The high capital expenditure required for advanced nanofabrication equipment, coupled with uncertain market demand and long development cycles, can deter investment. Intellectual property concerns and the lack of standardized fabrication protocols further complicate technology transfer and commercialization (IDTechEx).

Finally, regulatory and environmental considerations are emerging as potential barriers. The use of certain nanomaterials may be subject to evolving health and safety regulations, and the environmental impact of nanofabrication processes is under increasing scrutiny. Addressing these issues will require coordinated efforts between industry, academia, and regulatory bodies to develop safe, sustainable, and economically viable fabrication pathways.

Opportunities and Strategic Recommendations

The nanophotonic metamaterials fabrication market in 2025 is poised for significant growth, driven by advancements in nanofabrication techniques, increasing demand for miniaturized photonic devices, and expanding applications across telecommunications, sensing, and quantum computing. Several key opportunities and strategic recommendations can be identified for stakeholders aiming to capitalize on this evolving landscape.

- Adoption of Advanced Lithography and Self-Assembly Techniques: The integration of next-generation lithography methods, such as extreme ultraviolet (EUV) lithography and nanoimprint lithography, is enabling the production of complex nanostructures with high precision and scalability. Companies investing in these technologies can achieve cost-effective mass production, addressing the growing demand for nanophotonic components in data centers and 5G infrastructure (ASML Holding).

- Strategic Partnerships and Ecosystem Development: Collaborations between material suppliers, device manufacturers, and research institutions are essential to accelerate innovation and reduce time-to-market. Joint ventures and consortia can facilitate knowledge sharing and access to state-of-the-art fabrication facilities, as seen in initiatives led by imec and CSEM.

- Customization for Emerging Applications: Tailoring metamaterial properties for specific end-use cases—such as tunable optical filters for LiDAR, ultra-thin lenses for AR/VR, and quantum photonic chips—offers high-margin opportunities. Firms that develop application-specific fabrication processes can differentiate themselves in a competitive market (IDTechEx).

- Focus on Sustainability and Cost Reduction: As environmental regulations tighten, adopting greener fabrication processes and recyclable materials will become a market differentiator. Companies that invest in energy-efficient manufacturing and waste minimization can appeal to eco-conscious customers and comply with evolving standards (International Energy Agency).

- Government Funding and Policy Leverage: Tapping into public funding and incentive programs for advanced manufacturing and photonics R&D can offset capital expenditures and foster innovation. Monitoring policy developments in key regions such as the EU, US, and Asia-Pacific is crucial for strategic planning (European Commission).

In summary, the nanophotonic metamaterials fabrication sector in 2025 offers robust opportunities for growth through technological innovation, strategic alliances, application-driven customization, sustainability initiatives, and proactive engagement with public policy. Stakeholders that align their strategies with these trends are well-positioned to capture value in this dynamic market.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for nanophotonic metamaterials fabrication in 2025 is shaped by rapid advancements in both application domains and investment trends. As the demand for miniaturized, high-performance optical components intensifies, nanophotonic metamaterials are poised to revolutionize sectors such as telecommunications, quantum computing, medical diagnostics, and advanced imaging.

Emerging applications are particularly prominent in the development of ultra-compact photonic circuits, which promise to surpass the limitations of traditional electronic circuits in terms of speed and energy efficiency. The integration of nanophotonic metamaterials into silicon photonics platforms is expected to accelerate, enabling the creation of on-chip optical interconnects and modulators with unprecedented performance. This trend is supported by ongoing research and pilot projects at leading institutions and companies, including IBM Research and Intel, which are investing in scalable fabrication techniques such as nanoimprint lithography and self-assembly.

Another key area of growth is in quantum technologies. Nanophotonic metamaterials are being engineered to manipulate single photons with high precision, a critical requirement for quantum communication and computing. Startups and research consortia, such as those supported by the National Science Foundation, are channeling investments into scalable fabrication methods that can produce defect-free, reproducible nanostructures at commercial volumes.

In the medical field, nanophotonic metamaterials are enabling breakthroughs in biosensing and imaging. Their ability to enhance light-matter interactions at the nanoscale is leading to the development of highly sensitive diagnostic devices and super-resolution imaging systems. Companies like ZEISS and Olympus Life Science are exploring partnerships and acquisitions to secure intellectual property and manufacturing capabilities in this space.

From an investment perspective, hotspots are emerging in regions with strong semiconductor and photonics ecosystems, notably the United States, Germany, Japan, and South Korea. According to IDTechEx, venture capital and government funding for nanophotonic metamaterials fabrication startups are expected to grow by over 20% year-on-year through 2025, with a focus on scalable, cost-effective manufacturing solutions. Strategic collaborations between academia, industry, and government agencies are anticipated to further accelerate commercialization and market adoption.

Sources & References

- MarketsandMarkets

- Defense Advanced Research Projects Agency (DARPA)

- National Science Foundation (NSF)

- Imperial College London

- Nature Reviews Materials

- U.S. Department of Energy

- National Institute of Standards and Technology (NIST)

- Massachusetts Institute of Technology (MIT)

- Nanoscribe GmbH

- ams OSRAM

- Lumentum Holdings Inc.

- Meta Materials Inc.

- NKT Photonics

- European Commission

- IDTechEx

- ASML Holding

- imec

- CSEM

- International Energy Agency

- IBM Research

- ZEISS

- Olympus Life Science