2025 Optical Inspection in Semiconductor Packaging: Market Dynamics, Technology Innovations, and Strategic Forecasts. Explore Key Trends, Regional Insights, and Growth Opportunities Shaping the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Optical Inspection Systems

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR and Revenue Projections

- Regional Analysis: Demand Drivers and Market Share by Geography

- Challenges, Risks, and Emerging Opportunities

- Future Outlook: Strategic Recommendations and Investment Insights

- Sources & References

Executive Summary & Market Overview

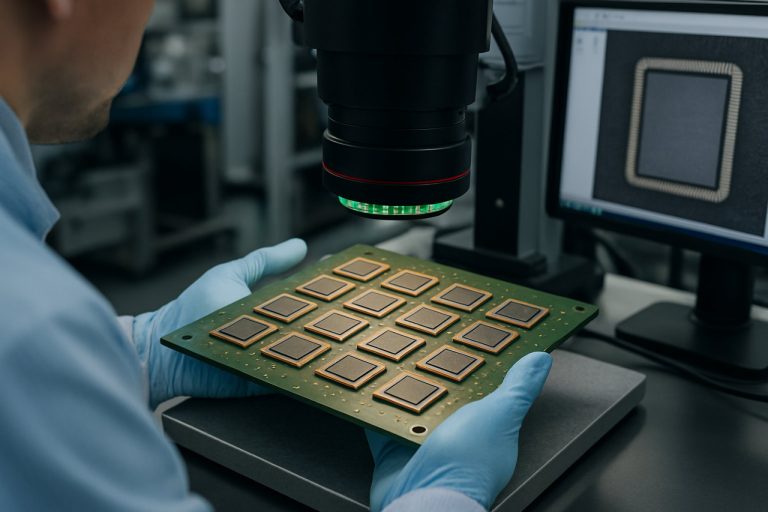

The optical inspection market in semiconductor packaging is poised for significant growth in 2025, driven by escalating demand for advanced packaging solutions and the increasing complexity of semiconductor devices. Optical inspection systems, which utilize technologies such as automated optical inspection (AOI), confocal microscopy, and 3D imaging, are critical for ensuring the quality and reliability of semiconductor packages by detecting defects, misalignments, and process deviations at various stages of production.

In 2025, the global market for optical inspection in semiconductor packaging is expected to surpass USD 1.5 billion, reflecting a compound annual growth rate (CAGR) of approximately 7-9% over the previous five years. This growth is underpinned by the proliferation of high-density advanced packaging formats such as fan-out wafer-level packaging (FOWLP), 2.5D/3D integration, and system-in-package (SiP) technologies, which require more stringent inspection standards and higher-resolution imaging capabilities SEMI.

Key industry players—including KLA Corporation, Hitachi High-Tech Corporation, and Camtek Ltd.—are investing heavily in R&D to enhance inspection speed, accuracy, and automation. The integration of artificial intelligence (AI) and machine learning (ML) into optical inspection platforms is further improving defect detection rates and reducing false positives, thereby optimizing yield and throughput for semiconductor manufacturers Gartner.

Geographically, Asia-Pacific remains the dominant region, accounting for over 60% of the market share, fueled by the concentration of leading foundries and outsourced semiconductor assembly and test (OSAT) providers in countries such as Taiwan, South Korea, and China IC Insights. North America and Europe are also witnessing increased adoption, particularly in the automotive, consumer electronics, and industrial sectors, where zero-defect requirements are paramount.

Looking ahead to 2025, the market is expected to be shaped by ongoing miniaturization trends, the transition to heterogeneous integration, and the need for real-time, in-line inspection solutions. These factors will continue to drive innovation and investment in optical inspection technologies, making them indispensable for the next generation of semiconductor packaging.

Key Technology Trends in Optical Inspection Systems

Optical inspection systems are playing an increasingly pivotal role in semiconductor packaging as the industry advances toward smaller nodes, heterogeneous integration, and advanced packaging formats such as fan-out wafer-level packaging (FOWLP) and 2.5D/3D integration. In 2025, several key technology trends are shaping the deployment and evolution of optical inspection in this sector.

- High-Resolution Imaging and AI Integration: The demand for sub-micron and even nanometer-level defect detection is driving the adoption of high-resolution cameras and advanced optics. Coupled with artificial intelligence (AI) and machine learning algorithms, these systems can now identify subtle defects, pattern shifts, and process anomalies with greater accuracy and speed. Companies like KLA Corporation and Hitachi High-Tech Corporation are at the forefront, integrating deep learning to reduce false positives and improve yield analysis.

- 3D Optical Inspection: As packaging complexity increases, especially with through-silicon vias (TSVs) and micro-bumps, 3D optical inspection technologies such as confocal microscopy and optical coherence tomography are gaining traction. These methods enable non-destructive, volumetric analysis of package structures, ensuring interconnect integrity and alignment. Camtek Ltd. and CyberOptics Corporation have introduced systems capable of high-speed, high-precision 3D metrology tailored for advanced packaging lines.

- Inline and Real-Time Inspection: The push for higher throughput and zero-defect manufacturing is accelerating the shift toward inline, real-time optical inspection. These systems are now being integrated directly into packaging production lines, providing immediate feedback and enabling adaptive process control. According to SEMI, this trend is critical for supporting the rapid ramp-up of new packaging technologies and minimizing costly rework.

- Advanced Data Analytics and Connectivity: Modern optical inspection platforms are increasingly connected, leveraging Industry 4.0 principles. They collect and analyze vast amounts of inspection data, which is then used for predictive maintenance, process optimization, and traceability. ASML Holding and Tokyo Electron Limited are investing in cloud-based analytics and digital twins to further enhance inspection efficiency and decision-making.

These technology trends are expected to continue driving innovation and competitiveness in semiconductor packaging, as manufacturers seek to balance yield, cost, and time-to-market in an increasingly complex landscape.

Competitive Landscape and Leading Players

The competitive landscape for optical inspection in semiconductor packaging is characterized by a mix of established global players and innovative niche companies, all vying to address the increasing complexity and miniaturization of semiconductor devices. As of 2025, the market is driven by the need for higher throughput, improved defect detection accuracy, and the integration of artificial intelligence (AI) and machine learning (ML) into inspection systems.

Key industry leaders include KLA Corporation, Hitachi High-Tech Corporation, Camtek Ltd., Cognex Corporation, and Onto Innovation Inc.. These companies command significant market share due to their comprehensive product portfolios, global service networks, and ongoing investments in R&D. For instance, KLA Corporation continues to lead with advanced 2D and 3D inspection systems tailored for advanced packaging, leveraging AI-driven analytics to enhance defect classification and yield management.

Emerging players and regional specialists are also making notable inroads, particularly in Asia-Pacific, where semiconductor manufacturing is concentrated. Companies such as Synapse Imaging and Ushio Inc. are expanding their presence by offering cost-effective, high-resolution inspection solutions tailored to local market needs. Strategic partnerships and collaborations between equipment manufacturers and semiconductor foundries are increasingly common, aiming to accelerate the adoption of next-generation inspection technologies.

The competitive environment is further shaped by rapid technological advancements. Leading players are differentiating themselves through innovations such as multi-modal imaging, deep learning-based defect recognition, and real-time data analytics. For example, Camtek Ltd. has introduced hybrid inspection platforms that combine optical and X-ray modalities, addressing the challenges of heterogeneous integration and advanced packaging formats like fan-out wafer-level packaging (FOWLP).

Mergers and acquisitions remain a key strategy for market consolidation and technology acquisition. Notably, Onto Innovation Inc. has expanded its capabilities through targeted acquisitions, enhancing its offerings in both front-end and back-end inspection. As the demand for higher reliability and smaller node sizes intensifies, the competitive landscape is expected to remain dynamic, with both established and emerging players investing heavily in R&D and strategic alliances to maintain their market positions.

Market Growth Forecasts (2025–2030): CAGR and Revenue Projections

The optical inspection market within semiconductor packaging is poised for robust growth between 2025 and 2030, driven by escalating demand for advanced packaging solutions and the increasing complexity of semiconductor devices. According to projections by MarketsandMarkets, the global optical inspection market for semiconductors is expected to register a compound annual growth rate (CAGR) of approximately 7–9% during this period. This growth is underpinned by the proliferation of high-density packaging technologies such as 2.5D/3D ICs, fan-out wafer-level packaging (FOWLP), and system-in-package (SiP), all of which require precise and reliable inspection solutions to ensure yield and quality.

Revenue projections for 2025 indicate that the optical inspection segment dedicated to semiconductor packaging will surpass $1.5 billion, with expectations to reach or exceed $2.5 billion by 2030. This trajectory is supported by increased capital expenditures from leading foundries and outsourced semiconductor assembly and test (OSAT) providers, who are investing in next-generation inspection systems to address shrinking feature sizes and the need for zero-defect manufacturing. SEMI reports that the Asia-Pacific region, particularly Taiwan, South Korea, and China, will continue to dominate market share, accounting for over 60% of global demand due to the concentration of packaging and testing facilities.

- Automated optical inspection (AOI) systems are expected to see the highest adoption rates, with a CAGR exceeding 8% through 2030, as manufacturers prioritize inline, high-throughput inspection to minimize downtime and maximize yield.

- Emerging technologies such as deep learning-based defect detection and hybrid inspection platforms (combining optical and X-ray modalities) are anticipated to drive incremental revenue, especially in advanced packaging lines.

- Key players including KLA Corporation, Hitachi High-Tech Corporation, and Camtek Ltd. are expected to expand their market presence through product innovation and strategic partnerships with major OSATs and integrated device manufacturers (IDMs).

In summary, the period from 2025 to 2030 will see sustained double-digit growth in optical inspection for semiconductor packaging, fueled by technological advancements, regional investments, and the relentless pursuit of higher yields in advanced packaging processes.

Regional Analysis: Demand Drivers and Market Share by Geography

The global market for optical inspection in semiconductor packaging is characterized by distinct regional dynamics, with demand drivers and market share distribution varying significantly across key geographies. In 2025, Asia-Pacific continues to dominate the market, accounting for the largest share due to the concentration of semiconductor manufacturing hubs in countries such as China, Taiwan, South Korea, and Japan. The region’s leadership is propelled by the presence of major foundries and outsourced semiconductor assembly and test (OSAT) providers, as well as robust investments in advanced packaging technologies. According to SEMI, over 70% of global semiconductor packaging capacity is located in Asia-Pacific, making it the epicenter for optical inspection equipment deployment.

China’s aggressive push for semiconductor self-sufficiency, supported by government incentives and the expansion of domestic players, is a key demand driver. The country’s focus on advanced packaging—such as system-in-package (SiP) and 2.5D/3D integration—necessitates high-precision optical inspection solutions to ensure yield and reliability. Similarly, Taiwan’s dominance in advanced packaging, led by companies like TSMC and ASE Group, sustains high demand for state-of-the-art inspection systems. South Korea’s leading memory manufacturers, including Samsung and SK Hynix, are also investing in next-generation packaging lines, further boosting regional demand.

North America holds a significant market share, driven by the presence of leading semiconductor equipment manufacturers and ongoing R&D in heterogeneous integration and chiplet architectures. The U.S. government’s CHIPS Act and related initiatives are spurring new investments in domestic packaging capacity, which is expected to translate into increased adoption of optical inspection tools. According to SEMI Market Reports, North America’s share is projected to grow modestly as new facilities come online in 2025.

Europe, while smaller in market share, is witnessing steady growth due to the region’s focus on automotive, industrial, and IoT applications that require advanced packaging. The European Union’s push for semiconductor sovereignty and the establishment of new packaging R&D centers are expected to drive incremental demand for optical inspection solutions. Key players in Germany, France, and the Netherlands are investing in both front-end and back-end semiconductor capabilities, as reported by Electronics Weekly.

In summary, Asia-Pacific remains the dominant region for optical inspection in semiconductor packaging, with North America and Europe poised for growth due to strategic investments and policy support. Regional demand drivers include technological advancements, government incentives, and the evolving requirements of end-use industries.

Challenges, Risks, and Emerging Opportunities

The landscape of optical inspection in semiconductor packaging is rapidly evolving, presenting a complex mix of challenges, risks, and emerging opportunities as the industry heads into 2025. One of the primary challenges is the increasing miniaturization and complexity of semiconductor devices. Advanced packaging technologies such as 2.5D/3D integration, fan-out wafer-level packaging (FOWLP), and system-in-package (SiP) demand higher resolution and more sensitive inspection systems to detect sub-micron defects and ensure yield. This escalation in technical requirements puts pressure on equipment manufacturers to innovate rapidly, often resulting in higher capital expenditures for semiconductor fabs and OSATs (SEMI).

Another significant risk is the integration of artificial intelligence (AI) and machine learning (ML) into optical inspection workflows. While AI-driven defect classification and predictive analytics can enhance throughput and accuracy, they also introduce concerns regarding data integrity, algorithm transparency, and the need for large, high-quality training datasets. The risk of false positives or negatives due to algorithmic bias or insufficient training data can impact yield and reliability, especially as device geometries shrink (Gartner).

Supply chain disruptions and geopolitical tensions continue to pose risks to the timely delivery and support of advanced optical inspection equipment. The semiconductor industry’s reliance on a handful of specialized equipment vendors means that any bottleneck or export restriction can have cascading effects on production schedules and costs (McKinsey & Company).

Despite these challenges, several emerging opportunities are shaping the future of optical inspection in semiconductor packaging. The adoption of hybrid metrology—combining optical inspection with other modalities such as X-ray and electron microscopy—offers a path to more comprehensive defect detection and process control. Additionally, the push toward smart manufacturing and Industry 4.0 is driving demand for real-time, in-line inspection solutions that can be seamlessly integrated into automated production lines (TechInsights).

In summary, while the sector faces technical, operational, and geopolitical headwinds, the ongoing digital transformation and the need for higher yield and reliability are catalyzing innovation and investment in next-generation optical inspection technologies.

Future Outlook: Strategic Recommendations and Investment Insights

The future outlook for optical inspection in semiconductor packaging is shaped by rapid technological advancements, increasing device complexity, and the relentless drive for higher yields and reliability. As the industry moves toward advanced packaging techniques such as 2.5D/3D integration, fan-out wafer-level packaging (FOWLP), and system-in-package (SiP) solutions, the demand for high-precision, high-throughput optical inspection systems is expected to intensify in 2025 and beyond.

Strategically, semiconductor manufacturers and equipment suppliers should prioritize investments in next-generation optical inspection technologies that leverage artificial intelligence (AI) and machine learning (ML) for defect detection and classification. These technologies enable faster, more accurate identification of sub-micron defects, which are increasingly prevalent in advanced nodes and heterogeneous integration. Companies such as KLA Corporation and Hitachi High-Tech Corporation are already integrating AI-driven analytics into their inspection platforms, setting new industry benchmarks for speed and accuracy.

Another key recommendation is to focus on hybrid inspection solutions that combine optical and e-beam modalities. This approach addresses the limitations of traditional optical systems in detecting ultra-fine defects and offers a more comprehensive inspection regime for advanced packaging. Strategic partnerships or acquisitions in this domain could provide a competitive edge, as evidenced by recent moves from ASML Holding and Cognex Corporation to expand their inspection portfolios.

From an investment perspective, the market for optical inspection in semiconductor packaging is projected to grow at a robust CAGR, driven by the proliferation of AI, 5G, and automotive electronics. According to Global Market Insights, the global semiconductor inspection system market is expected to surpass USD 8 billion by 2027, with packaging inspection representing a significant share. Investors should monitor companies with strong R&D pipelines, established customer bases in Asia-Pacific (the largest packaging hub), and a track record of innovation in inspection technologies.

- Prioritize R&D in AI/ML-powered inspection systems.

- Explore hybrid optical/e-beam inspection solutions.

- Target strategic partnerships and M&A to access new technologies.

- Focus on markets with high advanced packaging adoption, especially in Asia-Pacific.

In summary, the future of optical inspection in semiconductor packaging hinges on technological innovation, strategic collaborations, and targeted investments in high-growth regions and applications.

Sources & References

- KLA Corporation

- Hitachi High-Tech Corporation

- Camtek Ltd.

- IC Insights

- ASML Holding

- Onto Innovation Inc.

- Ushio Inc.

- Onto Innovation Inc.

- MarketsandMarkets

- Electronics Weekly

- McKinsey & Company

- TechInsights

- Global Market Insights