Piezoelectric Microfluidic Device Engineering Market Report 2025: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Opportunities

- Executive Summary & Market Overview

- Key Technology Trends in Piezoelectric Microfluidic Devices

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

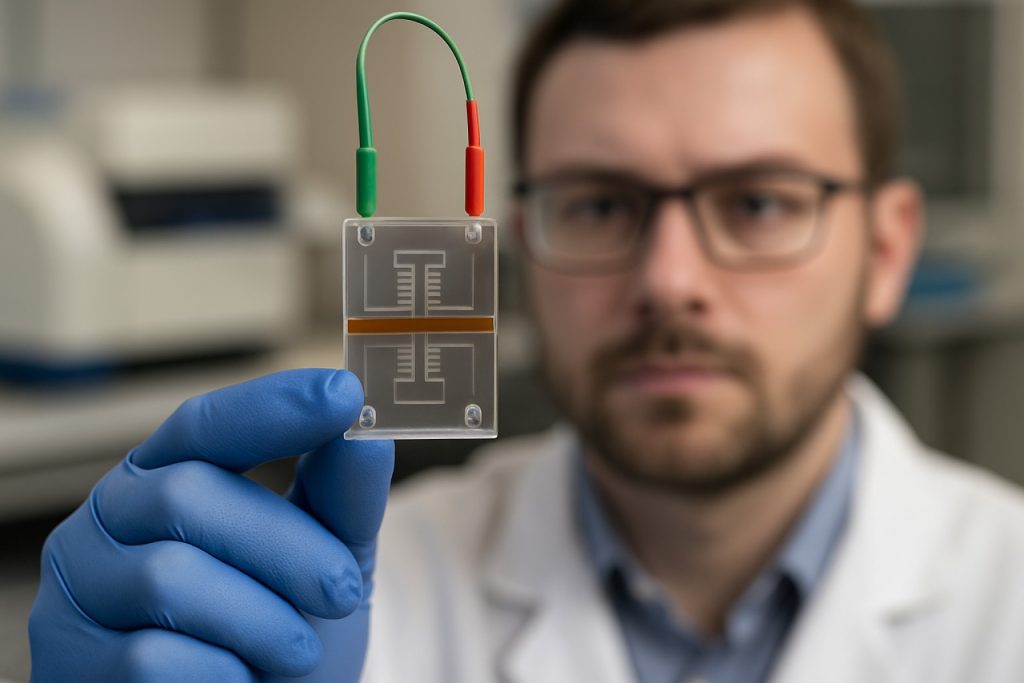

Piezoelectric microfluidic device engineering represents a rapidly advancing segment within the broader microfluidics and MEMS (Micro-Electro-Mechanical Systems) markets. These devices leverage the piezoelectric effect—where certain materials generate an electric charge in response to mechanical stress—to precisely manipulate fluids at the microscale. In 2025, the market for piezoelectric microfluidic devices is characterized by robust growth, driven by expanding applications in biomedical diagnostics, drug delivery, inkjet printing, and lab-on-a-chip technologies.

The global microfluidics market is projected to reach USD 42.2 billion by 2025, with piezoelectric actuation technologies accounting for a significant share due to their high precision, low power consumption, and compatibility with miniaturized systems (MarketsandMarkets). Piezoelectric microfluidic devices are particularly valued for their ability to generate rapid, repeatable, and finely controlled fluidic motions, making them ideal for applications such as droplet generation, cell sorting, and acoustic manipulation.

Key industry players—including Dolomite Microfluidics, Fluidigm Corporation, and Bartels Mikrotechnik—are investing in the development of next-generation piezoelectric microfluidic platforms. These efforts are focused on enhancing device integration, throughput, and reliability, as well as reducing manufacturing costs through advanced materials and scalable fabrication techniques.

The adoption of piezoelectric microfluidic devices is further accelerated by the growing demand for point-of-care diagnostics and personalized medicine. The COVID-19 pandemic underscored the need for rapid, portable, and accurate diagnostic tools, spurring innovation and investment in microfluidic technologies (Grand View Research). In addition, the integration of piezoelectric actuators with digital microfluidics and IoT-enabled platforms is opening new avenues for remote monitoring and automated sample processing.

Regionally, North America and Europe remain at the forefront of research, development, and commercialization, supported by strong academic-industry collaborations and government funding. However, Asia-Pacific is emerging as a high-growth market, driven by expanding healthcare infrastructure and increased R&D investments (Fortune Business Insights).

In summary, the piezoelectric microfluidic device engineering market in 2025 is poised for continued expansion, underpinned by technological innovation, diversified applications, and a favorable investment climate.

Key Technology Trends in Piezoelectric Microfluidic Devices

Piezoelectric microfluidic device engineering is undergoing rapid innovation, driven by the demand for higher precision, miniaturization, and integration in biomedical, chemical, and industrial applications. In 2025, several key technology trends are shaping the landscape of this field:

- Advanced Materials for Enhanced Performance: The adoption of novel piezoelectric materials, such as lead-free ceramics and flexible polymers, is enabling devices with improved biocompatibility, mechanical flexibility, and environmental sustainability. These materials are being engineered to deliver higher electromechanical coupling coefficients and lower actuation voltages, which are critical for sensitive biological assays and wearable applications (Nature Nanotechnology).

- Integration with CMOS and MEMS Technologies: The convergence of piezoelectric microfluidics with complementary metal-oxide-semiconductor (CMOS) and microelectromechanical systems (MEMS) fabrication processes is enabling the mass production of highly integrated, cost-effective devices. This integration supports the development of lab-on-a-chip platforms with embedded sensing, actuation, and data processing capabilities (STMicroelectronics).

- Digital and Programmable Microfluidics: The rise of digital microfluidics, where discrete droplets are manipulated using programmable piezoelectric actuators, is allowing for greater automation and reconfigurability in sample handling. This trend is particularly significant for point-of-care diagnostics and high-throughput screening, where flexibility and rapid prototyping are essential (Analytik Jena).

- Multi-Modal Actuation and Sensing: Engineers are increasingly designing devices that combine piezoelectric actuation with other modalities, such as acoustic, thermal, or optical manipulation. This multi-modal approach enhances the versatility and functionality of microfluidic platforms, enabling complex tasks like cell sorting, mixing, and real-time monitoring within a single device (Sensors and Actuators A: Physical).

- AI-Driven Design and Optimization: Artificial intelligence and machine learning are being leveraged to optimize device architectures, predict fluidic behaviors, and accelerate the development cycle. These tools are helping engineers to rapidly iterate designs and achieve higher performance with reduced experimental overhead (Nature Nanotechnology).

Together, these trends are propelling piezoelectric microfluidic device engineering toward more intelligent, integrated, and application-specific solutions in 2025.

Competitive Landscape and Leading Players

The competitive landscape of piezoelectric microfluidic device engineering in 2025 is characterized by a dynamic mix of established technology conglomerates, specialized microfluidics firms, and innovative startups. The sector is driven by rapid advancements in materials science, miniaturization, and integration with digital and IoT platforms, which have expanded the application scope of piezoelectric microfluidic devices in diagnostics, drug delivery, and lab-on-a-chip systems.

Key players in this market include Dolomite Microfluidics, which has maintained a strong position through its modular microfluidic systems and proprietary piezoelectric actuation technologies. Parker Hannifin Corporation leverages its expertise in precision motion and fluidics to offer piezo-driven microfluidic pumps and valves, targeting both life sciences and industrial automation sectors. Bartels Mikrotechnik is recognized for its compact, energy-efficient piezoelectric micropumps, which are widely adopted in point-of-care diagnostics and wearable medical devices.

Emerging players such as FluidicMEMS and Micropump Inc. are gaining traction by focusing on custom solutions and integration with advanced sensing and control electronics. These companies are increasingly collaborating with academic institutions and research consortia to accelerate innovation and address niche application requirements.

The competitive environment is further shaped by strategic partnerships, intellectual property portfolios, and investments in R&D. For instance, Dolomite Microfluidics has entered into collaborations with leading universities to develop next-generation piezoelectric droplet generators, while Parker Hannifin Corporation continues to expand its patent holdings in piezo-actuated microfluidic dispensing.

- Market leaders are prioritizing device miniaturization, energy efficiency, and integration with wireless communication protocols.

- Startups are differentiating through application-specific designs, such as high-throughput cell sorting and single-cell analysis platforms.

- Geographically, North America and Europe remain the primary innovation hubs, but significant growth is observed in Asia-Pacific, driven by increased investment in biomedical research and microelectronics manufacturing.

Overall, the competitive landscape in 2025 is marked by both consolidation among established players and the emergence of agile innovators, with success hinging on the ability to deliver highly reliable, scalable, and application-tailored piezoelectric microfluidic solutions.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The global market for piezoelectric microfluidic device engineering is poised for robust growth between 2025 and 2030, driven by expanding applications in biomedical diagnostics, drug delivery, and advanced manufacturing. According to projections by MarketsandMarkets, the piezoelectric microfluidics sector is expected to register a compound annual growth rate (CAGR) of approximately 13.2% during this period. This acceleration is attributed to increasing demand for high-precision, miniaturized fluid handling systems in point-of-care diagnostics and lab-on-a-chip technologies.

Revenue forecasts indicate that the global market size, valued at around USD 1.1 billion in 2025, could surpass USD 2.1 billion by 2030. This growth is underpinned by significant investments in research and development, particularly in North America and Asia-Pacific, where government and private sector funding are catalyzing innovation in microfluidic device engineering. Grand View Research highlights that the Asia-Pacific region is expected to witness the fastest revenue growth, with China, Japan, and South Korea emerging as key contributors due to their strong electronics and medical device manufacturing bases.

In terms of volume, the number of piezoelectric microfluidic devices shipped globally is projected to increase at a CAGR of 14.5% from 2025 to 2030. This surge is largely driven by the proliferation of disposable diagnostic cartridges and the integration of piezoelectric actuators in next-generation wearable and implantable medical devices. Fortune Business Insights reports that the healthcare segment will account for over 60% of total device volume by 2030, reflecting the sector’s rapid adoption of microfluidic solutions for personalized medicine and rapid testing.

- Key growth drivers include advancements in piezoelectric material science, enabling higher sensitivity and lower power consumption.

- Emerging applications in environmental monitoring and food safety testing are expected to further expand market volume.

- Strategic collaborations between device manufacturers and research institutions are accelerating the commercialization of novel piezoelectric microfluidic platforms.

Overall, the 2025–2030 period is set to witness dynamic expansion in both revenue and shipment volumes for piezoelectric microfluidic device engineering, with innovation and cross-sector adoption fueling sustained market momentum.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for piezoelectric microfluidic device engineering is experiencing robust growth, with regional dynamics shaped by technological innovation, regulatory environments, and end-user adoption rates. In 2025, North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each present distinct opportunities and challenges for stakeholders in this sector.

- North America: North America remains a leading region, driven by strong investments in biomedical research, microfluidics startups, and established players in the life sciences and diagnostics sectors. The United States, in particular, benefits from a mature R&D ecosystem and significant funding from agencies such as the National Institutes of Health. The region’s focus on point-of-care diagnostics and personalized medicine is accelerating the adoption of piezoelectric microfluidic devices, especially in clinical and pharmaceutical applications.

- Europe: Europe is characterized by a collaborative research environment and supportive regulatory frameworks, such as those from the European Commission. Countries like Germany, the UK, and the Netherlands are at the forefront, leveraging strong academic-industry partnerships. The region’s emphasis on miniaturization and automation in laboratory workflows is fostering demand for advanced microfluidic engineering, with piezoelectric actuation being a key enabling technology.

- Asia-Pacific: The Asia-Pacific region is witnessing the fastest growth, propelled by expanding healthcare infrastructure, rising investments in biotechnology, and government initiatives in countries like China, Japan, and South Korea. According to Mordor Intelligence, the region’s market is expected to outpace global averages, with local manufacturers increasingly integrating piezoelectric microfluidics into diagnostic and drug delivery platforms. The presence of a large patient pool and growing demand for cost-effective healthcare solutions further stimulate market expansion.

- Rest of World (RoW): In regions such as Latin America, the Middle East, and Africa, market penetration remains nascent but is gradually increasing. Growth is primarily driven by international collaborations and technology transfer from established markets. Efforts by organizations like the World Health Organization to improve diagnostic capabilities in resource-limited settings are expected to create new opportunities for piezoelectric microfluidic device deployment.

Overall, while North America and Europe lead in innovation and early adoption, Asia-Pacific is emerging as a high-growth market, and RoW regions are poised for gradual uptake as awareness and infrastructure improve. These regional trends will continue to shape the competitive landscape and investment priorities in piezoelectric microfluidic device engineering through 2025.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for piezoelectric microfluidic device engineering in 2025 is marked by rapid expansion into emerging applications and the identification of new investment hotspots. As the convergence of microfluidics and piezoelectric actuation matures, several sectors are poised for significant transformation.

One of the most promising areas is point-of-care diagnostics. The miniaturization and precision control enabled by piezoelectric microfluidics are driving the development of portable, low-cost diagnostic platforms capable of rapid pathogen detection and biomarker analysis. This is particularly relevant in the context of global health, where decentralized testing is a priority. According to MarketsandMarkets, the global microfluidics market is projected to reach $58.8 billion by 2025, with diagnostics representing a major growth driver.

Another emerging application is in drug discovery and personalized medicine. Piezoelectric microfluidic devices enable high-throughput screening and precise manipulation of single cells, facilitating the development of tailored therapeutics. Pharmaceutical companies are increasingly investing in these platforms to accelerate R&D timelines and reduce costs. Grand View Research highlights that the integration of microfluidics in drug development pipelines is expected to see double-digit CAGR through 2025.

In the field of synthetic biology and organ-on-chip technologies, piezoelectric microfluidics is enabling more accurate simulation of physiological environments. This is attracting investment from both venture capital and strategic corporate partners, particularly in North America and Asia-Pacific. The Nature Biotechnology journal notes a surge in funding for startups developing next-generation organ-on-chip platforms, with piezoelectric actuation cited as a key differentiator for achieving fine control over fluid dynamics.

Investment hotspots are emerging in regions with strong semiconductor and MEMS manufacturing capabilities, such as the United States, South Korea, and Taiwan. Government initiatives, such as the U.S. CHIPS Act, are further catalyzing domestic innovation and production capacity for advanced microfluidic devices (U.S. Department of Commerce).

Looking ahead, the intersection of piezoelectric microfluidics with AI-driven analytics and IoT connectivity is expected to unlock new business models and application domains, making this sector a focal point for both strategic and venture investment in 2025 and beyond.

Challenges, Risks, and Strategic Opportunities

Piezoelectric microfluidic device engineering faces a complex landscape of challenges, risks, and strategic opportunities as the field advances toward broader commercialization and integration in 2025. One of the primary technical challenges is the precise fabrication and integration of piezoelectric materials—such as lead zirconate titanate (PZT) and aluminum nitride (AlN)—onto microfluidic platforms. Achieving uniform thin-film deposition and reliable patterning at the microscale remains difficult, often resulting in device-to-device variability and reduced yield, which can hinder scalability and cost-effectiveness Nature Nanotechnology.

Material compatibility and long-term stability also present significant risks. Many piezoelectric materials are brittle or chemically reactive, posing challenges for integration with common microfluidic substrates like PDMS or glass. Additionally, the use of lead-based materials such as PZT raises environmental and regulatory concerns, especially in medical and consumer applications, prompting a push toward lead-free alternatives IEEE Ultrasonics, Ferroelectrics, and Frequency Control Society.

From a market perspective, the high cost of advanced piezoelectric materials and the specialized equipment required for their processing can limit adoption, particularly among smaller device manufacturers. Furthermore, the lack of standardized testing protocols and performance benchmarks complicates product validation and regulatory approval, especially in the biomedical sector U.S. Food & Drug Administration.

Despite these challenges, strategic opportunities abound. The growing demand for point-of-care diagnostics, single-cell analysis, and high-throughput screening in life sciences is driving investment in piezoelectric microfluidic technologies. These devices offer unique advantages in precise fluid manipulation, droplet generation, and acoustic cell sorting, which are difficult to achieve with other actuation methods MarketsandMarkets. Collaborations between academic research groups and industry players are accelerating the development of robust, scalable manufacturing processes and the exploration of novel piezoelectric materials.

- Adoption of lead-free piezoelectric materials to address regulatory and environmental risks.

- Development of hybrid integration techniques to improve material compatibility and device reliability.

- Standardization of performance metrics and regulatory pathways to streamline commercialization.

- Expansion into emerging applications such as wearable biosensors and lab-on-chip platforms.

In summary, while piezoelectric microfluidic device engineering in 2025 is challenged by material, manufacturing, and regulatory hurdles, it is also positioned for significant growth through innovation, strategic partnerships, and alignment with evolving market needs.

Sources & References

- MarketsandMarkets

- Dolomite Microfluidics

- Bartels Mikrotechnik

- Grand View Research

- Fortune Business Insights

- Nature Nanotechnology

- STMicroelectronics

- Analytik Jena

- FluidicMEMS

- Micropump Inc.

- National Institutes of Health

- European Commission

- Mordor Intelligence

- World Health Organization