Table of Contents

- Executive Summary & 2025 Outlook

- Key Market Drivers and Restraints

- Latest Technological Advancements in Polyimide Substrates

- Emerging Applications: Flexible Displays, 5G, and Beyond

- Major Manufacturers and Strategic Partnerships

- Regional Market Analysis: Asia-Pacific, North America, and Europe

- Sustainability, Recycling, and Environmental Impact

- Challenges in Manufacturing and Supply Chain

- Market Forecasts and Growth Projections Through 2030

- Future Trends: Next-Gen Materials and Disruptive Innovations

- Sources & References

Executive Summary & 2025 Outlook

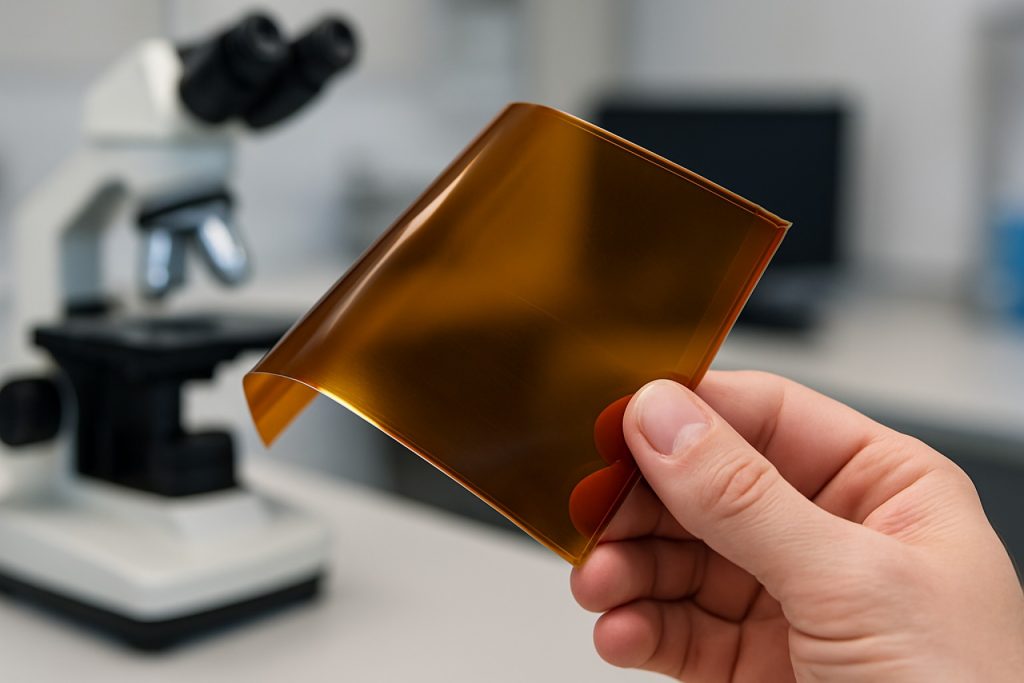

Polyimide substrate manufacturing occupies a central role in the advancement of flexible electronics, high-density interconnects, and next-generation display technologies. As of 2025, the global polyimide substrate sector is experiencing robust growth, propelled by surging demand in consumer electronics, automotive, and emerging applications such as 5G and wearable devices. Polyimide substrates are prized for their exceptional thermal stability, mechanical flexibility, and chemical resistance, making them a material of choice for flexible printed circuits (FPCs), organic light-emitting diode (OLED) panels, and advanced semiconductor packaging.

Leading manufacturers are expanding capacity and advancing processing technologies to meet this accelerating demand. DuPont has announced ongoing investments in its Kapton® polyimide film production to address growth in flexible displays and telecom infrastructure. Meanwhile, Toray Industries, Inc. continues to innovate with new grades of polyimide films targeting high-frequency and ultra-thin electronic applications. SKC and Sumitomo Chemical are also scaling up their polyimide substrate output, particularly for use in foldable smartphones and advanced automotive electronics.

Recent data indicates that production volumes and investments are shifting toward roll-to-roll processing and laser patterning, which enable high-throughput manufacturing with precise feature control—critical for miniaturized and high-density circuits. In 2025, automation and digitalization are further improving yield, cost efficiency, and substrate quality. The trend toward eco-friendly production is also evident; companies such as Kaneka Corporation are developing recyclable polyimide substrates and solvent-reduction processes, aligning with global sustainability mandates.

Looking ahead to the next few years, the outlook remains highly positive. The proliferation of foldable and rollable displays—as commercialized by customers of LG Chem—is expected to sustain double-digit growth in specialty polyimide substrates. The automotive sector’s transition to electric vehicles and advanced driver-assistance systems (ADAS) will further fuel demand for high-performance flexible circuits. Additionally, the ongoing rollout of 5G infrastructure and anticipated developments in wearable medical devices are set to drive further innovation and capacity expansion in polyimide substrate manufacturing.

In summary, 2025 marks a pivotal period for polyimide substrate manufacturing, characterized by technological advancement, capacity growth, and diversification of application fields. Industry leaders are well-positioned to capitalize on these trends, with continued investment in both materials science and manufacturing technology expected to define the sector’s trajectory through the remainder of the decade.

Key Market Drivers and Restraints

Polyimide substrate manufacturing is poised for significant evolution in 2025, driven by rapidly advancing applications in flexible electronics, automotive, and high-frequency communication devices. Several key drivers are shaping the market landscape, while notable restraints present ongoing challenges for manufacturers and end-users.

Key Market Drivers

- Rising Adoption in Flexible Electronics: Polyimide substrates are increasingly essential in the production of flexible printed circuits, organic light-emitting diode (OLED) displays, and wearable devices due to their superior thermal stability and mechanical flexibility. Leading electronics manufacturers such as Samsung Electronics and LG Display continue to integrate polyimide substrates in next-generation foldable smartphones and display panels, intensifying demand.

- Automotive Sector Growth: The automotive industry’s shift toward advanced driver-assistance systems (ADAS) and in-vehicle infotainment is fueling the requirement for high-performance substrates. Companies like Toray Industries and DuPont are expanding production capacity to meet the rising needs for lightweight, heat-resistant materials in automotive electronics.

- 5G and High-Frequency Communication: The global rollout of 5G networks is driving the deployment of polyimide substrates in antennas and high-frequency circuitry. LG Uplus and other telecom leaders are exploring advanced materials for improved signal integrity and miniaturization, propelling further innovation in polyimide manufacturing.

- Material Innovation: Ongoing R&D efforts by substrate producers such as Kaneka Corporation and Taimide Tech Inc. are focused on enhancing dielectric properties, chemical resistance, and processability, which is expected to open up new application horizons over the next few years.

Key Market Restraints

- High Production Costs: The sophisticated manufacturing processes and the need for high-purity raw materials make polyimide substrates more expensive compared to alternatives like PET or PEN, limiting their adoption in cost-sensitive segments. Even established producers such as DuPont acknowledge the premium pricing of their flagship Kapton® films, which can be a barrier for broader commercialization.

- Technical Barriers to Mass Production: Achieving defect-free, ultra-thin, and large-area substrates remains a technical challenge. Stringent quality requirements from electronics and aerospace customers place continuous pressure on manufacturers to innovate and refine processing technologies.

- Supply Chain Vulnerability: The polyimide substrate supply chain is sensitive to disruptions in raw material availability and global logistics, as evidenced by recent semiconductor industry shortages. Manufacturers are increasingly considering vertical integration and local sourcing to mitigate these risks.

Looking forward, while demand drivers remain robust, the industry’s ability to address cost and scalability issues will be pivotal for broader adoption and market expansion through the next several years.

Latest Technological Advancements in Polyimide Substrates

Polyimide substrate manufacturing has undergone notable technological advancements as of 2025, driven by increasing demand for flexible electronics, high-frequency communication devices, and advanced automotive systems. Polyimide’s chemical stability, flexibility, and thermal resistance continue to make it a material of choice for next-generation circuit boards and electronic assemblies.

One of the most significant trends is the scaling of ultra-thin polyimide films, with thicknesses reaching as low as 5 μm or less, enabling tighter bending radii and improved device miniaturization. DuPont has expanded its Kapton® product line in 2024–2025 to include ultra-thin, high-purity films specifically engineered for foldable smartphones and wearable electronics. These films are manufactured using advanced casting and surface treatment techniques that enhance adhesion and electrical properties without compromising mechanical strength.

In the realm of substrate fabrication, roll-to-roll (R2R) processing has gained momentum as a scalable, cost-effective approach to mass-producing flexible polyimide substrates. Companies like Toray Industries, Inc. are investing in R2R coating and sputtering technologies to deposit copper and other conductive layers onto polyimide films at high throughput, supporting the rapid growth of flexible printed circuits (FPCs) for automotive sensors and 5G antenna modules.

Laser direct structuring (LDS) is another area of advancement, enabling the creation of three-dimensional circuit patterns directly on polyimide substrates. SABIC has introduced new polyimide grades designed for compatibility with LDS, improving feature resolution and reliability in high-density interconnect (HDI) applications. These innovations are particularly relevant for manufacturers seeking to integrate more functionality into smaller and more complex device footprints.

Sustainability is increasingly influencing manufacturing practices. Recent developments include solvent-free synthesis methods and the use of bio-based dianhydrides and diamines in polyimide production, reducing environmental impact and aligning with global regulations. UBE Corporation has reported advancements in eco-friendly polyimide chemistries, targeting electronics customers committed to green supply chains.

Looking ahead, the outlook for polyimide substrate manufacturing is robust. Industry leaders are expected to further automate production lines, integrate artificial intelligence for quality control, and develop hybrid substrates (combining polyimide with ceramics or metals) to address the evolving requirements of high-speed, high-reliability electronics. These developments position polyimide substrates as foundational to next-generation flexible and wearable devices through 2025 and beyond.

Emerging Applications: Flexible Displays, 5G, and Beyond

Polyimide substrate manufacturing is undergoing rapid transformation in 2025, driven by surging demand from emerging applications such as flexible displays, advanced 5G infrastructure, and next-generation wearable devices. Polyimide’s unique combination of thermal stability, mechanical flexibility, and chemical resistance positions it at the forefront of next-wave electronics, with several major industry stakeholders investing heavily in production capacity and process innovation.

In flexible displays, leading display manufacturers continue to expand their use of polyimide substrates to enable ultra-thin, bendable OLED panels for smartphones, foldable laptops, and automotive infotainment systems. LG Chem has announced ongoing investments in high-transparency, colorless polyimide films specifically tailored for foldable device applications, aiming to improve yield rates and optical clarity. Similarly, Kolon Industries continues to expand its production of colorless polyimide, addressing the growing requirements of flexible and rollable displays by major consumer electronics brands.

The proliferation of 5G networks is also accelerating demand for polyimide substrates, which are used in flexible printed circuit boards (FPCBs) and antenna modules due to their low dielectric constant and high-frequency performance. DuPont has introduced advanced polyimide materials engineered for high-speed, low-loss signal transmission required in 5G base stations and smartphones, with further R&D underway to improve signal integrity and miniaturization. Meanwhile, Toray Industries is scaling up production of flexible polyimide films for high-frequency and wearable device applications, anticipating robust growth in telecommunications and IoT markets through 2027.

Beyond flexible displays and 5G, the outlook for polyimide substrate manufacturing is shaped by expansion into emerging fields such as advanced sensors, medical electronics, aerospace, and electric vehicles. UBE Corporation has disclosed new investments in high-performance polyimide production lines to support applications in EV battery insulation and aerospace-grade flexible circuitry. As miniaturization and reliability become more critical, manufacturers are also pursuing greener, more energy-efficient production methods and exploring bio-based polyimide chemistries.

Over the next few years, the polyimide substrate sector is expected to see intensified competition and technological innovation, particularly as global supply chains diversify and major electronics manufacturers seek local sourcing partners. With robust demand forecasts across multiple high-growth sectors, polyimide substrate manufacturing is poised for sustained expansion through 2025 and beyond.

Major Manufacturers and Strategic Partnerships

As the demand for advanced electronics, flexible displays, and high-performance PCBs continues to accelerate through 2025, the landscape of polyimide substrate manufacturing is driven by a select group of major manufacturers and a surge in strategic partnerships. These collaborations are primarily aimed at scaling production, improving material properties, and supporting next-generation applications such as 5G, wearable devices, and automotive electronics.

Key players in the sector include DuPont, Kaneka Corporation, Toray Industries, Inc., Nitto Denko Corporation, and Taimide Tech. Inc.. These companies represent the core of global supply, leveraging proprietary chemistries and large-scale production capabilities. For instance, DuPont remains a leader with its Kapton® line, which continues to be foundational for flexible circuits and space applications. Toray Industries has further expanded its manufacturing capacity in Asia to meet rising demand for polyimide films in flexible display and mobile device markets.

Recent years have seen a marked increase in strategic partnerships and joint ventures. In 2023 and 2024, Nitto Denko Corporation announced collaborations with leading electronics OEMs to co-develop next-generation polyimide substrates with enhanced thermal stability and lower dielectric loss, targeting high-speed communication devices. Similarly, Kaneka Corporation entered into a partnership with a major South Korean display manufacturer to supply ultra-thin polyimide films for foldable OLED panels, with mass production slated to ramp up through 2025.

On the regional front, East Asian manufacturers, including Taimide Tech. Inc. and Toray Industries, continue to invest heavily in automated production lines and process innovation. These investments are aimed at increasing yield and reducing costs, crucial for maintaining competitiveness as demand for flexible and wearable electronics surges. In parallel, DuPont has strengthened its supply chain partnerships in North America and Europe to ensure reliability for critical industries such as aerospace and automotive.

Looking ahead to the next few years, the competitive dynamics are likely to center on further material enhancements—such as improved transparency, mechanical flexibility, and heat resistance—and deeper collaborations between substrate manufacturers and end-use device makers. The ongoing expansion of manufacturing capacity, coupled with strategic alliances, is expected to support robust growth and innovation in polyimide substrate applications worldwide.

Regional Market Analysis: Asia-Pacific, North America, and Europe

The global landscape for polyimide substrate manufacturing is characterized by significant regional dynamics, with Asia-Pacific, North America, and Europe each playing distinct roles in the market’s development. As of 2025 and looking ahead, these regions are experiencing varied growth trajectories driven by technological advancements, strategic investments, and differing end-use demands.

Asia-Pacific continues to dominate polyimide substrate manufacturing, buoyed by its robust electronics, semiconductor, and flexible display industries. Countries such as China, Japan, and South Korea are at the forefront, with leading companies investing in new production lines and capacity expansions. For instance, Zhongtian Polyimide Materials Co., Ltd. in China and Kaneka Corporation in Japan have announced advancements in high-performance polyimide films, targeting applications in 5G infrastructure, flexible printed circuits, and OLED displays. Furthermore, SK Innovation in South Korea has reinforced its position by scaling up mass production of colorless polyimide films, crucial for next-generation foldable devices. Regional governments are also supporting this growth through incentives and policy frameworks aimed at enhancing local supply chains and R&D capabilities.

In North America, the market is characterized by a focus on high-value applications, particularly in aerospace, defense, and advanced electronics. DuPont remains a key player, leveraging its established Kapton® brand and continued investment in research to meet stringent performance requirements for flexible electronics and space-grade components. The region is also witnessing collaborations between manufacturers and technology startups to accelerate the adoption of polyimide substrates in emerging areas such as wearable medical devices and automotive electronics. U.S.-based companies are increasingly prioritizing domestic production and supply chain resilience, especially in light of recent geopolitical and trade uncertainties.

Europe is focusing on sustainability and specialty applications. Leading firms like SABIC and Solenis are investing in green manufacturing processes and the development of recyclable or bio-based polyimide substrates. The European market is also supported by strong demand from the automotive and renewable energy sectors, where polyimide’s thermal stability and dielectric properties are critical. The European Union’s regulatory emphasis on eco-friendly materials and circular economy initiatives is expected to shape the region’s market outlook over the next several years.

Overall, the polyimide substrate manufacturing sector is set for continued expansion, with Asia-Pacific leading in volume and innovation, North America excelling in high-performance and strategic verticals, and Europe advancing sustainability and specialized applications.

Sustainability, Recycling, and Environmental Impact

Sustainability considerations in polyimide substrate manufacturing are gaining momentum as the electronics and flexible display sectors prioritize environmental responsibility. Polyimide films are prized for their thermal stability, mechanical strength, and chemical resistance, making them indispensable in advanced electronics, but their production has historically involved significant energy consumption and hazardous solvents. The industry is now responding to regulatory pressures and customer demand for greener processes, spurring innovation throughout the value chain.

In 2025, leading polyimide manufacturers are focusing on process optimization and waste reduction. Companies such as DuPont and Toray Industries, Inc. have implemented closed-loop solvent recovery systems and advanced filtration to minimize emissions and solvent loss during imidization, the key step in polyimide film production. Additionally, energy management systems and the integration of renewable power sources are being adopted in facilities to reduce carbon footprints. UBE Corporation reports ongoing efforts to optimize reaction conditions and raw material use, targeting both environmental and cost efficiencies.

Recycling polyimide substrates presents unique challenges due to their crosslinked, thermoset nature. However, research and pilot projects are under way to develop chemical recycling routes that depolymerize waste films or offcuts back into reusable monomers or oligomers. In 2024, Kuraray Co., Ltd. announced a collaboration with academic partners to evaluate solvent-based recycling of polyimide films, aiming to demonstrate pilot-scale feasibility by 2026. Various companies are also exploring mechanical recycling options for polyimide-laminated components, especially in printed circuit board (PCB) manufacturing, to reclaim valuable metals and reduce landfill waste.

Environmental impact assessments (EIA) by major producers increasingly form part of regulatory submissions. For example, SK picglobal highlights life-cycle analyses to quantify resource use and emissions, guiding continuous improvements. Furthermore, the adoption of bio-based precursors is on the horizon: Toray Industries, Inc. announced in early 2025 its first pilot line using partially bio-based dianhydrides, potentially reducing reliance on fossil feedstocks.

Outlook for the next few years suggests a dual-track approach: incremental improvements in process efficiency and waste management, alongside longer-term investments in recycling technologies and bio-based chemistries. As customers in electronics, automotive, and aerospace sectors increase pressure for sustainable sourcing, the adoption of greener polyimide manufacturing practices is expected to accelerate, with progress closely tracked by regulatory agencies and end-users alike.

Challenges in Manufacturing and Supply Chain

The manufacturing and supply chain of polyimide substrates in 2025 faces a series of complex challenges, shaped by rapid market growth, evolving performance requirements, and ongoing geopolitical dynamics. As demand for advanced electronics—particularly flexible displays, wearables, and high-frequency printed circuit boards—continues to surge, manufacturers are under increasing pressure to scale capacity and improve quality while maintaining cost competitiveness.

One key challenge is the stringent control required during the synthesis and film formation processes. Polyimide films must exhibit exceptional thermal stability, mechanical strength, and uniformity, which necessitates precise control over polymerization and casting conditions. Even minor deviations can lead to defects such as pinholes, uneven thickness, or reduced dielectric strength, impacting downstream device yields. Leading producers such as DuPont and KANEKA Corporation continue to invest in advanced process automation and in-line inspection systems to mitigate these risks, but the implementation of new technologies can itself introduce integration challenges and capital expenditure constraints.

Supply chain volatility remains a significant concern in 2025. The polyimide substrate ecosystem is heavily reliant on a limited set of high-purity raw material suppliers, particularly for key monomers and solvents. Disruptions—whether due to geopolitical tensions, regulatory changes in chemical manufacturing, or logistical bottlenecks—can have outsized impacts on both cost and availability. In response, companies like Toray Industries are exploring backward integration and regional diversification of supply networks to enhance resilience.

Another emergent issue is the growing emphasis on environmental compliance and sustainability. Regulatory scrutiny over solvent emissions and waste management in polyimide manufacturing is intensifying in major markets such as the EU and China. Compliance requires investment in abatement systems, closed-loop processes, and, increasingly, the development of bio-based or lower-impact polyimide chemistries. Industry leaders including UBE Corporation have announced initiatives to reduce the environmental footprint of their polyimide operations, but scaling these solutions globally will be a multi-year effort.

Looking ahead, the polyimide substrate sector is expected to navigate ongoing supply chain tightness and operational challenges through 2025 and beyond. Strategic investments in digital manufacturing, vertical integration, and sustainable process innovation are anticipated to be key differentiators for companies aiming to secure market share in high-growth applications such as 5G, advanced packaging, and microLED displays.

Market Forecasts and Growth Projections Through 2030

The polyimide substrate manufacturing sector is poised for robust expansion through 2030, underpinned by surging demand in flexible electronics, automotive, and advanced semiconductor packaging. As of 2025, production capacity expansions and technological advancements are positioning leading manufacturers to meet evolving requirements for high thermal stability, mechanical resilience, and miniaturization in electronic devices.

Key industry players, such as DuPont and Kapton® (DuPont), have announced investments in new production lines and research collaborations aimed at scaling up polyimide substrate output while enhancing material performance. For example, Toray Industries and UBE Corporation are both expanding their manufacturing footprints in Asia and North America, targeting the growing market for flexible printed circuit boards (FPCBs) and display technologies.

Recent years have seen the integration of polyimide substrates into mass-market applications such as foldable smartphones and OLED displays, with Sumitomo Chemical and Kaneka Corporation supplying high-performance films to global electronics manufacturers. These trends are expected to accelerate through 2025 and beyond, fueled by the proliferation of 5G devices, wearable electronics, and electric vehicles—all of which demand substrates capable of withstanding harsh operating conditions without compromising flexibility or electronic performance.

Several manufacturers, including SK picglobal and TAIMIDE Tech Inc., are also advancing eco-friendly polyimide substrate solutions, addressing both regulatory pressures and customer sustainability targets. This shift is anticipated to open new market segments, particularly in Europe and East Asia, where environmental standards for electronic components are tightening.

Looking ahead to 2030, industry outlooks anticipate a compound annual growth rate (CAGR) in the mid-to-high single digits, with Asia-Pacific maintaining its dominance in both production and consumption. Capacity expansions, product differentiation, and supply chain localization will define competitive dynamics, while partnerships between substrate manufacturers and downstream device makers—such as those between LG Chem and major electronics brands—are set to drive innovation and secure market share. With persistent investment in R&D and manufacturing scalability, the polyimide substrate sector is well positioned to support next-generation electronics and automotive applications throughout the decade.

Future Trends: Next-Gen Materials and Disruptive Innovations

The landscape of polyimide substrate manufacturing is evolving rapidly as the industry responds to emerging technological demands in flexible electronics, advanced displays, and high-frequency applications. In 2025 and the coming years, several trends are shaping the sector, emphasizing both material innovation and process advancement.

A central trend is the development of next-generation polyimide films engineered for greater thermal stability, lower dielectric constants, and superior mechanical flexibility. These materials are critical for enabling ultra-thin, foldable, and stretchable devices. For example, DuPont, a leading innovator in the field, has introduced advanced Kapton® polyimide films with tailored properties for flexible printed circuits, 5G antennas, and organic light-emitting diode (OLED) displays. Their latest grades offer enhanced dimensional stability and chemical resistance, supporting manufacturing at ever-smaller scales.

Another key driver is the shift toward environmentally friendly and energy-efficient production processes. Manufacturers like Toray Industries, Inc. are investing in cleaner synthesis routes and recycling initiatives for polyimide waste, aligning with global sustainability goals. Toray’s high-performance polyimide films, such as Lumirror™, are produced using solvent recovery systems and reduced energy input, aiming to minimize the environmental footprint of electronics manufacturing.

Disruptive innovation is also occurring in the form of hybrid materials. Companies like Sumitomo Chemical Co., Ltd. are developing polyimide composites with embedded nanomaterials (e.g., graphene or boron nitride) to further enhance electrical conductivity and thermal management. These innovations are particularly relevant for next-generation logic and memory devices, where heat dissipation and signal integrity are paramount.

From a process standpoint, roll-to-roll (R2R) manufacturing and additive patterning are gaining traction. PI Advanced Materials Co., Ltd. has invested in R2R capabilities, enabling cost-effective, high-throughput production of ultra-thin substrates for flexible and wearable applications. This approach supports mass production of polyimide-based electronics with reduced defect rates and greater design flexibility.

Looking ahead, the convergence of material breakthroughs and process innovation is expected to accelerate the adoption of polyimide substrates across emerging sectors, including foldable smartphones, advanced medical devices, and automotive electronics. As manufacturers continue to push the limits of performance and sustainability, polyimide substrates are poised to remain at the heart of next-generation electronic systems.