Quantum Dot OLED Display Manufacturing in 2025: Unveiling Next-Gen Technology and Market Expansion. Explore How QD-OLED Innovations Are Shaping the Future of Displays Over the Next Five Years.

- Executive Summary: 2025 Market Landscape and Key Drivers

- Quantum Dot OLED Technology: Fundamentals and Recent Advances

- Global Market Size, Growth Projections, and Regional Trends (2025–2030)

- Major Players and Strategic Initiatives (e.g., samsung.com, sony.com, lg.com)

- Manufacturing Processes: Innovations, Efficiencies, and Challenges

- Supply Chain Dynamics: Materials, Equipment, and Sustainability

- Emerging Applications: Consumer Electronics, Automotive, and Beyond

- Competitive Analysis: QD-OLED vs. Competing Display Technologies

- Regulatory, Environmental, and Industry Standards (e.g., ieee.org, oled-a.org)

- Future Outlook: Disruptive Trends, R&D Focus, and Long-Term Opportunities

- Sources & References

Executive Summary: 2025 Market Landscape and Key Drivers

The quantum dot OLED (QD-OLED) display manufacturing sector is poised for significant transformation in 2025, driven by technological advancements, increased production capacity, and expanding applications across consumer electronics and professional displays. QD-OLED technology, which combines the high contrast and deep blacks of OLED with the vibrant color reproduction of quantum dots, is increasingly recognized as a next-generation display solution. The market landscape in 2025 is characterized by the scaling up of manufacturing capabilities, strategic investments by leading display makers, and a growing ecosystem of material and equipment suppliers.

A pivotal driver in 2025 is the aggressive expansion of QD-OLED panel production by Samsung Display, the current global leader in this segment. Samsung Display has invested heavily in its Asan plant, with plans to further increase QD-OLED output to meet rising demand from premium TV and monitor manufacturers. The company’s QD-OLED panels are now featured in flagship products from major brands, reflecting both the maturity of the technology and its acceptance in the high-end market. Samsung Electronics continues to integrate QD-OLED displays into its own product lines, while also supplying panels to other leading OEMs.

Another key player, Sony Corporation, has maintained its position as a prominent adopter of QD-OLED technology, particularly in the premium television segment. Sony’s collaboration with Samsung Display for QD-OLED panels underlines the growing trend of cross-industry partnerships to accelerate commercialization and innovation. Meanwhile, TCL Technology has announced intentions to enter the QD-OLED market, with investments in R&D and pilot production lines, signaling increased competition and potential for broader adoption.

Material suppliers such as Nanosys, Inc. play a crucial role in the QD-OLED value chain, providing advanced quantum dot materials that enable improved color performance and efficiency. Equipment manufacturers are also scaling up to support the unique requirements of QD-OLED fabrication, including inkjet printing and advanced encapsulation technologies.

Looking ahead, the QD-OLED manufacturing sector is expected to benefit from ongoing improvements in yield, cost reduction, and material innovation. The outlook for 2025 and beyond includes the introduction of larger panel sizes, higher resolutions, and enhanced energy efficiency, positioning QD-OLED as a strong contender against both traditional OLED and emerging microLED technologies. As more manufacturers enter the field and supply chains mature, QD-OLED displays are anticipated to gain a larger share of the premium display market, with potential expansion into automotive and commercial applications.

Quantum Dot OLED Technology: Fundamentals and Recent Advances

Quantum Dot OLED (QD-OLED) display manufacturing represents a convergence of quantum dot color conversion and organic light-emitting diode (OLED) technologies, aiming to deliver displays with superior color accuracy, brightness, and efficiency. As of 2025, the sector is characterized by rapid technological maturation, increased production capacity, and the entry of new players, particularly in Asia.

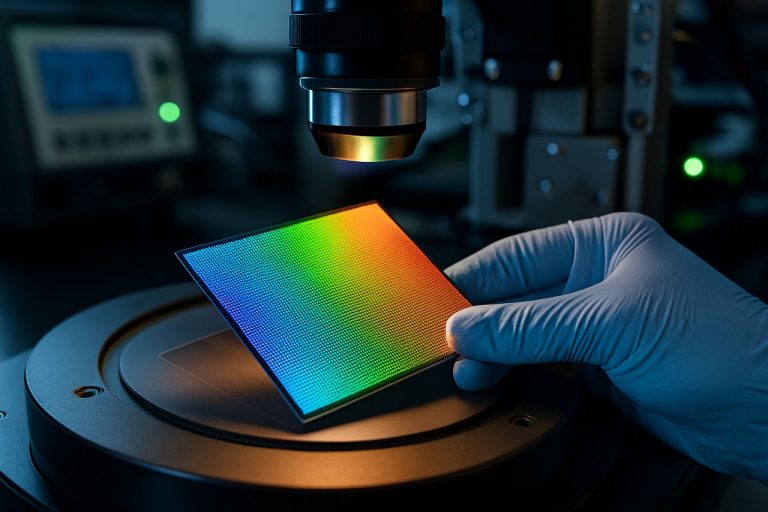

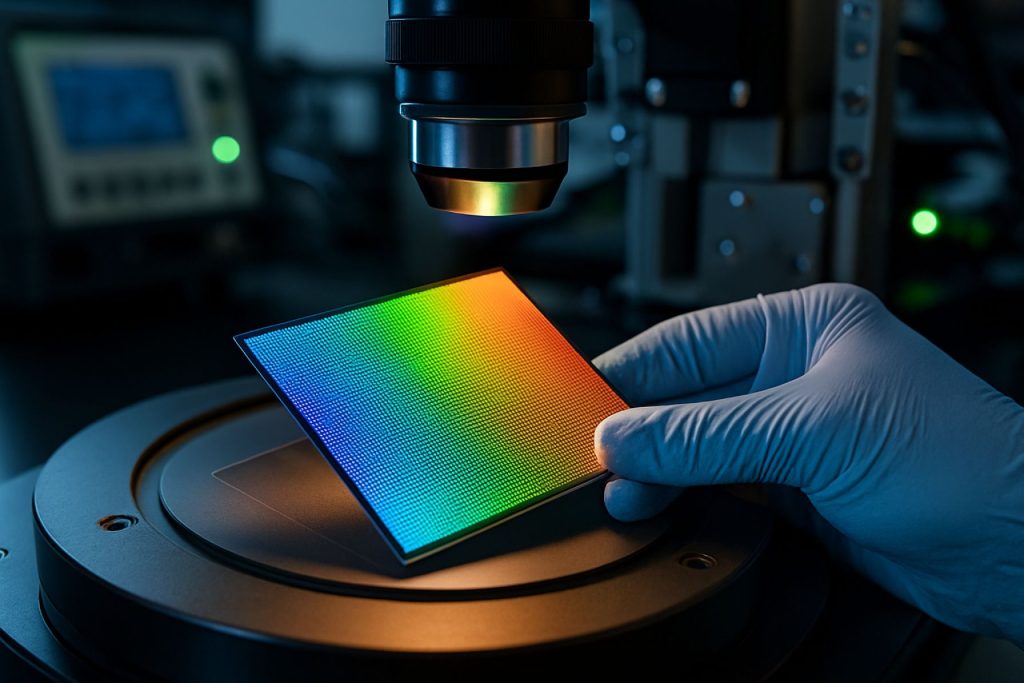

The manufacturing process for QD-OLED displays typically involves depositing a blue OLED emissive layer, over which quantum dot (QD) materials are patterned to convert portions of the blue light into red and green, thus achieving full-color output. This approach leverages the high efficiency and color purity of quantum dots while retaining the self-emissive advantages of OLEDs. The most significant advances in recent years have centered on improving the stability and uniformity of QD layers, as well as scaling up the inkjet printing and photolithography techniques used for QD patterning.

A leading force in QD-OLED manufacturing is Samsung Display, which began mass production of QD-OLED panels in 2022 and has since expanded its Gen 8.5 production lines. In 2025, Samsung Display continues to refine its process, focusing on increasing yield rates and reducing material costs. The company’s QD-OLED panels are now found in high-end televisions and monitors, with ongoing investments in automation and process optimization to support larger panel sizes and higher resolutions.

Another notable player is TCL, which, through its subsidiary China Star Optoelectronics Technology (CSOT), has announced plans to commercialize QD-OLED manufacturing. TCL is investing in pilot lines and R&D to develop proprietary QD patterning and encapsulation techniques, aiming to enter mass production within the next few years. This move is expected to intensify competition and drive further innovation in the sector.

Material suppliers such as Nanosys and Merck KGaA play a crucial role by providing advanced quantum dot materials and OLED chemicals tailored for high-volume manufacturing. These companies are focused on enhancing the environmental stability and quantum efficiency of their products, which are critical for the commercial viability of QD-OLED displays.

Looking ahead, the QD-OLED manufacturing landscape is poised for further expansion, with expectations of increased panel sizes, improved energy efficiency, and broader adoption in both consumer and professional markets. Industry roadmaps suggest that by the late 2020s, QD-OLED could become a mainstream display technology, supported by ongoing investments from leading display manufacturers and material suppliers.

Global Market Size, Growth Projections, and Regional Trends (2025–2030)

The global market for Quantum Dot OLED (QD-OLED) display manufacturing is poised for significant expansion between 2025 and 2030, driven by increasing demand for high-performance displays in premium televisions, monitors, and emerging applications such as automotive and professional visualization. QD-OLED technology, which combines the color purity and efficiency of quantum dots with the self-emissive properties of OLEDs, is being positioned as a next-generation display solution, offering superior color gamut, brightness, and contrast compared to conventional OLED and LCD panels.

As of 2025, the QD-OLED manufacturing landscape is dominated by a few key players, most notably Samsung Display, which has invested heavily in QD-OLED mass production lines at its Asan plant in South Korea. Samsung Display began commercial QD-OLED panel shipments in 2022 and has since expanded its capacity to meet growing demand from global TV brands and monitor manufacturers. The company’s panels are featured in flagship products from Samsung Electronics and Sony Corporation, among others. In parallel, LG Display—a leader in OLED manufacturing—has announced R&D initiatives and pilot lines for quantum dot-enhanced OLEDs, signaling potential future competition and capacity expansion in the sector.

Regionally, Asia-Pacific remains the epicenter of QD-OLED manufacturing, with South Korea leading in both production scale and technological innovation. China is also emerging as a potential competitor, with display giants such as BOE Technology Group and China Star Optoelectronics Technology (CSOT) investing in quantum dot and OLED research, though large-scale QD-OLED mass production outside Korea is not expected before the late 2020s. North America and Europe are primarily end-markets, with local assembly and integration activities but limited panel manufacturing.

Growth projections for the QD-OLED display market from 2025 to 2030 are robust, with annual double-digit percentage increases anticipated as manufacturing yields improve and costs decline. The expansion of QD-OLED into mid-range TV segments, gaming monitors, and automotive displays is expected to further accelerate adoption. Industry analysts anticipate that by 2030, QD-OLED could account for a significant share of the premium display market, challenging both traditional OLED and advanced LCD technologies. The outlook is further bolstered by ongoing material innovations from suppliers such as Nanosys, which provides quantum dot materials to leading panel makers, and by the continued scaling of production lines by established display manufacturers.

Major Players and Strategic Initiatives (e.g., samsung.com, sony.com, lg.com)

The landscape of Quantum Dot OLED (QD-OLED) display manufacturing in 2025 is defined by the strategic initiatives and technological investments of a select group of major players, most notably Samsung Electronics, Sony Corporation, and LG Electronics. These companies are leveraging their extensive R&D capabilities, supply chain integration, and global market reach to advance QD-OLED technology and secure leadership positions in the premium display segment.

Samsung Electronics remains the undisputed leader in QD-OLED manufacturing. Through its display subsidiary, Samsung Display, the company has invested billions of dollars in dedicated QD-OLED production lines at its Asan plant in South Korea. In 2024 and 2025, Samsung is expanding its QD-OLED panel capacity, targeting both large-format TVs and high-end monitors. The company’s QD-OLED panels are recognized for their high color volume, deep blacks, and improved energy efficiency compared to traditional OLEDs. Samsung’s vertical integration—from quantum dot material synthesis to final panel assembly—enables rapid innovation cycles and cost optimization. The company is also actively collaborating with downstream partners to broaden the adoption of QD-OLED technology in consumer and professional markets.

Sony Corporation is a prominent adopter and promoter of QD-OLED technology, sourcing panels from Samsung Display for its flagship Bravia TV lineup. Sony’s strategic focus is on leveraging its proprietary image processing algorithms and brand reputation to differentiate its QD-OLED offerings in the premium segment. In 2025, Sony continues to expand its QD-OLED product portfolio, emphasizing cinematic picture quality and advanced gaming features. The company’s close partnership with Samsung Display ensures early access to the latest QD-OLED panel innovations, reinforcing its competitive position in the high-end TV market.

LG Electronics, while historically dominant in WOLED (white OLED) technology, is actively exploring QD-OLED as part of its broader display strategy. LG Display, the manufacturing arm, is reportedly investing in R&D and pilot production lines for QD-OLED panels, aiming to diversify its premium display offerings and respond to evolving market demand. LG’s expertise in OLED mass production and global distribution provides a strong foundation for potential QD-OLED commercialization in the coming years.

Looking ahead, these major players are expected to intensify their investments in QD-OLED manufacturing, with a focus on improving yield rates, scaling up production, and reducing costs. Strategic partnerships, supply chain optimization, and continued innovation in quantum dot materials and OLED architectures will be critical to maintaining technological leadership and capturing growth opportunities in the premium display market.

Manufacturing Processes: Innovations, Efficiencies, and Challenges

Quantum Dot OLED (QD-OLED) display manufacturing is undergoing significant transformation in 2025, driven by both technological innovation and the need for greater production efficiency. QD-OLED technology, which combines the self-emissive properties of OLEDs with the color conversion capabilities of quantum dots, is positioned as a next-generation display solution for premium televisions and monitors.

The manufacturing process for QD-OLED displays involves depositing blue OLED emitters as the light source, over which quantum dot layers are patterned to convert blue light into red and green, achieving high color purity and brightness. This approach eliminates the need for color filters and white OLED stacks, resulting in improved energy efficiency and color performance. The most prominent manufacturer in this space is Samsung Display, which has been mass-producing QD-OLED panels since 2022 and continues to expand its capacity and refine its processes in 2025.

Recent innovations focus on enhancing material stability, increasing yield rates, and reducing production costs. Samsung Display has invested in advanced inkjet printing techniques for precise quantum dot patterning, which minimizes material waste and enables finer pixel control. The company is also working on improving the longevity of blue OLED emitters, historically a limiting factor for OLED lifespans. In parallel, LG Display—while primarily focused on WOLED—has announced R&D efforts into hybrid QD-OLED structures, signaling potential diversification in the competitive landscape.

Supply chain integration remains a challenge, particularly in sourcing high-quality quantum dot materials and ensuring uniform deposition at scale. Nanosys, a leading quantum dot material supplier, collaborates closely with panel makers to deliver cadmium-free quantum dots that meet stringent environmental and performance standards. The push for cadmium-free solutions is also in response to tightening global regulations on hazardous substances.

Looking ahead, the outlook for QD-OLED manufacturing is optimistic. Industry analysts expect further cost reductions as process yields improve and as more suppliers, such as TCL and China Star Optoelectronics Technology (CSOT), explore QD-OLED or similar quantum dot-enhanced technologies. The next few years are likely to see increased panel sizes, higher resolutions, and broader adoption in both consumer and professional markets, provided that manufacturers can continue to address challenges related to material durability and large-scale production efficiency.

Supply Chain Dynamics: Materials, Equipment, and Sustainability

The supply chain for Quantum Dot OLED (QD-OLED) display manufacturing in 2025 is characterized by a complex interplay of advanced materials sourcing, specialized equipment, and increasing emphasis on sustainability. QD-OLED technology, which combines the color purity of quantum dots with the self-emissive properties of OLEDs, requires a highly integrated supply chain involving multiple stakeholders.

Key materials for QD-OLED displays include high-purity quantum dots, organic light-emitting materials, and precision glass substrates. The quantum dots themselves are typically cadmium-free indium phosphide (InP) or perovskite-based, reflecting regulatory and environmental pressures to eliminate toxic substances. Major suppliers of quantum dot materials, such as Nanosys, Inc. and Samsung Electronics (through its materials division), have expanded production capacity in response to growing demand from display manufacturers. Samsung Electronics remains the leading producer of QD-OLED panels, leveraging its vertically integrated supply chain to secure critical materials and maintain quality control.

On the equipment side, manufacturing QD-OLED displays requires advanced deposition and encapsulation technologies. Companies like Applied Materials, Inc. and ULVAC, Inc. supply vacuum deposition and thin-film encapsulation equipment essential for producing uniform OLED layers and protecting sensitive quantum dot materials from moisture and oxygen. The precision required in patterning quantum dots onto OLED substrates has driven investment in new inkjet printing and photolithography systems, with equipment suppliers collaborating closely with panel makers to optimize yield and throughput.

Sustainability is an increasingly important consideration in the QD-OLED supply chain. Manufacturers are adopting closed-loop recycling systems for solvents and rare materials, and are working to reduce energy consumption in both materials synthesis and panel fabrication. LG Display and Samsung Electronics have both announced initiatives to lower the carbon footprint of their display manufacturing operations, including the use of renewable energy and eco-friendly packaging. The shift toward cadmium-free quantum dots, driven by European Union RoHS directives and similar regulations, is expected to become universal by 2026.

Looking ahead, the QD-OLED supply chain is poised for further consolidation and vertical integration, as leading display makers seek to secure access to critical materials and proprietary equipment. Strategic partnerships between quantum dot material suppliers, equipment manufacturers, and panel producers will be essential to meet the anticipated growth in demand for high-end displays in consumer electronics, automotive, and professional applications.

Emerging Applications: Consumer Electronics, Automotive, and Beyond

Quantum Dot OLED (QD-OLED) display manufacturing is rapidly evolving, with 2025 marking a pivotal year for the technology’s expansion into new application domains. QD-OLEDs combine the self-emissive properties of OLEDs with the color conversion efficiency of quantum dots, resulting in displays with superior color gamut, brightness, and energy efficiency. The manufacturing process involves the integration of quantum dot layers onto blue OLED emitters, a technique that has matured significantly since its commercial debut in the early 2020s.

In consumer electronics, QD-OLED displays are increasingly featured in premium televisions and high-end monitors. Samsung Display remains the primary manufacturer, having scaled up mass production at its Asan plant since 2022. The company’s QD-OLED panels are now supplied to major brands such as Sony and Dell Technologies for their flagship products. In 2025, Samsung Display is expected to further expand its QD-OLED capacity, with investments aimed at larger panel sizes and improved production yields. TCL has also announced plans to enter QD-OLED manufacturing, signaling growing competition and potential cost reductions in the near future.

The automotive sector is emerging as a significant new market for QD-OLED displays. Automakers are seeking advanced display solutions for digital dashboards, infotainment systems, and head-up displays. QD-OLED’s high contrast ratios, wide viewing angles, and resistance to image burn-in make it particularly attractive for automotive interiors. LG Display has signaled its intent to develop QD-OLED panels tailored for automotive use, leveraging its expertise in OLED and quantum dot technologies. Collaborations between display manufacturers and automotive OEMs are expected to accelerate in 2025, with pilot projects and concept vehicles showcasing QD-OLED integration.

Beyond consumer electronics and automotive, QD-OLED technology is being explored for applications in medical imaging, professional visualization, and even wearable devices. The ability to produce flexible and transparent QD-OLED panels opens new possibilities for innovative form factors. However, challenges remain in scaling up manufacturing, particularly in achieving high yields and long-term reliability for demanding environments.

Looking ahead, the outlook for QD-OLED display manufacturing is robust. As more manufacturers invest in production lines and as material suppliers such as Nanosys and Nanoco Group advance quantum dot materials, costs are expected to decline, enabling broader adoption. The next few years will likely see QD-OLED displays move from niche premium products to mainstream adoption across multiple industries, driven by ongoing innovation and economies of scale.

Competitive Analysis: QD-OLED vs. Competing Display Technologies

Quantum Dot OLED (QD-OLED) display manufacturing has emerged as a focal point in the premium display sector, with competition intensifying against established technologies such as White OLED (WOLED), Mini-LED, and MicroLED. As of 2025, the competitive landscape is shaped by technological advancements, production scalability, and cost dynamics among leading manufacturers.

The primary proponent of QD-OLED technology is Samsung Display, which began mass production of QD-OLED panels in 2021 and has since expanded its capacity. QD-OLED panels combine the self-emissive properties of OLED with quantum dot color conversion layers, resulting in higher color purity, improved brightness, and wider viewing angles compared to traditional WOLED panels. In 2025, Samsung Display remains the sole large-scale manufacturer of QD-OLED panels, supplying them to premium TV and monitor brands, including Samsung Electronics and Sony Corporation.

In contrast, WOLED technology, pioneered and dominated by LG Display, continues to hold a significant share of the OLED TV market. WOLED panels use a white OLED stack with color filters, which can result in lower peak brightness and color volume compared to QD-OLED, but benefit from mature manufacturing processes and broader product availability. LG Display has invested in Gen 8.5 and Gen 10.5 OLED fabs, enabling larger panel sizes and higher throughput, which helps maintain competitive pricing.

Mini-LED and MicroLED technologies, championed by companies such as TCL Technology and Samsung Electronics, offer alternative approaches. Mini-LED backlights, used in high-end LCDs, provide improved local dimming and brightness at lower costs than OLED, but cannot match the pixel-level contrast of QD-OLED. MicroLED, while promising superior brightness and longevity, faces significant manufacturing challenges and high costs, limiting its adoption to ultra-premium segments as of 2025.

Looking ahead, the competitive outlook for QD-OLED hinges on further improvements in manufacturing yield, material efficiency, and cost reduction. Samsung Display is reportedly exploring larger substrate sizes and advanced quantum dot materials to enhance performance and lower costs. Meanwhile, LG Display is advancing its OLED technology with improved efficiency and brightness, while Mini-LED and MicroLED manufacturers are investing in automation and mass transfer techniques to scale production.

In summary, QD-OLED manufacturing is positioned as a premium solution with superior color and contrast, but faces ongoing competition from WOLED’s scale and cost advantages, as well as the evolving capabilities of Mini-LED and MicroLED. The next few years will be defined by each technology’s ability to innovate and scale, with QD-OLED expected to expand its presence in the high-end display market if manufacturing efficiencies continue to improve.

Regulatory, Environmental, and Industry Standards (e.g., ieee.org, oled-a.org)

Quantum Dot OLED (QD-OLED) display manufacturing is subject to a complex landscape of regulatory, environmental, and industry standards, which are evolving rapidly as the technology matures and production scales up in 2025 and beyond. The integration of quantum dots (QDs) with OLED technology offers significant performance advantages, but also introduces new considerations regarding material safety, environmental impact, and compliance with international standards.

A primary regulatory focus in QD-OLED manufacturing is the management of hazardous substances, particularly cadmium, which has historically been used in some quantum dot formulations. However, due to stringent regulations such as the European Union’s Restriction of Hazardous Substances (RoHS) directive, leading manufacturers have shifted toward cadmium-free quantum dots. Companies like Samsung Electronics and Sony Corporation have publicly committed to cadmium-free QD-OLED products, aligning with global environmental directives and consumer demand for greener electronics.

Industry standards for QD-OLED displays are being shaped by organizations such as the Institute of Electrical and Electronics Engineers (IEEE) and the OLED Association. These bodies are actively developing and updating technical standards and best practices for display performance, reliability, and safety. For example, the IEEE has published standards related to display measurement and testing, which are increasingly referenced by manufacturers to ensure product consistency and interoperability.

Environmental stewardship is also a growing priority. QD-OLED manufacturing involves the use of organic materials and nanomaterials, necessitating careful management of waste streams and emissions. Companies are investing in closed-loop recycling systems and advanced filtration to minimize environmental impact. Samsung Electronics, the current leader in QD-OLED panel production, has highlighted its commitment to sustainable manufacturing, including the reduction of volatile organic compounds (VOCs) and the implementation of energy-efficient processes in its facilities.

Looking ahead, the industry is expected to see further tightening of environmental regulations, particularly concerning nanomaterial safety and end-of-life recycling. Industry groups such as the OLED Association are collaborating with manufacturers to establish guidelines for the safe handling and disposal of QD-OLED materials. As QD-OLED adoption expands into new markets, compliance with regional standards—such as China’s RoHS and the U.S. Environmental Protection Agency (EPA) guidelines—will become increasingly important for global supply chains.

In summary, the regulatory and standards environment for QD-OLED display manufacturing in 2025 is characterized by a strong emphasis on hazardous substance elimination, adherence to evolving industry standards, and proactive environmental management. Ongoing collaboration between manufacturers and standards organizations will be critical to ensuring the sustainable growth of the QD-OLED sector in the coming years.

Future Outlook: Disruptive Trends, R&D Focus, and Long-Term Opportunities

Quantum Dot OLED (QD-OLED) display manufacturing is poised for significant transformation in 2025 and the following years, driven by disruptive trends, intensified R&D, and emerging long-term opportunities. The convergence of quantum dot color conversion with OLED emissive layers is enabling displays with higher color purity, improved energy efficiency, and enhanced brightness, positioning QD-OLED as a leading technology for premium televisions, monitors, and potentially new form factors.

A key trend is the scaling up of mass production capacity. Samsung Display remains the primary commercial manufacturer of QD-OLED panels, having invested heavily in its Asan plant to expand Gen 8.5 substrate lines. In 2025, Samsung Display is expected to further optimize its inkjet printing and quantum dot patterning processes, aiming to reduce material waste and improve yield rates. The company’s roadmap includes larger panel sizes and higher resolutions, targeting both consumer and professional markets.

Meanwhile, LG Display—a leader in OLED—has signaled increased R&D into hybrid QD-OLED structures, leveraging its expertise in large-area OLED manufacturing. LG Display’s efforts focus on integrating quantum dot enhancement layers (QDEL) to boost color gamut and efficiency, with pilot lines anticipated to transition to commercial production within the next few years.

Material innovation is another disruptive force. Suppliers such as Nanosys and Nanoco Group are advancing cadmium-free quantum dot materials, addressing regulatory and environmental concerns while improving stability and performance. These developments are critical for broader adoption, especially as global regulations tighten around hazardous substances.

Looking ahead, R&D is increasingly focused on flexible and transparent QD-OLED displays, with potential applications in automotive, signage, and wearable devices. Collaborative efforts between display makers and material suppliers are accelerating the development of solution-processable quantum dots and scalable manufacturing techniques. For instance, Samsung Display and Nanosys have announced joint initiatives to commercialize next-generation QD-OLED architectures.

Long-term, the QD-OLED sector is expected to benefit from continued investment in automation, AI-driven process control, and green manufacturing practices. As costs decline and performance improves, QD-OLED displays are likely to capture a larger share of the high-end display market, while also opening new opportunities in emerging segments. The next few years will be pivotal as manufacturers race to overcome technical and economic barriers, setting the stage for QD-OLED to become a mainstream display technology.

Sources & References

- Samsung Display

- LG Display

- BOE Technology Group

- LG Electronics

- ULVAC, Inc.

- Dell Technologies

- Institute of Electrical and Electronics Engineers (IEEE)