Quantum Dot Photodetector Manufacturing in 2025: Revolutionizing Sensing Technologies and Accelerating Market Expansion. Explore How Advanced Materials and Breakthrough Fabrication Are Shaping the Future of Photodetection.

- Executive Summary: Key Findings and Market Highlights

- Market Overview: Definition, Scope, and Segmentation

- 2025 Market Size & Forecast (2025–2030): Growth Drivers and 18% CAGR Analysis

- Technology Landscape: Quantum Dot Materials, Architectures, and Fabrication Innovations

- Competitive Analysis: Leading Players, Startups, and Strategic Alliances

- Application Deep Dive: Consumer Electronics, Medical Imaging, Security, and Beyond

- Regional Insights: North America, Europe, Asia-Pacific, and Emerging Markets

- Supply Chain and Manufacturing Trends: Scale-Up, Cost, and Quality Challenges

- Regulatory Environment and Standards Impacting Quantum Dot Photodetectors

- Future Outlook: Disruptive Trends, R&D Pipelines, and Commercialization Roadmap

- Conclusion and Strategic Recommendations

- Sources & References

Executive Summary: Key Findings and Market Highlights

The quantum dot photodetector manufacturing sector is poised for significant growth in 2025, driven by advancements in nanomaterials, increasing demand for high-performance optoelectronic devices, and expanding applications across industries. Quantum dot photodetectors leverage the unique optical and electronic properties of quantum dots—semiconductor nanocrystals—to achieve superior sensitivity, tunable wavelength detection, and enhanced signal-to-noise ratios compared to traditional photodetectors.

Key findings indicate that the integration of quantum dots into photodetector architectures is accelerating, particularly in fields such as medical imaging, environmental monitoring, and next-generation consumer electronics. Major manufacturers and research institutions, including Samsung Electronics Co., Ltd. and Sony Semiconductor Solutions Corporation, are investing heavily in R&D to improve quantum dot synthesis, device stability, and scalable fabrication processes. These efforts are resulting in devices with broader spectral response, higher quantum efficiency, and improved operational lifespans.

Market highlights for 2025 include the emergence of solution-processable quantum dot photodetectors, which enable cost-effective, large-area device manufacturing using printing and coating techniques. This trend is lowering barriers to entry for new players and fostering innovation in flexible and wearable photodetector applications. Additionally, collaborations between industry leaders and academic institutions, such as those facilitated by National Institute of Standards and Technology (NIST), are accelerating the standardization of performance metrics and reliability testing protocols.

Geographically, Asia-Pacific remains the dominant region for quantum dot photodetector manufacturing, supported by robust supply chains, government incentives, and the presence of leading electronics manufacturers. However, North America and Europe are rapidly expanding their capabilities, focusing on specialized applications in defense, automotive LiDAR, and quantum communications.

In summary, the quantum dot photodetector manufacturing market in 2025 is characterized by rapid technological progress, expanding application scope, and increasing collaboration across the value chain. Continued investment in material science and process engineering is expected to further enhance device performance and commercial viability, positioning quantum dot photodetectors as a cornerstone technology in the evolving optoelectronics landscape.

Market Overview: Definition, Scope, and Segmentation

Quantum dot photodetector manufacturing refers to the industrial-scale production of photodetectors that utilize quantum dots—nanoscale semiconductor particles with unique optoelectronic properties—as the active sensing material. These devices are engineered to detect light across a broad spectrum, from ultraviolet to infrared, with high sensitivity and tunable wavelength response. The market for quantum dot photodetectors is expanding rapidly, driven by advancements in nanomaterials, increasing demand for high-performance imaging systems, and the integration of quantum dot technology into consumer electronics, medical diagnostics, and security applications.

The scope of the quantum dot photodetector manufacturing market encompasses the entire value chain, including quantum dot synthesis, device fabrication, encapsulation, and system integration. Key stakeholders include quantum dot material suppliers, photodetector manufacturers, equipment providers, and end-use industries such as healthcare, automotive, defense, and consumer electronics. The market also covers various device architectures, such as photoconductors, photodiodes, and phototransistors, each tailored for specific application requirements.

Segmentation within the quantum dot photodetector manufacturing market is typically based on several criteria:

- Material Type: Cadmium-based (e.g., CdSe, CdTe), lead-based (e.g., PbS, PbSe), and cadmium-free quantum dots (e.g., InP, perovskite quantum dots).

- Device Architecture: Photoconductors, photodiodes, phototransistors, and hybrid structures.

- Wavelength Sensitivity: Ultraviolet, visible, near-infrared, and short-wave infrared photodetectors.

- End-Use Industry: Consumer electronics (e.g., cameras, smartphones), medical imaging, automotive (e.g., LiDAR, night vision), security and surveillance, and scientific instrumentation.

- Geography: North America, Europe, Asia-Pacific, and Rest of the World, reflecting regional manufacturing hubs and demand centers.

Leading industry players such as Nanosys, Inc., Samsung Electronics Co., Ltd., and Nanoco Group plc are actively investing in research and scaling up production capabilities to meet the growing market demand. The market is also shaped by regulatory considerations regarding the use of heavy metals in quantum dots, prompting innovation in environmentally friendly alternatives. As of 2025, the quantum dot photodetector manufacturing sector is poised for significant growth, underpinned by technological breakthroughs and expanding application landscapes.

2025 Market Size & Forecast (2025–2030): Growth Drivers and 18% CAGR Analysis

The global market for quantum dot photodetector manufacturing is poised for significant expansion in 2025, with projections indicating an impressive compound annual growth rate (CAGR) of approximately 18% through 2030. This robust growth is driven by a confluence of technological advancements, increasing demand for high-performance optoelectronic devices, and expanding applications across diverse sectors.

Key growth drivers include the rapid adoption of quantum dot photodetectors in next-generation imaging systems, such as those used in medical diagnostics, security surveillance, and autonomous vehicles. Quantum dots offer superior sensitivity, tunable wavelength detection, and enhanced signal-to-noise ratios compared to traditional photodetectors, making them highly attractive for these applications. The integration of quantum dot photodetectors into consumer electronics, particularly in smartphone cameras and wearable devices, is also accelerating market growth, as manufacturers seek to deliver improved image quality and low-light performance.

Another significant factor fueling market expansion is the ongoing investment in research and development by leading industry players and research institutions. Companies such as Samsung Electronics Co., Ltd. and Sony Group Corporation are actively exploring quantum dot technologies to enhance their product portfolios. Additionally, collaborations between manufacturers and academic institutions are fostering innovation in material synthesis, device architecture, and scalable manufacturing processes.

The market is also benefiting from supportive government initiatives and funding aimed at advancing quantum technologies. For instance, organizations like the National Science Foundation and the U.S. Department of Energy are providing grants and resources to accelerate the commercialization of quantum dot-based devices, including photodetectors.

From a regional perspective, Asia-Pacific is expected to dominate the market in 2025, driven by the presence of major electronics manufacturers and a robust semiconductor supply chain. North America and Europe are also anticipated to witness substantial growth, supported by strong research ecosystems and increasing adoption in industrial and defense applications.

In summary, the quantum dot photodetector manufacturing market is set for dynamic growth in 2025 and beyond, propelled by technological innovation, expanding end-use applications, and strategic investments from both public and private sectors. The anticipated 18% CAGR underscores the sector’s potential to reshape the landscape of optoelectronic device manufacturing over the next five years.

Technology Landscape: Quantum Dot Materials, Architectures, and Fabrication Innovations

The technology landscape for quantum dot (QD) photodetector manufacturing in 2025 is characterized by rapid advancements in materials science, device architectures, and fabrication techniques. Quantum dots—semiconductor nanocrystals with size-tunable optical and electronic properties—are enabling a new generation of photodetectors with enhanced sensitivity, spectral selectivity, and integration potential. The choice of QD materials has expanded beyond traditional cadmium selenide (CdSe) and lead sulfide (PbS) to include environmentally friendlier alternatives such as indium phosphide (InP) and perovskite-based quantum dots, driven by regulatory and sustainability considerations. Leading manufacturers and research institutions, such as National Institute of Standards and Technology (NIST) and Samsung Electronics Co., Ltd., are actively developing and characterizing these new materials for photodetector applications.

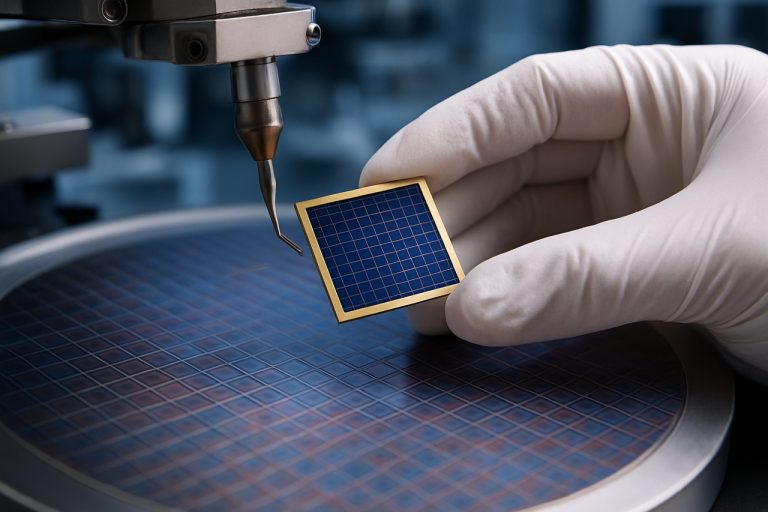

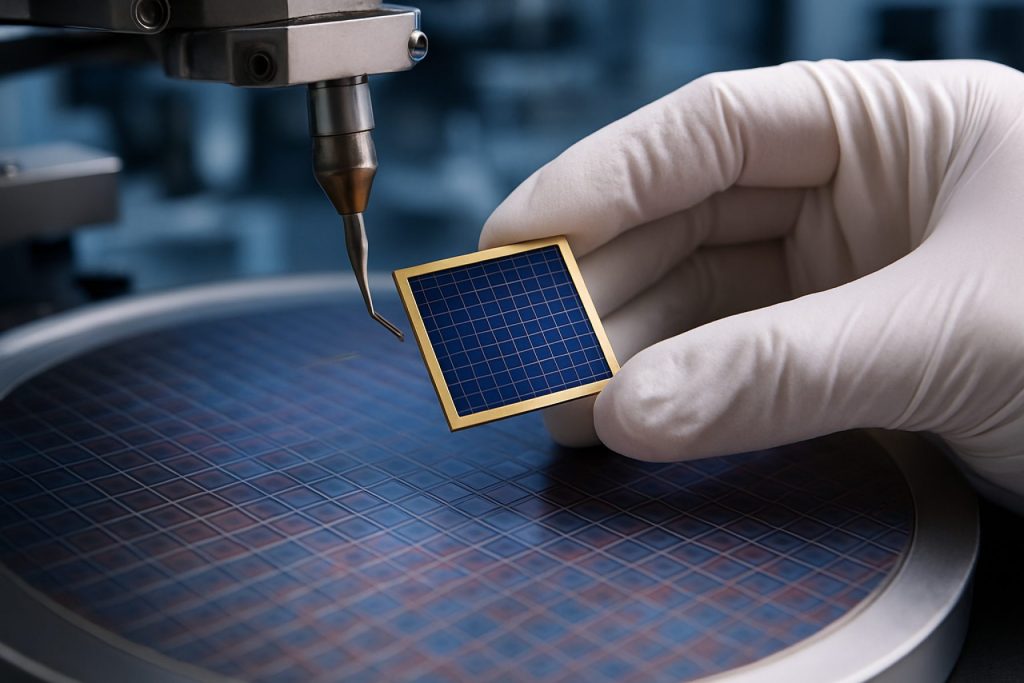

Architecturally, QD photodetectors are moving from simple photoconductive and photodiode structures to more complex designs, including hybrid and heterojunction devices. These architectures leverage the unique properties of quantum dots—such as high absorption coefficients and tunable bandgaps—to achieve broad spectral response, from ultraviolet to short-wave infrared. Integration with complementary metal-oxide-semiconductor (CMOS) technology is a key focus, enabling scalable, low-cost, and high-resolution imaging arrays. Companies like Sony Semiconductor Solutions Corporation are exploring QD-CMOS integration for next-generation image sensors.

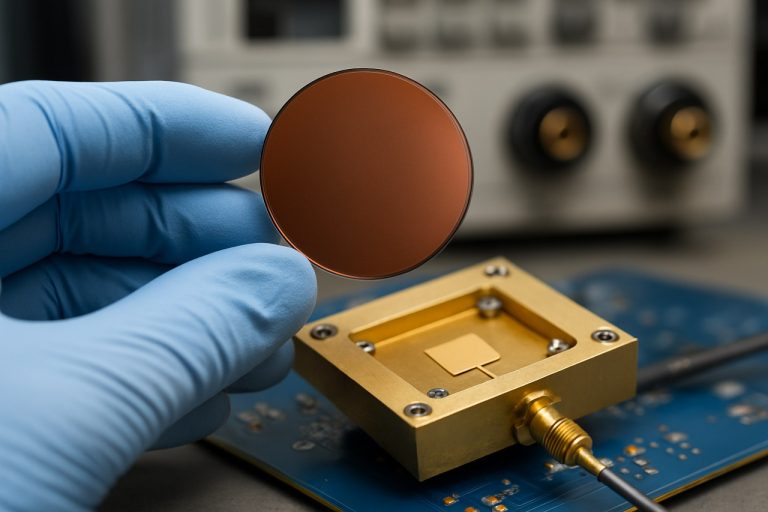

Fabrication innovations are central to the progress in QD photodetector manufacturing. Solution-processable QDs allow for low-temperature, large-area deposition using techniques such as spin-coating, inkjet printing, and spray-coating. These methods are compatible with flexible substrates, opening pathways for wearable and conformable photodetectors. Advances in ligand engineering and surface passivation, as pursued by organizations like National Renewable Energy Laboratory (NREL), have significantly improved QD film stability and charge transport, addressing longstanding challenges in device performance and reliability.

Looking ahead, the convergence of novel QD materials, sophisticated device architectures, and scalable fabrication methods is expected to drive the commercialization of high-performance, cost-effective quantum dot photodetectors across diverse sectors, including medical imaging, environmental monitoring, and consumer electronics.

Competitive Analysis: Leading Players, Startups, and Strategic Alliances

The quantum dot photodetector (QDPD) manufacturing sector in 2025 is characterized by a dynamic interplay between established industry leaders, innovative startups, and a growing number of strategic alliances. This competitive landscape is shaped by rapid advancements in nanomaterials, increasing demand for high-performance optoelectronic devices, and the integration of quantum dot technologies into mainstream applications such as imaging, sensing, and telecommunications.

Among the leading players, Samsung Electronics Co., Ltd. and Sony Group Corporation have leveraged their expertise in semiconductor fabrication and display technologies to develop advanced QDPDs for consumer electronics and industrial imaging. Nanoco Group plc stands out as a pioneer in cadmium-free quantum dot synthesis, supplying materials to major device manufacturers and collaborating on next-generation photodetector prototypes. Nanosys, Inc. continues to expand its quantum dot material portfolio, focusing on scalable manufacturing processes and partnerships with display and sensor companies.

Startups are playing a crucial role in pushing the boundaries of QDPD performance and integration. Companies such as Ube Industries, Ltd. and Quantum Solutions are developing novel quantum dot compositions and device architectures, targeting niche markets like biomedical imaging and low-light detection. These startups often collaborate with academic institutions and leverage government grants to accelerate R&D, positioning themselves as attractive acquisition targets or strategic partners for larger firms.

Strategic alliances are increasingly common, as companies seek to combine complementary strengths in materials science, device engineering, and system integration. For example, Samsung Electronics Co., Ltd. has entered into joint development agreements with quantum dot material suppliers to ensure a stable supply chain and accelerate the commercialization of QDPD-enabled products. Similarly, Sony Group Corporation has partnered with research institutes to co-develop high-sensitivity photodetectors for emerging applications in autonomous vehicles and medical diagnostics.

Overall, the competitive landscape in quantum dot photodetector manufacturing is marked by a blend of established expertise, disruptive innovation, and collaborative ventures. This environment is expected to drive further technological breakthroughs and expand the adoption of QDPDs across diverse industries in 2025 and beyond.

Application Deep Dive: Consumer Electronics, Medical Imaging, Security, and Beyond

Quantum dot photodetectors (QDPDs) are rapidly gaining traction across a spectrum of industries due to their unique ability to detect light with high sensitivity, tunable spectral response, and compatibility with flexible substrates. In 2025, advancements in quantum dot synthesis and device integration are enabling QDPDs to move from research labs into real-world applications, particularly in consumer electronics, medical imaging, and security systems.

In consumer electronics, QDPDs are being integrated into next-generation cameras and display technologies. Their tunable bandgap allows for enhanced color discrimination and low-light performance, making them ideal for smartphone cameras and wearable devices. Companies such as Samsung Electronics Co., Ltd. are exploring quantum dot-based sensors to improve image quality and enable new functionalities like gesture recognition and augmented reality.

The medical imaging sector is leveraging QDPDs for their high sensitivity and spectral selectivity, which are crucial for applications such as fluorescence imaging, X-ray detection, and biosensing. Quantum dot photodetectors can be engineered to detect specific wavelengths, improving contrast and enabling early disease detection. Research collaborations with institutions like Siemens Healthineers AG are focusing on integrating QDPDs into compact, high-resolution imaging systems for point-of-care diagnostics and wearable health monitors.

In security and surveillance, QDPDs offer significant advantages in low-light and multispectral imaging, which are essential for facial recognition, night vision, and threat detection. Their ability to be fabricated on flexible or transparent substrates allows for discreet integration into smart windows and security cameras. Industry leaders such as Bosch Security Systems are investigating quantum dot-based sensors to enhance the performance of surveillance equipment in challenging lighting conditions.

Beyond these sectors, QDPDs are finding roles in environmental monitoring, industrial automation, and automotive LiDAR systems, where their fast response times and customizable detection ranges are highly valued. As manufacturing processes mature—incorporating scalable techniques like inkjet printing and roll-to-roll processing—the cost and complexity of QDPD integration are expected to decrease, further accelerating their adoption across diverse markets.

Regional Insights: North America, Europe, Asia-Pacific, and Emerging Markets

The global landscape for quantum dot photodetector manufacturing in 2025 is marked by distinct regional dynamics, shaped by technological capabilities, investment levels, and policy frameworks. North America remains a leader, driven by robust R&D ecosystems and the presence of pioneering companies and research institutions. The United States, in particular, benefits from significant federal funding and collaborations between academia and industry, with organizations such as the National Science Foundation supporting foundational research and commercialization efforts. Major semiconductor manufacturers and startups in Silicon Valley and other tech hubs are accelerating the integration of quantum dot photodetectors into imaging, sensing, and communication applications.

Europe is characterized by a strong emphasis on sustainable manufacturing and cross-border collaboration. The European Union’s Quantum Technologies Flagship program fosters innovation through coordinated research projects and funding, while countries like Germany, France, and the UK host leading photonics and nanotechnology clusters. European manufacturers are particularly focused on developing environmentally friendly quantum dot synthesis methods and ensuring compliance with stringent regulatory standards.

The Asia-Pacific region, led by China, South Korea, and Japan, is rapidly expanding its quantum dot photodetector manufacturing capacity. China’s government-backed initiatives, such as those promoted by the Ministry of Science and Technology of the People’s Republic of China, have resulted in significant investments in both research infrastructure and industrial-scale production. South Korea and Japan leverage their established electronics and display industries, with companies like Samsung Electronics and Sony Group Corporation integrating quantum dot photodetectors into next-generation consumer electronics and imaging devices.

Emerging markets, including India, Southeast Asia, and parts of the Middle East, are beginning to establish a presence in the quantum dot photodetector value chain. These regions are attracting foreign direct investment and forming partnerships with global technology leaders to build local manufacturing capabilities. Initiatives by organizations such as Invest India are aimed at fostering innovation ecosystems and supporting startups in advanced materials and photonics.

Overall, regional strengths in quantum dot photodetector manufacturing reflect a combination of policy support, industrial expertise, and collaborative networks, with each region contributing unique capabilities to the global market in 2025.

Supply Chain and Manufacturing Trends: Scale-Up, Cost, and Quality Challenges

The manufacturing of quantum dot photodetectors (QDPDs) in 2025 is characterized by rapid scale-up efforts, cost optimization, and persistent quality assurance challenges. As demand for high-performance photodetectors grows in sectors such as imaging, telecommunications, and medical diagnostics, manufacturers are transitioning from laboratory-scale synthesis to industrial-scale production. This scale-up involves not only increasing batch sizes but also ensuring uniformity in quantum dot (QD) size, composition, and surface chemistry, which are critical for device performance and reproducibility.

One of the primary challenges in scaling up QDPD manufacturing is maintaining the precise control over QD properties that is achievable in small-scale synthesis. Variations in temperature, mixing, and precursor purity can lead to batch-to-batch inconsistencies, affecting device yield and reliability. To address this, companies are investing in advanced process control systems and in-line metrology tools that enable real-time monitoring of QD synthesis and device fabrication. For example, Nanosys, Inc. and Nanoco Group plc have developed proprietary manufacturing platforms that emphasize scalability and quality control for QD production.

Cost remains a significant barrier to widespread adoption of QDPDs. The synthesis of high-quality QDs often relies on expensive precursors and complex purification steps. Efforts to reduce costs include the development of less toxic, earth-abundant materials and the adoption of roll-to-roll and inkjet printing techniques for device fabrication. These methods promise to lower material waste and enable high-throughput manufacturing, as demonstrated by pilot lines at organizations like Samsung Electronics Co., Ltd. and Sony Group Corporation, which are exploring QD integration in optoelectronic devices.

Quality assurance is another critical focus, as QDPDs must meet stringent standards for stability, sensitivity, and spectral selectivity. Manufacturers are implementing rigorous testing protocols, including accelerated aging and environmental stress tests, to ensure long-term device reliability. Collaboration with industry consortia such as the SEMI (Semiconductor Equipment and Materials International) is helping to establish standardized metrics and best practices for QDPD quality assessment.

In summary, the 2025 landscape for QDPD manufacturing is defined by the interplay between scaling up production, reducing costs, and ensuring consistent quality. Continued innovation in materials, process engineering, and quality control will be essential for the successful commercialization of quantum dot photodetectors.

Regulatory Environment and Standards Impacting Quantum Dot Photodetectors

The regulatory environment and standards landscape for quantum dot photodetector (QDPD) manufacturing is rapidly evolving as these devices transition from laboratory prototypes to commercial products. Regulatory frameworks primarily address two critical areas: material safety—especially concerning the use of heavy metals such as cadmium—and device performance standards, which ensure reliability and interoperability in end-use applications.

A significant regulatory focus is on the environmental and health implications of quantum dot materials. Many high-performance QDPDs utilize cadmium-based quantum dots, which are subject to stringent restrictions under the European Union’s Restriction of Hazardous Substances (RoHS) Directive and the U.S. Environmental Protection Agency (EPA) guidelines. These regulations limit the allowable concentration of cadmium and other hazardous substances in electronic devices, compelling manufacturers to develop cadmium-free alternatives or implement robust containment and recycling strategies.

In parallel, international standards organizations such as the International Organization for Standardization (ISO) and the International Electrotechnical Commission (IEC) are working to establish standardized testing protocols for QDPDs. These standards cover parameters like spectral responsivity, noise characteristics, and long-term stability, which are essential for benchmarking device performance and ensuring compatibility across different manufacturers and application domains.

Additionally, the Institute of Electrical and Electronics Engineers (IEEE) is involved in developing standards for the integration of QDPDs into optoelectronic systems, addressing issues such as signal integrity, interface protocols, and system-level safety. Compliance with these standards is increasingly required by major industry players and government procurement agencies, influencing both design and manufacturing processes.

Looking ahead to 2025, regulatory trends indicate a tightening of material restrictions and a greater emphasis on lifecycle management, including end-of-life recycling and traceability of quantum dot materials. Manufacturers are responding by investing in greener synthesis methods and collaborating with standards bodies to shape practical, science-based regulations that support innovation while safeguarding public health and the environment.

Future Outlook: Disruptive Trends, R&D Pipelines, and Commercialization Roadmap

The future of quantum dot photodetector (QDPD) manufacturing is shaped by rapid advances in materials science, device engineering, and integration strategies, with significant implications for commercial adoption by 2025 and beyond. Disruptive trends include the transition from traditional vacuum-based deposition to scalable solution-processable techniques, such as inkjet printing and roll-to-roll manufacturing. These methods promise to reduce production costs and enable large-area, flexible photodetector arrays, expanding applications in imaging, sensing, and wearable electronics.

Research and development pipelines are increasingly focused on improving quantum dot (QD) stability, spectral tunability, and environmental robustness. Efforts by leading research institutions and industry players are directed at engineering core-shell QD structures and surface passivation techniques to enhance photodetector sensitivity and operational lifetimes. For instance, the development of lead-free QDs addresses toxicity concerns, aligning with global regulatory trends and opening new markets in consumer electronics and healthcare.

Integration of QDPDs with complementary metal-oxide-semiconductor (CMOS) technology is a key R&D priority, as it enables seamless incorporation into existing electronic and optoelectronic platforms. Companies such as Samsung Electronics Co., Ltd. and Sony Group Corporation are actively exploring hybrid architectures that combine QDs with silicon-based readout circuits, targeting high-performance imaging sensors for smartphones, automotive cameras, and industrial inspection systems.

The commercialization roadmap for QDPDs involves overcoming challenges related to uniformity, reproducibility, and upscaling. Strategic partnerships between QD material suppliers, device manufacturers, and end-users are accelerating pilot production lines and qualification processes. Organizations like Nanosys, Inc. and Nanoco Group plc are investing in proprietary synthesis and encapsulation technologies to ensure consistent device performance and reliability at scale.

Looking ahead, the convergence of QDPDs with artificial intelligence and Internet of Things (IoT) ecosystems is expected to drive new functionalities, such as multispectral imaging and real-time environmental monitoring. As R&D pipelines mature and manufacturing bottlenecks are addressed, the quantum dot photodetector market is poised for significant growth, with commercialization efforts likely to intensify across consumer, industrial, and scientific sectors by 2025.

Conclusion and Strategic Recommendations

Quantum dot photodetector manufacturing in 2025 stands at a pivotal juncture, driven by rapid advancements in nanomaterials, device engineering, and scalable fabrication techniques. The integration of quantum dots (QDs) into photodetectors has enabled significant improvements in sensitivity, spectral selectivity, and operational flexibility, positioning these devices for widespread adoption in imaging, sensing, and optoelectronic applications. However, the transition from laboratory-scale prototypes to commercial-scale production presents both opportunities and challenges.

To capitalize on the potential of quantum dot photodetectors, manufacturers should prioritize the following strategic recommendations:

- Invest in Scalable and Reproducible Synthesis: Consistent quality and uniformity of QDs are critical for device performance. Companies should invest in advanced synthesis methods, such as continuous-flow reactors and automated process controls, to ensure batch-to-batch reproducibility and scalability. Collaboration with established nanomaterials suppliers like Nanosys, Inc. and Nanoco Technologies Ltd. can accelerate access to high-quality QDs.

- Enhance Device Integration and Packaging: The compatibility of QDs with existing semiconductor processes is essential for cost-effective manufacturing. Strategic partnerships with semiconductor foundries and packaging specialists, such as Taiwan Semiconductor Manufacturing Company Limited (TSMC), can facilitate the integration of QDs into mainstream device architectures.

- Focus on Environmental and Regulatory Compliance: As environmental regulations tighten, especially regarding heavy metals like cadmium, manufacturers should prioritize the development and adoption of cadmium-free QDs. Engaging with regulatory bodies such as the United States Environmental Protection Agency (EPA) and the European Commission Directorate-General for Environment will ensure compliance and market access.

- Accelerate Application-Driven Innovation: Targeting high-value applications—such as medical imaging, low-light cameras, and infrared sensing—can drive early adoption and justify investment in advanced manufacturing. Collaboration with end-users and industry consortia, like the SEMI (Semiconductor Equipment and Materials International), can help align product development with market needs.

In conclusion, the successful commercialization of quantum dot photodetectors in 2025 will depend on a holistic approach that combines material innovation, process optimization, regulatory foresight, and market-driven product development. Strategic collaboration across the value chain will be essential to unlock the full potential of this transformative technology.

Sources & References

- National Institute of Standards and Technology (NIST)

- National Science Foundation

- National Renewable Energy Laboratory (NREL)

- Ube Industries, Ltd.

- Quantum Solutions

- Siemens Healthineers AG

- Bosch Security Systems

- Quantum Technologies Flagship

- Ministry of Science and Technology of the People’s Republic of China

- Invest India

- Restriction of Hazardous Substances (RoHS) Directive

- International Organization for Standardization (ISO)

- Institute of Electrical and Electronics Engineers (IEEE)

- European Commission Directorate-General for Environment