Semiconductor Nanophotonics Industry Report 2025: Market Dynamics, Growth Projections, and Strategic Insights for the Next 5 Years

- Executive Summary and Market Overview

- Key Technology Trends in Semiconductor Nanophotonics

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Opportunities

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary and Market Overview

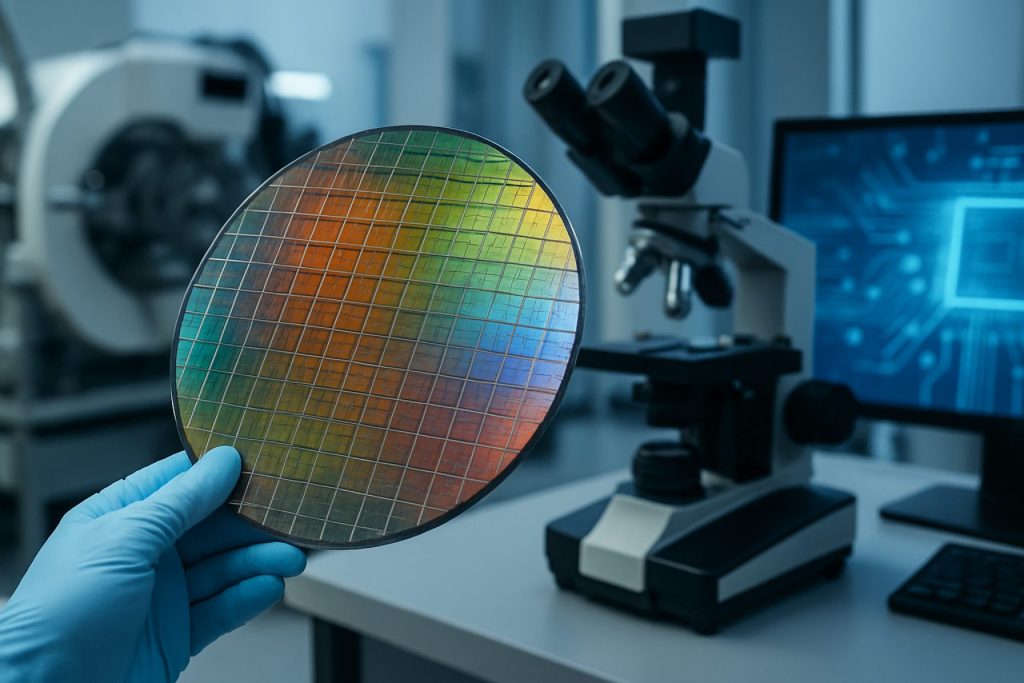

Semiconductor nanophotonics is an advanced field at the intersection of semiconductor technology and photonics, focusing on the manipulation and control of light at the nanometer scale using semiconductor materials. This technology underpins innovations in optical communications, quantum computing, biosensing, and next-generation display systems. As of 2025, the global semiconductor nanophotonics market is experiencing robust growth, driven by escalating demand for high-speed data transmission, miniaturized photonic devices, and energy-efficient optoelectronic components.

According to MarketsandMarkets, the nanophotonics market is projected to reach USD 30.1 billion by 2025, growing at a CAGR of over 7% from 2020. This growth is propelled by the proliferation of data centers, the expansion of 5G networks, and the increasing integration of photonic chips in consumer electronics and automotive applications. The Asia-Pacific region, led by China, South Korea, and Japan, dominates the market due to significant investments in semiconductor manufacturing and government-backed R&D initiatives.

Key industry players such as Intel Corporation, Samsung Electronics, and Taiwan Semiconductor Manufacturing Company (TSMC) are accelerating the commercialization of nanophotonic devices, including silicon photonics transceivers and on-chip optical interconnects. These advancements are critical for overcoming the limitations of traditional electronic data transfer, enabling higher bandwidth and lower latency in computing systems.

The market landscape is also shaped by strategic collaborations between semiconductor foundries, photonics startups, and research institutions. For instance, imec and GlobalFoundries have announced joint efforts to develop scalable nanophotonic platforms for AI and high-performance computing applications. Furthermore, government funding in the US, EU, and Asia is fostering innovation in quantum photonics and integrated photonic circuits, further expanding the addressable market.

In summary, the semiconductor nanophotonics market in 2025 is characterized by rapid technological advancements, strong end-user demand, and a dynamic competitive environment. The sector is poised for continued expansion as photonic integration becomes essential for next-generation computing, communications, and sensing technologies.

Key Technology Trends in Semiconductor Nanophotonics

Semiconductor nanophotonics, the field focused on manipulating light at the nanoscale using semiconductor materials, is experiencing rapid technological evolution in 2025. Several key trends are shaping the landscape, driven by the demand for faster, more energy-efficient, and miniaturized photonic devices across data communications, sensing, and quantum technologies.

- Integration of Photonics and Electronics: The convergence of photonic and electronic circuits on a single chip is accelerating, with silicon photonics leading the way. Advanced CMOS-compatible processes now enable the co-integration of lasers, modulators, and detectors with electronic logic, reducing latency and power consumption in data centers and high-performance computing. Intel and GlobalFoundries are at the forefront, commercializing silicon photonics transceivers and platforms.

- III-V Semiconductors on Silicon: Heterogeneous integration of III-V materials (such as InP and GaAs) onto silicon substrates is overcoming the limitations of silicon’s indirect bandgap, enabling efficient on-chip light sources and amplifiers. This trend is crucial for scalable, cost-effective photonic integrated circuits (PICs) and is being advanced by companies like imec and ams OSRAM.

- Plasmonics and Metasurfaces: The use of plasmonic nanostructures and engineered metasurfaces is enabling unprecedented control over light at subwavelength scales. These technologies are leading to ultra-compact modulators, switches, and sensors with applications in optical computing and biosensing. Research from Nature and Elsevier journals highlights breakthroughs in loss mitigation and fabrication scalability.

- Quantum Nanophotonics: The integration of quantum emitters (such as quantum dots and color centers) with semiconductor nanophotonic structures is advancing quantum communication and computing. Efforts by IBM and Xanadu are pushing the boundaries of on-chip quantum photonic circuits.

- Advanced Manufacturing and Lithography: Extreme ultraviolet (EUV) lithography and novel nanofabrication techniques are enabling the production of ever-smaller and more complex nanophotonic structures, supporting mass-market adoption. ASML remains a key player in EUV technology deployment.

These trends collectively point to a future where semiconductor nanophotonics underpins next-generation computing, communications, and sensing, with ongoing innovation expected to further reduce device footprints and energy requirements while expanding functionality.

Competitive Landscape and Leading Players

The competitive landscape of the semiconductor nanophotonics market in 2025 is characterized by a dynamic mix of established semiconductor giants, specialized photonics firms, and innovative startups. The sector is driven by rapid advancements in integrated photonic circuits, silicon photonics, and quantum photonics, with applications spanning data centers, telecommunications, biosensing, and quantum computing.

Leading players include Intel Corporation, which has made significant investments in silicon photonics for high-speed data transmission and optical interconnects. IBM Corporation is another key contender, leveraging its expertise in quantum photonics and integrated photonic chips for next-generation computing. Cisco Systems, Inc. continues to expand its photonic component portfolio, targeting hyperscale data centers and cloud infrastructure.

Specialized companies such as Coherent Corp. (formerly II-VI Incorporated) and Lumentum Holdings Inc. are prominent in the development of photonic integrated circuits and advanced optical modules. ams-OSRAM AG is notable for its innovations in nanophotonic sensors and emitters, particularly for automotive and consumer electronics applications.

Startups and university spin-offs are also shaping the competitive landscape. Companies like Rockley Photonics and Ayar Labs are pioneering chip-scale photonic solutions for AI, machine learning, and high-performance computing. These firms often collaborate with academic institutions and leverage venture capital to accelerate R&D and commercialization.

Strategic partnerships, mergers, and acquisitions are common as companies seek to expand their technological capabilities and market reach. For example, Intel’s acquisition of photonics startups and Lumentum’s merger activities have strengthened their positions in the nanophotonics value chain.

Geographically, North America and Europe remain the primary hubs for innovation and commercialization, supported by robust R&D ecosystems and government funding. However, Asian players, particularly in Japan, South Korea, and China, are rapidly increasing their investments and market share, intensifying global competition.

Overall, the semiconductor nanophotonics market in 2025 is marked by technological convergence, aggressive innovation, and a race to deliver scalable, cost-effective solutions for data-intensive and emerging applications.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The semiconductor nanophotonics market is poised for robust growth between 2025 and 2030, driven by escalating demand for high-speed data transmission, miniaturized photonic devices, and advancements in quantum computing and optical interconnects. According to projections by MarketsandMarkets, the global nanophotonics market—which includes semiconductor-based solutions—is expected to register a compound annual growth rate (CAGR) of approximately 7.5% during this period. This growth is underpinned by the increasing integration of nanophotonic components in data centers, telecommunications infrastructure, and consumer electronics.

Revenue forecasts indicate that the semiconductor nanophotonics segment will contribute significantly to the overall market, with global revenues anticipated to surpass $25 billion by 2030, up from an estimated $16 billion in 2025. This surge is attributed to the rapid adoption of silicon photonics in high-performance computing and the proliferation of 5G and next-generation wireless networks, which require advanced optical components for efficient signal processing and transmission (International Data Corporation (IDC)).

In terms of volume, the shipment of semiconductor nanophotonic devices—including photonic integrated circuits (PICs), light-emitting diodes (LEDs), and laser diodes—is expected to grow at a CAGR of 8–9% from 2025 to 2030. The Asia-Pacific region, led by China, South Korea, and Taiwan, will remain the largest contributor to volume growth, owing to the concentration of semiconductor manufacturing hubs and aggressive investments in photonics R&D (SEMI).

- Key growth drivers: Rising data traffic, demand for energy-efficient optical components, and the evolution of AI and machine learning workloads.

- End-use sectors: Data centers, telecommunications, automotive LiDAR, biosensing, and consumer electronics.

- Technological trends: Integration of nanophotonics with CMOS processes, development of hybrid photonic-electronic chips, and advances in quantum photonics.

Overall, the semiconductor nanophotonics market is set for sustained expansion through 2030, with both revenue and shipment volumes reflecting the sector’s critical role in next-generation information and communication technologies.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global semiconductor nanophotonics market in 2025 is characterized by distinct regional dynamics, shaped by investment levels, R&D intensity, and end-user adoption across North America, Europe, Asia-Pacific, and the Rest of the World.

North America remains a leader in semiconductor nanophotonics, driven by robust funding for research and a strong ecosystem of technology companies and academic institutions. The United States, in particular, benefits from significant government initiatives and private sector investments targeting photonic integrated circuits (PICs) and advanced optical interconnects. The presence of major players such as Intel Corporation and IBM accelerates commercialization, especially in data centers and high-performance computing. According to SEMI, North America accounted for over 30% of global nanophotonics R&D spending in 2024, a trend expected to continue into 2025.

Europe is marked by strong collaboration between academia and industry, with the European Union’s Horizon Europe program providing substantial funding for photonics research. Countries like Germany, the Netherlands, and France are at the forefront, with companies such as ASML and research consortia like Photonics21 driving innovation in nanophotonic devices for telecommunications and sensing. The region’s focus on sustainability and energy efficiency is fostering demand for nanophotonics in green data centers and smart infrastructure.

- Asia-Pacific is the fastest-growing region, propelled by aggressive investments in semiconductor manufacturing and a burgeoning consumer electronics market. China, Japan, South Korea, and Taiwan are investing heavily in nanophotonics for 5G, AI, and quantum computing applications. According to SEMI, Asia-Pacific is projected to capture over 40% of new nanophotonics manufacturing capacity in 2025, with companies like Samsung Electronics and TSMC leading the charge.

- Rest of World (including Latin America, Middle East, and Africa) is at an earlier stage of adoption, with market growth primarily driven by government-led digitalization initiatives and international partnerships. While the installed base is smaller, countries such as Israel and the United Arab Emirates are emerging as innovation hubs, leveraging targeted investments in photonics research and start-up ecosystems.

Overall, regional disparities in infrastructure, funding, and industrial focus will continue to shape the competitive landscape of semiconductor nanophotonics in 2025, with Asia-Pacific and North America setting the pace for global market expansion.

Future Outlook: Emerging Applications and Investment Opportunities

The future outlook for semiconductor nanophotonics in 2025 is marked by a convergence of technological innovation and expanding investment opportunities, driven by the demand for faster, more energy-efficient, and miniaturized photonic devices. As the boundaries of Moore’s Law are approached, nanophotonics offers a pathway to overcome electronic bottlenecks, enabling new paradigms in data processing, communication, and sensing.

Emerging applications are particularly prominent in data centers and high-performance computing, where nanophotonic interconnects promise to dramatically increase bandwidth while reducing power consumption. Companies such as Intel and IBM are actively developing silicon photonics platforms that integrate nanophotonic components directly onto semiconductor chips, targeting commercial deployment in 2025 and beyond. These advances are expected to support the exponential growth of cloud computing and artificial intelligence workloads.

Another key area is quantum information science. Nanophotonic devices, such as single-photon sources and detectors, are foundational for scalable quantum computing and secure quantum communication. Startups and research institutions, including Paul Scherrer Institute and PsiQuantum, are attracting significant venture capital and government funding to accelerate the commercialization of quantum photonic technologies.

In biosensing and medical diagnostics, semiconductor nanophotonics enables ultra-sensitive detection of biomolecules, paving the way for rapid, point-of-care diagnostics. The integration of nanophotonic sensors with lab-on-chip platforms is anticipated to reach new milestones in 2025, with companies like Thermo Fisher Scientific and ZEISS investing in R&D for next-generation medical devices.

From an investment perspective, the global nanophotonics market is projected to grow at a CAGR of over 30% through 2025, according to MarketsandMarkets. Venture capital activity is robust, with funding rounds increasingly targeting startups focused on integrated photonics, quantum technologies, and advanced sensing. Strategic partnerships between semiconductor foundries and photonics startups are also accelerating technology transfer and scaling.

In summary, 2025 is poised to be a pivotal year for semiconductor nanophotonics, with breakthroughs in data communications, quantum technologies, and biosensing driving both technological progress and investment momentum. Stakeholders across the value chain are expected to benefit from the rapid maturation and commercialization of nanophotonic innovations.

Challenges, Risks, and Strategic Opportunities

The semiconductor nanophotonics sector in 2025 faces a complex landscape of challenges, risks, and strategic opportunities as it seeks to revolutionize data processing, communications, and sensing technologies. One of the foremost challenges is the integration of nanophotonic components with existing semiconductor manufacturing processes. Achieving compatibility with established CMOS fabrication lines remains difficult due to material mismatches, thermal budget constraints, and the need for sub-wavelength precision in patterning. This integration challenge can slow commercialization and increase production costs, as highlighted by SEMI.

Another significant risk is the scalability of nanophotonic devices. While laboratory demonstrations have shown promising results, scaling up to mass production without compromising performance or yield is a persistent hurdle. The high cost of advanced lithography and the need for defect-free nanostructures further exacerbate this risk, as noted by imec. Additionally, the sector is exposed to supply chain vulnerabilities, particularly for rare materials such as indium phosphide and gallium arsenide, which are critical for high-performance nanophotonic devices.

Intellectual property (IP) risks also loom large. The rapid pace of innovation has led to a crowded patent landscape, increasing the likelihood of litigation and the need for robust IP strategies. Companies must navigate this environment carefully to avoid costly disputes and ensure freedom to operate, as discussed by World Intellectual Property Organization (WIPO).

Despite these challenges, strategic opportunities abound. The surging demand for high-speed, energy-efficient data transmission in data centers and 5G/6G networks is driving investment in nanophotonic interconnects and modulators. The push for artificial intelligence and quantum computing further amplifies the need for advanced photonic chips, opening new markets for innovative players. Strategic partnerships between semiconductor foundries, photonics startups, and research institutions are accelerating technology transfer and reducing time-to-market, as evidenced by collaborations reported by GlobalFoundries and Intel.

In summary, while semiconductor nanophotonics in 2025 faces formidable technical and market risks, the sector’s strategic opportunities—driven by digital transformation and next-generation computing—are catalyzing significant investment and innovation. Companies that can navigate integration, scalability, and IP challenges are well-positioned to capture substantial value in this rapidly evolving market.

Sources & References

- MarketsandMarkets

- imec

- ams OSRAM

- Nature

- IBM

- Xanadu

- ASML

- Cisco Systems, Inc.

- Lumentum Holdings Inc.

- Rockley Photonics

- Ayar Labs

- International Data Corporation (IDC)

- Photonics21

- Paul Scherrer Institute

- Thermo Fisher Scientific

- ZEISS

- World Intellectual Property Organization (WIPO)