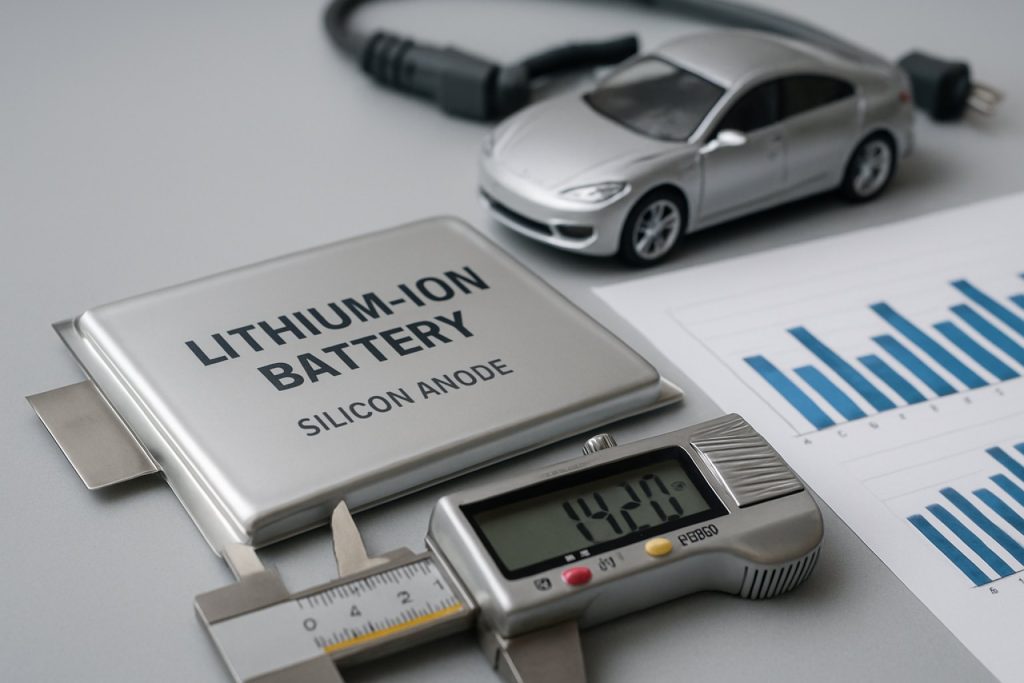

2025 Silicon Anode Lithium-ion Nanobatteries Market Report: Growth Drivers, Technology Innovations, and Global Forecasts. Explore Key Trends, Competitive Dynamics, and Strategic Opportunities Shaping the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Silicon Anode Lithium-ion Nanobatteries

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Volume, and Revenue Projections

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

Silicon anode lithium-ion nanobatteries represent a transformative advancement in energy storage technology, leveraging the superior theoretical capacity of silicon compared to traditional graphite anodes. As of 2025, the global market for silicon anode lithium-ion nanobatteries is experiencing robust growth, driven by escalating demand for high-performance batteries in electric vehicles (EVs), consumer electronics, and grid storage applications. Silicon’s ability to store approximately ten times more lithium ions than graphite has positioned it as a critical material for next-generation batteries, addressing the limitations of energy density and cycle life that have constrained conventional lithium-ion technologies.

According to MarketsandMarkets, the silicon anode battery market is projected to grow at a compound annual growth rate (CAGR) exceeding 40% from 2023 to 2028, with the market size expected to surpass USD 2 billion by 2028. This surge is underpinned by significant investments from automotive OEMs and battery manufacturers seeking to enhance EV range and charging speed. Notably, companies such as Tesla, Inc. and Panasonic Corporation are actively exploring silicon anode integration in their next-generation battery platforms.

Technological advancements in nanostructured silicon—such as silicon nanowires, nanoparticles, and composites—have mitigated historical challenges related to silicon’s volumetric expansion and mechanical degradation during charge-discharge cycles. These innovations have enabled improved cycle stability and manufacturability, making commercial adoption increasingly viable. The Asia-Pacific region, led by China, South Korea, and Japan, dominates both production and consumption, supported by strong government incentives and a mature battery manufacturing ecosystem (IDTechEx).

- Key Drivers: Rising EV adoption, demand for longer-lasting consumer electronics, and renewable energy integration.

- Challenges: High production costs, scalability of nanomaterial synthesis, and supply chain constraints for high-purity silicon.

- Outlook: Ongoing R&D and strategic partnerships are expected to accelerate commercialization, with major breakthroughs anticipated in the next 2-3 years.

In summary, silicon anode lithium-ion nanobatteries are poised to disrupt the energy storage landscape in 2025, offering a pathway to higher energy densities and supporting the global transition toward electrification and sustainable energy solutions.

Key Technology Trends in Silicon Anode Lithium-ion Nanobatteries

Silicon anode lithium-ion nanobatteries are at the forefront of next-generation energy storage, promising significant improvements over conventional graphite-based lithium-ion batteries. In 2025, several key technology trends are shaping the development and commercialization of these advanced batteries, driven by the need for higher energy density, faster charging, and longer cycle life.

- Nanostructured Silicon Materials: The use of nanostructured silicon—such as silicon nanowires, nanoparticles, and porous silicon—remains a central trend. These nanostructures accommodate the substantial volume expansion of silicon during lithiation, mitigating mechanical degradation and enhancing cycle stability. Companies like Amprius Technologies are leveraging silicon nanowire anodes to achieve energy densities exceeding 450 Wh/kg, a significant leap over traditional cells.

- Composite Anode Designs: Hybrid anodes that blend silicon with carbon or graphene are gaining traction. These composites combine the high capacity of silicon with the structural stability and conductivity of carbon materials, resulting in improved performance and manufacturability. Sila Nanotechnologies has commercialized silicon-dominant composite anodes, which are being adopted by consumer electronics and automotive OEMs.

- Advanced Binders and Electrolytes: The development of novel polymer binders and electrolyte additives is critical to maintaining electrode integrity and suppressing undesirable side reactions. Research from Samsung SDI and academic institutions highlights the use of self-healing binders and fluorinated electrolytes to extend battery lifespan and safety.

- Scalable Manufacturing Techniques: As demand for silicon anode batteries grows, scalable and cost-effective manufacturing processes are a priority. Roll-to-roll coating, chemical vapor deposition, and slurry casting are being optimized for high-volume production, as reported by IDTechEx.

- Integration in Electric Vehicles (EVs) and Consumer Electronics: Automakers and device manufacturers are accelerating the integration of silicon anode nanobatteries to meet consumer demand for longer range and faster charging. Tesla and Panasonic are actively exploring silicon anode technologies for next-generation EVs.

These technology trends underscore the rapid evolution of silicon anode lithium-ion nanobatteries, positioning them as a pivotal solution for the energy storage challenges of 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape for silicon anode lithium-ion nanobatteries in 2025 is characterized by rapid innovation, strategic partnerships, and significant investments from both established battery manufacturers and emerging technology startups. The drive to enhance energy density, cycle life, and charging speed has intensified competition, with companies racing to commercialize silicon anode technologies that can outperform traditional graphite-based lithium-ion batteries.

Leading the market are established players such as Panasonic Corporation and Samsung SDI, both of which have announced advancements in silicon anode integration for next-generation electric vehicles (EVs) and consumer electronics. Tesla, Inc. continues to invest in silicon anode research, leveraging its partnership with Amprius Technologies, a pioneer in silicon nanowire anode development. Amprius has reported commercial shipments of high-energy-density cells, with energy densities exceeding 450 Wh/kg, targeting aerospace and high-performance EV applications.

Startups are also playing a pivotal role. Sila Nanotechnologies has secured major supply agreements with automakers such as Mercedes-Benz, aiming to integrate its silicon-dominant anode materials into mass-market vehicles by 2025. Enovix Corporation is another notable entrant, focusing on 3D silicon lithium-ion batteries for wearables and mobile devices, with commercial production scaling up in 2025.

Asian battery giants, including Contemporary Amperex Technology Co. Limited (CATL) and LG Energy Solution, are investing heavily in silicon anode R&D, often collaborating with material science firms and universities to accelerate breakthroughs. These companies are leveraging their manufacturing scale and supply chain integration to bring silicon anode batteries to market faster and at lower cost.

- Strategic partnerships between automakers and battery innovators are accelerating commercialization.

- Intellectual property portfolios and proprietary manufacturing processes are key competitive differentiators.

- Regional competition is intensifying, with North America, Europe, and Asia-Pacific all vying for leadership in silicon anode battery production.

Overall, the 2025 market for silicon anode lithium-ion nanobatteries is defined by a dynamic mix of established corporations and agile startups, with the competitive edge hinging on technological maturity, scalability, and the ability to secure high-volume contracts with automotive and electronics OEMs.

Market Growth Forecasts (2025–2030): CAGR, Volume, and Revenue Projections

The global market for silicon anode lithium-ion nanobatteries is poised for robust expansion between 2025 and 2030, driven by surging demand for high-performance energy storage in electric vehicles (EVs), consumer electronics, and grid applications. According to projections from MarketsandMarkets, the silicon anode battery market is expected to register a compound annual growth rate (CAGR) of approximately 40% during this period, with nanobattery subsegments outpacing the broader market due to their superior energy density and cycle life.

In terms of revenue, the global silicon anode lithium-ion nanobattery market is forecast to reach between USD 2.5 billion and USD 3.2 billion by 2030, up from an estimated USD 350 million in 2025. This surge is attributed to accelerated commercialization efforts by leading battery manufacturers and the scaling of pilot production lines into mass manufacturing, particularly in Asia-Pacific and North America. IDTechEx highlights that the adoption of silicon nanostructures in anodes could enable battery capacities to increase by 20–40% over conventional graphite-based cells, further fueling market growth.

Volume projections indicate that annual shipments of silicon anode lithium-ion nanobatteries could exceed 25 GWh by 2030, up from less than 2 GWh in 2025. This growth is underpinned by strategic partnerships between automakers and battery technology firms, as well as government incentives for next-generation battery R&D. For instance, Sila Nanotechnologies and Amprius Technologies are scaling up production capacities to meet anticipated demand from EV and consumer electronics OEMs.

- CAGR (2025–2030): ~40%

- Revenue (2030): USD 2.5–3.2 billion

- Volume (2030): 25+ GWh annual shipments

Overall, the 2025–2030 period is expected to mark a pivotal phase for silicon anode lithium-ion nanobatteries, with rapid market scaling, technological breakthroughs, and increasing end-user adoption driving both volume and revenue to new heights.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The regional landscape for silicon anode lithium-ion nanobatteries in 2025 is shaped by varying levels of technological advancement, investment, and end-user demand across North America, Europe, Asia-Pacific, and the Rest of the World (RoW).

North America remains a frontrunner, driven by robust R&D ecosystems and significant investments from both public and private sectors. The United States, in particular, benefits from the presence of leading battery manufacturers and automotive giants accelerating the adoption of next-generation batteries for electric vehicles (EVs) and grid storage. Government initiatives, such as those from the U.S. Department of Energy, continue to fund advanced battery research, while partnerships with universities and startups foster innovation. The region’s focus on energy security and decarbonization further propels market growth.

Europe is experiencing rapid expansion, underpinned by stringent emissions regulations and ambitious electrification targets. The European Union’s European Commission has launched several initiatives to localize battery manufacturing and reduce reliance on imports. Countries like Germany, France, and Sweden are home to major battery gigafactories and collaborative projects between automakers and technology firms. The region’s emphasis on sustainability and circular economy principles is also driving research into recyclable silicon anode materials.

Asia-Pacific dominates global production and consumption, led by China, Japan, and South Korea. China, in particular, commands a significant share of the silicon anode lithium-ion nanobattery market, supported by aggressive government policies, a vast EV market, and the presence of industry leaders such as Contemporary Amperex Technology Co. Limited (CATL) and Panasonic Corporation. Japan and South Korea continue to invest in advanced materials and manufacturing processes, with companies like Samsung SDI and Toshiba Corporation at the forefront of innovation. The region’s integrated supply chain and cost advantages make it a global hub for battery technology.

- Rest of World (RoW) includes emerging markets in Latin America, the Middle East, and Africa. While adoption is slower due to infrastructure and investment constraints, these regions are beginning to attract attention for raw material sourcing and as potential future markets for EVs and energy storage solutions.

Overall, regional dynamics in 2025 reflect a blend of policy support, industrial capability, and market demand, with Asia-Pacific leading in scale, North America and Europe focusing on innovation and sustainability, and RoW gradually integrating into the global value chain.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for silicon anode lithium-ion nanobatteries in 2025 is marked by accelerating innovation, expanding application domains, and intensifying investment activity. As the limitations of conventional graphite anodes become more pronounced—particularly in terms of energy density and charging speed—silicon anode nanobatteries are emerging as a transformative solution, attracting significant attention from both established industry players and venture capital.

Emerging Applications

- Electric Vehicles (EVs): The automotive sector is poised to be the largest beneficiary of silicon anode nanobatteries. With the potential to deliver up to 30-40% higher energy density compared to traditional lithium-ion batteries, these advanced cells can extend EV range and reduce charging times. Major automakers and battery suppliers, such as Tesla and Panasonic, are actively piloting silicon anode technologies in next-generation vehicle platforms.

- Consumer Electronics: The demand for longer-lasting, faster-charging batteries in smartphones, laptops, and wearables is driving adoption. Companies like Amprius Technologies have already commercialized silicon nanowire anode batteries for high-performance consumer devices, with further expansion expected in 2025.

- Grid Storage and Renewable Integration: As renewable energy penetration increases, the need for high-capacity, durable storage solutions grows. Silicon anode nanobatteries, with their improved cycle life and energy density, are being evaluated for stationary storage projects by utilities and energy companies such as Siemens Energy.

Investment Hotspots

- North America: The U.S. continues to lead in R&D and commercialization, with significant funding flowing into startups and scale-ups. According to BloombergNEF, venture capital investment in silicon anode battery companies reached record highs in 2024, with expectations of further growth in 2025.

- Asia-Pacific: China, South Korea, and Japan are ramping up pilot production lines and forming strategic partnerships between battery manufacturers and automotive OEMs. Samsung and CATL are notable players investing in silicon anode R&D and manufacturing scale-up.

- Europe: The EU’s focus on battery sovereignty and green mobility is driving public and private investment in advanced battery materials, with initiatives supported by EIT InnoEnergy and the European Battery Alliance.

In summary, 2025 is set to be a pivotal year for silicon anode lithium-ion nanobatteries, with breakthroughs in material science translating into real-world deployments and robust investment across key global regions.

Challenges, Risks, and Strategic Opportunities

Silicon anode lithium-ion nanobatteries represent a significant leap in energy storage technology, promising higher energy density and faster charging compared to conventional graphite-based batteries. However, the path to widespread commercialization in 2025 is marked by a complex landscape of challenges, risks, and strategic opportunities.

Challenges and Risks

- Material Degradation: Silicon anodes undergo significant volumetric expansion (up to 300%) during charge-discharge cycles, leading to particle pulverization, loss of electrical contact, and rapid capacity fading. This remains a primary technical hurdle, as highlighted by Nature Energy.

- Manufacturing Scalability: The integration of nanostructured silicon into commercial-scale battery production is complex and costly. Achieving uniformity and consistency in nanomaterial synthesis and electrode fabrication is a persistent challenge, as noted by IDTechEx.

- Cost Competitiveness: Silicon nanomaterials are more expensive than traditional graphite, both in terms of raw material costs and processing requirements. This impacts the overall cost structure and market adoption, especially in price-sensitive sectors like electric vehicles (EVs).

- Supply Chain Risks: The supply of high-purity silicon and specialized nanomaterials is limited, with potential bottlenecks in sourcing and geopolitical risks affecting global supply chains, as reported by Benchmark Mineral Intelligence.

Strategic Opportunities

- Performance Differentiation: Companies that successfully commercialize durable silicon anode nanobatteries can offer batteries with up to 30-50% higher energy density, enabling longer-range EVs and more compact consumer electronics (Sila Nanotechnologies).

- Partnerships and Licensing: Strategic collaborations between battery manufacturers, automakers, and nanomaterial innovators are accelerating R&D and de-risking scale-up. For example, Amprius Technologies and Group14 Technologies have secured major partnerships with global OEMs.

- Government Incentives: Policy support and funding for advanced battery research, particularly in the US, EU, and China, are creating favorable conditions for innovation and early market entry (U.S. Department of Energy).

- New Market Segments: Beyond EVs, silicon anode nanobatteries are opening opportunities in aerospace, grid storage, and high-performance wearables, where premium performance justifies higher costs (Bain & Company).

In summary, while technical and economic barriers remain, 2025 is poised to be a pivotal year for silicon anode lithium-ion nanobatteries, with strategic moves by industry leaders and supportive policy frameworks shaping the competitive landscape.

Sources & References

- MarketsandMarkets

- IDTechEx

- Amprius Technologies

- Contemporary Amperex Technology Co. Limited (CATL)

- European Commission

- Toshiba Corporation

- Siemens Energy

- BloombergNEF

- EIT InnoEnergy

- Nature Energy

- Benchmark Mineral Intelligence

- Group14 Technologies

- Bain & Company