2025 Silver Nanowire Transparent Electrode Manufacturing Market Report: Growth Drivers, Technology Innovations, and Strategic Forecasts. Explore Key Trends, Regional Insights, and Competitive Analysis for the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Silver Nanowire Transparent Electrodes

- Market Size, Segmentation, and Growth Forecasts (2025–2030)

- Competitive Landscape and Leading Manufacturers

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges, Risks, and Market Entry Barriers

- Opportunities and Strategic Recommendations

- Future Outlook: Emerging Applications and Long-Term Projections

- Sources & References

Executive Summary & Market Overview

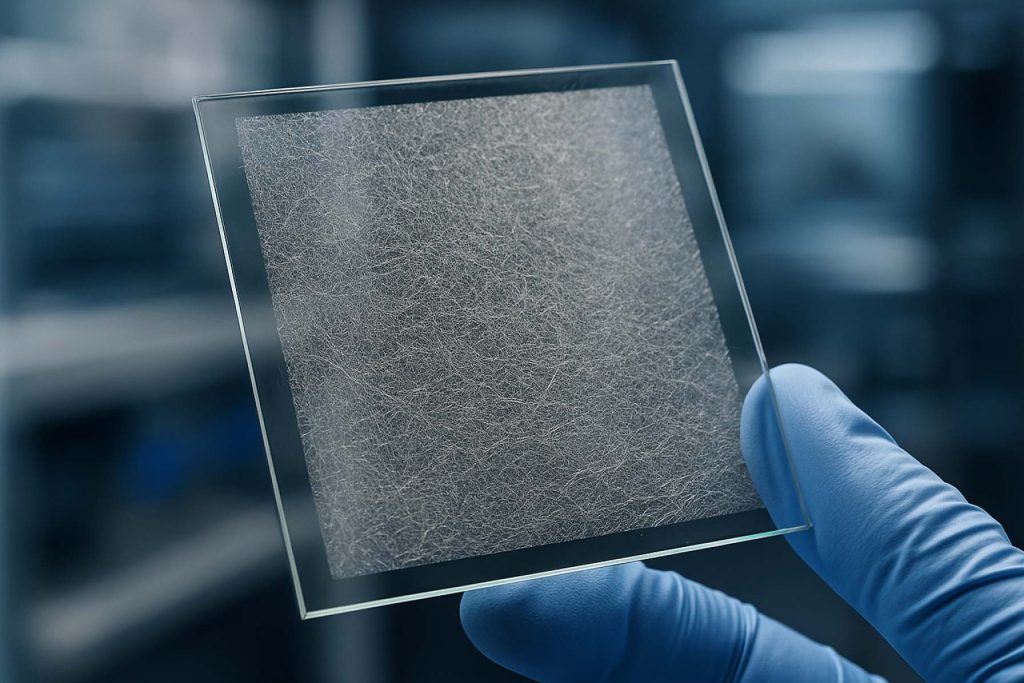

The global market for silver nanowire transparent electrode manufacturing is poised for significant growth in 2025, driven by escalating demand for flexible, lightweight, and highly conductive materials in next-generation electronic devices. Silver nanowire (AgNW) transparent electrodes are rapidly emerging as a preferred alternative to traditional indium tin oxide (ITO) due to their superior flexibility, lower processing temperatures, and cost-effectiveness, especially in applications such as touchscreens, OLED displays, solar cells, and smart windows.

According to recent market analyses, the silver nanowire transparent electrode market is expected to achieve a compound annual growth rate (CAGR) exceeding 20% through 2025, with the Asia-Pacific region leading both production and consumption. This growth is underpinned by robust investments in consumer electronics manufacturing, particularly in China, South Korea, and Japan, where companies are aggressively pursuing innovations in flexible and wearable devices. Key industry players such as Cambrios, Sekisui Chemical, and C3Nano are expanding their production capacities and forming strategic partnerships to secure supply chains and accelerate commercialization.

The market landscape in 2025 is characterized by rapid technological advancements in nanowire synthesis, coating techniques, and substrate integration, which are collectively reducing production costs and improving electrode performance. Notably, silver nanowire electrodes are increasingly being adopted in large-area and curved display panels, where traditional ITO faces limitations in flexibility and mechanical durability. Furthermore, the push for sustainable and recyclable materials in electronics manufacturing is bolstering the adoption of AgNW-based solutions, as they offer lower environmental impact compared to rare-metal-based alternatives.

Despite these positive trends, the industry faces challenges related to the long-term stability of silver nanowires, potential oxidation, and the need for scalable, defect-free manufacturing processes. Ongoing research and development efforts, supported by organizations such as IDTechEx and MarketsandMarkets, are focused on addressing these technical barriers and unlocking new application areas.

In summary, the silver nanowire transparent electrode manufacturing market in 2025 is set for robust expansion, fueled by technological innovation, expanding end-use applications, and a favorable shift toward flexible electronics. Market participants are expected to benefit from continued investment in R&D, strategic collaborations, and the growing emphasis on sustainable materials in the electronics sector.

Key Technology Trends in Silver Nanowire Transparent Electrodes

Silver nanowire (AgNW) transparent electrode manufacturing is undergoing rapid technological evolution in 2025, driven by the demand for flexible, lightweight, and highly conductive alternatives to traditional indium tin oxide (ITO) electrodes. Key technology trends are shaping the production landscape, focusing on scalability, cost reduction, and performance enhancement.

Roll-to-Roll (R2R) Processing: One of the most significant advancements is the adoption of roll-to-roll manufacturing techniques. R2R enables continuous, high-throughput production of AgNW films on flexible substrates, significantly reducing unit costs and supporting large-area applications such as touch panels, OLED displays, and solar cells. Companies like Nitto Denko Corporation and C3Nano are leveraging R2R to scale up production while maintaining uniformity and transparency.

Ink Formulation and Coating Methods: Innovations in silver nanowire ink formulations are improving dispersion stability, viscosity control, and compatibility with various substrates. Advanced coating methods, including slot-die, spray, and gravure printing, are being optimized for precise nanowire alignment and density control, which are critical for achieving high optical transmittance and low sheet resistance. DuPont and Heliospectra are among the industry players investing in next-generation ink and coating technologies.

- Post-Processing Techniques: Thermal annealing, photonic sintering, and plasma treatments are being refined to enhance nanowire junction conductivity and adhesion to substrates. These processes are crucial for improving mechanical durability and environmental stability, especially for flexible and wearable electronics.

- Hybrid and Composite Structures: Manufacturers are increasingly integrating AgNWs with other materials, such as graphene, conductive polymers, or metal oxides, to overcome limitations like haze and surface roughness. These hybrid electrodes offer a balance between conductivity, transparency, and flexibility, expanding their applicability in next-generation optoelectronic devices.

- Environmental and Cost Considerations: Efforts to reduce silver consumption through nanowire diameter optimization and recycling processes are gaining traction, addressing both cost and sustainability concerns. The use of greener solvents and low-temperature processing further aligns with global environmental standards.

As these manufacturing trends mature, the silver nanowire transparent electrode market is poised for robust growth, with industry analysts projecting a CAGR exceeding 20% through 2025, according to MarketsandMarkets and IDTechEx.

Market Size, Segmentation, and Growth Forecasts (2025–2030)

The global market for silver nanowire transparent electrode manufacturing is poised for robust growth between 2025 and 2030, driven by surging demand in consumer electronics, photovoltaics, and flexible display technologies. In 2025, the market size is projected to reach approximately USD 650 million, with a compound annual growth rate (CAGR) estimated at 17–20% through 2030, according to recent analyses by MarketsandMarkets and Grand View Research.

Segmentation

- By Application: The largest segment is consumer electronics, particularly touchscreens for smartphones, tablets, and wearables, accounting for over 45% of total demand in 2025. Photovoltaics (solar cells) and OLED lighting are rapidly growing segments, together expected to comprise nearly 30% of the market. Other applications include sensors, smart windows, and transparent heaters.

- By Substrate Type: PET (polyethylene terephthalate) and glass are the dominant substrates, with PET favored for flexible and wearable devices. PET-based electrodes are projected to grow at a CAGR above 20% due to the proliferation of flexible electronics.

- By Region: Asia-Pacific leads the market, driven by manufacturing hubs in China, South Korea, and Japan, collectively accounting for over 60% of global production in 2025. North America and Europe follow, with increasing investments in advanced display and solar technologies.

Growth Drivers and Forecasts (2025–2030)

- Rising adoption of flexible and foldable displays in consumer electronics is a primary growth catalyst, as silver nanowire electrodes offer superior flexibility and conductivity compared to traditional ITO (indium tin oxide).

- Expansion of the solar energy sector, particularly in building-integrated photovoltaics (BIPV), is expected to boost demand for transparent electrodes with high optical transmittance and low sheet resistance.

- Ongoing R&D and cost reductions in silver nanowire synthesis and coating processes are anticipated to further accelerate market penetration, making the technology more accessible for mid-tier device manufacturers.

By 2030, the market is forecast to surpass USD 1.4 billion, with Asia-Pacific maintaining its dominance and new entrants from North America and Europe increasing competition. The market’s trajectory will be shaped by technological advancements, price competitiveness, and the pace of adoption in emerging applications such as smart windows and next-generation sensors (IDTechEx).

Competitive Landscape and Leading Manufacturers

The competitive landscape of the silver nanowire transparent electrode manufacturing market in 2025 is characterized by a mix of established material science companies, innovative startups, and regional players, all vying for market share in applications such as touchscreens, OLED lighting, flexible displays, and photovoltaics. The market is driven by the growing demand for flexible, lightweight, and highly conductive transparent electrodes as alternatives to indium tin oxide (ITO), which faces supply and flexibility limitations.

Leading manufacturers in this sector include Cambrios, widely recognized for its pioneering work in silver nanowire technology and its ClearOhm® product line, which is used in touch panels and flexible displays. C3Nano is another major player, leveraging its proprietary NanoGlue™ technology to enhance conductivity and mechanical robustness, securing partnerships with display and electronics manufacturers globally. Nanopyxis from South Korea has also gained traction, particularly in the Asian market, by supplying high-quality silver nanowire inks for large-area applications.

Other notable companies include Seashell Technology, which focuses on scalable production methods, and Blue Nano, which targets cost-effective synthesis for mass-market adoption. In China, C3Nano and Nanjing Tech are expanding their manufacturing capacities to meet domestic and international demand, supported by government initiatives to localize advanced material supply chains.

The competitive dynamics are shaped by several factors:

- Technological Innovation: Companies are investing in R&D to improve nanowire uniformity, reduce haze, and enhance adhesion to flexible substrates, which are critical for next-generation electronics.

- Strategic Partnerships: Collaborations with display panel manufacturers and consumer electronics brands are common, as seen in Cambrios’s alliances with Asian OEMs.

- Cost Competitiveness: Reducing silver content and optimizing synthesis processes are key to lowering production costs and competing with ITO and other alternatives.

- Geographic Expansion: Asian manufacturers, particularly in China and South Korea, are increasing their global footprint through exports and joint ventures.

According to MarketsandMarkets, the silver nanowire transparent electrode market is expected to grow at a double-digit CAGR through 2025, with leading manufacturers focusing on scaling up production and securing supply chains to address the surging demand in flexible electronics and renewable energy sectors.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The regional landscape for silver nanowire transparent electrode manufacturing in 2025 is shaped by varying levels of technological advancement, investment, and end-user demand across North America, Europe, Asia-Pacific, and the Rest of the World (RoW).

- North America: The region, led by the United States, remains a hub for R&D and early-stage commercialization of silver nanowire transparent electrodes. Key drivers include robust investments in flexible electronics, touch panels, and next-generation display technologies. Strategic collaborations between research institutions and industry players, such as those fostered by the National Science Foundation, have accelerated innovation. However, large-scale manufacturing is often limited by higher production costs and regulatory scrutiny regarding nanomaterials.

- Europe: Europe’s market is characterized by a strong emphasis on sustainability and regulatory compliance. Countries like Germany and the Netherlands are at the forefront, leveraging their advanced materials sectors and stringent environmental standards. The European Commission has supported several initiatives to integrate silver nanowire electrodes into energy-efficient devices, such as OLED lighting and solar cells. Despite a slower pace of commercialization compared to Asia-Pacific, Europe’s focus on quality and eco-friendly processes is fostering steady growth.

- Asia-Pacific: Asia-Pacific dominates global manufacturing, with China, South Korea, and Japan leading in both capacity and innovation. The region benefits from a well-established electronics supply chain, cost-effective production, and strong government support for advanced materials. Major electronics manufacturers, including Samsung Electronics and LG Electronics, are actively integrating silver nanowire transparent electrodes into displays, touchscreens, and wearable devices. According to MarketsandMarkets, Asia-Pacific is expected to account for the largest share of the market in 2025, driven by high-volume consumer electronics production and rapid adoption of flexible devices.

- Rest of World (RoW): In regions such as Latin America, the Middle East, and Africa, adoption remains nascent. Market growth is constrained by limited local manufacturing capabilities and lower R&D investment. However, increasing demand for advanced electronics and renewable energy solutions is prompting gradual interest, with some countries exploring partnerships with established players from Asia and Europe to access silver nanowire technology.

Overall, while Asia-Pacific leads in manufacturing scale and market share, North America and Europe continue to drive innovation and regulatory standards, shaping the global trajectory of silver nanowire transparent electrode manufacturing in 2025.

Challenges, Risks, and Market Entry Barriers

The manufacturing of silver nanowire (AgNW) transparent electrodes faces a complex array of challenges, risks, and market entry barriers that are expected to persist into 2025. These factors significantly influence the competitive landscape and the pace of technology adoption in applications such as touchscreens, OLED displays, photovoltaics, and flexible electronics.

- Technical Challenges: Achieving uniform dispersion and alignment of silver nanowires on substrates remains a critical hurdle. Variations in nanowire length, diameter, and surface chemistry can lead to inconsistent optical transmittance and sheet resistance, impacting device performance. Additionally, issues such as haze, surface roughness, and junction resistance between nanowires can degrade the quality of the final electrode, limiting its suitability for high-end applications (IDTechEx).

- Material Costs and Supply Chain Risks: Silver is a precious metal with price volatility, and the high purity required for nanowire synthesis further elevates costs. Fluctuations in silver prices can directly impact the profitability of AgNW electrode manufacturing. Moreover, the supply chain for high-quality silver nanowires is still maturing, with a limited number of reliable suppliers, increasing the risk of bottlenecks and quality inconsistencies (MarketsandMarkets).

- Scalability and Process Integration: Scaling up from laboratory to industrial-scale production without compromising performance is a significant barrier. Roll-to-roll coating and printing techniques require precise control to ensure reproducibility and yield. Integrating AgNW electrodes into existing device manufacturing lines, which are often optimized for indium tin oxide (ITO), can necessitate costly equipment upgrades and process modifications (Grand View Research).

- Regulatory and Environmental Risks: The use of nanomaterials raises regulatory scrutiny regarding worker safety and environmental impact. Disposal and recycling of silver nanowire-containing products are not yet standardized, potentially leading to compliance risks as environmental regulations tighten globally (OECD).

- Market Acceptance and Competition: ITO remains the dominant transparent electrode material, with established supply chains and proven performance. Competing with ITO and emerging alternatives such as graphene and conductive polymers requires AgNW manufacturers to demonstrate clear advantages in cost, flexibility, and durability, which is challenging given current technical and economic constraints (FlexTech Alliance).

These challenges collectively create high entry barriers for new players and slow the broader commercialization of silver nanowire transparent electrodes, despite their promising properties for next-generation optoelectronic devices.

Opportunities and Strategic Recommendations

The silver nanowire (AgNW) transparent electrode manufacturing sector is poised for significant growth in 2025, driven by expanding applications in flexible displays, touch panels, photovoltaics, and smart windows. As the demand for high-performance, flexible, and cost-effective transparent conductors intensifies, several opportunities and strategic recommendations emerge for stakeholders in this market.

- Expansion into Flexible Electronics: The proliferation of foldable smartphones, wearable devices, and flexible OLED displays is accelerating the need for transparent electrodes that combine high conductivity with mechanical flexibility. Manufacturers should prioritize R&D investments in scalable, roll-to-roll production techniques to meet the volume and quality requirements of consumer electronics OEMs. Collaborations with display manufacturers such as Samsung Display and LG Display can facilitate early adoption and co-development of next-generation products.

- Cost Optimization and Material Innovation: While AgNW electrodes offer superior performance over indium tin oxide (ITO), cost competitiveness remains a challenge. Strategic sourcing of silver, process optimization, and the development of hybrid materials (e.g., AgNW-graphene composites) can reduce material costs and improve margins. Partnerships with material suppliers and research institutions, such as DuPont and BASF, are recommended to accelerate innovation.

- Market Diversification: Beyond consumer electronics, AgNW transparent electrodes are gaining traction in solar cells, smart windows, and automotive applications. Targeting emerging sectors—such as building-integrated photovoltaics and automotive HUDs—can diversify revenue streams and reduce dependence on cyclical electronics markets. Engaging with companies like First Solar and Saint-Gobain can open new channels for technology deployment.

- Regulatory and Sustainability Considerations: With increasing scrutiny on material sustainability and end-of-life recycling, manufacturers should invest in eco-friendly production processes and transparent supply chains. Adhering to evolving regulations in key markets (e.g., EU’s REACH) and obtaining relevant certifications can enhance brand reputation and market access.

In summary, the 2025 landscape for silver nanowire transparent electrode manufacturing is rich with opportunity, provided companies focus on technological innovation, cost reduction, market expansion, and sustainability. Strategic alliances and proactive engagement with downstream industries will be critical for capturing market share and driving long-term growth, as highlighted in recent analyses by IDTechEx and MarketsandMarkets.

Future Outlook: Emerging Applications and Long-Term Projections

The future outlook for silver nanowire (AgNW) transparent electrode manufacturing in 2025 is shaped by rapid advancements in flexible electronics, display technologies, and energy devices. As the limitations of indium tin oxide (ITO) become more pronounced—particularly its brittleness and supply constraints—AgNW-based electrodes are increasingly positioned as a viable alternative for next-generation applications.

Emerging applications are expected to drive significant demand for AgNW transparent electrodes. Flexible and foldable displays, wearable electronics, and touch panels are at the forefront, leveraging the superior flexibility, conductivity, and optical transparency of AgNW films. The proliferation of smart devices and the Internet of Things (IoT) is further accelerating the need for robust, flexible, and scalable transparent conductors. In photovoltaics, AgNW electrodes are being integrated into perovskite and organic solar cells, where their mechanical flexibility and high transmittance can enhance device efficiency and enable novel form factors such as building-integrated photovoltaics and portable solar chargers IDTechEx.

From a manufacturing perspective, 2025 will see continued innovation in scalable, cost-effective production methods. Roll-to-roll (R2R) processing, inkjet printing, and spray coating are being refined to improve uniformity, reduce material wastage, and lower production costs. These advances are critical for meeting the volume and price requirements of consumer electronics and large-area applications such as smart windows and automotive displays MarketsandMarkets.

Long-term projections indicate robust market growth, with the global AgNW transparent electrode market expected to expand at a double-digit CAGR through the end of the decade. Strategic partnerships between material suppliers, device manufacturers, and research institutions are anticipated to accelerate commercialization and address technical challenges such as haze, adhesion, and long-term stability. Regulatory trends favoring sustainable and recyclable materials may also boost adoption, as AgNW electrodes can be processed at lower temperatures and are compatible with flexible substrates Grand View Research.

- Key growth sectors: flexible displays, wearable devices, solar cells, smart windows

- Manufacturing focus: scalable R2R processes, printable inks, cost reduction

- Challenges: optical haze, durability, supply chain integration

- Opportunities: eco-friendly electronics, next-gen automotive interfaces, IoT expansion

Sources & References

- Sekisui Chemical

- IDTechEx

- MarketsandMarkets

- DuPont

- Heliospectra

- Grand View Research

- Nanjing Tech

- National Science Foundation

- European Commission

- LG Electronics

- Samsung Display

- LG Display

- BASF

- First Solar