Spintronic Memory Devices Market Report 2025: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Opportunities. Explore Market Size, Key Players, and Strategic Forecasts for the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Spintronic Memory Devices

- Competitive Landscape and Leading Players

- Market Growth Forecasts and CAGR Analysis (2025–2030)

- Regional Market Analysis and Emerging Hotspots

- Future Outlook: Innovations and Strategic Roadmap

- Challenges, Risks, and Emerging Opportunities

- Sources & References

Executive Summary & Market Overview

Spintronic memory devices represent a transformative segment within the broader non-volatile memory (NVM) market, leveraging the intrinsic spin of electrons, in addition to their charge, to store and process information. This technology underpins several advanced memory solutions, most notably Magnetoresistive Random Access Memory (MRAM), which is gaining traction as a next-generation alternative to traditional memory technologies such as DRAM and Flash. The global spintronic memory devices market is poised for robust growth in 2025, driven by escalating demand for faster, more energy-efficient, and highly durable memory solutions across data centers, consumer electronics, automotive, and industrial automation sectors.

According to Gartner, the proliferation of data-intensive applications and the rise of edge computing are accelerating the adoption of spintronic memory, particularly MRAM, due to its superior endurance, low latency, and non-volatility. The market is further buoyed by the increasing integration of MRAM in embedded systems and microcontrollers, as reported by IDC. In 2025, the global spintronic memory devices market is projected to surpass USD 2.5 billion, with a compound annual growth rate (CAGR) exceeding 30% through the end of the decade, according to MarketsandMarkets.

Key industry players such as Samsung Electronics, Toshiba Corporation, and Everspin Technologies are intensifying their R&D investments to enhance device scalability, reduce power consumption, and improve write/read speeds. Strategic collaborations between semiconductor foundries and memory device manufacturers are also accelerating commercialization and mass production, as highlighted by SEMI.

- Data center modernization and AI/ML workloads are driving demand for high-performance, persistent memory.

- Automotive applications, especially in advanced driver-assistance systems (ADAS), are adopting MRAM for its reliability and endurance under harsh conditions.

- Consumer electronics are integrating spintronic memory to enable instant-on functionality and longer battery life.

Despite these opportunities, challenges such as high manufacturing costs and integration complexities with existing CMOS processes persist. However, ongoing advancements in materials science and fabrication techniques are expected to mitigate these barriers, positioning spintronic memory devices as a pivotal technology in the evolving memory landscape in 2025 and beyond.

Key Technology Trends in Spintronic Memory Devices

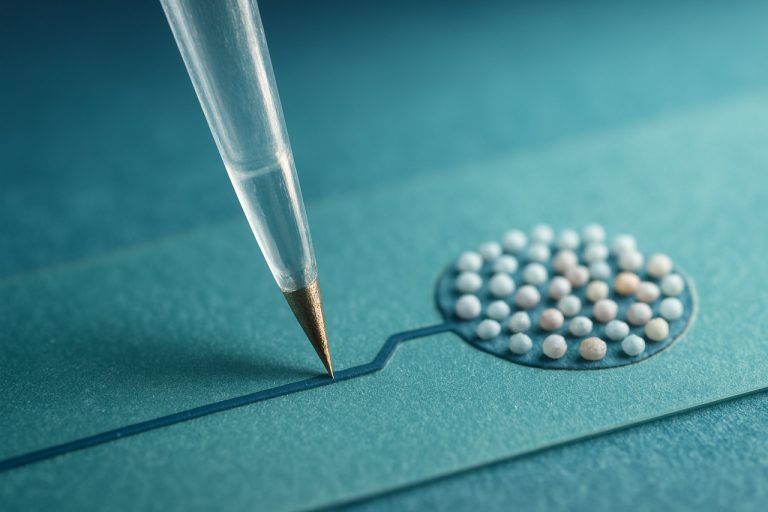

Spintronic memory devices, leveraging the intrinsic spin of electrons alongside their charge, are at the forefront of next-generation non-volatile memory technologies. As of 2025, several key technology trends are shaping the evolution and commercialization of these devices, particularly in the context of Magnetic Random Access Memory (MRAM), Spin-Transfer Torque MRAM (STT-MRAM), and emerging variants such as Voltage-Controlled MRAM (VC-MRAM) and Racetrack Memory.

- Scaling and Integration: The push for higher density and lower power consumption is driving the miniaturization of spintronic memory cells. Advanced lithography and materials engineering are enabling sub-20nm MRAM cells, making them increasingly competitive with traditional SRAM and DRAM in embedded and standalone applications. Major semiconductor foundries, such as TSMC and Samsung Electronics, are integrating MRAM into their advanced process nodes, facilitating broader adoption in system-on-chip (SoC) designs.

- Endurance and Reliability Improvements: Recent advances in tunnel barrier materials and interface engineering have significantly enhanced the endurance of spintronic memory devices, with some STT-MRAM products now exceeding 1012 write cycles. This positions them as strong candidates for cache memory and storage-class memory, where endurance is critical (GlobalFoundries).

- Voltage-Controlled and SOT-MRAM: Voltage-Controlled MRAM (VC-MRAM) and Spin-Orbit Torque MRAM (SOT-MRAM) are emerging as promising alternatives to conventional STT-MRAM. VC-MRAM offers ultra-low switching energy, while SOT-MRAM enables faster write speeds and improved endurance by separating read and write current paths. Companies like Crocus Technology and Everspin Technologies are actively developing these next-generation devices.

- 3D Integration and Stacking: To further boost density and performance, research is advancing toward 3D stacking of spintronic memory layers. This approach, analogous to 3D NAND, could enable terabit-scale non-volatile memory solutions (imec).

- AI and Edge Computing Applications: The non-volatility, speed, and endurance of spintronic memory devices are increasingly attractive for AI accelerators and edge computing platforms, where instant-on capability and low standby power are essential (IBM).

These trends underscore the rapid maturation of spintronic memory technologies, positioning them as pivotal enablers for future computing architectures in 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape for spintronic memory devices in 2025 is characterized by a dynamic mix of established semiconductor giants, specialized memory technology firms, and emerging startups. The market is primarily driven by the increasing demand for high-speed, energy-efficient, and non-volatile memory solutions, with spin-transfer torque magnetic random-access memory (STT-MRAM) and other spintronic-based technologies gaining traction in both enterprise and consumer electronics sectors.

Leading the market are companies such as Samsung Electronics and Toshiba Corporation, both of which have made significant investments in the research, development, and commercialization of MRAM technologies. Samsung, in particular, has leveraged its advanced fabrication capabilities to integrate MRAM into its memory product portfolio, targeting applications in automotive, industrial, and data center markets. Toshiba, meanwhile, continues to focus on the development of next-generation spintronic memory for embedded systems.

Another key player is Everspin Technologies, recognized as a pioneer in commercial MRAM products. Everspin’s discrete and embedded MRAM solutions are widely adopted in industrial automation, aerospace, and enterprise storage, and the company has established strategic partnerships with foundries and system integrators to expand its market reach. Intel Corporation and GlobalFoundries are also active in the spintronic memory space, with collaborative efforts to develop scalable MRAM processes for integration into advanced logic and memory chips.

Startups and research-driven firms such as Crocus Technology and Spin Memory are contributing to the competitive landscape by introducing innovative architectures and materials aimed at improving endurance, density, and switching speeds. These companies often collaborate with academic institutions and leverage government-funded research programs to accelerate technology transfer and commercialization.

The competitive environment is further shaped by ongoing patent activity, joint ventures, and mergers and acquisitions, as companies seek to secure intellectual property and expand their technological capabilities. The presence of a robust ecosystem of equipment suppliers, foundries, and research consortia—such as imec—also supports rapid innovation and market adoption. As the market matures, differentiation is increasingly based on scalability, integration with existing CMOS processes, and the ability to meet the stringent reliability requirements of automotive and industrial applications.

Market Growth Forecasts and CAGR Analysis (2025–2030)

The global spintronic memory devices market is poised for robust growth between 2025 and 2030, driven by increasing demand for high-speed, energy-efficient, and non-volatile memory solutions across data centers, consumer electronics, and automotive applications. According to recent projections, the market is expected to register a compound annual growth rate (CAGR) ranging from 28% to 35% during this period, reflecting both technological advancements and expanding commercial adoption.

Key drivers underpinning this growth include the rapid proliferation of artificial intelligence (AI) and Internet of Things (IoT) devices, which require memory solutions with faster read/write speeds and lower power consumption. Spintronic memory devices, such as Magnetoresistive Random Access Memory (MRAM), are increasingly favored over traditional memory technologies due to their superior endurance and scalability. Industry leaders like Samsung Electronics and Toshiba Corporation have accelerated investments in MRAM production, signaling confidence in the technology’s commercial viability.

- Data Center Expansion: The exponential growth of cloud computing and edge data centers is expected to be a major catalyst, as spintronic memory devices offer significant improvements in data retention and energy efficiency compared to conventional DRAM and NAND flash memory.

- Automotive Electronics: The automotive sector, particularly in advanced driver-assistance systems (ADAS) and electric vehicles (EVs), is projected to be a high-growth segment for spintronic memory, given its resilience to harsh environments and ability to retain data without power.

- Consumer Electronics: The integration of MRAM in smartphones, wearables, and other portable devices is anticipated to accelerate, as manufacturers seek to enhance device performance and battery life.

Regionally, Asia-Pacific is forecasted to dominate the market, accounting for the largest share by 2030, propelled by the presence of major semiconductor foundries and aggressive government initiatives supporting next-generation memory technologies. North America and Europe are also expected to witness significant growth, driven by R&D investments and early adoption in enterprise and automotive sectors (MarketsandMarkets).

In summary, the spintronic memory devices market is set for exponential expansion from 2025 to 2030, with a high CAGR reflecting both technological maturation and broadening end-use applications. Strategic partnerships, increased production capacity, and ongoing innovation will be critical in shaping the competitive landscape during this forecast period (Global Market Insights).

Regional Market Analysis and Emerging Hotspots

The global market for spintronic memory devices is witnessing dynamic regional shifts, with certain geographies emerging as key growth hotspots in 2025. Asia-Pacific continues to dominate both production and consumption, driven by robust investments in semiconductor manufacturing and aggressive R&D initiatives. Countries such as China, Japan, and South Korea are at the forefront, leveraging their established electronics industries and government-backed innovation programs. For instance, Japan’s focus on next-generation memory technologies and South Korea’s leadership in DRAM and NAND flash manufacturing are accelerating the adoption of spintronic solutions, particularly in data centers and consumer electronics Statista.

North America remains a significant market, propelled by the presence of major technology firms and a strong emphasis on data security and high-performance computing. The United States, in particular, is fostering advancements through collaborations between leading universities and semiconductor companies, as well as through government funding for quantum and spintronic research. The region’s demand is further amplified by the rapid expansion of cloud infrastructure and AI-driven applications, which require faster, more energy-efficient memory solutions SEMI.

Europe is emerging as a strategic player, with the European Union’s initiatives to bolster semiconductor sovereignty and reduce reliance on imports. Countries like Germany and France are investing in pilot lines and research consortia focused on MRAM (Magnetoresistive Random Access Memory) and other spintronic devices. The region’s automotive and industrial automation sectors are also driving demand, as spintronic memory offers enhanced reliability and endurance for embedded applications European Commission.

- Asia-Pacific: Largest and fastest-growing market, with China, Japan, and South Korea as innovation leaders.

- North America: Strong R&D ecosystem and high adoption in data-intensive sectors.

- Europe: Strategic investments in semiconductor independence and industrial applications.

Emerging hotspots include India and Taiwan, where government incentives and expanding electronics manufacturing are fostering new opportunities. As global supply chains evolve and demand for high-performance memory intensifies, these regions are expected to play increasingly pivotal roles in the spintronic memory device landscape through 2025 and beyond McKinsey & Company.

Future Outlook: Innovations and Strategic Roadmap

The future outlook for spintronic memory devices in 2025 is shaped by rapid innovation and a strategic focus on overcoming current technological bottlenecks. Spintronic memory, particularly Magnetoresistive Random Access Memory (MRAM), is positioned as a next-generation non-volatile memory technology, offering high speed, endurance, and low power consumption. As the semiconductor industry faces scaling limitations with traditional memory, spintronic solutions are gaining traction in both research and commercial sectors.

Key innovations expected in 2025 include the commercialization of advanced MRAM variants such as Spin-Transfer Torque MRAM (STT-MRAM) and Spin-Orbit Torque MRAM (SOT-MRAM). These technologies promise faster write speeds and improved scalability, making them suitable for embedded applications in automotive, industrial IoT, and data centers. Major semiconductor companies like Samsung Electronics and TSMC are investing in integrating MRAM into their advanced process nodes, targeting sub-28nm geometries for system-on-chip (SoC) solutions.

Strategically, the roadmap for spintronic memory devices involves:

- Scaling and Integration: Efforts are underway to integrate MRAM into mainstream CMOS processes, enabling broader adoption in consumer electronics and enterprise storage. GlobalFoundries and Intel are actively developing embedded MRAM (eMRAM) for use in microcontrollers and edge devices.

- Endurance and Reliability: Research is focused on enhancing the endurance of spintronic memories, with targets exceeding 1012 write cycles, making them viable for high-write environments such as AI accelerators and automotive ECUs.

- Energy Efficiency: Innovations in material science, such as the use of perpendicular magnetic anisotropy (PMA) and novel tunnel barrier materials, are expected to further reduce switching energy, aligning with the industry’s push for greener electronics.

- New Architectures: The development of neuromorphic and in-memory computing architectures leveraging spintronic devices is anticipated, with research institutions and companies like IBM exploring these frontiers for AI and machine learning workloads.

According to MarketsandMarkets, the global MRAM market is projected to grow at a CAGR of over 30% through 2025, driven by these technological advancements and strategic partnerships across the value chain. The convergence of spintronics with advanced logic and memory architectures is set to redefine the competitive landscape, positioning spintronic memory as a cornerstone of future computing platforms.

Challenges, Risks, and Emerging Opportunities

Spintronic memory devices, such as Magnetoresistive Random Access Memory (MRAM), are at the forefront of next-generation data storage solutions, offering non-volatility, high speed, and endurance. However, the sector faces several challenges and risks that could impact its widespread adoption, while also presenting emerging opportunities for innovation and market growth in 2025.

One of the primary challenges is the high manufacturing cost associated with spintronic memory devices. The integration of complex magnetic tunnel junctions (MTJs) and the need for advanced lithography processes increase production expenses compared to conventional memory technologies. This cost barrier limits the competitiveness of spintronic memory in price-sensitive markets, particularly in consumer electronics. Additionally, scaling down device dimensions to meet the demands of high-density memory applications introduces issues related to thermal stability and retention, as smaller magnetic elements are more susceptible to thermal fluctuations, potentially leading to data loss or reduced reliability.

Another significant risk is the technological competition from established and emerging memory technologies, such as Dynamic Random Access Memory (DRAM), NAND flash, and Resistive RAM (ReRAM). These alternatives continue to evolve, offering improvements in speed, density, and cost-effectiveness, which could delay or diminish the adoption of spintronic solutions. Furthermore, the lack of standardized manufacturing processes and design architectures for spintronic devices poses interoperability and integration challenges for system designers and OEMs.

Despite these hurdles, several emerging opportunities are shaping the future of spintronic memory devices. The growing demand for energy-efficient and high-endurance memory in data centers, edge computing, and automotive electronics is driving interest in MRAM and related technologies. Spintronic memory’s inherent non-volatility and fast switching capabilities make it an attractive candidate for replacing or complementing SRAM and DRAM in cache and embedded applications. Moreover, ongoing research into voltage-controlled magnetic anisotropy and spin-orbit torque mechanisms promises to further reduce power consumption and enhance scalability, opening new avenues for innovation.

Strategic partnerships between semiconductor manufacturers and research institutions are accelerating the commercialization of spintronic memory. For example, collaborations between Samsung Electronics, TSMC, and academic entities are fostering advancements in process technology and device architecture. As the ecosystem matures, the development of industry standards and improved fabrication techniques are expected to mitigate current risks and unlock broader market opportunities by 2025 MarketsandMarkets.

Sources & References

- IDC

- MarketsandMarkets

- Toshiba Corporation

- Everspin Technologies

- Crocus Technology

- imec

- IBM

- Global Market Insights

- Statista

- European Commission

- McKinsey & Company