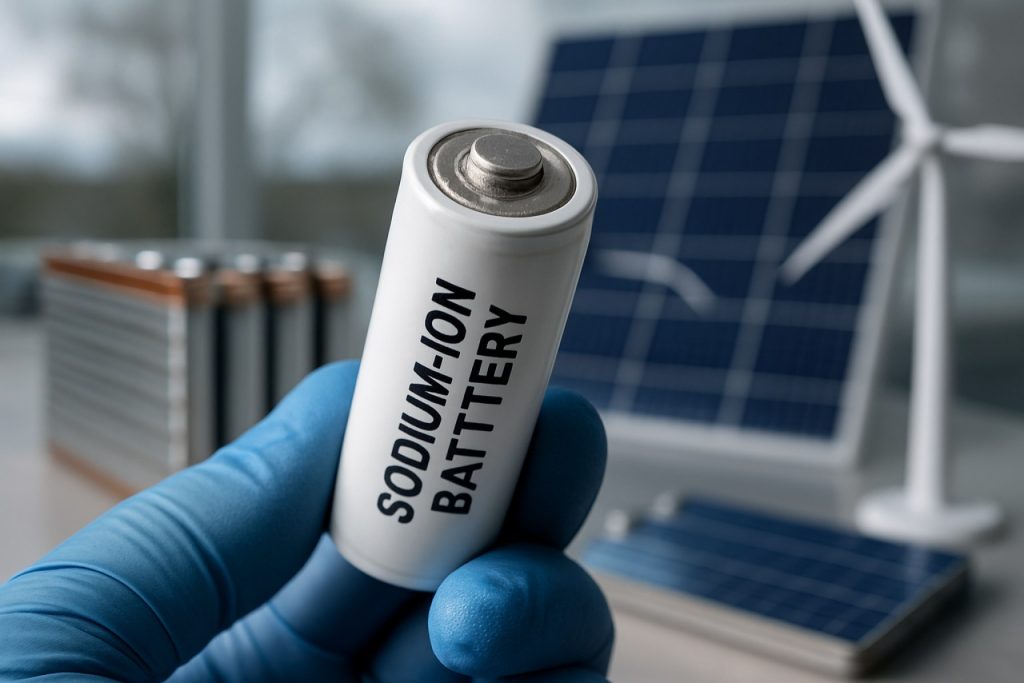

- Sodium-ion batteries are emerging as a promising alternative to lithium-ion, thanks to sodium’s abundance, low cost, and safety.

- This technology is ideal for large-scale energy storage, remote communities, and disaster-prone areas, delivering reliable power across varying temperatures.

- Global momentum is accelerating, with major investments and new products by leading companies in China, the U.S., Europe, and India.

- Hybrid battery systems, combining sodium-ion and lithium-ion, optimize performance and cost for grid storage and commercial use.

- Sodium-ion batteries support grid expansion, energy security, and decarbonization—reducing dependence on scarce critical minerals.

- The market is projected to more than double by 2030, making sodium-ion batteries increasingly essential in the clean energy transition.

Vast stretches of desert glare beneath the sun, wind turbines arc over rolling plains—and everywhere, the electricity flows. Yet storing that green power for days and nights, storms and calm, remains an urgent quest for a planet eager to decarbonize. Now, an unlikely challenger has stepped onto the global stage: the humble sodium-ion battery.

A New Contender Emerges

Lithium-ion batteries have long reigned supreme in everything from smartphones to electric vehicles. But as the world races to electrify, the strain on lithium supply chains is beginning to show. That’s where sodium—a common element found in table salt, seawater, and vast mineral beds—offers fresh promise. Market analysts project the sodium-ion battery sector to more than double in value, leaping to nearly $915 million by 2030 with a robust 16.3% annual growth rate.

Why Sodium? Think Abundance and Affordability

Sodium’s allure goes far beyond its sheer availability. These batteries are safe, robust, and efficient—qualities that make them especially appealing for large-scale storage. Remote villages, island microgrids, and disaster-prone regions all stand to benefit from resilient energy systems powered by sodium. Because the chemistry operates efficiently in a wide range of temperatures and minimizes fire hazards, even rural health clinics and schools can tap into reliable, sustainable power.

A Technological Turning Point

Recent years have witnessed a surge in innovation. Chinese battery giant CATL ignited industry buzz with the Freevoy Super Hybrid—a battery boasting a 400-kilometer pure electric range and ultra-fast charging, tailored for hybrid vehicles. In the U.S., sodium-ion pioneers like Natron Energy are pouring billions into production facilities, laying down blueprints for gigawatt-scale output that could supply grids, factories, and fleets.

Meanwhile, companies like BMZ Group in Germany are rolling out sodium-ion products that cater to industrial and niche uses where energy density takes a back seat to durability and value. This global momentum, coupled with supportive policies in the U.S., Europe, and China, is propelling sodium tech from labs and pilot projects into the real world.

The Rise of Hybrid Battery Systems

A bold new chapter is being written with hybrid battery architectures. By pairing sodium-ion cells with traditional lithium-ion modules, grid operators can harness the strength of both: lithium for rapid energy bursts; sodium for slow, steady backup. This harmony slashes overall costs and boosts resilience, opening the door to broader adoption in utility-scale storage, microgrids, and commercial buildings.

Grid Expansion and Green Goals

Globally, nations are jostling for leadership. North America is increasing investments into grid modernization and homegrown battery innovation. China surges ahead with scale and manufacturing might, while Europe—fueled by circular economy principles and green tech incentives—drives research and builds eco-conscious supply chains. In these diverse landscapes, sodium-ion’s flexibility gives it an edge in supporting local energy transitions and reducing reliance on critical minerals.

Major Players and Market Outlook

Well-funded startups and battery titans alike are racing to dominate this emerging market, from Faradion and AMTE Power in the UK to Sweden’s Altris AB, India’s Indi Energy, and global force CATL. Through joint ventures, breakthrough products, and ever-widening applications, they’re pushing sodium-ion from alternative to essential.

What’s Next?

The sodium-ion revolution signals more than just another iteration in battery chemistry—it’s a reimagining of how the world stores and delivers clean energy. As the market swells, the technology will expand across sectors: powering the renewable grid, electrifying transport, safeguarding critical infrastructure, and lighting up communities at the margins.

The Takeaway: In a world hungry for affordable, sustainable solutions, sodium-ion batteries are poised to become a pillar of tomorrow’s decarbonized energy landscape—proving that, sometimes, the most transformative innovation begins with the stuff beneath our feet.

Explore breakthroughs in energy and more at Bloomberg and global news from Reuters.

The Surprising Battery Revolution: 15 Sodium-Ion Secrets That Could Outshine Lithium-Ion

# Sodium-Ion Batteries: The Game-Changer You Need to Know About

Sodium-ion batteries are rapidly transforming from a scientific curiosity to an energy sector disruptor. While the source article highlighted the growing promise of sodium-ion technology amid global decarbonization efforts, there are additional facts, nuances, and trends that can help consumers, policymakers, and industry insiders make more informed decisions.

The “Why Now?” – Hidden Advantages You Need to Know

1. Supply Chain Security:

Lithium is geographically concentrated—about 50% of global reserves are in South America’s “Lithium Triangle,” and production is dominated by a few countries (USGS, 2023). Sodium, by contrast, is abundant worldwide, reducing geopolitical risks related to supply shortages or export restrictions.

2. Cost Dynamics:

Sodium salts cost as little as $150–200 per metric ton, compared to lithium carbonate at over $70,000 per metric ton in 2022, making sodium-ion batteries fundamentally less expensive at the materials level (Source: International Energy Agency).

3. Recycling and End-of-Life:

Sodium is less toxic than lithium and easier to recycle. Some companies are already developing closed-loop systems, making sodium-ion batteries a more sustainable solution (Battery University, 2024).

4. Cold-Weather Performance:

Sodium-ion batteries maintain capacity in temperatures as low as –20°C, making them ideal for northern climates, outdoor telecom equipment, and off-grid cabins (Fraunhofer Institute).

5. Compatibility with Existing Manufacturing:

Many sodium-ion batteries can be built using equipment intended for lithium-ion cell production, lowering capex for manufacturers and expediting scaling.

Key Limitations—Not Just a Fairy Tale

6. Lower Energy Density:

Currently, sodium-ion batteries deliver 90–160 Wh/kg, while top-tier lithium-ion batteries achieve up to 300 Wh/kg. This means sodium won’t replace lithium in long-range EVs just yet (Nature Energy, 2023).

7. Early-Stage Ecosystem:

The sodium-ion industry is in its infancy compared to lithium; fewer raw material processors, cell makers, and recyclers are in operation world-wide.

8. Cycle Life & Calendar Life:

While sodium-ion cells are improving, some chemistries lag behind the proven 2000–5000 charge cycles typical of lithium iron phosphate (LFP) batteries.

9. Patent Landscape:

Key sodium-ion battery technologies are held by a handful of companies (CATL, Faradion, Natron), potentially slowing open innovation and licensing.

IN-DEPTH: How to Use Sodium-Ion in Real Life

Life Hack: For Off-Grid, Rural, or Renewable Microgrids

– Step 1: Assess local sunlight/wind potential.

– Step 2: Source a commercial sodium-ion storage system (contact providers like Faradion, Natron Energy, BMZ Group).

– Step 3: Integrate with solar/wind inverters and intelligent energy management software.

– Step 4: Monitor performance and savings (reduced maintenance, longer cycle life in harsh conditions).

For Grid Operators:

Hybridize existing battery banks with sodium-ion modules to provide long-duration backup, reducing costs and enhancing resilience in the face of variable renewables.

For Manufacturers:

Use existing lithium-ion production lines with minor retrofits to trial sodium cells before full investment—de-risking your entry into the sodium-ion market.

Industry Trends: Where Is It All Headed?

10. Market Expansion Forecast:

Recent Allied Market Research projects sodium-ion battery market value to reach $915 million by 2030, with compound annual growth over 16%.

11. Policy Acceleration:

The U.S. Department of Energy, European Union, and China have all included sodium-ion in strategic critical battery funds, accelerating R&D (Source: DOE Energy Storage Grand Challenge).

12. CATL & BYD’s Coming Push:

Industry giants CATL (China) and BYD are expected to release sodium-ion EVs and grid batteries in late 2024–2025, moving the technology into the mainstream.

13. Integration with Renewable Energy:

As wind and solar power adoption climbs, grid operators are pivoting to sodium-ion for peak-shifting and overnight power, especially where lithium availability is strained.

14. Localization:

India, the U.K., and the EU are backing domestic sodium battery value chains, creating regional supply and reducing dependence on Asian imports.

Reviews, Specs & Pricing (Mid-2024)

– Natron Energy BlueTray 4000: 2.5 kWh, ~3500 cycles, offers fast recharge (minutes), price undisclosed but aimed at commercial backup solutions.

– Faradion cells: Energy density ~150 Wh/kg, cycle life ~2000 cycles, in pilot-scale production.

– CATL Freevoy Hybrid: Promised 400 km EV range with sodium-ion pairing, full specs TBA.

Quick Pros & Cons

| Pros | Cons |

|——————————-|————————————|

| Abundant, low-cost materials | Lower energy density vs. lithium |

| Fire safety—nonflammable | Less mature ecosystem |

| Low temperature performance | Currently limited in EV use |

| Easy recycling | Early-stage calendar life data |

Most Pressing Questions Answered

Q: Will sodium-ion batteries replace lithium-ion in all applications?

A: Not in the near term. Sodium-ion will lead in stationary storage, backup, small EVs, and cost-sensitive or harsh environments. Lithium will retain its edge in consumer electronics and long-range EVs, for now.

Q: Are sodium-ion batteries really safer?

A: Yes. Unlike lithium, sodium chemistry is nonflammable and stable under abuse, making it ideal for places where fire safety is paramount (Source: Journal of Power Sources, 2022).

Q: Who are the main players to watch?

A: CATL, Natron Energy, Faradion, BMZ Group, Altris AB, and Indi Energy are leading on patents, production scaling, and real-world deployments.

Security & Sustainability Insights

Sodium-ion offers a path to true energy independence. Domestic manufacturing reduces cyber and physical risks associated with foreign-controlled lithium supply chains. Additionally, eco-friendly extraction and straightforward recycling help advance ESG and circular economy goals.

Actionable Recommendations: How to Ride the Sodium-Ion Wave

– Invest in knowledge: Follow industry news at Bloomberg and Reuters.

– If you operate a microgrid or utility: Request sodium-ion pilot demos—leverage subsidies where available.

– For battery OEMs: Audit your production lines for sodium-ion compatibility; explore technology licensing with Faradion or Natron.

– As a policymaker: Support sodium-ion R&D, including recycling R&D and domestic supply chains.

– Consumers & Businesses: Ask renewable energy system installers about sodium-ion options for off-grid storage where safety and longevity matter more than maximum density.

Final Takeaway

Sodium-ion batteries aren’t just a passing trend—they’re a leap toward affordable, climate-friendly, and reliable energy storage. By staying informed and proactive, you can be among the first to benefit as this transformative technology powers up the green energy revolution.