Vision-Based Industrial Robotics Market Report 2025: Unveiling Growth Drivers, AI Integration, and Global Opportunities. Explore Key Trends, Forecasts, and Strategic Insights for the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Vision-Based Industrial Robotics

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

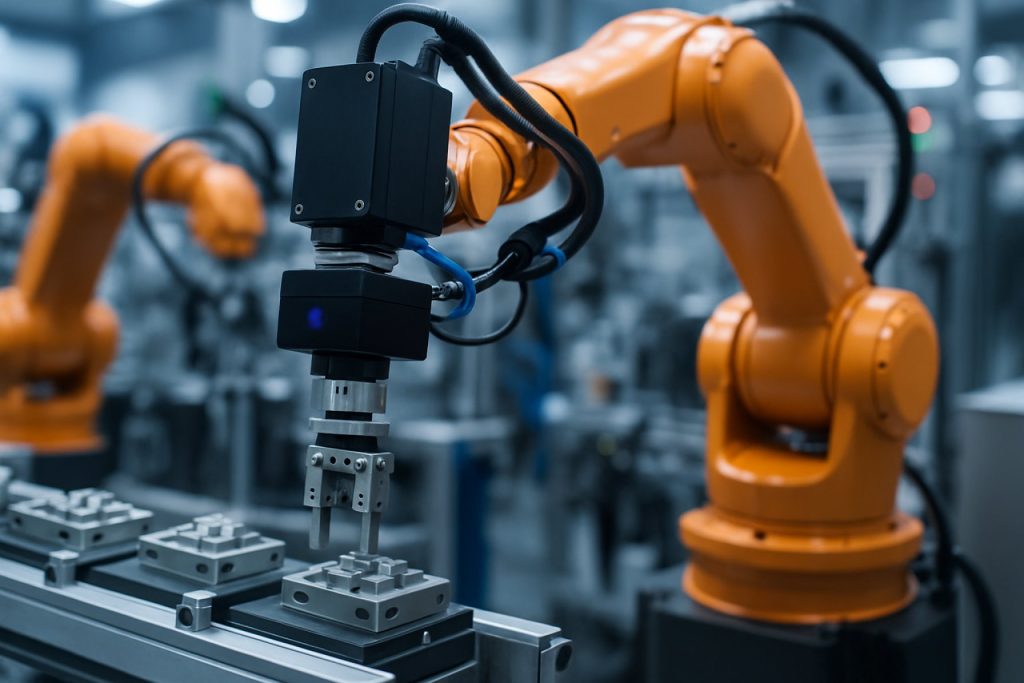

Vision-based industrial robotics refers to the integration of advanced machine vision systems with robotic platforms to enable real-time perception, analysis, and decision-making in manufacturing and industrial environments. These systems leverage cameras, sensors, and sophisticated image processing algorithms to guide robots in tasks such as inspection, assembly, sorting, and quality control. The global market for vision-based industrial robotics is experiencing robust growth, driven by the increasing demand for automation, precision, and flexibility in production processes.

In 2025, the vision-based industrial robotics market is projected to reach new heights, propelled by rapid advancements in artificial intelligence (AI), deep learning, and sensor technologies. According to MarketsandMarkets, the industrial machine vision market, a key enabler for vision-based robotics, is expected to surpass USD 18 billion by 2025, with a compound annual growth rate (CAGR) of over 7%. This growth is underpinned by the manufacturing sector’s push for higher productivity, reduced error rates, and enhanced product quality.

Key industries adopting vision-based robotics include automotive, electronics, pharmaceuticals, food and beverage, and logistics. The automotive sector, for instance, utilizes vision-guided robots for precise assembly and defect detection, while electronics manufacturers deploy them for micro-component placement and inspection. The COVID-19 pandemic has further accelerated automation trends, as companies seek to minimize human intervention and ensure operational continuity.

Geographically, Asia-Pacific remains the dominant market, led by China, Japan, and South Korea, where significant investments in smart manufacturing and Industry 4.0 initiatives are underway. Europe and North America are also witnessing substantial adoption, particularly in high-value manufacturing and process industries. According to International Federation of Robotics, the global operational stock of industrial robots reached a record 3.5 million units in 2023, with vision-based systems accounting for a growing share of new installations.

- Rising labor costs and workforce shortages are accelerating automation adoption.

- Technological advancements in 3D vision, AI, and edge computing are expanding application possibilities.

- Integration challenges and high initial investment remain barriers, especially for small and medium enterprises.

In summary, the vision-based industrial robotics market in 2025 is characterized by strong growth prospects, technological innovation, and expanding application scope, positioning it as a critical enabler of next-generation smart manufacturing.

Key Technology Trends in Vision-Based Industrial Robotics

Vision-based industrial robotics is undergoing rapid transformation, driven by advancements in artificial intelligence (AI), machine learning, and sensor technologies. As of 2025, several key technology trends are shaping the deployment and capabilities of these systems across manufacturing, logistics, and quality control sectors.

- AI-Powered Image Processing: The integration of deep learning algorithms has significantly improved object recognition, defect detection, and scene understanding. Modern vision systems can now adapt to variable lighting, complex backgrounds, and diverse product types, reducing the need for manual programming and increasing flexibility on the factory floor. According to ABB, AI-driven vision solutions are enabling robots to handle previously unstructured tasks, such as sorting irregular items or inspecting intricate assemblies.

- 3D Vision and Sensing: The adoption of 3D cameras and LiDAR sensors is expanding the scope of robotic applications. These technologies provide depth perception, allowing robots to perform precise bin picking, palletizing, and assembly operations. OMRON Corporation reports that 3D vision is particularly valuable in industries requiring high accuracy, such as electronics and automotive manufacturing.

- Edge Computing and Real-Time Analytics: Processing visual data at the edge—directly on the robot or nearby devices—minimizes latency and enhances responsiveness. This is crucial for time-sensitive applications like high-speed inspection and dynamic material handling. Siemens AG highlights that edge-enabled vision systems are supporting predictive maintenance and adaptive process control, leading to reduced downtime and improved operational efficiency.

- Collaborative Robotics (Cobots) with Vision: The fusion of advanced vision with collaborative robots is making human-robot interaction safer and more intuitive. Vision-guided cobots can detect human presence, interpret gestures, and dynamically adjust their actions, facilitating flexible automation in mixed work environments. Universal Robots notes a surge in demand for vision-equipped cobots in small and medium-sized enterprises (SMEs) seeking scalable automation.

- Cloud-Based Vision Systems: Cloud connectivity is enabling centralized data analysis, remote monitoring, and continuous improvement of vision algorithms. Manufacturers can leverage aggregated visual data to optimize processes across multiple sites. FANUC America is investing in cloud-based platforms to deliver real-time insights and facilitate remote troubleshooting.

These technology trends are collectively driving the evolution of vision-based industrial robotics, making them more intelligent, adaptable, and accessible for a wide range of industrial applications in 2025.

Competitive Landscape and Leading Players

The competitive landscape of the vision-based industrial robotics market in 2025 is characterized by rapid technological innovation, strategic partnerships, and a strong focus on vertical integration. The sector is dominated by a mix of established robotics manufacturers, specialized vision system providers, and emerging startups leveraging artificial intelligence (AI) and machine learning (ML) to enhance robotic perception and adaptability.

Key players such as ABB Ltd., FANUC Corporation, KUKA AG, and Yaskawa Electric Corporation continue to lead the market by integrating advanced vision technologies into their industrial robots. These companies invest heavily in R&D to improve object recognition, defect detection, and real-time decision-making capabilities, which are critical for applications in automotive, electronics, and logistics sectors. For instance, ABB has launched next-generation robots with embedded vision systems, enabling higher speed and accuracy in pick-and-place operations.

Specialized vision technology providers such as Cognex Corporation and Keyence Corporation play a pivotal role by supplying high-performance cameras, sensors, and software that are often integrated into robots from leading OEMs. These companies are recognized for their innovations in 3D vision, deep learning-based inspection, and flexible machine vision platforms, which are increasingly demanded in quality control and assembly line automation.

The market is also witnessing the rise of agile startups and niche players, such as VisionNav Robotics and Rapid Robotics, which focus on plug-and-play vision-guided robotic solutions for SMEs and specific industry pain points. These entrants are driving competition by offering cost-effective, easy-to-deploy systems that lower the barrier to automation for smaller manufacturers.

Strategic collaborations and acquisitions are shaping the competitive dynamics. For example, Rockwell Automation has expanded its vision capabilities through partnerships and targeted acquisitions, aiming to deliver integrated automation solutions. The competitive environment is further intensified by the entry of technology giants such as Google and Microsoft, which are providing cloud-based AI and vision services to robotics OEMs.

Overall, the 2025 vision-based industrial robotics market is marked by consolidation among established players, disruptive innovation from startups, and a growing emphasis on AI-driven vision systems to meet the evolving demands of smart manufacturing and Industry 4.0 initiatives.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The vision-based industrial robotics market is poised for robust growth between 2025 and 2030, driven by accelerating automation trends, advancements in machine vision technology, and increasing demand for flexible manufacturing solutions. According to projections by MarketsandMarkets, the global vision-based robotics market is expected to register a compound annual growth rate (CAGR) of approximately 9–11% during this period. This growth trajectory is underpinned by the rapid adoption of smart factories and Industry 4.0 initiatives, particularly in automotive, electronics, and food & beverage sectors.

Revenue forecasts indicate that the market, which was valued at around USD 7.5 billion in 2024, could surpass USD 13 billion by 2030. This expansion is attributed to the integration of advanced vision systems—such as 3D vision, deep learning, and AI-powered image processing—into industrial robots, enabling higher precision, quality control, and adaptability in complex manufacturing environments. International Data Corporation (IDC) highlights that investments in vision-based robotics are expected to outpace those in traditional robotics, as manufacturers seek to enhance productivity and reduce operational costs.

In terms of volume, the number of vision-equipped industrial robots shipped globally is projected to grow from approximately 120,000 units in 2025 to over 220,000 units by 2030, according to data from the International Federation of Robotics (IFR). Asia-Pacific remains the dominant region, accounting for more than 50% of new installations, fueled by strong manufacturing bases in China, Japan, and South Korea. North America and Europe are also expected to witness significant growth, driven by the modernization of legacy production lines and the adoption of collaborative robots (cobots) with integrated vision systems.

- CAGR (2025–2030): 9–11%

- Revenue (2030): USD 13+ billion

- Volume (2030): 220,000+ units shipped globally

Overall, the market outlook for vision-based industrial robotics from 2025 to 2030 is highly positive, with technological innovation and the need for agile, quality-driven manufacturing processes serving as primary growth catalysts.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The vision-based industrial robotics market is experiencing robust growth globally, with distinct regional dynamics shaping adoption and innovation. In 2025, North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each present unique opportunities and challenges for market participants.

North America remains a leader in vision-based robotics, driven by advanced manufacturing sectors, high labor costs, and a strong focus on automation. The United States, in particular, is witnessing increased deployment in automotive, electronics, and food & beverage industries. According to Association for Advancing Automation, the integration of machine vision with robotics is accelerating, supported by investments in AI and deep learning. The region’s mature ecosystem of technology providers and end-users fosters rapid adoption of sophisticated vision systems.

Europe is characterized by stringent quality standards and a strong emphasis on Industry 4.0 initiatives. Germany, Italy, and France are at the forefront, leveraging vision-based robotics for precision manufacturing and quality inspection. The VDMA Robotics + Automation reports that European manufacturers are increasingly integrating vision systems to enhance flexibility and traceability in production lines. The region’s regulatory environment and focus on sustainability are also driving demand for intelligent automation solutions.

Asia-Pacific is the fastest-growing market, propelled by rapid industrialization, government incentives, and a burgeoning electronics manufacturing sector. China, Japan, and South Korea dominate regional adoption, with China accounting for the largest share due to its massive manufacturing base and policy support for smart factories. According to International Federation of Robotics, Asia-Pacific’s robot density continues to rise, with vision-based systems playing a critical role in quality control and assembly automation. Local players are innovating to offer cost-effective solutions tailored to small and medium enterprises.

Rest of the World (RoW) encompasses emerging markets in Latin America, the Middle East, and Africa. While adoption is at an earlier stage, sectors such as automotive and food processing are beginning to invest in vision-based robotics to improve efficiency and meet export standards. According to International Data Corporation (IDC), increasing foreign direct investment and the expansion of multinational manufacturers are expected to drive gradual growth in these regions through 2025.

Overall, regional market dynamics in 2025 reflect varying levels of technological maturity, regulatory environments, and industry focus, but all point toward continued expansion of vision-based industrial robotics worldwide.

Future Outlook: Emerging Applications and Investment Hotspots

Looking ahead to 2025, vision-based industrial robotics is poised for significant expansion, driven by rapid advancements in artificial intelligence (AI), machine learning, and sensor technologies. The integration of sophisticated vision systems is enabling robots to perform increasingly complex tasks, such as real-time quality inspection, adaptive assembly, and autonomous navigation within dynamic manufacturing environments. These capabilities are unlocking new applications across diverse sectors, including electronics, automotive, pharmaceuticals, and food processing.

One of the most promising emerging applications is in the electronics industry, where vision-based robots are being deployed for high-precision tasks such as printed circuit board (PCB) inspection and micro-component placement. The demand for miniaturized and defect-free electronics is pushing manufacturers to invest in advanced vision-guided robotics to enhance yield and reduce error rates. Similarly, in the automotive sector, vision systems are enabling robots to handle intricate assembly operations and conduct comprehensive surface inspections, supporting the shift toward electric and autonomous vehicles.

Pharmaceutical manufacturing is another hotspot, with vision-based robots increasingly used for sterile packaging, vial inspection, and traceability. The need for stringent quality control and regulatory compliance is accelerating adoption in this sector. In food and beverage processing, vision-guided robots are being leveraged for sorting, grading, and packaging, addressing labor shortages and ensuring consistent product quality.

From an investment perspective, Asia-Pacific remains the dominant region, led by China, Japan, and South Korea, where government initiatives and robust manufacturing ecosystems are fueling growth. According to International Federation of Robotics, China’s continued investment in smart manufacturing and automation is expected to drive the largest share of new installations through 2025. North America and Europe are also witnessing increased investment, particularly in flexible automation solutions that can be rapidly reconfigured for different products and production runs.

Venture capital and corporate investments are flowing into startups and established players developing next-generation vision algorithms, 3D imaging, and edge AI solutions. Companies such as Cognex Corporation and Keyence Corporation are expanding their portfolios to address emerging needs in deep learning-based inspection and collaborative robotics. Strategic partnerships between robotics manufacturers and AI software firms are expected to accelerate innovation and commercialization of new applications.

In summary, 2025 will see vision-based industrial robotics move beyond traditional pick-and-place and inspection roles, becoming central to smart, adaptive manufacturing. Investment hotspots will align with sectors and regions prioritizing automation, quality, and flexibility, setting the stage for robust market growth and technological breakthroughs.

Challenges, Risks, and Strategic Opportunities

The landscape of vision-based industrial robotics in 2025 is shaped by a dynamic interplay of challenges, risks, and strategic opportunities. As manufacturers increasingly integrate machine vision with robotics to enhance automation, several critical factors influence adoption and market growth.

Challenges and Risks

- Technical Complexity: Integrating advanced vision systems with robotics requires sophisticated hardware and software coordination. Variability in lighting, object orientation, and surface reflectivity can degrade image quality, impacting accuracy and reliability. This complexity often necessitates specialized engineering talent, which is in short supply globally (International Federation of Robotics).

- High Initial Investment: The upfront costs for vision-based robotic systems—including cameras, sensors, and AI-driven software—remain significant. Small and medium-sized enterprises (SMEs) may find these costs prohibitive, slowing widespread adoption (Grand View Research).

- Cybersecurity Risks: As vision-based robots become more connected, they are increasingly vulnerable to cyberattacks. Breaches can disrupt operations or compromise sensitive production data, posing a substantial risk to manufacturers (Gartner).

- Regulatory and Safety Concerns: Evolving safety standards and regulatory requirements for collaborative robots (cobots) with vision capabilities can delay deployment and increase compliance costs (International Organization for Standardization).

Strategic Opportunities

- AI-Driven Innovation: Advances in deep learning and computer vision are enabling robots to perform more complex tasks, such as real-time defect detection and adaptive assembly. This opens new applications in electronics, automotive, and food processing (ABB).

- Flexible Manufacturing: Vision-based robotics support rapid reconfiguration of production lines, allowing manufacturers to respond quickly to changing market demands and customization trends (FANUC America).

- Cost Reduction Through Scale: As adoption increases and component prices fall, vision-based systems are becoming more accessible to SMEs, expanding the addressable market (Statista).

- Enhanced Data Analytics: The integration of vision systems with industrial IoT platforms enables predictive maintenance and process optimization, driving operational efficiencies (Siemens).

In summary, while vision-based industrial robotics in 2025 faces notable technical, financial, and regulatory hurdles, the sector is poised for robust growth driven by AI innovation, flexible manufacturing, and expanding market accessibility.

Sources & References

- MarketsandMarkets

- International Federation of Robotics

- ABB

- Siemens AG

- Universal Robots

- FANUC America

- KUKA AG

- VisionNav Robotics

- Rapid Robotics

- Rockwell Automation

- International Data Corporation (IDC)

- VDMA Robotics + Automation

- International Federation of Robotics

- Grand View Research

- International Organization for Standardization

- Statista