Unlocking the Future of Microwave Devices: How Yttrium-Iron Garnet (YIG) Film Synthesis is Set to Transform the Industry in 2025 and Beyond. Explore Market Growth, Breakthrough Technologies, and Strategic Opportunities.

- Executive Summary: Key Findings and 2025 Outlook

- Market Overview: YIG Film Synthesis for Microwave Devices

- Technology Landscape: Advances in YIG Film Synthesis Methods

- Key Applications: Microwave Devices and Emerging Use Cases

- Competitive Analysis: Leading Players and Strategic Initiatives

- Market Size & Forecast (2025–2030): CAGR of 8.2% and Revenue Projections

- Drivers and Challenges: Factors Shaping Market Dynamics

- Regional Analysis: Growth Hotspots and Investment Trends

- Innovation Pipeline: Next-Generation YIG Films and Device Integration

- Future Outlook: Strategic Recommendations and Growth Opportunities

- Sources & References

Executive Summary: Key Findings and 2025 Outlook

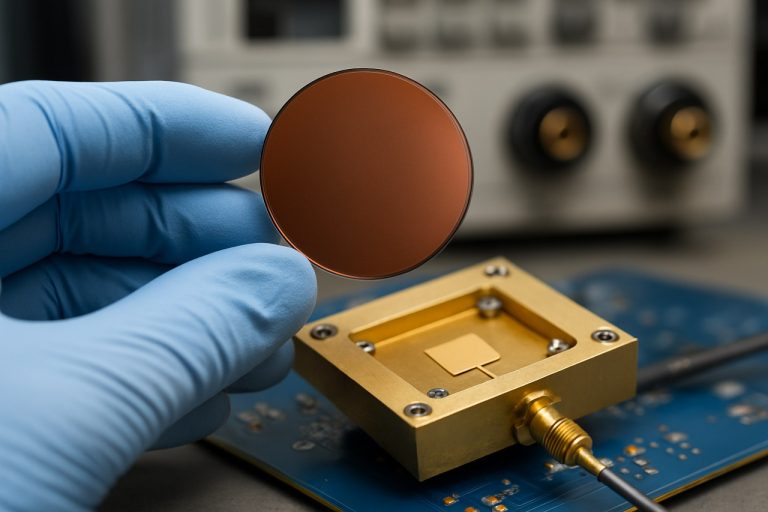

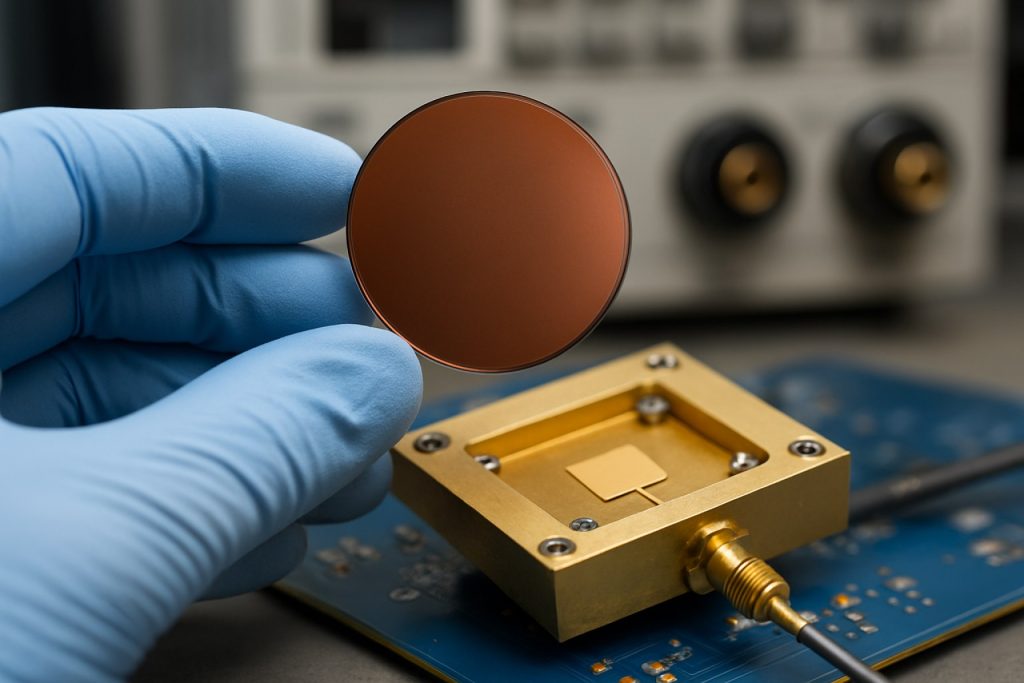

Yttrium-Iron Garnet (YIG) films are critical materials in the fabrication of advanced microwave devices, including filters, isolators, and circulators, due to their exceptional magnetic and low-loss properties at microwave frequencies. In 2025, the synthesis of high-quality YIG films continues to be a focal point for both academic research and industrial innovation, driven by the expanding demand for high-frequency communication systems and quantum technologies.

Key findings from recent developments indicate significant progress in the optimization of YIG film synthesis techniques. Liquid phase epitaxy (LPE) remains the dominant method for producing thick, low-loss YIG films, while pulsed laser deposition (PLD) and sputtering are increasingly adopted for thin-film applications, offering improved integration with semiconductor processes. Notably, advances in substrate engineering and post-deposition annealing have led to films with enhanced crystallinity and reduced magnetic damping, directly benefiting device performance.

Collaborative efforts between research institutions and industry leaders, such as FERROXCUBE and TDK Corporation, have accelerated the commercialization of YIG-based components. These partnerships have resulted in scalable synthesis protocols and the development of wafer-scale YIG films, addressing the needs of next-generation 5G and satellite communication systems.

Looking ahead to 2025, the outlook for YIG film synthesis is marked by several trends:

- Continued refinement of deposition techniques to achieve ultra-low magnetic losses and high uniformity across large substrates.

- Integration of YIG films with silicon and other semiconductor platforms, enabling compact, on-chip microwave devices.

- Increased focus on eco-friendly and cost-effective synthesis routes, in line with global sustainability goals.

- Emergence of new applications in quantum information processing and non-reciprocal photonic devices, expanding the market for high-quality YIG films.

In summary, the synthesis of YIG films for microwave devices is poised for robust growth in 2025, underpinned by technological advancements and strategic industry collaborations. The sector is expected to play a pivotal role in the evolution of high-frequency electronics and quantum technologies, with ongoing research ensuring continuous improvements in film quality and device integration.

Market Overview: YIG Film Synthesis for Microwave Devices

The market for yttrium-iron garnet (YIG) film synthesis, particularly for microwave device applications, is experiencing notable growth as the demand for high-performance, low-loss magnetic materials intensifies across telecommunications, radar, and quantum computing sectors. YIG films are prized for their exceptional microwave properties, including low magnetic damping, high Q-factors, and tunable ferromagnetic resonance, making them indispensable in devices such as filters, isolators, circulators, and phase shifters.

Recent advancements in synthesis techniques—such as liquid phase epitaxy (LPE), pulsed laser deposition (PLD), and sputtering—have enabled the production of high-quality, ultra-thin YIG films with improved uniformity and scalability. These innovations are crucial for integrating YIG films onto various substrates, including silicon, to facilitate compatibility with mainstream semiconductor manufacturing processes. Leading research institutions and industry players are actively investing in refining these methods to meet the stringent requirements of next-generation microwave and spintronic devices.

The telecommunications industry, driven by the rollout of 5G and the anticipated development of 6G networks, is a primary driver of YIG film demand. The need for miniaturized, high-frequency components with superior signal integrity is pushing manufacturers to adopt advanced YIG-based solutions. Additionally, the defense sector’s focus on sophisticated radar and electronic warfare systems further bolsters market growth, as YIG films enable the development of agile, frequency-tunable components.

Geographically, North America and Asia-Pacific are leading the market, supported by robust R&D ecosystems and the presence of major electronics and defense manufacturers. Companies such as Hitachi, Ltd. and TDK Corporation are at the forefront, leveraging their expertise in magnetic materials and thin-film technologies to expand their YIG product portfolios. Collaborative efforts between academia and industry, exemplified by partnerships with organizations like National Institute for Materials Science (NIMS), are accelerating the commercialization of novel YIG synthesis techniques.

Looking ahead to 2025, the YIG film synthesis market is poised for continued expansion, underpinned by ongoing technological innovation and the proliferation of microwave-enabled applications. The convergence of material science breakthroughs and increasing end-user demand is expected to sustain a dynamic and competitive landscape for YIG film suppliers and device manufacturers.

Technology Landscape: Advances in YIG Film Synthesis Methods

Yttrium-Iron Garnet (YIG) films are pivotal in the development of advanced microwave devices due to their exceptional magnetic and low-loss properties. The technology landscape for YIG film synthesis has evolved rapidly, with significant advances in deposition techniques, film quality, and scalability. Traditionally, liquid phase epitaxy (LPE) has been the gold standard for producing high-quality YIG films, offering excellent crystallinity and low magnetic damping. However, LPE is limited by substrate compatibility and film thickness control, prompting the exploration of alternative synthesis methods.

Recent years have seen the rise of pulsed laser deposition (PLD) and sputtering techniques, which allow for greater flexibility in substrate choice and enable the fabrication of ultra-thin YIG films—crucial for miniaturized microwave components. PLD, in particular, has demonstrated the ability to produce epitaxial YIG films with thicknesses down to a few nanometers, while maintaining low ferromagnetic resonance (FMR) linewidths. This is essential for applications in magnonics and spintronics, where interface quality and film uniformity directly impact device performance.

Molecular beam epitaxy (MBE) is another emerging method, offering atomic-level control over film composition and thickness. MBE-grown YIG films exhibit superior interface sharpness and can be integrated with a variety of functional oxides, opening new avenues for multifunctional microwave devices. Additionally, chemical solution deposition (CSD) and sol-gel methods are being refined to provide cost-effective, scalable routes for YIG film synthesis, albeit with ongoing challenges in achieving the same magnetic quality as physical vapor deposition techniques.

The integration of YIG films onto silicon and other semiconductor substrates is a key focus, aiming to bridge the gap between traditional microwave components and modern integrated circuits. Collaborative efforts by research institutions and industry leaders, such as International Business Machines Corporation (IBM) and Hitachi, Ltd., are driving innovations in heteroepitaxial growth and wafer-scale processing. These advances are expected to accelerate the adoption of YIG-based devices in next-generation wireless communication and quantum information systems.

In summary, the technology landscape for YIG film synthesis is characterized by a shift towards versatile, scalable, and integration-friendly methods. Continued progress in deposition techniques and material engineering will be instrumental in unlocking the full potential of YIG films for microwave device applications in 2025 and beyond.

Key Applications: Microwave Devices and Emerging Use Cases

Yttrium-Iron Garnet (YIG) films have long been integral to the advancement of microwave devices due to their exceptional magnetic and low-loss properties. In 2025, the synthesis of high-quality YIG films continues to underpin a range of established and emerging applications in microwave technology. The most prominent use of YIG films remains in tunable microwave components, such as filters, oscillators, and phase shifters. These devices leverage the unique magneto-optical and magneto-dynamic characteristics of YIG, enabling precise frequency control and low insertion loss, which are critical for modern communication systems and radar technologies.

Recent advances in YIG film synthesis—particularly through techniques like liquid phase epitaxy (LPE) and pulsed laser deposition (PLD)—have enabled the fabrication of ultra-thin, defect-free films with superior uniformity. This has expanded the operational frequency range and miniaturization potential of microwave devices. For instance, YIG-based filters and resonators are now being integrated into compact modules for 5G and satellite communications, where high selectivity and low noise are paramount. Keysight Technologies and Analog Devices, Inc. are among the industry leaders incorporating YIG-based components into their advanced test and measurement equipment.

Beyond traditional applications, emerging use cases for YIG films are rapidly gaining traction. In quantum information processing, YIG’s low magnetic damping and high spin-wave propagation efficiency make it a promising material for magnonic devices, which manipulate spin waves for data transmission and logic operations. Research institutions and companies such as IBM are exploring YIG-based magnonic circuits as potential building blocks for quantum computers and ultra-low-power signal processing.

Another notable trend is the integration of YIG films with photonic and microelectromechanical systems (MEMS). Hybrid devices that combine YIG’s magnetic tunability with optical or mechanical functionalities are being developed for next-generation sensors, isolators, and circulators. These innovations are supported by collaborative efforts between academic laboratories and industry, including partnerships with National Institute of Standards and Technology (NIST) for standardization and performance benchmarking.

In summary, the synthesis of high-quality YIG films is not only sustaining the evolution of microwave devices but also catalyzing new frontiers in quantum technology, integrated photonics, and advanced sensing, positioning YIG as a cornerstone material for the future of high-frequency electronics.

Competitive Analysis: Leading Players and Strategic Initiatives

The competitive landscape for yttrium-iron garnet (YIG) film synthesis, particularly for microwave device applications, is shaped by a select group of advanced materials companies, research institutions, and specialized manufacturers. These entities are distinguished by their proprietary synthesis techniques, scale-up capabilities, and integration with device fabrication processes. Key players include TDK Corporation, National Magnetics Group, Inc., and Hitachi High-Tech Corporation, each leveraging decades of expertise in ferrite and garnet materials.

Strategic initiatives among these leaders focus on refining liquid phase epitaxy (LPE), pulsed laser deposition (PLD), and sputtering methods to achieve ultra-low-loss YIG films with precise thickness control and high crystalline quality. TDK Corporation has invested in automated LPE systems, enabling consistent production of YIG films for high-frequency microwave filters and circulators. Meanwhile, Hitachi High-Tech Corporation emphasizes integration of YIG films with semiconductor substrates, targeting next-generation monolithic microwave integrated circuits (MMICs).

Collaborative research and licensing agreements are also central to competitive strategy. For instance, partnerships between industrial players and academic institutions facilitate the transfer of novel synthesis protocols, such as off-axis sputtering and molecular beam epitaxy (MBE), into scalable manufacturing environments. This approach accelerates the commercialization of YIG films with tailored magnetic and dielectric properties, essential for emerging 5G and quantum information applications.

In addition, companies are differentiating through vertical integration—controlling the supply chain from raw material purification to device assembly. National Magnetics Group, Inc. exemplifies this by offering both bulk YIG materials and thin-film deposition services, ensuring quality and supply security for OEMs in the microwave device sector.

Looking ahead to 2025, the competitive edge will likely hinge on the ability to deliver YIG films with sub-micrometer uniformity, minimal ferromagnetic resonance (FMR) linewidth, and compatibility with advanced device architectures. Strategic investments in pilot-scale production lines, intellectual property portfolios, and cross-sector collaborations are expected to define market leadership in YIG film synthesis for microwave applications.

Market Size & Forecast (2025–2030): CAGR of 8.2% and Revenue Projections

The global market for Yttrium-Iron Garnet (YIG) film synthesis, particularly for microwave device applications, is poised for robust growth between 2025 and 2030. Driven by escalating demand in telecommunications, radar systems, and advanced signal processing, the market is projected to expand at a compound annual growth rate (CAGR) of 8.2% during this period. This growth is underpinned by the unique magnetic and low-loss properties of YIG films, which are critical for the performance of microwave isolators, circulators, and filters.

Revenue projections indicate that the YIG film synthesis market will reach approximately USD 420 million by 2030, up from an estimated USD 260 million in 2025. This surge is attributed to ongoing advancements in thin-film deposition techniques, such as liquid phase epitaxy (LPE) and pulsed laser deposition (PLD), which are enabling higher quality films with improved uniformity and scalability. The adoption of YIG films in emerging 5G infrastructure and quantum computing components is also expected to fuel market expansion.

Key industry players, including TDK Corporation and Domen Ferrite, are investing in research and development to enhance film synthesis processes and meet the stringent requirements of next-generation microwave devices. Additionally, collaborations between academic institutions and manufacturers are accelerating the commercialization of novel YIG film technologies.

Regionally, Asia-Pacific is anticipated to dominate the market, supported by significant investments in electronics manufacturing and telecommunications infrastructure, particularly in China, Japan, and South Korea. North America and Europe are also expected to witness steady growth, driven by defense modernization programs and the proliferation of advanced communication systems.

Overall, the YIG film synthesis market for microwave devices is set for sustained expansion through 2030, with technological innovation and increasing application diversity serving as primary growth catalysts.

Drivers and Challenges: Factors Shaping Market Dynamics

The market dynamics for yttrium-iron garnet (YIG) film synthesis, particularly for microwave device applications, are shaped by a complex interplay of drivers and challenges. On the demand side, the proliferation of advanced wireless communication systems, including 5G and emerging 6G technologies, is a significant driver. YIG films are prized for their low microwave losses and high Q-factors, making them indispensable in components such as filters, isolators, and circulators used in base stations and radar systems. The ongoing miniaturization of electronic devices and the need for higher frequency operation further amplify the demand for high-quality YIG films.

Another key driver is the increasing investment in research and development by both public and private sectors. Organizations such as the National Institute of Standards and Technology (NIST) and Oak Ridge National Laboratory are actively supporting innovation in magnetic materials and thin-film deposition techniques. These efforts are leading to improved synthesis methods, such as pulsed laser deposition and liquid phase epitaxy, which enhance film uniformity and scalability for industrial production.

However, the market faces notable challenges. The synthesis of high-purity, defect-free YIG films with precise stoichiometry remains technically demanding. Achieving consistent film thickness and magnetic properties across large substrates is critical for device performance but is often limited by current fabrication technologies. Additionally, the cost of raw materials and the complexity of deposition equipment can be prohibitive for smaller manufacturers, potentially restricting broader market adoption.

Environmental and regulatory considerations also play a role. The handling and disposal of chemical precursors used in YIG film synthesis are subject to stringent regulations, particularly in regions with robust environmental standards. Compliance with these regulations can increase operational costs and necessitate investment in waste management infrastructure.

In summary, while the YIG film synthesis market for microwave devices is buoyed by technological advancements and expanding application areas, it must navigate technical, economic, and regulatory hurdles. Continued collaboration between research institutions, such as NIST, and industry stakeholders will be essential to overcoming these challenges and sustaining market growth through 2025 and beyond.

Regional Analysis: Growth Hotspots and Investment Trends

The regional landscape for Yttrium-Iron Garnet (YIG) film synthesis, particularly for microwave device applications, is shaped by a combination of technological expertise, investment flows, and the presence of advanced manufacturing infrastructure. In 2025, Asia-Pacific continues to dominate as a growth hotspot, driven by robust electronics manufacturing sectors in countries such as China, Japan, and South Korea. These nations benefit from strong government support for semiconductor and materials research, as well as established supply chains for rare earth elements like yttrium. For instance, Hitachi, Ltd. and TDK Corporation in Japan are actively involved in the development and commercialization of YIG-based components for microwave and spintronic devices.

North America, led by the United States, is another significant region, propelled by investments in defense, telecommunications, and quantum computing. Research institutions and companies such as IBM Corporation and National Institute of Standards and Technology (NIST) are at the forefront of YIG film innovation, focusing on high-purity synthesis methods and integration with next-generation microwave circuits. The U.S. government’s emphasis on domestic semiconductor manufacturing and critical materials security further accelerates investment in this sector.

Europe, while smaller in scale compared to Asia-Pacific and North America, maintains a strong presence through collaborative research initiatives and specialized manufacturers. Germany and France, in particular, are home to advanced materials research centers and companies like Thales Group, which leverage YIG films for high-frequency signal processing in aerospace and defense applications. The European Union’s strategic focus on technological sovereignty and sustainable supply chains is fostering new investments in rare earth processing and thin-film deposition technologies.

Emerging regions, including India and Southeast Asia, are beginning to attract attention due to growing electronics manufacturing capabilities and government incentives for high-tech materials research. However, these regions still face challenges related to raw material sourcing and technical expertise in advanced film synthesis.

Overall, the global investment trend in YIG film synthesis for microwave devices is characterized by a concentration of R&D and manufacturing in technologically advanced regions, with increasing cross-border collaborations and a gradual expansion into new markets as demand for high-frequency, low-loss microwave components rises.

Innovation Pipeline: Next-Generation YIG Films and Device Integration

The innovation pipeline for next-generation yttrium-iron garnet (YIG) films is rapidly evolving, driven by the increasing demand for high-performance microwave devices in telecommunications, radar, and quantum information systems. YIG’s exceptional low magnetic damping and high Q-factor make it a cornerstone material for microwave applications, but integrating high-quality YIG films onto diverse substrates and device architectures remains a significant challenge.

Recent advances in YIG film synthesis focus on achieving ultra-thin, single-crystal films with superior magnetic and structural properties. Techniques such as pulsed laser deposition (PLD), liquid phase epitaxy (LPE), and sputtering have been refined to produce films with thicknesses down to the nanometer scale, while maintaining low surface roughness and minimal defect density. For instance, research groups collaborating with Oxford Instruments have demonstrated improved control over stoichiometry and interface quality, which are critical for device performance.

A key innovation in the pipeline is the integration of YIG films onto non-garnet substrates, such as silicon and sapphire, to enable compatibility with mainstream semiconductor processing. This integration is essential for scalable manufacturing of hybrid devices, including magnonic waveguides, filters, and isolators. Companies like Ferrotec Corporation are exploring wafer-bonding and direct growth techniques to facilitate this transition, aiming to bridge the gap between traditional YIG device fabrication and modern microelectronics.

Device integration also benefits from advances in patterning and etching processes, allowing for the fabrication of complex YIG-based structures with sub-micron features. These developments are crucial for the realization of on-chip microwave components and magnonic circuits, which require precise control over film geometry and interface properties. Collaborative efforts with organizations such as National Institute of Standards and Technology (NIST) are accelerating the standardization of measurement techniques and performance benchmarks for next-generation YIG devices.

Looking ahead to 2025, the innovation pipeline is expected to deliver YIG films with unprecedented uniformity, integration flexibility, and device compatibility. These advancements will underpin the next wave of microwave technologies, supporting the rollout of 5G/6G networks, quantum computing platforms, and advanced radar systems.

Future Outlook: Strategic Recommendations and Growth Opportunities

The future of Yttrium-Iron Garnet (YIG) film synthesis for microwave devices is poised for significant advancement, driven by the escalating demand for high-performance, miniaturized, and energy-efficient components in telecommunications, radar, and quantum information systems. As the industry moves toward 2025, several strategic recommendations and growth opportunities emerge for stakeholders across the value chain.

- Adoption of Advanced Deposition Techniques: The transition from traditional liquid phase epitaxy (LPE) to advanced methods such as pulsed laser deposition (PLD), sputtering, and molecular beam epitaxy (MBE) is critical. These techniques enable the fabrication of ultra-thin, high-quality YIG films on diverse substrates, supporting device miniaturization and integration with silicon-based technologies. Collaboration with research institutions like National Institute of Standards and Technology (NIST) can accelerate the optimization of these processes.

- Integration with CMOS and Photonic Platforms: The compatibility of YIG films with complementary metal-oxide-semiconductor (CMOS) and photonic integrated circuits is a key growth area. Strategic partnerships with semiconductor foundries and photonics companies, such as Intel Corporation, can facilitate the co-development of hybrid devices, expanding YIG’s application in next-generation microwave and optical systems.

- Focus on Quantum and Non-Reciprocal Devices: YIG’s low magnetic damping and high Q-factor make it ideal for quantum magnonics and non-reciprocal microwave components. Investment in R&D for quantum-compatible YIG devices, in collaboration with organizations like IBM Quantum, can unlock new markets in quantum computing and secure communications.

- Supply Chain and Sustainability Initiatives: Ensuring a stable supply of high-purity yttrium and iron precursors is essential. Engaging with responsible suppliers such as LKAB Minerals and implementing recycling programs can mitigate raw material risks and align with global sustainability goals.

- Standardization and Industry Collaboration: Active participation in standardization efforts led by bodies like the IEEE will help define performance benchmarks and interoperability requirements, fostering broader adoption of YIG-based microwave devices.

In summary, the YIG film synthesis sector stands at a pivotal juncture. By embracing advanced manufacturing, fostering cross-industry collaborations, and prioritizing sustainability, stakeholders can capitalize on the expanding opportunities in microwave and quantum device markets through 2025 and beyond.

Sources & References

- FERROXCUBE

- Hitachi, Ltd.

- National Institute for Materials Science (NIMS)

- International Business Machines Corporation (IBM)

- National Institute of Standards and Technology (NIST)

- Hitachi High-Tech Corporation

- Oak Ridge National Laboratory

- Thales Group

- Oxford Instruments

- Ferrotec Corporation

- LKAB Minerals

- IEEE