Zirconia-Based Sintering Technologies in 2025: Unleashing the Next Wave of High-Performance Ceramics. Explore How Innovations in Sintering Are Shaping the Future of Industrial and Medical Applications.

- Executive Summary: Key Trends and Market Drivers

- Global Market Forecasts Through 2030

- Technological Innovations in Zirconia Sintering

- Major Players and Industry Initiatives

- Emerging Applications: Medical, Dental, and Industrial Uses

- Sustainability and Energy Efficiency in Sintering Processes

- Regional Analysis: Growth Hotspots and Investment Trends

- Challenges: Material Costs, Scalability, and Quality Control

- Regulatory Landscape and Industry Standards

- Future Outlook: Disruptive Technologies and Strategic Opportunities

- Sources & References

Executive Summary: Key Trends and Market Drivers

Zirconia-based sintering technologies are experiencing significant advancements and market momentum as of 2025, driven by their critical role in high-performance ceramics for dental, medical, and industrial applications. The ongoing shift towards digital manufacturing, particularly in dental prosthetics, is accelerating the adoption of advanced zirconia materials and innovative sintering processes. Key trends include the integration of high-speed and energy-efficient sintering furnaces, the development of translucent and multi-layered zirconia, and the expansion of additive manufacturing techniques.

One of the primary market drivers is the growing demand for dental restorations, where zirconia’s superior mechanical properties and biocompatibility have made it the material of choice for crowns, bridges, and implants. Leading manufacturers such as Ivoclar and Dentsply Sirona are investing in next-generation sintering furnaces that offer reduced cycle times and improved temperature control, enabling dental labs to deliver same-day restorations. The introduction of speed-sintering protocols, which can process zirconia in under 20 minutes, is transforming laboratory workflows and reducing operational costs.

In parallel, the industrial sector is witnessing increased utilization of zirconia-based ceramics in applications requiring high wear resistance, thermal stability, and chemical inertness. Companies like Tosoh Corporation, a global leader in zirconia powder production, are expanding their product portfolios to include ultra-fine and yttria-stabilized zirconia grades tailored for advanced sintering techniques. These materials are essential for components in electronics, automotive, and energy sectors, where reliability and longevity are paramount.

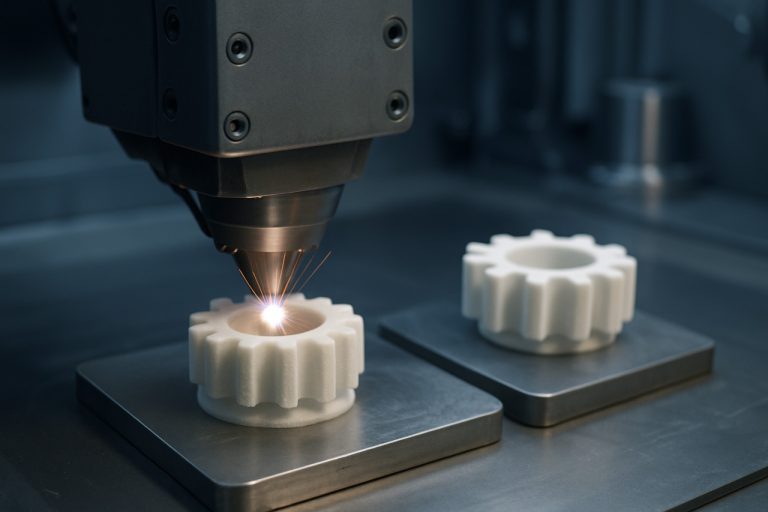

Additive manufacturing (AM) is another key trend shaping the zirconia sintering landscape. The adoption of 3D printing technologies, such as stereolithography and binder jetting, is enabling the fabrication of complex zirconia parts with minimal material waste. Companies like 3D Systems and Stratasys are actively developing AM solutions compatible with zirconia, while established ceramic specialists are optimizing sintering profiles to ensure full densification and mechanical integrity of printed parts.

Looking ahead, the market outlook for zirconia-based sintering technologies remains robust. Continued R&D investments, regulatory approvals for new medical and dental applications, and the push for sustainable manufacturing are expected to drive further innovation. As digital workflows and automation become standard, the demand for high-quality, fast-sintering zirconia materials and equipment is set to grow, positioning industry leaders and technology innovators at the forefront of this dynamic sector.

Global Market Forecasts Through 2030

Zirconia-based sintering technologies are poised for significant growth through 2030, driven by expanding applications in dental, medical, electronics, and advanced structural ceramics. As of 2025, the global market is witnessing robust investments in both traditional and advanced sintering methods, including pressureless sintering, hot isostatic pressing (HIP), and spark plasma sintering (SPS). These technologies are being refined to improve the mechanical properties, translucency, and cost-effectiveness of zirconia ceramics, which are highly valued for their strength, biocompatibility, and resistance to wear and corrosion.

Key industry players are scaling up production capacities and investing in R&D to meet rising demand. Tosoh Corporation, a leading global supplier of zirconia powders, continues to innovate in powder processing and sintering aids, enabling manufacturers to achieve finer microstructures and enhanced performance in end products. Similarly, 3M is advancing its dental zirconia portfolio, focusing on high-translucency materials that require precise sintering protocols to balance aesthetics and durability. Ivoclar, another major dental materials provider, is expanding its range of pre-shaded zirconia blocks and investing in faster, energy-efficient sintering furnaces to streamline dental lab workflows.

In the electronics and industrial sectors, Kyocera Corporation and CoorsTek are notable for their advancements in zirconia-based components, such as oxygen sensors, fuel cell parts, and wear-resistant machine elements. These companies are adopting next-generation sintering technologies to produce complex geometries and achieve tighter tolerances, responding to the miniaturization and performance requirements of modern devices.

Looking ahead to 2030, the outlook for zirconia-based sintering technologies is shaped by several trends. The adoption of digital manufacturing and automation is expected to accelerate, with more companies integrating computer-aided design and manufacturing (CAD/CAM) with advanced sintering equipment. Environmental considerations are also influencing the market, as manufacturers seek to reduce energy consumption and emissions associated with high-temperature sintering. Companies like Tosoh Corporation and Ivoclar are exploring lower-temperature sintering additives and rapid sintering cycles to address these challenges.

Overall, the global zirconia-based sintering technology market is forecast to experience steady growth through 2030, underpinned by continuous innovation, expanding end-use applications, and a strong focus on sustainability and process efficiency.

Technological Innovations in Zirconia Sintering

Zirconia-based sintering technologies are undergoing significant advancements as the demand for high-performance ceramics continues to rise across industries such as dental, medical, electronics, and advanced manufacturing. In 2025, the focus is on optimizing sintering processes to enhance the mechanical properties, translucency, and cost-effectiveness of zirconia ceramics, while also reducing energy consumption and cycle times.

One of the most notable trends is the adoption of hybrid sintering techniques, which combine conventional pressureless sintering with advanced methods like microwave, spark plasma, and two-step sintering. These approaches enable densification at lower temperatures and shorter durations, preserving fine microstructures and improving the reliability of zirconia components. For example, spark plasma sintering (SPS) is gaining traction for its ability to produce fully dense zirconia at temperatures 200–400°C lower than traditional methods, significantly reducing grain growth and enhancing fracture toughness.

Major manufacturers are investing in next-generation sintering furnaces equipped with precise temperature control, rapid heating/cooling rates, and digital process monitoring. Scheftner Dental, a leading supplier of dental zirconia, has introduced advanced sintering furnaces tailored for high-translucency zirconia, supporting the trend toward more aesthetic dental restorations. Similarly, Ivoclar and VITA Zahnfabrik are developing proprietary sintering protocols and materials that allow for faster cycles—some under 30 minutes—without compromising material integrity, a significant leap from the multi-hour cycles typical just a few years ago.

In the electronics and energy sectors, companies like Tosoh Corporation are advancing the production of yttria-stabilized zirconia (YSZ) powders with controlled particle size distributions, enabling more uniform sintering and superior ionic conductivity for solid oxide fuel cells and oxygen sensors. The push for greener manufacturing is also evident, with efforts to lower sintering temperatures and adopt energy-efficient kilns, aligning with global sustainability goals.

Looking ahead to the next few years, the outlook for zirconia-based sintering technologies is marked by continued integration of digitalization and automation. Real-time process analytics, AI-driven optimization, and closed-loop control systems are expected to become standard, further improving yield and reproducibility. As additive manufacturing of zirconia parts matures, sintering protocols will be increasingly tailored to 3D-printed geometries, opening new possibilities for complex, customized components in both medical and industrial applications.

Overall, the convergence of material science innovation, advanced furnace technology, and digital process control is set to define the evolution of zirconia-based sintering through 2025 and beyond, with leading companies driving the sector toward higher performance, efficiency, and sustainability.

Major Players and Industry Initiatives

The zirconia-based sintering technologies sector is experiencing significant momentum in 2025, driven by advancements in dental, medical, and industrial ceramics. Major players are investing in both material innovation and process optimization to meet the growing demand for high-performance zirconia components.

One of the most prominent companies in this field is Tosoh Corporation, a global leader in advanced ceramics. Tosoh is renowned for its high-purity zirconia powders, which are widely used in sintering applications for dental prosthetics, fuel cells, and structural ceramics. The company continues to expand its production capacity and refine its powder processing technologies to deliver materials with superior sinterability and mechanical properties.

Another key player, 3M, maintains a strong presence in the dental zirconia market, offering pre-sintered blocks and discs for CAD/CAM systems. 3M’s focus on process consistency and product reliability has made its zirconia materials a standard in dental laboratories worldwide. The company is also exploring new sintering protocols to reduce cycle times and energy consumption, aligning with sustainability goals.

In Europe, Ivoclar and VITA Zahnfabrik are at the forefront of zirconia-based dental solutions. Both companies have introduced next-generation translucent zirconia materials, which require precise sintering schedules to achieve optimal esthetics and strength. Their ongoing R&D efforts are focused on improving the speed and efficiency of sintering furnaces, as well as developing digital workflows that integrate seamlessly with modern dental practices.

On the equipment side, Nabertherm GmbH and Cremer Thermoprozessanlagen GmbH are recognized for their advanced sintering furnace technologies. These companies are introducing new models with enhanced temperature control, atmosphere management, and automation features, catering to both high-volume manufacturers and specialized laboratories.

Industry initiatives in 2025 are increasingly centered on sustainability and digitalization. Companies are collaborating to develop energy-efficient sintering processes, such as microwave and spark plasma sintering, which promise reduced carbon footprints and shorter production cycles. There is also a trend toward integrating real-time process monitoring and data analytics, enabling predictive maintenance and quality assurance.

Looking ahead, the outlook for zirconia-based sintering technologies is robust. With continued investment from established players and the emergence of new entrants, the industry is poised for further innovation in both materials and manufacturing processes, supporting the expanding applications of zirconia ceramics across dental, medical, and industrial sectors.

Emerging Applications: Medical, Dental, and Industrial Uses

Zirconia-based sintering technologies are experiencing rapid evolution in 2025, driven by their unique combination of mechanical strength, biocompatibility, and chemical stability. These properties are fueling a surge in emerging applications across medical, dental, and industrial sectors. The ongoing shift toward digital manufacturing and advanced ceramics is further accelerating the adoption of zirconia sintering solutions.

In the medical field, zirconia’s biocompatibility and resistance to corrosion have made it a material of choice for orthopedic implants, such as hip and knee replacements. Recent advancements in powder processing and sintering control are enabling the production of highly dense, toughened zirconia components with improved longevity and wear resistance. Companies like Tosoh Corporation, a global leader in zirconia powder production, are actively expanding their product lines to meet the growing demand for medical-grade zirconia, emphasizing high-purity and tailored particle size distributions for optimal sintering outcomes.

The dental sector remains a primary driver of zirconia-based sintering technology innovation. The widespread adoption of CAD/CAM systems in dental laboratories has led to increased use of pre-sintered zirconia blanks, which are subsequently milled and fully sintered to create crowns, bridges, and implant abutments. Companies such as Ivoclar and Dentsply Sirona are at the forefront, offering advanced zirconia materials and sintering furnaces designed for rapid, energy-efficient processing. In 2025, the focus is on ultra-translucent and multi-layered zirconia, which closely mimic the aesthetics of natural teeth while maintaining high strength. The introduction of speed-sintering protocols—reducing cycle times from several hours to under one hour—marks a significant leap in productivity and cost-effectiveness for dental practices and labs.

Industrial applications are also expanding, with zirconia-based sintering technologies being utilized in wear-resistant components, cutting tools, and fuel cell membranes. 3M and Morgan Advanced Materials are notable players, supplying engineered zirconia ceramics for demanding environments. The push toward electrification and hydrogen technologies is spurring interest in zirconia’s role as a solid electrolyte in solid oxide fuel cells (SOFCs), where precise control of sintering parameters is critical for achieving the required ionic conductivity and mechanical integrity.

Looking ahead, the next few years are expected to bring further integration of digital manufacturing, AI-driven process optimization, and sustainable sintering practices. The convergence of these trends is poised to enhance the performance, accessibility, and environmental profile of zirconia-based components across medical, dental, and industrial domains.

Sustainability and Energy Efficiency in Sintering Processes

Zirconia-based sintering technologies are at the forefront of efforts to enhance sustainability and energy efficiency in advanced ceramics manufacturing. As of 2025, the industry is witnessing a significant shift toward greener production methods, driven by both regulatory pressures and the need to reduce operational costs. Zirconia (ZrO₂), prized for its high strength, fracture toughness, and ionic conductivity, is widely used in dental, medical, and industrial applications. However, traditional sintering processes for zirconia ceramics are energy-intensive, typically requiring temperatures above 1400°C.

To address these challenges, leading manufacturers are investing in alternative sintering techniques. One prominent approach is microwave sintering, which enables volumetric heating and can reduce energy consumption by up to 30% compared to conventional furnaces. Companies such as Tosoh Corporation, a major global supplier of zirconia powders, are actively developing powders optimized for lower-temperature and rapid sintering cycles. Similarly, 3M has introduced advanced zirconia materials for dental applications that are compatible with fast-sintering protocols, reducing both energy use and cycle times.

Another innovation gaining traction is spark plasma sintering (SPS)</strong), which applies pulsed electric currents to achieve densification at lower temperatures and shorter durations. This method not only cuts energy requirements but also enhances the microstructural properties of zirconia ceramics. Equipment manufacturers such as Sandvik are supplying advanced sintering systems that support these emerging techniques, enabling industrial users to scale up sustainable production.

In parallel, the adoption of digital process control and real-time monitoring is improving energy efficiency across the zirconia sintering value chain. Companies like Siemens are providing automation and control solutions that optimize furnace operation, minimize heat loss, and ensure consistent product quality. These digital tools are increasingly integrated with energy management systems to track and reduce carbon footprints in line with global sustainability targets.

Looking ahead, the next few years are expected to see further advances in hybrid sintering technologies—combining microwave, SPS, and conventional methods—to tailor energy input to specific product requirements. The industry outlook is shaped by ongoing R&D collaborations between material suppliers, equipment manufacturers, and end-users, with a shared focus on reducing environmental impact while maintaining the superior performance of zirconia ceramics. As regulatory frameworks tighten and energy prices fluctuate, the adoption of sustainable zirconia-based sintering technologies is poised to accelerate, setting new benchmarks for efficiency and environmental stewardship in the ceramics sector.

Regional Analysis: Growth Hotspots and Investment Trends

The global landscape for zirconia-based sintering technologies is experiencing dynamic shifts, with several regions emerging as growth hotspots due to increased investment, technological advancements, and expanding end-use industries. As of 2025, Asia-Pacific continues to dominate the market, driven by robust manufacturing sectors, particularly in China, Japan, and South Korea. These countries benefit from strong supply chains, government support for advanced ceramics, and a growing demand for high-performance materials in electronics, automotive, and dental applications. For instance, Tosoh Corporation in Japan is a leading producer of zirconia powders and has been expanding its production capacity to meet rising global demand, while Kyocera Corporation leverages its expertise in fine ceramics to supply advanced sintered zirconia components for various industries.

China remains a central player, with significant investments in both upstream zirconia production and downstream sintering technologies. The country’s focus on domestic innovation and self-sufficiency in advanced materials is reflected in the activities of companies like Sinocera, which specializes in zirconia ceramics for electronics and medical devices. Additionally, the Chinese government’s support for high-tech manufacturing is expected to further accelerate the adoption of zirconia-based sintering technologies through 2025 and beyond.

Europe is another key region, with Germany, France, and Switzerland at the forefront of research and industrial application. The presence of established players such as Dentsply Sirona (Germany/US) and Ivoclar (Liechtenstein) underscores the region’s strength in dental and medical ceramics. These companies are investing in next-generation sintering processes, including digital and additive manufacturing techniques, to enhance product performance and reduce production times. The European Union’s emphasis on sustainable manufacturing and advanced materials research is also fostering innovation and attracting investment in zirconia-based technologies.

North America, led by the United States, is witnessing steady growth, particularly in the medical, aerospace, and electronics sectors. Companies such as CeramTec and Ceradyne (a subsidiary of 3M) are notable for their investments in high-purity zirconia and advanced sintering solutions. The region’s focus on R&D, coupled with a strong base of end-user industries, is expected to sustain moderate growth through the next few years.

Looking ahead, the Middle East and Latin America are emerging as potential growth areas, driven by infrastructure development and increasing adoption of advanced ceramics in energy and industrial applications. However, these regions currently lag behind Asia-Pacific and Europe in terms of technological maturity and investment scale.

Overall, the outlook for zirconia-based sintering technologies is positive, with Asia-Pacific and Europe leading in innovation and capacity expansion, while North America maintains a strong presence in high-value applications. Strategic investments, government support, and cross-industry collaborations are expected to shape regional growth trajectories through 2025 and into the latter part of the decade.

Challenges: Material Costs, Scalability, and Quality Control

Zirconia-based sintering technologies are at the forefront of advanced ceramics manufacturing, offering exceptional mechanical properties, chemical stability, and biocompatibility. However, as the industry moves through 2025 and into the coming years, several challenges persist—most notably in material costs, scalability, and quality control.

Material costs remain a significant barrier. High-purity zirconia powders, essential for achieving the desired mechanical and aesthetic properties in applications such as dental prosthetics and industrial components, are expensive due to complex extraction and purification processes. Leading suppliers like Tosoh Corporation and Saint-Gobain have invested in refining production methods to improve yield and reduce impurities, but global demand—especially from the medical and electronics sectors—continues to exert upward pressure on prices. The volatility of raw material costs, influenced by geopolitical factors and supply chain disruptions, further complicates long-term planning for manufacturers.

Scalability is another pressing issue. While laboratory-scale sintering of zirconia can achieve excellent results, translating these processes to industrial-scale production introduces new complexities. Uniform heating, precise temperature control, and consistent atmosphere management are critical to avoid defects such as grain growth, porosity, or phase instability. Companies like 3M and Ivoclar have developed proprietary sintering furnaces and process controls to address these challenges, but the capital investment required for such equipment is substantial. Additionally, the energy-intensive nature of high-temperature sintering (often above 1400°C) raises both operational costs and environmental concerns, prompting ongoing research into alternative methods such as microwave or spark plasma sintering.

Quality control is paramount, especially in sectors where zirconia components must meet stringent regulatory standards. Variability in powder characteristics, sintering profiles, and post-processing can lead to inconsistencies in density, translucency, and mechanical strength. To mitigate these risks, manufacturers are increasingly adopting advanced in-line monitoring systems and automated inspection technologies. For example, Dentsply Sirona and Kuraray Noritake Dental have integrated digital quality assurance protocols to ensure batch-to-batch consistency in dental zirconia products.

Looking ahead, the industry is expected to focus on optimizing raw material sourcing, developing energy-efficient sintering techniques, and enhancing process automation. Collaboration between material suppliers, equipment manufacturers, and end-users will be crucial to overcoming these challenges and unlocking the full potential of zirconia-based sintering technologies in the years beyond 2025.

Regulatory Landscape and Industry Standards

The regulatory landscape and industry standards for zirconia-based sintering technologies are evolving rapidly as the material’s applications expand across dental, medical, and advanced manufacturing sectors. In 2025, regulatory bodies and industry organizations are focusing on harmonizing standards to ensure product safety, performance, and interoperability, particularly as zirconia ceramics become more prevalent in critical applications such as dental prosthetics, orthopedic implants, and high-performance components.

In the dental sector, zirconia’s biocompatibility and mechanical strength have led to its widespread adoption for crowns, bridges, and implant abutments. Regulatory oversight is primarily guided by international standards such as ISO 6872:2015 for dental ceramics, which specifies requirements for sintered zirconia materials. Updates to these standards are under review to address new sintering techniques, including high-speed and microwave-assisted sintering, which are being adopted by leading manufacturers like Ivoclar and Dentsply Sirona. These companies are actively involved in standardization committees and contribute to the development of best practices for material processing and quality assurance.

In the medical device sector, zirconia-based components must comply with stringent regulations such as the European Union’s Medical Device Regulation (MDR 2017/745) and the U.S. Food and Drug Administration’s (FDA) 510(k) premarket notification process. The FDA recognizes standards like ASTM F1873 for zirconia ceramics used in surgical implants, and ongoing revisions are expected to address the unique characteristics of next-generation sintering technologies. Companies such as Tosoh Corporation, a major global supplier of zirconia powders, are working closely with regulatory agencies to ensure their materials meet evolving requirements for traceability, purity, and performance.

Industry organizations, including the American Ceramic Society and the International Organization for Standardization (ISO), are facilitating collaboration between manufacturers, researchers, and regulators to update and harmonize standards. In 2025 and beyond, there is a strong emphasis on digital traceability, process validation, and lifecycle management, particularly as additive manufacturing and digital workflows become more integrated with zirconia sintering processes.

Looking ahead, the regulatory environment is expected to become more rigorous, with increased requirements for documentation, in-process monitoring, and post-market surveillance. Manufacturers are investing in advanced quality control systems and digital platforms to ensure compliance and maintain competitiveness. As zirconia-based sintering technologies continue to advance, proactive engagement with regulatory bodies and standards organizations will be essential for industry stakeholders to navigate the evolving landscape and capitalize on emerging opportunities.

Future Outlook: Disruptive Technologies and Strategic Opportunities

Zirconia-based sintering technologies are poised for significant advancements in 2025 and the coming years, driven by the demand for high-performance ceramics in sectors such as dental, medical, electronics, and advanced manufacturing. The ongoing evolution in sintering methods—particularly the adoption of digital and energy-efficient processes—signals a shift toward greater precision, scalability, and sustainability.

One of the most notable trends is the increasing integration of digital manufacturing and additive technologies with zirconia sintering. Companies like 3D Systems and Stratasys are actively developing 3D printing solutions that utilize zirconia powders, enabling the production of complex geometries with reduced material waste. These advancements are expected to accelerate the adoption of zirconia in custom dental prosthetics and medical implants, where individualized solutions are critical.

In parallel, leading materials suppliers such as Tosoh Corporation and Saint-Gobain are investing in the refinement of zirconia powders and the optimization of sintering parameters. Their focus is on achieving finer grain sizes, improved translucency, and enhanced mechanical properties, which are essential for next-generation dental and structural ceramics. These companies are also exploring the use of dopants and composite formulations to further tailor the performance of zirconia-based materials.

Energy efficiency and process innovation are also at the forefront. The adoption of microwave and spark plasma sintering (SPS) technologies is gaining momentum, offering significant reductions in sintering time and energy consumption compared to conventional furnaces. Sinterite, a recognized manufacturer of industrial sintering equipment, is among those advancing these technologies, aiming to provide scalable solutions for both high-volume and specialized applications.

Looking ahead, the convergence of digital design, advanced powder processing, and novel sintering techniques is expected to unlock new strategic opportunities. The dental sector, in particular, is anticipated to benefit from faster turnaround times and improved product consistency, while the electronics industry may leverage zirconia’s superior dielectric properties for next-generation components. As regulatory standards evolve and sustainability becomes a greater priority, companies with robust R&D and vertically integrated supply chains—such as Ivoclar and Dentsply Sirona—are well positioned to capitalize on these disruptive shifts.

Overall, the outlook for zirconia-based sintering technologies in 2025 and beyond is characterized by rapid innovation, cross-sector collaboration, and a clear trajectory toward smarter, greener, and more customizable ceramic solutions.

Sources & References

- Ivoclar

- Dentsply Sirona

- 3D Systems

- Stratasys

- Scheftner Dental

- VITA Zahnfabrik

- Morgan Advanced Materials

- Sandvik

- Siemens

- Sinocera

- CeramTec

- Kuraray Noritake Dental

- American Ceramic Society

- International Organization for Standardization